Special Situation – A Different Angle on the Weight Watchers Long Thesis

This one comes from the credit side of the ledger.

A large and growing list of serious investors — portfolio managers, analysts, private investors — already have signed on as premium subscribers to my Red Flag Alerts for one reason:

To understand what could go wrong before... not after the news hits.

👉 Join them here and start flying your own red flags. (With a few green ones – Special Situations like WW – thrown in!)

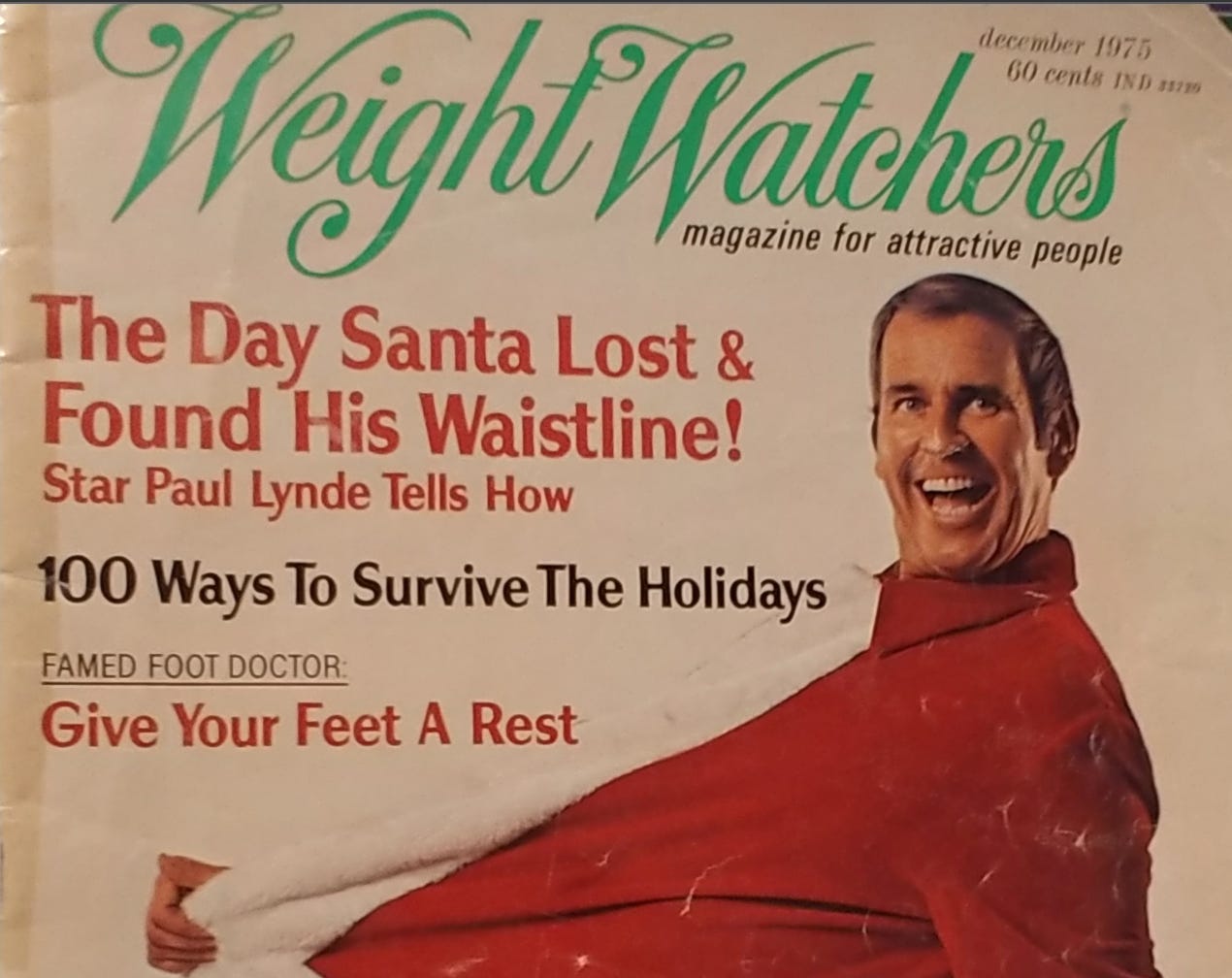

▶Ever since its emergence from bankruptcy a few months ago, WW International WW 0.00%↑ – best known as Weight Watchers – has pretty much fallen off the radar.

Of the three analysts who picked up coverage, only one has a buy rating. You can see the lack of enthusiasm – in this otherwise AI-fueled market – in WW shares, which have been struggling since the company’s post-bankruptcy debut…

That shouldn’t be surprising given its tiny float and the very fact that it is, after all, Weight Watchers – one of the best-known victims of the boom in GLP-1 weight-loss drugs.

New and Improved

Since reincarnated, the company has leaned into the GLP-1 frenzy by adding its behavioral approach, which WW touts has better results than GLP-1s alone. Perhaps the best take on why a slimmed-down Weight Watchers might be a good bet comes not from the analysts, but from my friend Paul Cerro at Cedar Grove Capital Management. Paul had been short the stock well before its bankruptcy… but is long the new and improved version. You can read his bullish report here, with a summary below.

But beyond what Paul wrote, there’s yet another side to the bullish thesis, which most stock investors have likely missed. That’s because this angle is steeped in one of those nuanced details only a credit investor with a focus on bankruptcies would pick up. That’s to be expected, because with distressed situations, there is often an information gap between what credit and stock investors know. And as we all know, credit investors often know best.

In this case, that gap represents not just a likely cushion to its shares, but a reason the stock could be sharply higher three years from now… even if the much ballyhooed revival of Weight Watchers doesn’t amount to what investors are hoping.

Here’s Why

As a Red Flag Alerts premium subscriber, who is steeped in the credit and distress markets, explains…