Finding Treasure in Corporate America's Trash

Spin-offs remain a great hunting ground for under-the-radar stock ideas

Early last year, I almost fell into a spin-off trap...

I was looking for a new idea, and a friend had seen that medical technology company Becton Dickinson (BDX) was spinning off its diabetes business Embecta (EMBC).

As I learned early in my career, spin-offs can be a source of great investment ideas.

On the surface, Embecta seemed like it might be one...

Not only was it a pure play on diabetes, but it was the biggest manufacturer of insulin syringes and pen needles. And it gushed cash.

What's more, unencumbered by Becton Dickinson – which had milked Embecta for its own good – the setup was enticing.

But the more worked I did on it, including talking with the company and checking in with David Kliff of the Diabetic Investor, the more I decided to give it a pass.

And I'm glad I did... because Embecta has collapsed since the spin-off. Take a look...

For years, spin-offs have been a great place to shop for under-the-radar investment ideas...

This year, there have been quite a few to choose from – with 40 involving spins of companies with market caps greater than $1 billion expected by year end. That's a bit more than usual.

This pruning process goes on continuously, of course, as corporations for whatever reason use spin-offs as a form of housecleaning.

And as with anything tossed to the curb, you can find treasures within the trash.

But that's the tricky part... There's always quite a bit of trash being dressed up to look like treasure.

An analysis in 2019 by market research Boyar Research showed that over the prior decade, spin-offs underperformed the S&P 500 Index by around 2.7%. However, those that did well outperformed the index by an average by around 11%.

That leads to the obvious question...

Why as a group haven't spin-offs performed better?

I started thinking about this a few weeks ago after I was speaking with Jonathan Boyar of Boyar Research, whose firm does exceptional work.

As it turns out, he had the same question and wrote a full report on it in 2019. He believes the answers are still valid and summarized them in a recent report, which boils down to three points...

The growth of passive investing via index funds, which poured more money into the parent company because of its perceived value.

A rise in shareholder activism, which pressure companies to get rid of some of their underperformers or weaker divisions.

Even without shareholder pressure, some companies take it on their own to get rid of the deadwood... dressing up underperformers to look better than they really are.

Therein lies the opportunity...

With spin-offs, investors in the parent company get shares in the spun-off firm as part of the deal.

They often wind up dumping those shares for the cash, which is where the fun starts...

As Jim Osman – the founder of the special situations research firm The Edge, which also publishes The Spinoff Report – says...

The spin-off process is a fundamentally inefficient method of distributing stock to the wrong people... You receive shares whether you want them or not.

I first met Osman years ago, and he became a go-to source on spin-offs, since he knows more than most. As he explains...

Investors tend to gain these shares by default and sell them in the open market pretty much immediately, often making them cheap companies that no one is looking at. They are sometimes known as "orphan securities." It's at this point that X marks the spot, and you should start digging...

He adds…

The key is selectively analyzing them case by case and not just buying them all. Our 23-year study shows that 30% of Spin-offs are flat or negative in the first year. The last thing is that investors should want is to buy every spin.

That’s because nearly half fail to ever generate value – making them almost "a 50/50 coin flip."

Osman goes on to say that the best time to typically get involved is one month after the spin-off...

Historically, the best spins involved utilities, materials, information technology, and health care... in that order.

The worst: energy and communication services.

And while there are exceptions to every rule, over time spin-offs tend to outperform their parents. Right now, one glaring exception to that is Madison Square Garden Entertainment (MSGE), which was spun off from what now is known as Sphere Entertainment (SPHR) – owner of the newly opened state-of-the-art entertainment venue the Sphere in Las Vegas. Sphere, the parent, has soared since the spin-off...

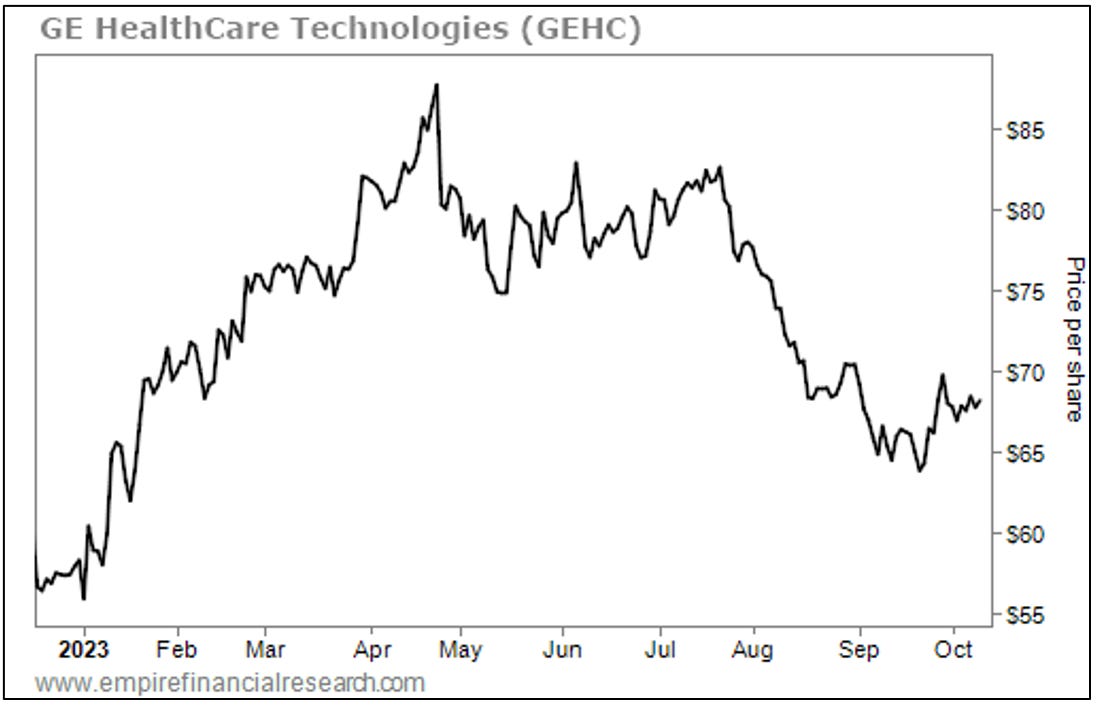

Among the spin-offs, so far this year there have been a few notable winners – including GE HealthCare Technologies (GEHC), which was spun off from conglomerate General Electric (GE).

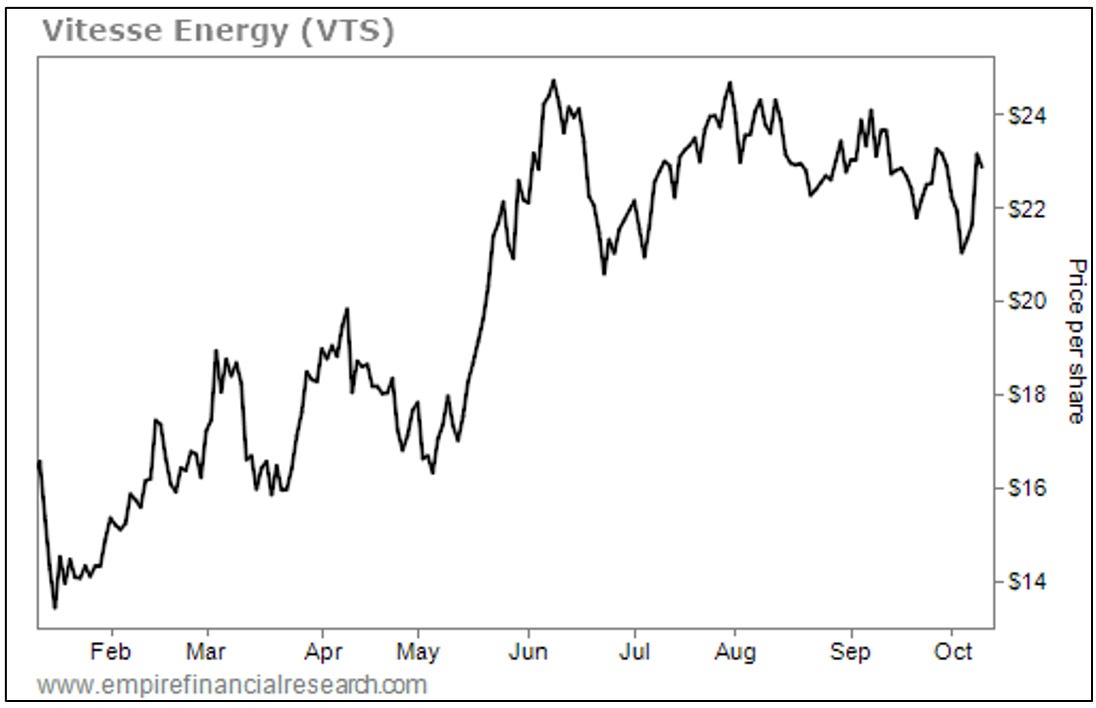

There's also Vitesse Energy (VTS), which was spun off from Jefferies Financial (JEF)...

And there's Crane (CR), which was spun off from Crane NXT (CXT)...

Others haven't done quite as well, at least not yet...

Among them are Veralto (VRLT), the water purification business jettisoned from Danaher (DHR)... the WK Kellogg (KLG) cereal spin-off from Kellanova (K), and the Vestis (VSTS) uniform spin-off from Aramark (ARMK). (Note: They’ve all been public for less than a month.)

For some of the best ideas, though, Osman suggests sifting through the orphans or 'distressed' spin-offs, that nobody seems to want...

One of his current favorites: Phinia (PHIN), a global auto parts supplier that was spun off in July from BorgWarner (BWA) as the company tried to lessen its exposure to internal combustion engines.

Phinia is a prominent leader in fuel systems, starters, alternators, and aftermarket parts... which seems a counter-intuitive investment as electric vehicles ("EVs") are gaining mindshare.

It reminds me a lot of Garrett Motion (GTX) – a Honeywell (HON) spin-off from several years ago – which is an open recommendation in my QUANT-X Systems newsletter... and was left for dead, until it sprang to life.

Osman's view is that Phinia's strategic positioning is designed to mitigate potential risks associated with the pace and scale of EV adoption. As he wrote in a report...

As a result, investors who want to avoid risk exposure to the EV market can consider PHIN an appealing investment option that offers diversification and resilience against uncertainties surrounding the EV transition.

Going forward into next year, the spin-off machine is expected to roll on...

Deals worth watching include Baxter International's (BAX) spin-off of its renal care unit, 3M's (MMM) partial spin of its health care unit and GE's spin of its Aerospace and Vernova power businesses.

And earlier this week, real estate development and management company Howard Hughes (HHH) announced it is spinning off Seaport Entertainment, a newly formed unit that owns the Seaport in New York and air rights for a potential new casino in Las Vegas.

That idea, no doubt, was sparked by the success of the Sphere deal.

As always, some will be better than others... but one thing is certain: If Wall Street isn't paying attention to these, you should be.

Nothing is more fun than finding treasure in the trash.

If you liked this, feel free to hit the heart button below… and tell your friends and neighbors!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

In over 50 years of investing my alltime best return was on the Perkin Elmer spinoff of Celera Genomics.

Cool piece! I'll be on the lookout...