Hostile React-O-Meter™ Squeaking Back to Life

Chatting the markets, QXO, OKLO, SVV, senseless stocks and life.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

Greetings everybody...

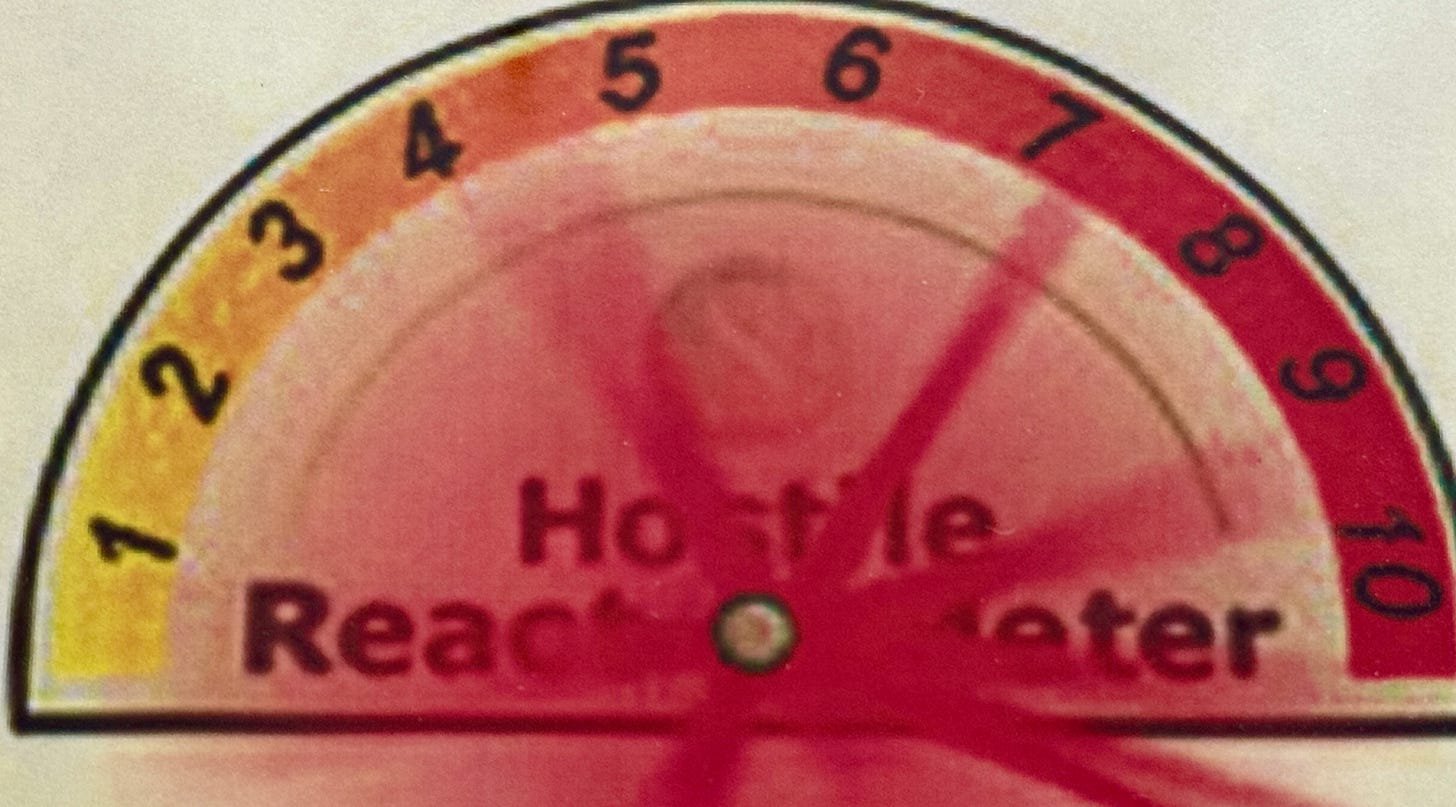

Quick note here to say it’s like the old days of not that long ago when people started to confuse brains with a bull market.... I’ve been doing this long enough to see it, feel it and hear it... and I can always either see it with my Hostile React-O-Meter™, which has been gathering dust over in the corner. Or my Red Flag Alerts Master List, which is considerably less negative than it was when fear was at its peak... just the other day.

If you’ve never heard of the Hostile React-O-Meter, it’s something I created in a different era to gauge the level of hostile comments I would get regarding something I wrote... whether it was on the old Yahoo stock message boards, or even in the earlier years of Twitter. Or just emails I would get. The more the needle moved, the more likely it would be that I was onto something. But nothing was better than knowing that the Hostile React-O-Meter was spinning outta control. (Outta control, I tell ya!) I quasi-retired it a while back, but I keep it here in my office and couldn’t believe it when I heard a squeaking sound over in the corner, and looked – and it was starting to move. But given how fast/how far this market has come, that shouldn’t be surprising...

After all, if it’s not nailed down, it’s flying... It’s a classic squeeze-o-rama, like a loaded spring. Should have known it when Steve Strazza, the chief market strategist at All Star Charts asked me a week ago why I was so bearish on Oklo, which he said that he was getting more bullish on. He’s just looking at the charts, but like it or not, that’s part of how Wall Street works. It’s not new. Just more pronounced thanks (or no thanks) to social media, Reddit, Robinhood and the yee-haw, YOLO-spawned smugness – at least when stocks are going up. Steve, for his part, is just the opposite, persona-wise. So, I sent him my work on Oklo. But it was meaningless because he’s staring at the charts, and I’m staring at reality... Such as Open AI’s Sam Altman, its chief backer, stepping down as chairman and the more recent filing to sell shares by the team at Alchemy Atomic, which was just acquired by Oklo.

My pal JC Parets, who founded All Star Charts, jokes that sometimes the stocks I think are the most senseless are the ones he can make money with on the long side. I’ve been hearing that for years, but the smartest of the smart, who play that game – or more politely, trade that way – also may very well be short that same stock when it hits whatever they perceive to be the magic number. I often say I don’t care what people do with my info, as long as it helps them make money – or avoid losing it.

Anyway, as my dad used to say, it’s just another day in the salt mines. I don’t do charts, but somewhere, somehow you just know they’re showing excesses. And if they’re not, they’re getting awfully close on some of these names. Right now – as a guy who doesn’t look at the charts – what I know is that we’ve gone from fear to greed in what feels like record time. I’d say that if we were putting this on the confidence map devised by my friend Peter Atwater, who wrote “The Confidence Map,” it would be showing peak hubris. Or as he wrote yesterday in his Financial Insyghts newsletter, “Not only is the U.S. equity market up sharply, but the trading bros on X are behaving like gladiators after a victory in the Colosseum. From their perspective, the timing has never been better to buy more 3X bullish ETFs!" Just remember, boys and girls, hubris can be oh so humbling. And Peter is a master of this.

Which gets us back to the Hostile React-O-Meter... It seems like too long since I’ve received the kind of messages I’m starting to see on Twitter, like this DM from some guy who writes, “You’re a f*cking moron,” referring to my QXO report, whose chairman and CEO is Brad Jacobs, who has a history as a Wall Street money maker. And then on Substack, also a QXO report saying, “I’d take Brad Jacobs over Herb Greenberg any day.” So would I, except, as I wrote back to the guy – “did you read my full report?” Of course, he didn’t, because he’s not a paid subscriber, and he had no idea what the thesis was... only that I was raising red flags over a company run by a legendary CEO. The way I view it: It’s just a stock, not a jihad. But then again, therein lies the story... and where we are in this market.

Oh, and before we go... Savers Value Village is down around 55% since I first wrote about it a little more than a year ago with my friend KatherineSpurlock. Today, alone, it’s down 12% on news that Ares Management, its biggest holder and one of its key backers, is peeling off a large portion of its holdings. SVV operates thrift stores in the U.S. and Canada, which makes their sale and the stock’s sub-performance intriguing since, in theory, we may be entering a new golden era of thrift stores. At least that’s what this Wall Street Journal story suggests based on the current direction of the economy. For all, it appears, but SVV, which wasn’t mentioned in the story. The beat goes on...

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no position in any stock mentioned here. I’m under no obligation to update or alert subscribers if and when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.