Michael Saylor, tl;dr: 'Just Trust Me.'

I've seen and heard a lot; this latest infomercial by Strategy for its preferred stock takes the cake.

One take-it-to-the-bank rule-of-thumb of investing and Wall Street is that the higher the yield, the higher the risk.

Another is that if it’s too good to be true, it usually is.

Worse, if it’s being pitched as if it’s the next-best thing to risk-free, it usually isn’t.

The wild card is when the pitchman is Michael Saylor of Strategy (née MicroStrategy) MSTR 0.00%↑, when he’s talking anything bitcoin-related, but especially what he calls “digital credit.”

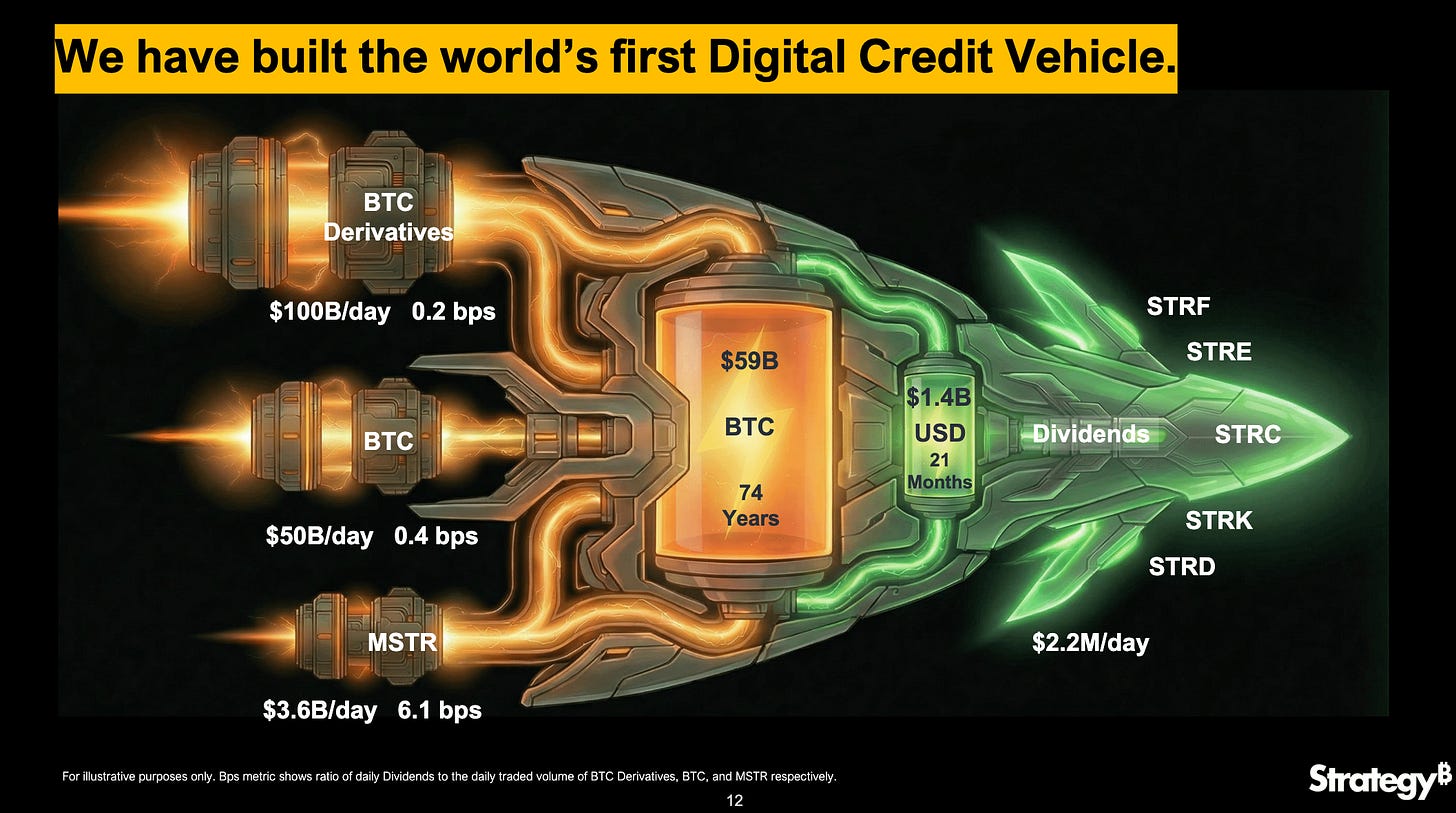

Never mind that there’s no such thing as digital credit as a security. But that hasn’t stopped Saylor from talking about it nonstop, starting mid-last year, as if digital credit were common knowledge rather than a made-up marketing wrapper used to sell his latest financially engineered concoctions… created for the sole purpose of financing Strategy’s purchase of more bitcoin. “Big innovation,” is the way he has described it. It’s so big that “digital credit” was mentioned a record 48 times during scripted comments by management on the company’s latest earnings call, with 37 mentions – the most ever – in the earnings presentation, including this one…

Like most of Strategy’s earnings and investor calls, this one was part revival meeting, part traveling medicine show, and part Advertising/Marketing 101 – pulled directly from the “tell them what you want them to hear and think” school of salesmanship. (Think Mad Men’s Don Draper turning Kodak’s drab-sounding slide projector “wheel” into a “Carousel” of memories.)

Saylor’s approach is either brilliant or brilliantly devious or deviously deceptive, depending on which side of the bitcoin and more specifically – Strategy – divide you’re on. Or as the New York Times recently wondered, in an article in which I’m quoted…

I’ll let you debate that question, bitcoin, and all other Strategy matters among yourselves.

What I do know is that if you eliminate the name of the company or the person saying it and just go merely on what has and is being said – especially on this last earnings call – you might consider holding on to your wallet.

Here’s why…

Not only was that call, at two hours, roughly twice as long as the company’s other earnings calls. But after stripping away everything else, it turns out my pal Fil Zucchi – who writes Fil’s Randoms on the Markets, and knows a thing or two about credit – was right when he told me: “This is nothing more than an infomercial for STRC.”

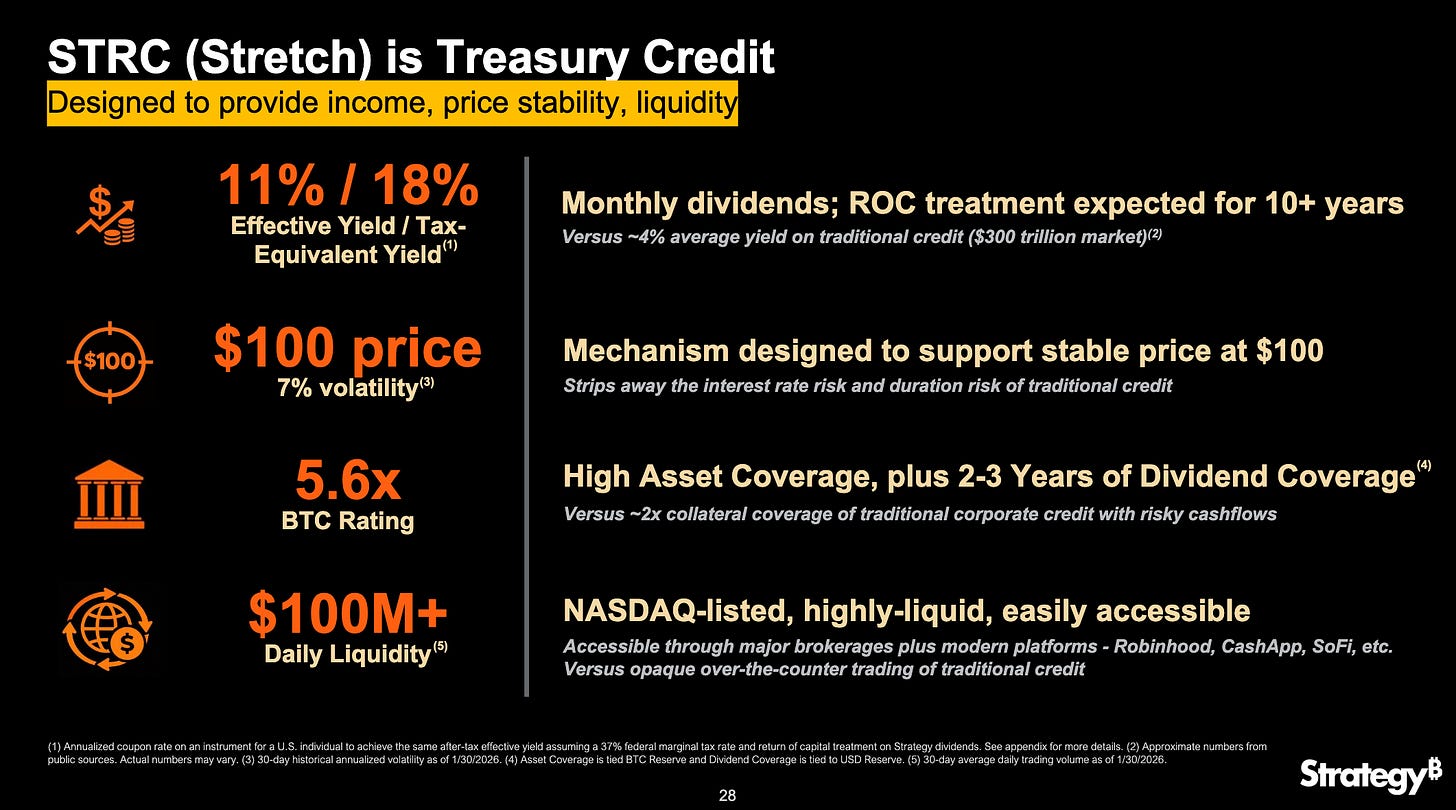

STRC 0.00%↑, or Stretch, as the company calls it, is the latest in a series of preferred stock – oh, sorry, digital credit – Strategy has issued to fund its ongoing bitcoin purchases.

What makes this one different? For one thing, it boasts a monthly 11.25% cash dividend.

On its own, that’s a red flag. But then Saylor said this…

Our view with Stretch is we're going to market it to the general public. We're going to market it to credit investors. We're going to market it to enterprises. We're going to market it to corporate treasurers and corporate CFOs, right? We're going to offer you 2 to 4 times more than your existing treasury strategy.

With that, I thought: Wait, I’ve heard this before…

Oh, yeah, it was those supposedly “safe,” highly rated money-market alternatives, known as Auction Rate Securities, which offered a slight premium above money market rates and famously blew up in 2008. Sold by brokers, they sucked in everybody from retail investors to corporate treasures, all in the name of a slightly higher yield.

Corporate treasurers often reach for yield, but there’s reaching, and there’s reaching. Strategy isn’t just offering slightly higher rates with STRC, but extraordinarily higher rates with the claims of providing income with the bonuses of liquidity and stability…

Don’t understand bitcoin? Not sure about Strategy? Not to worry, Saylor says. As he explained a quarter ago, when the rate was lower…

The simplest idea is 10.5% dividends paid monthly for those who like money. It’s just that simple. You like money, you trust the company, but you don’t understand anything else. You collect 10.5% dividends. They’re tax-deferred. They’re paid monthly. You tell your friends.

Now that it’s 11.25%, he takes it a step further, calling STRC a “10-second idea” while reinforcing the “digital credit” part of the story…

Clearly, we believe the killer app of digital capital is digital credit. And oftentimes people joke, it takes 100 hours to understand Bitcoin, maybe it takes 1,000 hours to become a Bitcoin maximalist. It only takes 10 seconds to understand Stretch. Stretch is 11.25% dividend yield paid monthly. That’s it, right? It’s a 10-second idea.

Easy, peasy.

But as Michael Lewitt, who writes The Credit Strategist and focuses on almost nothing but credit, told me…

Go for the dumb money. High dividends are a red flag here. Of course, investors will like an 11% yield, but that’s a CCC-coupon. A company that has to pay this high a coupon knows it can’t raise capital at a lower yield because it is extremely risky.

That’s where the infomercial nature of the call comes in. Here are a few choice comments from Strategy management, with a bit of narration by me…

CEO Phong Le…

Stretch is one of the most attractive instruments and securities in the market today.

If he doesn’t say so himself, but if that wasn’t convincing enough…

It pays an 11% effective yield, 18% on a tax equivalent basis. We paid monthly dividends on time, on schedule. And we have said that we expect the return of capital treatment for the next 10 years. We’ll run our business to be able to give everybody tax-deferred earnings for the next 10 years.

Does it matter that STRC currently trades a tad below $100, or par? Not to worry, Le says…

We’re targeting a $100 price. The volatility is 7%, it’s actually decreased recently to 6%, and we have mechanisms above and below that price to keep the price stable. It’s quite a bit of a feat of financial engineering. And it’s extremely over-collateralized. After you take out all instruments that are senior to Stretch, we still have 5.6x collateral over Stretch. And so it’s an over-collateralized instrument. And then after that, we’ve added $2.25 billion of U.S. dollar reserves. So we have 2 to 3 years of dividend coverage. And I mentioned the liquidity of Stretch is trading extremely well.

Sounds almost too good to be true. Relax! According to Le..

It’s Nasdaq-listed, and it has a 4-letter ticker, is easily accessible to folks. It’s now accessible on Robinhood and Square Cash App and pretty much anywhere else that you can buy a security.

Nasdaq-listed? Beautiful. That means it’s easily traded. On the Nasdaq, no less. And at Robinhood… and Square! (Hopefully you can hear my sarcasm.) Still leery? Let’s bring in Saylor for the close…

We don't just benchmark ourselves against other credit instruments. We also benchmark ourselves against all the other non-U.S. dollar currencies. And what you can see here is the U.S. dollar has got a 370 basis point risk-free rate, but the Korean won, the Canadian currency, the euro, Singapore dollars, Japanese yen, Swiss francs… they're much weaker. And so fundamentally, you can think of the Stretch rate as the risk-free rate in the Bitcoin ecosystem. It's like the Bitcoin rate, short end of the yield curve.

Wait, did he say “risk-free”? This is getting confusing. It shouldn’t be, Saylor says…

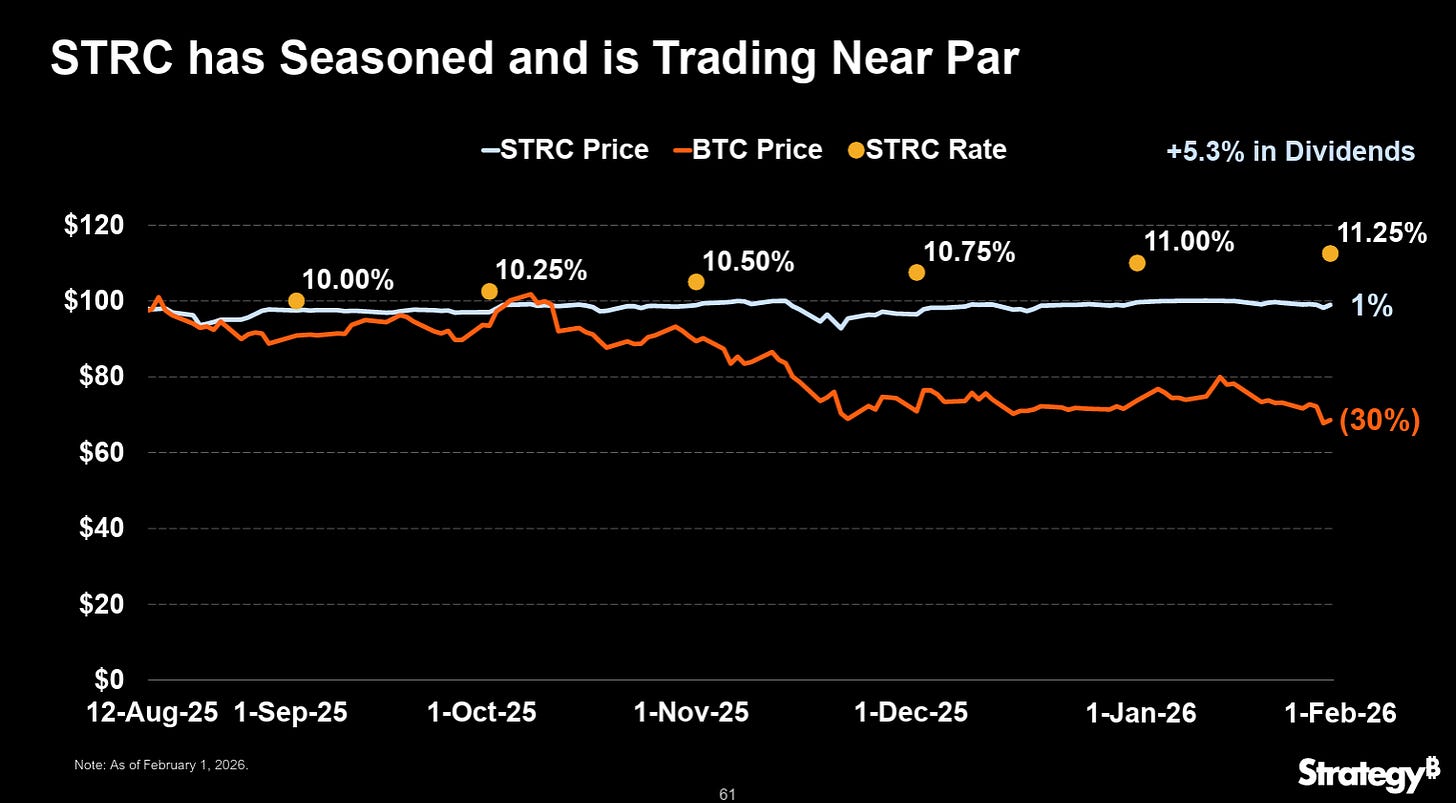

Here's an actual 4-month snapshot. And this is an interesting comparison, Stretch versus Bitcoin…

He went on to say…

What's the difference between credit and capital? Well, in the last 4 months, Bitcoin has traded down 30% through the first of February, Stretch is up 1%. And so it doesn't take a rocket scientist to look at this chart. If you're a retiree, if you're a corporate treasurer, if you're a fixed income investor, if you're any kind of investor and you look at these two charts – if your crypto curious or you think you might like Bitcoin, you look at this and you think, "Well, I like it, I just can't stand the vol,” and you can see why.

Do you want 30% drawdown and no dividends, or do you want a 1% price appreciation and 5.3% paid dividends with an ongoing 11.25% dividend rate? And with a company that's making a commitment to stabilize that price… to target $100 and do whatever it takes, including raising the dividend.

I’m certainly not a rocket scientist, but I get it! Stretch is a no-brainer, right? Again, Saylor…

If you believe in the future of digital credit and you want to invest in the company that is making it possible, you would buy our equity. And if you do that, you should probably have a 7-year time horizon because we’re long-term thinkers. Every day is not going to be a great day, every week, every month. If our thesis is wrong for 100 years, the equity won’t work, and we’ll run out of money to pay the dividends at some point in 100 years. If our thesis doesn’t work for 10 years straight, if that doesn’t work, then the credit will get paid, the dividends will get paid, the equity won’t be a great investment for you.

He continued…

But if we actually execute and if over the next 7 to 10 years, things work out fine, the company is well managed, well collateralized, and responsibly structured so that we can stand difficult months, difficult quarters, even difficult years or 2 or 3-year cycles at a time. We’ve done it before. And we’re prepared to do it going forward.

And, there it is: Either you trust Saylor at his word or you don’t. Or, if you’re still not sure, you head over to the company’s SEC filings, where, in the fine print, you get the equivalent of the old “past performance doesn’t guarantee future results” warning(s).

What you’ll find, summarized, is…

The company has no obligation to maintain $100.

The company can abandon the dividend framework at will.

Assumptions will be inaccurate.

That last one is important, especially if read in context…

Like any other security, the trading price or value of STRC Stock will depend on a wide range of factors, including those described elsewhere in this "Risk Factor Updates" section, many of which are beyond our control. While we expect that the dividend rate on STRC Stock will directly impact its trading price or value, there are many other factors that could have equal or more significant impacts. Any adjustment we make to the monthly regular dividend rate per annum of STRC Stock that is designed to achieve a specified trading price or value will, necessarily, be based on assumptions regarding those other factors. These assumptions will always be inaccurate or incomplete to some degree, and potentially to a material extent.

Did they say they will always be “inaccurate” or “incomplete” and to some degree “to a material extent”? They sure did, and while all of those risks are boilerplate, don’t ever forget they’re there for a reason… mostly to give the company wiggle room to say, if all things don’t go as planned: “Don’t say you weren’t warned.”

Still eager to take the bait? Go for it, but remember what Warren Buffett said in his 1987 letter to shareholders: “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.”

Interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no position in any stock mentioned here.

I can be reached at herb@herbgreenberg.com.