Monday Mashup: Sailing on a NO Boat from China

Also, Chinese IPOs, Repatha (AMGN) vs. Praluent (REGN), Alzheimers (would you want to know?!), obituaries and some housekeeping.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

Broken link... Decades ago I wrote about a U.S. company, Media Vision, whose CEO and CFO both wound up going to prison. Among the reasons were my investigations into the company, which showed it had recorded revenue on products that hadn’t even been manufactured yet. Turns out the parts for the products whose revenue had been recognized were still on a slow boat from China. With China relations now strained to the point of breaking – again! – just a reminder there's a chance Netgear $NTGR could be a huge winner – assuming there is no boat from China for its largest competitor, T.P. Link. If you missed my original Netgear report, you can read it here. And my recent update here.

Speaking of China... The Chinese chatter includes speculation that the U.S. could jettison all Chinese companies listed in the U.S. Chances of that happening? I’d say meager, only because listing fees from Chinese IPOs have been a cash cow for U.S. stock exchanges. That’s supported by the U.S.–China Economic & Security Review Commission, which was formed by Congress in 2020 and seems to operate in the shadows. As of March 7, there were 286 Chinese companies listed on U.S. exchanges, with a total market cap of $1.1 trillion.

In Q1 2025 alone there were 21 Chinese lPOs in the U.S., or 36% of the total. For perspective, in all of last year there were 48 Chinese IPOs. And as I recently pointed out in “The Increasingly Silly Art of Spin” and “The New China Hustle,” more than a few of them – via by domiciling themselves in the Cayman Islands – are going out of their way to distance themselves from China. The only question now is whether sabre-rattling over this will be another ringing of the TACO bell...

Turning to medicine...: A few weeks ago, in the TMI department, I mentioned that I was about to start taking Repatha, the Amgen $AMGN PCSK9 inhibitor (A.K.A. a supposed game-changing cholesterol lowering drug that’s akin to statins on steroids.) Scratch that. I’ve shifted to rival Praluent, from Regeneron $REGN – simple reason: My insurance won’t cover the Repatha. As I do with any drug I take, I like to know more about what I’m swallowing or, in this case, injecting. I was struck by how little I found on Praluent. I even wondered... Why did my doctor prescribe one over the other?

As best I can tell, when it comes to PCSK9s, Amgen has won the marketing and reimbursement wars. You can see it in the revenue, with Regeneron’s PCSK9 last year generating sales of $639 million (or 4% of its total revs) vs $2.2 billion for Regeneron (where it’s 6%.) Digging deeper, lawsuits are flying back-and-forth between the companies over this drug. I don’t follow either company – drug approvals are too much of a wild card – but there’s a good story buried in here somewhere and this three-year stock chart comparing both is all you really need to know.

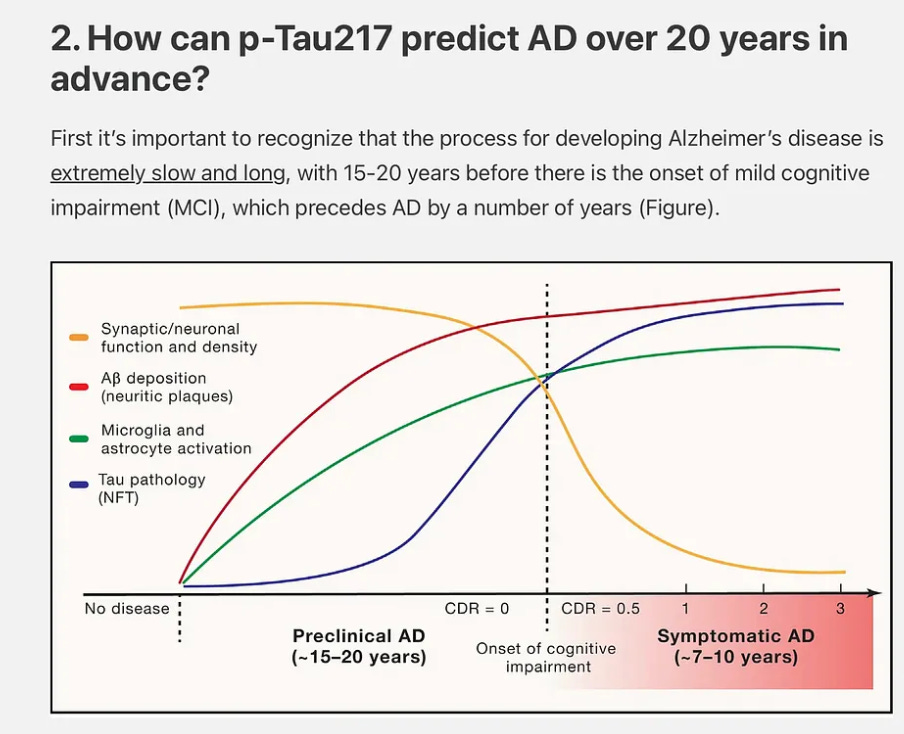

Sticking with a theme: This post from Eric Topol, who runs the Scripps Research Translational Institute and has been a consulting cardiologist to me, caught my attention. It’s about using biomarker blood tests to predict Alzheimer’s Disease 20 years in advance.

My question: But do I want to know? Spoiler alert: If knowing could delay the day of reckoning, I suppose. Head it off at the pass entirely, absolutely. But without the chance of either, considering the psychological hit of knowing... unlikely. I’m assuming I’ll live to see the day. What about you? Know or not know?

Speaking of Alzheimers...: I used to write obituaries. Well, I wasn’t THE obit writer but when I interned at the Miami Herald decades ago, while IN college, I did the fill-in on weekends or when the obit writer was out. Rule No. 1 back then, and in journalism in general, was to always cite the cause of death. I’m always surprised today when deaths, especially celeb deaths, don’t give a cause. EVERYBODY wants to know… in part because when we see someone dying closer to our age (and for some odd reason I’m seeing more and more of that every day) you always wonder... how? At least I do, especially when it’s “after a brief illness.”

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no positions in any stocks mentioned here. I’m under no obligation to update or alert subscribers if and when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.