A Common Sense Approach to Investing

Investing and making money the old-fashioned way still works.

I love old school because truth is, I am old school. (Or maybe just old.)

I make no excuses...

Neither does Bob Howard, a former stockbroker who is roughly my age and writes the Positive Patterns newsletter. It’s a throwback to another era of investment newsletters... and at times, seemingly another era of investing.

I have no idea when I first ran across Bob, but I wrote a story or two about him earlier in my career, including this one in the Wall Street Journal in 2007...

It was about a few big companies that let their numbers do the talking, not their executives... like J.G. Boswell ($BWEL), Expeditors International of Washington ($EXPD) and Seaboard Corp. ($SEB). They all had their moments in the sun, even Boswell, which has since sunk back down – and which today Bob concedes “has been super frustrating... the family owns 80% and treats it like their fiefdom, and the stock has done nothing. I gave up on it.”

I hadn’t talked with Bob, let alone thought about him, until a few weeks ago when he saw something I had written a group of people I had pulled together. He wrote me a note saying...

You guys need some people who live in Fly OVER country, where the economy is booming – Little Rock, Bentonville, OK, Plano, Huntsville.

Yeah, like Bob, right? I called him, but he had no interest in getting involved.

Plain Spoken, Folksy

We’re talking about a guy who enjoys calling his own shots... who has lived in the same house in rural Missouri that he bought in 1991 for $52,500, pretty much the same time he started his newsletter.

He also happens to write one of the most enjoyable, instructive, plain-spoken, folksy and genuinely entertaining stock-centric investment newsletters I’ve come across.

This is no ordinary investment newsletter... certainly not in today’s world of meme stock maniacs.

In a throwback to another era, Bob doesn’t have a website and has never done any marketing. He’s the antithesis of the breathlessly copy written, get-rich-come-ons that have proliferated, thanks to the Internet and a booming bull market.

Still, he has 500 customers who pay him $1,400 a year, which he quickly adds, “pays the bills down here in the Ozarks.”

His churn, he says, is low... and of his 22 non-renewals last year, he says that “half of them died.” All of his customers come from referrals... unless, of course, a story like this is written. (And very few are these days because he doesn’t seek publicity. It was my idea to write this.)

Bob prefers to do things his way, on his time, in his space, in a way that fits his lifestyle.

Red, Black and Blue

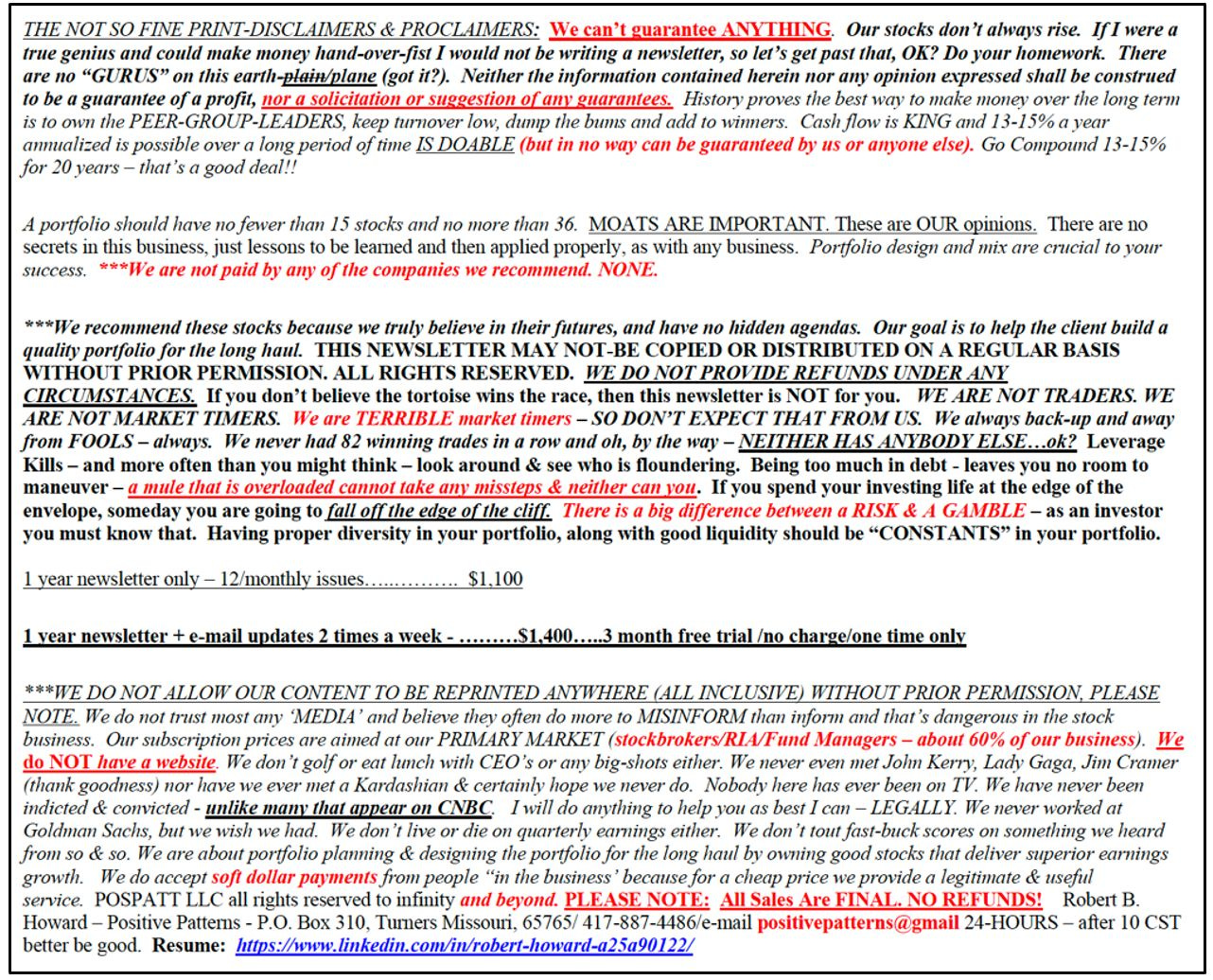

Not including regular updates, he writes one monthly issue, the very old-fashioned way – nothing fancy, just around 40 single-spaced, typewritten pages in Microsoft Word... with lots of red and sometimes blue type to make his points. It looks like this...

He doesn’t keep a formal record of his performance, though he reckons his win rate is about 70%. His view is long-term, and he lays out what to expect in his disclaimers, such as this one at the tail end of his reports...

If the print was too small to read here, there are such warnings as...

We are TERRIBLE market timers – SO DON’T EXPECT THAT FROM US.

And...

We never had 82 winning trades in a row and oh, by the way – NEITHER HAS ANYBODY ELSE...ok?

And...

If you don’t believe the tortoise wins the race, then this newsletter is NOT for you.

And a reminder that...

If you spend your investing life at the edge of the envelope, someday you are going to fall off the edge of the cliff. There is a big difference between a Risk & A Gamble.

What Bob says should be seemingly obvious, but it’s also easy to lose sight of his kind of message in noisy markets like these... when everybody around you is smugly boasting about how much money they made yesterday.

A Break from the Insanity

That’s why I felt a need to write about Bob, who provides a break from the insanity and a welcome recentering...

After all, there is no right or wrong approach to investing, as long as you make considerably more money than you lose...and you can sleep at night. (That “sleep at night” part is directed at me because that’s what I prefer.) But common sense can go a long way, regardless of your investing style...

Like Bob’s comments on dividend payers. In his May newsletter he listed 17 ideas under the category, “Income Stocks For Yield & Modest-To-Decent Growth.”

Under that list he writes...

What struck me in going through the May issue of his newsletter was that Bob commented on 76 companies and ETFs.

Some you’ve likely never heard of, but he has researched all of them, some for decades, like Seaboard. Its longtime CEO died a few years ago, but he continues to hang in there, as he wrote this month...

And given the realities of investing – not everything goes in a straight line or as expected – there were others he’s less-than-pleased with, which get put “on probation,” like UPS, about which he advised his subscribers...

Or, worse, Potlach, ($PCH), about which he writes...

If you haven’t guessed by now, most of Bob’s ideas are not likely to be shoot-the-lights out overnight jackpots... unless, of course, he’s lucky.

Investing vs Trading

While Bob is a fan of technical analysis and actively uses charts, especially when it comes to buying and selling, it’s all in combo with fundamentals.

His approach is far more focused on the art of investing (in a company) versus the sport of the trade (of a symbol.)

It’s what works for him. Or as he told me in one of our dozens of email volleys the other day...

QUALITY WILLS OUT, HERB - and if you want to take a few fliers, then 5-10% of the dough - that's fine with me.

As much as the structure and nature of the stock market has changed, Bob believes the basics still work – starting with the structure of a portfolio. As he put it in one of our discussions...

Start looking at it in Groups: Insurance, tech, railroads, electricity, food, natural resources, etc.

Get eight to 10 to 12 groups – no more than 30 stocks. That’s what I tell everybody.

So many people have no overall plan. They own a mish-mash. I had a doctor the other day – 140 stocks. If you get more than 40 you are a MUTUAL fund. Too much trading, no diversity.

He then narrows it down – again based on common sense...

Eighty percent blue chips; 20% more risky – or adjust up and down, depending on your risk tolerance.

If this sounds overly simplistic, that’s the point: A good part of investing is not rocket science. (In my view it’s skill mixed with luck.)

Where it Gets Tricky

There are also plenty of variables about how people approach the same stock. I often marvel about how two very smart people armed with the same set of numbers can draw such vastly different opinions on what to do with the same stock.

Take, for example, AAON ($AAON), which is in the industrial heating/air conditioning business.

It just so happens that a few weeks ago a friend who is steeped in researching industrial companies – and owns AAON – was telling me that he liked it so much he was considering buying more... pending further research.

A few days later I was looking at Bob’s most recent issue and there he was – with AAON having shot up to $94 – recommending that his subscribers start to “sell some.” Keep in mind, this is a company he started recommending in 2013 at $7. As he told his subscribers...

Amazing strength, relentless rally just does not stop but at 41 times earnings, for an HVAC company it’s just too generous. Up 60% since November – too fast – too happy. Good Hold but for big winners it’s time to Sell Some.

The very next day the company reported earnings and the stock fell from $94 to $75. It’s now around $77.

To Bob, at 44-times earnings at its peak, the stock was simply too expensive for an HVAC company.

To which my friend said...

I clearly have a different view. Speaking specifically to valuation, one of the biggest lessons I have learned in recent years is ‘cheap’ doesn’t save you from a bad story and “expensive” can keep you out of a good one. AAON reported last night. Backlog up 10% sequentially and margins over 35%. Not many industrial stories like that.

To which Bob said...

There’s no right or wrong, Herb... only HOW’s your portfolio doing?’ My opinion is he’s late – but that’s just MY OPINION.

And that, of course, is what makes markets.

What’s a Good Buy Now?

While Bob is taking profits in the likes of AAON, he also has a new favorite...

He’s a big longtime fan and owner of cement companies, saying that he believes “it will be a big winner in the next five to 10 years. He already owns CRH ($CRH), but says with its 40% run since he first bought it in 2023, it’s “too late” to buy here.

By contrast, he says, “I think we are getting in early on” with is Swiss-based Holcim AG ($HCMLY). The catalyst here, he believes, is the company’s plan to spin off its North American operations during the first half of next year.

In his view, “the USA business has much better growth potential” than the rest of the company,. He then goes on to spend 10 pages explaining what the company does and concludes by saying..

When I moved here 32 years-ago I noticed Ash Grove Cement owned all sorts of quarries around here. That stock was a big winner for us & CRH bought them out. There is residual value in ROCKS – they always cost more – rock vs. paper = ROCK WINS!!

Rocks go up in value, just like Dirt & Real Estate. When HCMLY breaks $20 that would be a significant/upside chart breakout.

Last Word

While Bob’s ideas tend to be long-term in nature, he’s also cognizant of when to buy. While he’s the first to tell you he has no idea where the market is headed, he also writes...

This is NOT a great time to buy stocks in size, and put big money into stocks (my opinion) not based on the MARKET but the value of stocks.

Also I would add that even though YOUR portfolio is doing well, overall it's about 40-50% that are responsible for the performance and by the way this is NORMAL.

So for right now, be PICKY. DEFENSIVE STOCKS are all buyable here, they are out of style (see our INCOME PORTFOLIO) ....but, they are also ALL in fine fiddle, are all BLUE-CHIP/peer-group dominators first-class all around. Stocks are cyclical, right now the market is going for GROWTH. So just remember that.

We will, Bob, trust us, we will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) After this was originally published I bought shares of Holcim.

I can be reached at herb@herbgreenberg.com.