Beware of the ‘Financially Fragile’. Also, Update on the Legal Drug Cartel

Some stocks simply are riskier and junkier than others. It’s as simple as that...

Yet as I mused in my recent On the Street, “Playing Investors as Fools,”

For most investors, it’s the same old “fear of missing out” (“FOMO”) trap… that if they don’t get in they’ll miss out on the next big home run – which for some reason always happens to involve a company on the verge of going out of business. (When there are thousands of other stocks they can choose from, that makes perfect sense, right?)

Some of these companies are easy to spot, like those that have little in the way of sales or earnings... and are really little more than public Petrie dishes in search of a business.

Others are a bit harder, but if you look closely, they share one thing you might want to go out of your way to avoid...

They have so much debt, and their businesses are doing so poorly, that they can’t cover interest expenses out of their operating profits... or as my friends at Kailash Concepts (“KCR”) put it in a just-published report...

With the broad economy booming, we thought it reasonable that if a firm could not pay interest expenses out of operating profits today, that was probably a pretty risky firm.

After crunching the numbers, what they found was astonishing (their emphasis)...

Across all stocks in the United States, nearly 20% of them are NOT earning enough to pay their interest expense. A level of financial weakness eclipsed only at the nadir of the economic collapse during the Covid lockdowns.

There are obviously plenty of ways to slice-and-dice numbers, so don’t confuse this with another one of KCR’s stunning stats, which I featured here in March in an On the Street titled, “1,000 Stocks to Avoid.”

In that report, I cited their work that showed 33% of the Russell 3000 were losing money or couldn’t afford to pay their interest expense.

The difference is that the latest report encompasses all U.S. stocks, small and large cap, and they don’t earn enough to cover their interest...

KCR calls these companies the “financially fragile”.

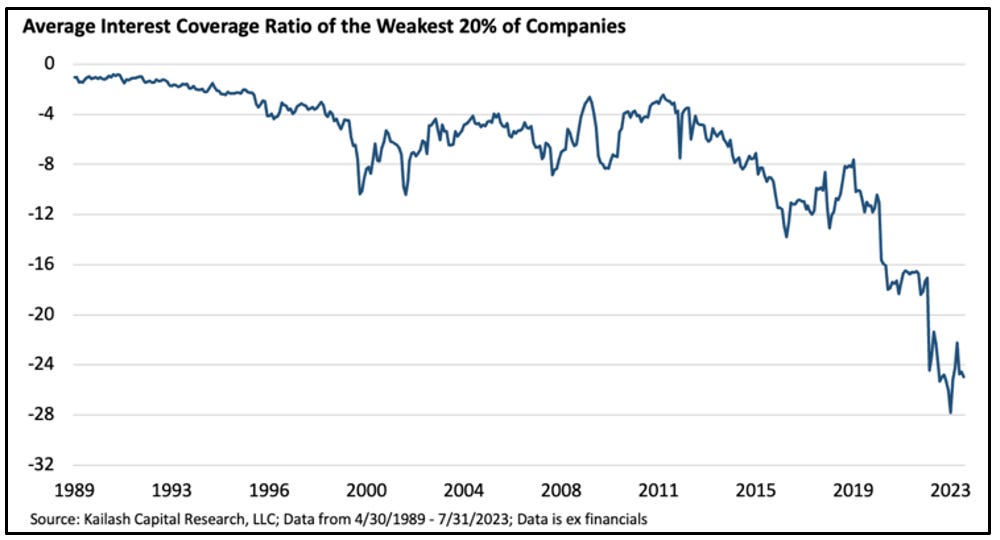

To show just how precarious they are, look no further than the average interest coverage for the lowest ranked 20%.

To say it’s ugly would be an understatement, as the chart below shows so well...

Or as KCR explains...

The vulnerable slice of the US equity market has never been so broad or so weak. Full stop

These include several companies that have been on my Red Flag Alerts, including Sunrun (RUN), ChargePoint Holdings (CHPT) and Enviva (EVA). And, of course, Carvana, which has made guest appearances here from time to time.

Obviously, some companies on the financially fragile list will get from here to there....

By nature of their industries, some at times will wind up on the endangered list. And some may get saved by being the smart seller to a dumb buyer. (Don’t laugh... it happens!) One thing is certain: Other than getting swept up in a bubble, in general these kinds of companies tend to underperform the market.

Just eyeballing KCR’s list of the 150 bottom-of-the-barrel companies (with market caps above $500 million) the top four (with market caps from $37 billion to $99 billion) have been flat to down for at least three years, having been over-hyped and, as a result, over-inflated during the bubble. (So classic!)

Worse, as a group the financially fragile have underperformed the broader market fundamentally on all levels, with considerably worse 3-year sales growth, earnings growth, free cash flow yield, return on assets and return on equity.

Once again, courtesy KCR…

Yet, they continue to attract investors who for some reason either intentionally overlook the obvious or simply don’t know... blinded by whatever story is being floated.

None of that matters in a bull market, of course, when rates were zero. But now... last I looked they’re a tad higher. And any of those who can’t cover their interest and have debt coming due soon are – how can I put this? – somewhat screwed. (Memo to KCR or anybody else: That would be a great screen.)

Bottom line: I think it’s safe to say if you’re trying to predict which public companies are likely to file for bankruptcy, especially as bankruptcies spiral higher at the fastest rate since 2010, the list of the financially fragile might be the perfect place to start.

Moving on, if you missed it, Blue Shield of California is dropping CVS Caremark as its pharmacy benefit manager (PBM)...

They’re moving to several companies, including Mark Cuban’s Cost Plus Drugs, which I’ve mentioned numerous times here. (Disclosure: Yes I’m a fanboy, but only because I’m a customer, and have morphed 60% of my daily generic cocktail over there because I’ve found it cheaper than even my supplemental drug plan on Medicare.)

As regular readers know, I’ve ranted several times about PBMs, most recently in an On the Street titled, “Cracking Down on the ‘Legal’ Drug Cartel.”

I’ve pointed out numerous times how broken the system is, especially with PBMs dictating which drugs we can take... or afford to take.

It seems Blue Shield has had enough. As Paul Markovich, the president and CEO of Blue Shield of California, said in a statement last week...

The current pharmacy system is extremely expensive, enormously complex, completely opaque, and designed to maximize the profit of participants instead of the quality, convenience and cost-effectiveness for consumers. That is why we are working with like-minded partners to create a completely new, more transparent system that gets the right drugs to the right people at the right time at a substantially lower cost.

The truth is, it didn’t have to be the way it was. It simply took someone with guts to execute on what turned out to be a better idea.

So far... so good.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

All these weak sisters came public for one reason only, to make $ for management and advisors, all at the expense of the public investors

Only a thin line betw the status of (i) junkier and (ii) debtor in possession—all needed is a good Ch 11 lawyer who has received a good retainer or deposit