Red Flag Alert: Is Lululemon More Like Under Armour or Chipotle?

Victim of its own success...

The big question for investors at that point is whether it’s a breather... or a break.

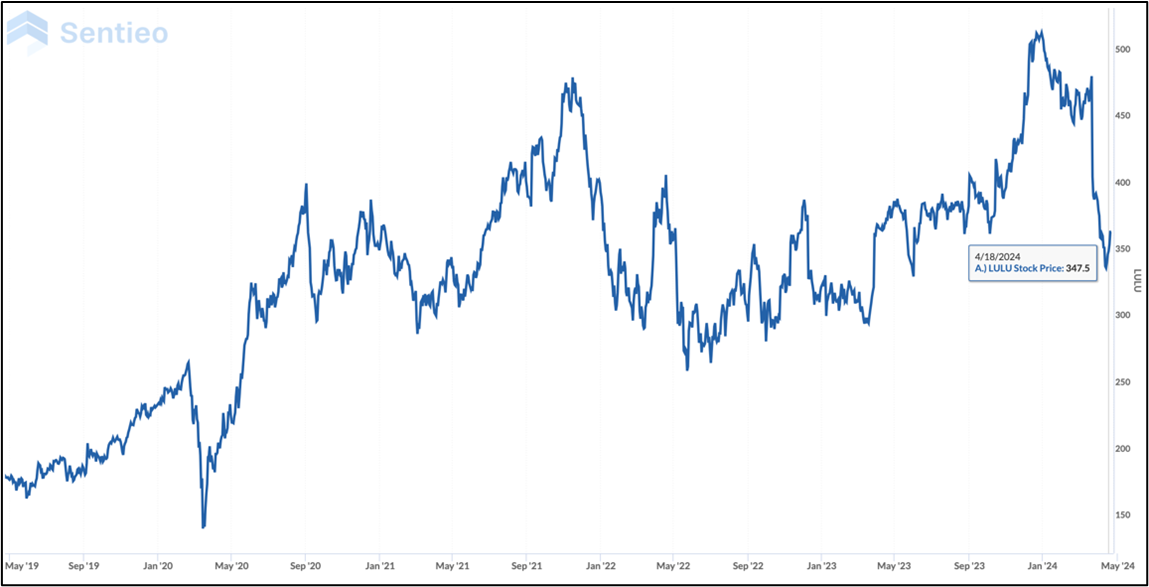

Enter Lululemon ($LULU), which has tumbled 22% since reporting earnings last month and nearly 30% since hitting its all-time high in December.

Lulu has been a topic of conversation lately with my friend, retail analyst Jeff Macke, the consummate Lulu bull. Jeff has been a fan for years. He was pounding the table on it when it first rolled out its men’s line, and put his money where his mouth was: Not only wearing the clothes, but as an investor for around eight years, buying the dips – even the big ones – along the way.

This time, he isn’t. Or as he puts it...

I'm not sure if it's a short yet. I'm not ready to go there. But I don't feel really compelled to buy it here. Normally my instinct when you say ‘down 30, 40 %’ is to start loading the boat on almost anything and ask questions later.

Not so much in a situation like this. I feel that, you know, I've got too big a position in basics. I like Levi's over Lulu. If you would have told me I'd say that a year ago, I would have thought you had gone insane. It's entirely possible I have, but that's where I am.

That’s where this gets interesting...

A Double Sell

It’s one thing when longtime bulls pause in their buying when stocks fall. It’s another when longtime bulls don’t just sell, but go short. (A double-sell!)