Beware of This SPAC Attack

Proof that suckers continue to be born every minute.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

A few weeks ago somebody in my sphere was chatting up a nuclear company going public by way of a SPAC. As it turns out, it’s one of two.

My first thought – a SPAC? My second thought... they’re back! Why any company worthy of the public markets would go the SPAC route – especially now – is beyond baffling.

But Here We Are...

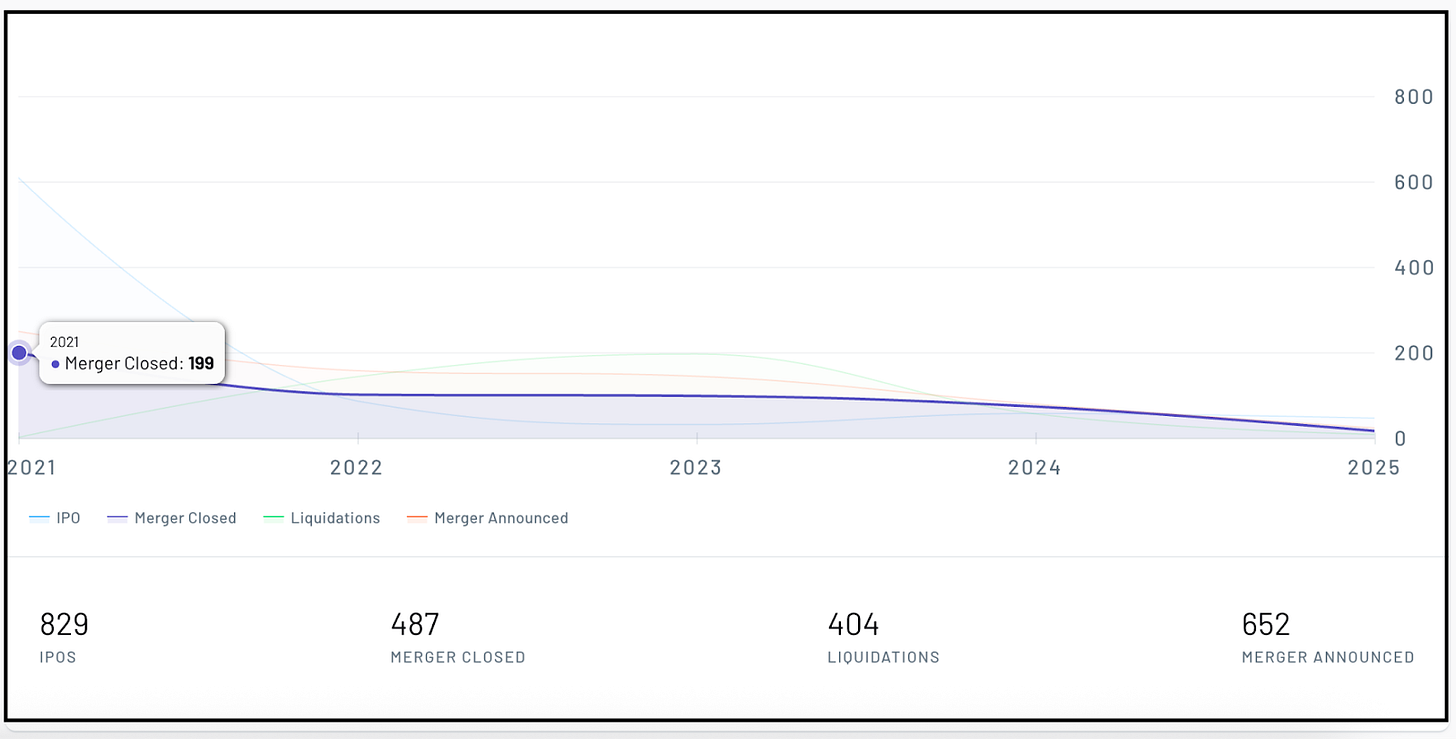

A few years after the Great SPAC Meltdown and to prove there really is a sucker born every minute, there’s a push to make SPACs great again. Here’s the past year, courtesy of ListingTrack...

SPAC IPOs have popped higher. Not that we’re anywhere near back to the future. Over the past 12 months, according to ListingTrack, there have been 94 IPOs of shell companies looking for a merger partner compared with 827 since 2021. But half have been this year alone... and in May there were 15. And from the Class of 2025, 16 have already de-SPAC’ed – that is, the the merger with what appears to be a real company has closed. In 2021, there were 199.

And then there were the hundreds of shells that never amounted to anything because they ran out of time to find a dance partner.

But It IS a Change...

... And not surprisingly, according to a New York Times story earlier this week, “the most sought-after ones involve people in President Trump’s orbit or investments close to his heart.” Like Trump Media, which is one of the very few SPACs to be in the green since it de-SPACed to become a company in its own right – albeit full of controversy. A few others are tied to Commerce Secretary Howard Lutnick’s old firm, Cantor Fitzgerald – a long-time backer of SPACs.

The story went on to say...

As Bitcoin and crypto assets continue to trade higher, many of the latest SPACs have either explicitly noted they’re hunting for crypto deals or simply raised the possibility of doing such a deal in investor meetings.

Whether this continues depends on investors’ eagerness for risky bets, something that could change if the volatility that hammered the stock market in early April returns.

For proof of just how risky they are, look at the numbers, which show that only 8% of all de-SPACs since 2021 are in the green, with a median negative return of 87%. Of the 73 that de-SPAC’ed last year, only 6% are above their IPO price, with a negative return of 88%.

Here’s a year-by-year view...

What’s more, of those in the green this year – as of yesterday – only two were positive. One is WeBull, an online trading platform officially headquartered in Florida, but whose strong China ties raise questions about whether it’s really a Chinese company. After popping higher by more than 500% immediately after its April de-SPAC, it’s now up around 20% from its IPO price.

The other was AleAnna, which owns natural gas reserves in Italy. It was up half a percent. It hailed its Nasdaq listing a few months ago as a “proud moment... a testament to our team’s dedication and vision.”

To Which I Say...

No, it’s not. It's merely a testament to the fact that they were able to find a SPAC sponsor and then meet listing requirements.

You see, like WeBull, it trades on the Nasdaq Capital Markets, which is different from the Nasdaq. Or as the Nasdaq itself explains, the Nasdaq Capital Markets is a platform that “makes it easier for early-stage companies to get listed, especially when compared to other senior exchanges with more onerous requirements.”

Paging P.T. Barnum.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no positions in any stocks mentioned here. I’m under no obligation to update or alert subscribers if and when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.