Red Flag Alert – Rolling Out the Self-Kicking Machine. Two Stocks to Avoid, Two updates

I'll bet you've never heard of Tom Haywood...

Back in the 1930s, he invented a self-kicking machine – consisting of a hand-operated crank connected by a belt and pulleys to a wheel, which had four spokes with a shoe attached to each spoke. For a swift kick in the rear, the operator would bend over and turn the crank.

Haywood's contraption went on to become a tourist attraction in the small North Carolina town of Croatan. The original is now in the North Carolina Museum of History.

The only reason I know about Haywood and his contraption is because I started researching self-kicking machines the other day after realizing I had missed a great idea for the Red Flag Alert… by a week!

This isn't the first time and it won't be the last... but no matter how old I get, each time feels the same – making me want to give myself a swift kick in the rear.

The good news, as is often the case, is that there's a learning experience in this one...

The company in question, Leslie's (LESL), is synonymous with swimming pool supplies, with more than 1,000 physical stores in 39 U.S. states.

I first started poking around it when the company went public during the market frenzy in October 2020. That’s when Leslie's was spun off by private equity ("PE"), which was clearly taking advantage of money pouring into the stay-at-home boom in all things home improvement. The PE firm, which had loaded the company with debt, was clearly the smart seller.

I didn't look again until Leslie's started showing up awhile back on the monthly buy/sell lists I get from Kailash Concepts ("KCR"), a quantitative research firm whose work I value.

But it wasn't until the latest list hit my inbox a little over a week ago when tagged it as my next red flag.

Not only was it on KCR's earnings manipulation list, which is always fun to peruse, but now it also landed in the bottom 25 stocks in the Russell 2500, where it ranked 1,604 out of 1,609 small- and mid-cap companies.

The reason for its low-ranking was obvious: The quality of the company's numbers were sinking rather rapidly to the lowest tier of scores...

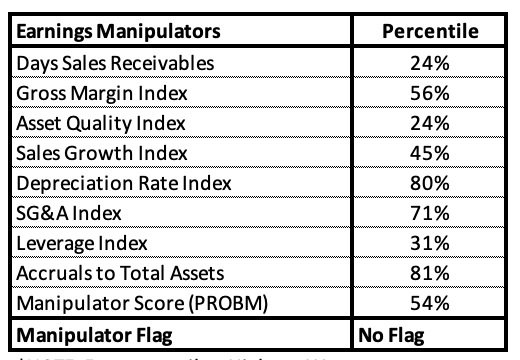

Equally alarming was that the so-called "M-Score," which can suggest earnings manipulation, dropped from a ho-hum 54% in November of last year...

...to 96% at the end of June – so high that Leslie's was flagged as a "possible manipulator."

I use the M-Score to help screen out potential landmines as I hunt for long ideas for my QUANT-X Systems newsletter. (You can learn more about QUANT-X Systems right here.)

There's obviously no foolproof way to avoid getting bamboozled…

That’s why quant data should be used as a jumping off point for further long-biased research.

But that data can help quickly flag stocks to avoid, which is the focus of the Red Flag Alert.

Using the M-Score and KCR's data, once I identify a name I like to scrape back through more than a half years' worth of screens to determine just how bad things really might be.

For me, Leslie's checked all the boxes... and I figured I would write it up as my primary Red Flag Alert stock this week.

With the stock already hit so hard, I thought I had time... Famous last words.

After the close on Thursday, Leslie's preannounced unexpectedly bad third-quarter results. The warning came a mere two months after the CFO reassured investors that the company would meet its guidance. And that's even after inventory more than doubled from a year earlier.

Oh, and by the way: Leslie's announced that it was replacing its CFO.

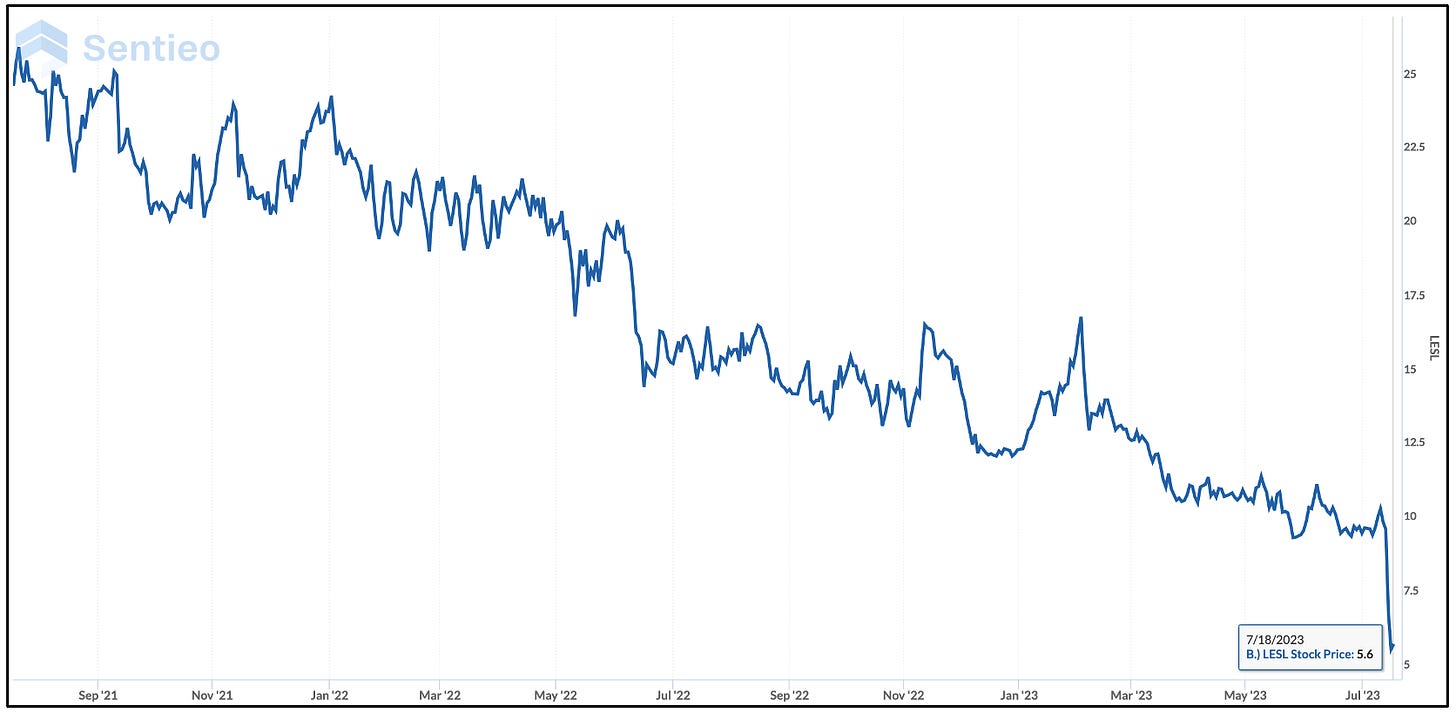

In response, the stock tumbled 30%.

Here's the lesson...

After a stock has fallen so hard, there's a tendency to think it has already been pummeled enough, so the worst must surely be over.

With Leslie's, before tumbling, the stock had already lost two-thirds of its value from its 2021 peak, and 33% from its January high.

But if I have learned nothing else over the years, and should be exceedingly clear here: It's that just because a stock gets hammered doesn't mean it can't get hammered even more.

Right now, Leslie's is trading for less than $6 per share. In conjunction with its earnings report and announcing the departure of its CFO, it announced a new CFO, who seems to have a solid pedigree.

However, no matter how clever he is, it would appear all of the financial levers have already been pulled... short of cutting the fat and muscle.

That leaves any improvement in the fundamentals of Leslie's to be operational. Obviously, it's a turnaround candidate... Who knows, maybe an activist will find something here. Or maybe Leslie's will wind up back in the clutches of private equity.

But then again, in its quest to build inventory after supply chain disruptions, its debt has ratcheted higher – much of it tied to a floating rate that as of last quarter had soared to higher than 7%, or roughly double the rate at the initial public offering ("IPO"). Meanwhile, cash has dwindled to nearly zero. Sales growth and profits are through the floor.

It’s so far under water that – who knows? – even PE might not want it.

Which is why at this point, even with its stock having been as clobbered as it has, I view Leslie's a high-risk "show me" story. Avoid.

Moving on, one look at its stock chart and ChargePoint (CHPT) might appear too obvious...

It's a money-losing provider of electric-vehicle ("EV") charging stations, hardware, and software. It's as much a pure play on EV charging as you can get.

But ChargePoint's business model has yet to be proven, its competition from Tesla (TSLA) on the charging front seems to be increasing, and charging in general is an industry without any real moats. Take a look at the stock since it hit an all-time high back in December 2020...

Furthermore, ChargePoint been showing up on the KCR lists with some regularity.

But this month, there was something new...

In addition to low-quality financials, the company has now landed on the earnings manipulator list for the third straight month, with its M-Score steadily getting worse... hitting 94%. That's up from 89% and 87% in June and May, respectively.

The quality of its earnings – or lack thereof – continues to decline.

Investors often overlook earnings and balance sheet quality at growth companies, but ChargePoint's sales growth is decelerating as its losses continue and its net debt has started to rise.

Management has been on the road telling its story to investors. There are higher quality investment ideas out there. Avoid.

Finally, two quick updates on previous red flags...

Sunrun (RUN). Its stock may be flying since first flagged here back in May, but solar installation company Sunrun continues earn a slot on KCR's unattractive high debt and earnings manipulator lists. The only bright note: It's M-Score has slid to 90% from 95% when I first flagged it. On the other hand, it’s overall quality among small- and mid-caps has continued to sink, ranking 1,582 out of 1,609.

Enviva (EVA). And Enviva, one of the red flags earlier this month, now ranks 1,609 out of 1,609 companies on KCR's small-midcap list. Translation: Doesn't get worse than that.

Have Ideas? Join the Red Flag Team

As always, I welcome ideas and enjoy collaborating and hope to build a circle of Red Flag contributors. Feel free to reach out via my private email (if you have it) or via herbgreenberg@substack.com.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

I love the idea of a Manipulator score, but I also like to consider Executive confidence & competence.

When I look at a company like GPOR, I see insiders not holding hardly any stock and selling a substantial amount of that over the last 3 months.

I also see big investors whittling down their holdings (Silverpoint Capital down about 20% in 3 months and last chunk sold at $118, Now:$116.)

For a company that was BK in 2021, it doesn't inspire confidence.

Yet, I don't have a quick, easy way to screen for earnings manipulation.

And another nice screen would be for Analyst Manipulation:

KeyBanc Capital Markets analyst Tim Rezvan upgraded Gulfport Energy stock to Overweight and set a $145 price target in early August.

Could Keybanc have some tie with GPOR?

Silverpoint does, they still hold 1.7M shares they bought out of the 2021 bankruptcy and may have an incentive to hold these as they are convertible to Prefered.