There are cycles, and there are cycles...

I've seen one too many cycles last considerably longer than even companies and certainly analysts and investors expect.

I'm following a company in the chipmaker space, for example, that has been talking about things bottoming for quarters... and it's still not there.

This brings me to solar energy, especially the two big manufactures of inverters used alongside solar panels – SolarEdge Technologies (SEDG) and Enphase Energy (ENPH). Inverters are little boxes attached to the panels which, in effect, convert solar energy to electricity.

One look at their stock charts, and it might appear that whatever bad news is out there is already priced in. Both stocks, after all, have already fallen hard this year...

Here’s SolarEdge…

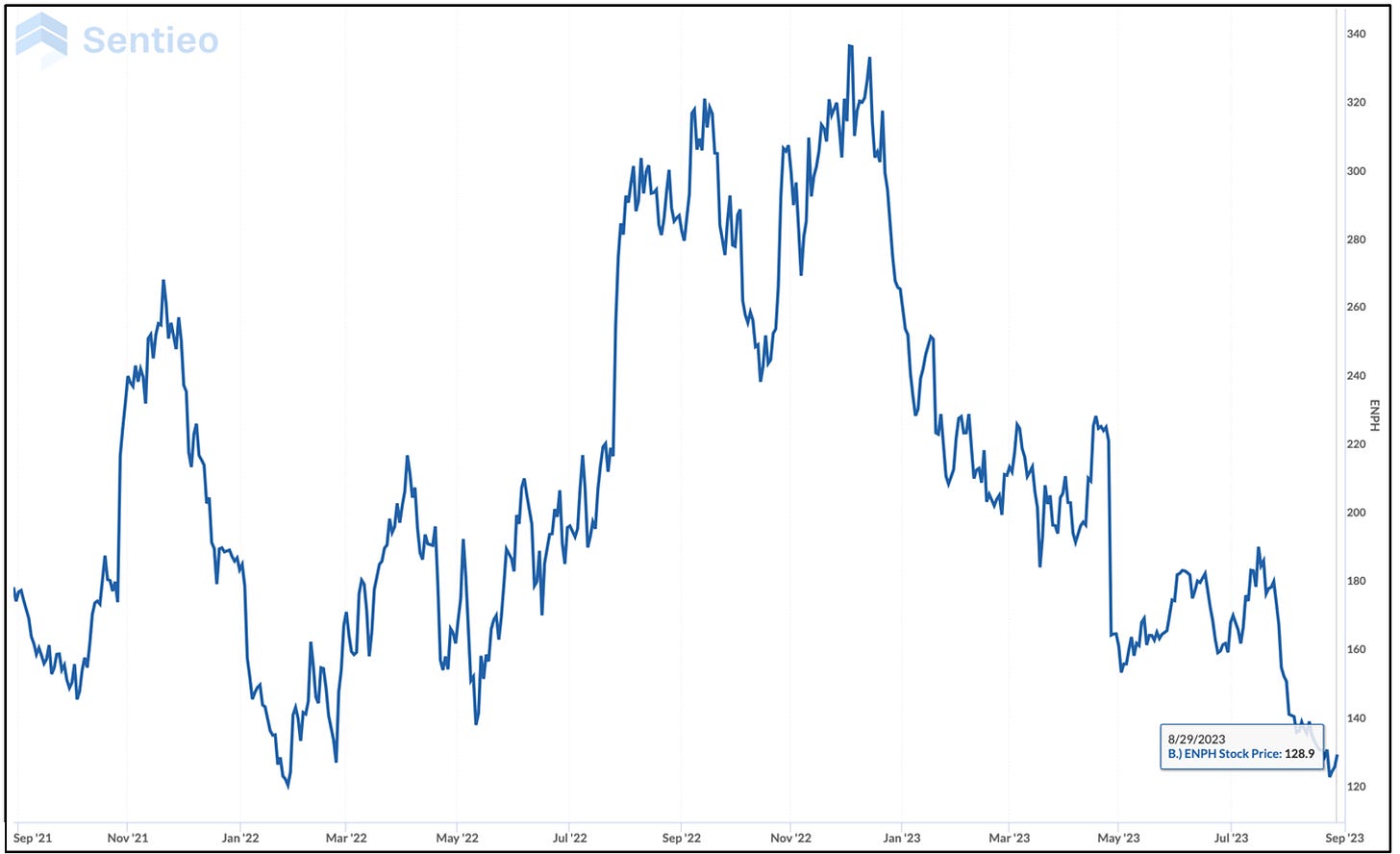

And Enphase…

Don't fall into the trap of thinking that just because "their multiples have already compressed," they can't compress further. Or in simpler terms, that since their stocks have already fallen so far, so fast, that they can't... because they can. Or the way I see it, there are currently better stocks to own. (That’s a theme here, if you haven’t noticed.)

The solar industry has been hit by the perfect storm...

If it's a cycle, it isn't a cycle in the normal sense. It's so abnormal, in fact, that industry was caught totally by surprise by how swiftly things came unwound. (Which in itself, folks, is a red flag.)

There are a number of reasons, but here are five that matter:

There was a big change in California, which represents half the solar industry in the U.S. Earlier this year, the state changed its so-called "net metering" rules, which in effect govern the amount of money a solar customer gets by selling energy back to the grid. In this case the amount was chopped by 75%. At the same time, under the new system, it's advisable to add solar batteries to the packages. They're expensive. The lower credit combined with batteries has pushed out the payback period on solar from just a few years to many years... even as federal tax credits continue. That, in turn, makes solar less attractive.

Beyond California, most homeowners in the U.S. get loans to help pay for solar. That was fine when rates were lower and the payback was faster. But along came sharply higher rates... not good for sales.

Europe has always been big for solar, especially Germany and Spain. And everybody thought the war in Ukraine would be a bonanza for solar in Europe, and it was. Going into winter, the industry thought sales in Europe would grow by 50% to 60%, so it flooded distributors with inventory. As it turns out, sales grew considerably less, and winter was milder than expected. As distributors reduced inventory, they kept less inventory on hand.

Even as demand fell, Chinese inverter manufacturers did what Chinese manufacturers typically do... To keep their factories running to cover high fixed costs, they kept producing product and flooding the European market with lower-priced products.

If that wasn't enough, both Enphase and SolarEdge are about to ramp up production in the U.S., thanks to manufacturing incentives from the Inflation Reduction Act... and it's happening just as demand has fallen.

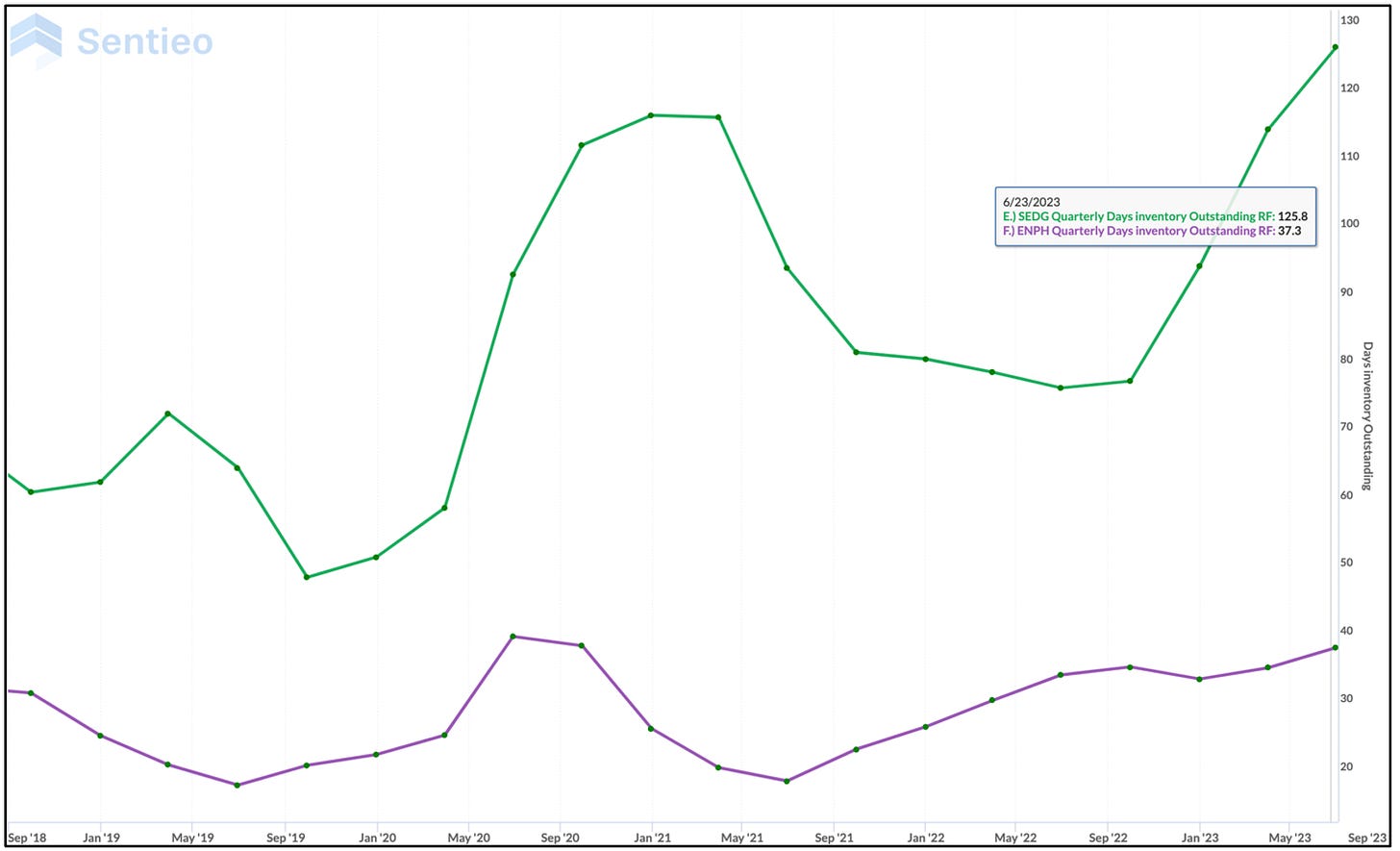

Inventories, as a result, have shot higher...

SolarEdge, which does most of its business in Europe, has said it expects things to normalize by year-end. Meanwhile, Enphase says things will be back to where they should be within a quarter.

There's just one problem, as I see it...

Like the chipmaker I mentioned earlier, the managements of these companies don't know for sure what's going to happen. If you listen to what they say on their earnings calls – especially SolarEdge – they're fairly candid about what has been going on. Or as SolarEdge CFO Ronen Faier said at an investment conference earlier this month...

I would say that we haven't seen anything like it before. I think that the two new characteristics of the phenomenon that we see right now is, first of all, the speed in which everything happened. I would say that if you asked me six weeks ago, we saw a little bit of a different picture...

We've never seen such a big move from oversupply, over demand to an extreme oversupply.

Let's just stop there, and think through what he said...

Here you have the CFO of the largest solar inverter manufacturer (by revenue) saying that he had never seen anything like that before.

To say the company got whipsawed would be an understatement, which is why it would seem unrealistic to think management fully knows how this will really evolve.

How whipsawed? The below chart tells that story... and why Enphase thinks it can clear things in a quarter...

Inventory days at SolarEdge (green line) shot up to nearly 130 days as of last quarter from 76 at the end of last September. During the same period, Enphase's was up by just a few days.

But then something else odd happened...

When inventory shoots that high, in theory gross margin should collapse, since a company isn't spending money building new inventory. Except... at SolarEdge, the gross margin actually rose. Same with Enphase, but Enphase's inventory didn't rise quite a dramatically.

Interestingly enough, away from the inventory issues... Fundamentally, SolarEdge is considerably worse than Enphase, using my "QUANT-X system" scoring and data from my friends at Kailash Concepts ("KCR")... where SolarEdge ranks 610 out of 667 in KCR's S&P 500 Model rankings.

Worse, unlike Enphase, SolarEdge has for months flashed a warning as being a "possible manipulator," using the "M-Score," which can help identify earnings manipulation. Below is SolarEdge's August score, using KCR's data...

Here's the thing...

Just because Enphase doesn't appear to be a manipulator doesn't mean it's off the hook, especially as it has been trying to gain market share.

It's the industry, especially if Chinese manufacturers gain traction. There already are indications in Europe that their market share is rising.

But more important, as I mentioned earlier: Inventory issues can take a long time to adjust, even more when the spin is that it will correct quickly. Supply crossing demand has been the bane of technology, from DRAMs to disk drives.

It appears, now, that solar is having its day in that sun. As a result, both SolarEdge and Enphase are in… The No-Buy Zone. Avoid.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

been looking at wind generators, which can produce power in darkness, or bad weather. If off solar generation takes up the slack these companies will be selling new transponders. there is also water reservoir storage which together with rain water collection systems can store electric power cheaply. and solar owners can also sell electricity to their neighbors (EV charging stations), or just throw an extension cord over the fence. to me the problem is like the EV vs the hybrid.