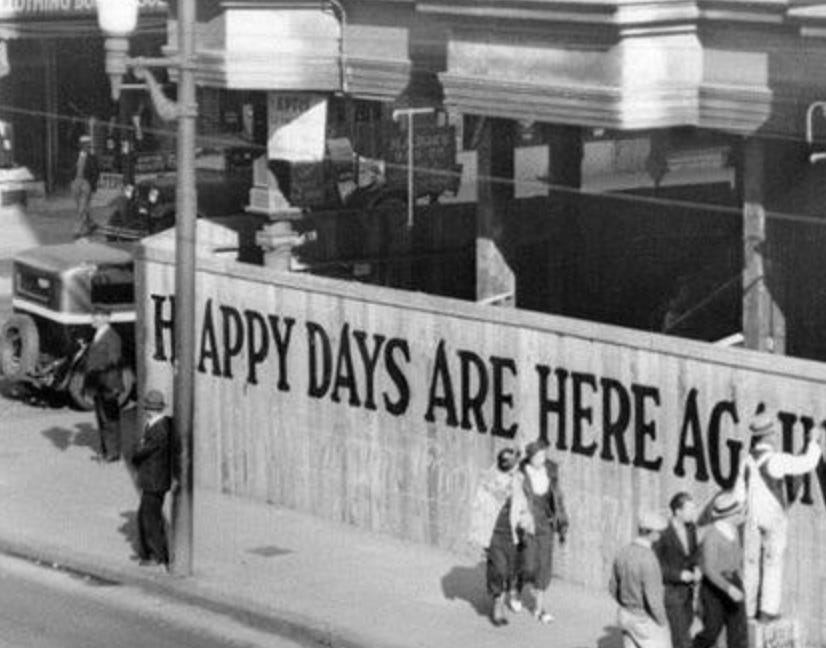

Monday Mixer: ‘Happy Days Are Here Again’

The market, SoundHound, Hims, MP, QXO, Amgen, Repatha and today’s grammar lesson.

Greetings everybody…

Wow, what was that all about? This stress over tariffs, which sucked in the entire world – caused by self-inflicted chaos – was all about 10%? Really? I try to keep politics out of what I write about, but this isn’t politics, this is just… Well, if it were a company I’d be having a field day. For better or worse, I look at everything through the lens of how it would be viewed as a publicly traded company. And for some reason, red flags often wind up flying over companies run by “all about me” executives, who surround themselves with “yes” men and women and become so insular they can’t see what everybody else does. It’s the epitome of poor management.

Speaking of which… Now that stocks are rising, I can’t get "happy days are here again” out of my head, knowing full well that the amount of conviction in this market is as strong as a frayed thread. But, careful. For the market as a whole, stocks look for reasons to rise and fall. Today they have a reason to rise. The higher stocks go, sweeping up even the garbage in its wake, the riskier the riskiest stocks get. The higher they go, the more opportunity for my Red Flag Alerts… because trust me when I say, rising stocks make fundamentally weaker companies that much more vulnerable.

Examples abound… I always say my Red Flag Alerts list is a great indicator of excess… because if names on that list rise excessively in squeezes – like the one today – it should be an opportunity for trapped longs to exit with grace. Look no further than SoundHound and Hims and Hers, with one (SoundHound) up on air and the other (Hims) up on the latest twist to an ever-evolving narrative. This time it’s that Trump’s latest drug-induced executive order will create a new tailwind to direct-to-consumer models, such as the one Hims operates. Except… if the goal of this new drug deal is to cut out the middleman, it would seem you don’t need – a middleman. For example, I recently started buying the dry eye drug Vevye directly from the manufacturer, Harrow, for $59 rather than the $600+ my first dose cost just before they started a new DTC program. (Can’t imagine what that does to margins.) And thanks to Mark Cuban’s Cost Plus Drugs, and GoodRX, I’ve been able to get loads of generics cheaper than I can get with Medicare and a secondary insurer. I get it, I get it – Hims serves the uninsured and those who don’t want to “go” to a doctor. Cool, except, it has plenty of private competitors. That part of the story often gets lost in the hype surrounding a public company.

Speaking of Hims, that reminds me... This is for you kids out there: It’s not “him and me” or “her and me.” it’s “he and I” or “she and I.” Just so you know, if you find yourselves using that – and it seems more and more of you are – you sound illiterate.

Back to stocks… One red-flagged stock not getting squeezed is MP Materials, the rare earths miner that had been bid up on protectionism and national pride with the goal of making rare earths great again. I laid out why they’re not and likely won’t be here and here. As I wrote, if there is any industry that proves the fallacy of protectionism and the genuine need for geopolitical cooperation, it’s rare earths. MP was perceived to be a beneficiary of isolationism. Any progress with China doesn’t work in its favor. It’s the ultimate lose/lose scenario.

More stocks… If you missed my report over the weekend on the likely short-term risk facing QXO, the latest creation by serial entrepreneur Brad Jacobs, you can read it here. Rare to see a company do what QXO did - and point out, as a risk, that its CEO’s past success “may not be representative of our future performance or the returns the Company will generate going forward.”

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no position in any stock mentioned here. I’m under no obligation to update or alert subscribers if and when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.

i’ll take brad jacob’s over herb greenberg any day