Weekly Wrap...

▶Credit where credit is due... I stole that headline from my pal Fil Zucchi, who writes Fil’s Randoms on the Markets on Substack. And whose most recent piece is headlined, “The Rippee-dee-doo-dah Market.” The timing couldn’t be more perfect, plus as he explains...

Risks are everywhere of course, with the daily watch for incoherent tape-bombs from the orange ape, a less than ideal fiscal backdrop, geopolitics, etc. but nothing matters until it does. Did I forget about “valuations” having left the realm of “valuating”? Nope, but there too nothing matters until it does.

Or as my Ozarks friend, Bob Howard, who writes the Positive Patterns newsletter, puts it...

Reminds me of the summer of 1987 when I worked at Lehman. It was up, up, up, everyday. Relentless... Then October came with a thud of reality.

But that’s for some point in the future. “Right now,” Bob says, “they are running around the party with lampshades and Krispy Kremes on their heads.”

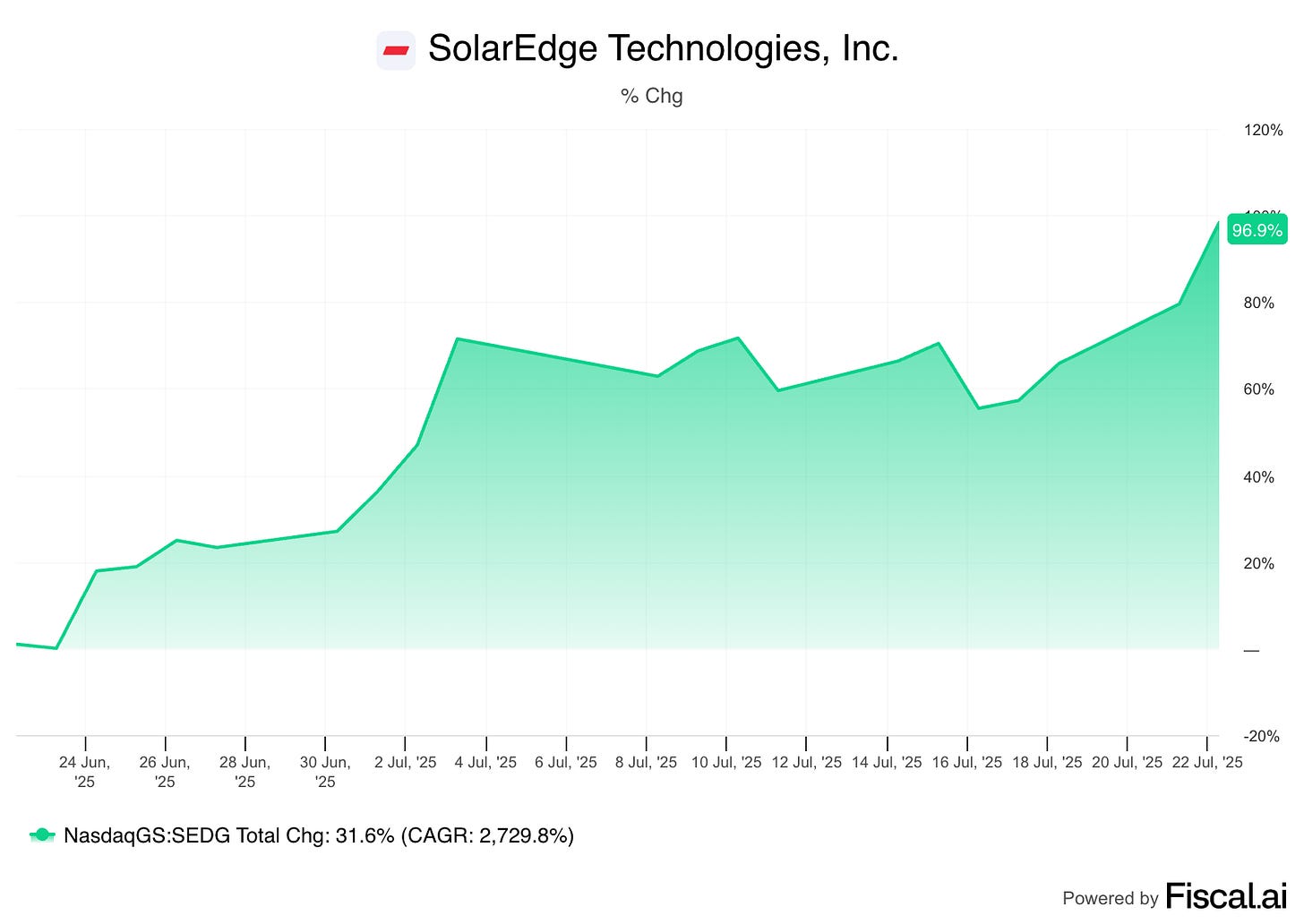

▶Solar storm heating up... If you missed it, on Wednesday I wrote about why the squeeze in solar stocks was the silliest of all squeezes. I included this one-month chart on SolarEdge $SEDG, which showed a 97% gain.

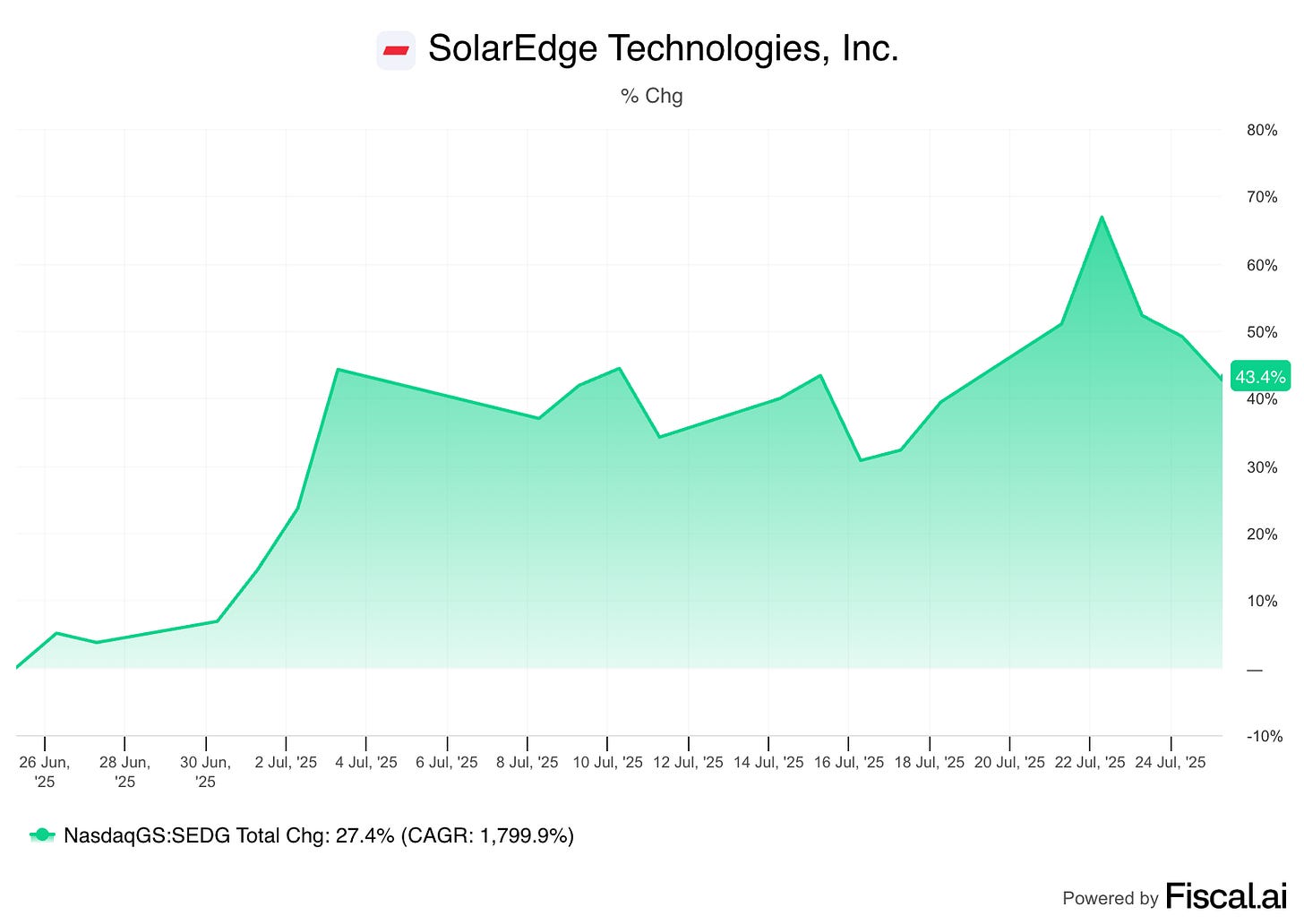

Here’s the stock at Friday’s close...

Yes, that gain was cut in half. For what it’s worth, even at its current price the stock is down 83% from where I first red-flagged it in August of 2023. At its depths it was down more than 90%. I’ll explain to Red Flag Alert readers, in an upcoming update, why it’s likely going... lower.

▶It’s moving time... You may have noticed my mentions here lately that I’m transitioning away from Substack to a new platform. Substack has been fantastic. It’s easy to use and brilliant in the elegance of its execution – which only gets better – and which is why it is now the king of all content. The missing link for me, and my drive for alternatives, has been marketing, plus access to a team of analysts and additional tools and features.

▶For current premium and free subscribers, the change will be seamless, with one exception: My archives will shift from Substack to the new website for Herb Greenberg’s Red Flags, which will be the umbrella for my premium Red Flag Alerts and my free, long-running Herb on the Street. I’ll be adding weekly video office hours for premium subs, plus a few other bells and whistles as we go forward... including a video backstory on any new Red Flag Alerts.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com