Replay – You’re Not as Dumb as You Feel

And other timeless investment tips you should never forget.

During this holiday week, I’m republishing a few favorites from the past year or two that many of you may not have seen. Including this one, which is worth reading if you feel dumb… or maybe even too smart when it comes to the markets. These are all from my pal Ed Borgato’s trading journals and squibs he puts on social media. Enjoy! And in the spirit… feel free to share.

Originally published, May 2024.

Say what you will about investing, but the one thing all seasoned investors will agree on is how humbling the stock market can be.

And that’s if you’re managing your own money. I can’t come close to imagining how magnified that feeling would be if you’re managing other people’s.

But my friend Ed Borgato can, because that’s what he has done much of his career. As he puts it...

Anyone who spends their life in markets will have humility thrust upon them.

He adds..

Enduring these periods is easier if one never deviates too far from an emotional baseline of intellectual modesty – even when a recent performance makes you feel at your most potent. Protect your mind from emotional highs as well as lows. Save emotion for people, not stocks.

Ed knows something about this. He started his career at the old (and now long gone, but not entirely forgotten) Lehman Brothers at the age of 19. He went on to become a broker and an investment advisor before ultimately launching his own hedge funds. He has returned to managing outside money after losing his taste for retirement.

Timeless Reminders

Through it all, he started writing a daily investment journal, including his general observations as a reminder of lessons already learned. “I found over time that the best of them were worth saving because they were timeless reminders that helped me codify a philosophical blueprint for how to approach portfolio management.”

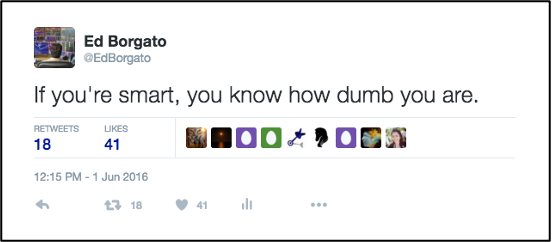

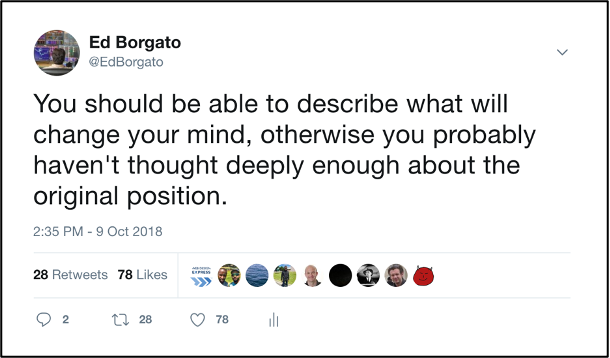

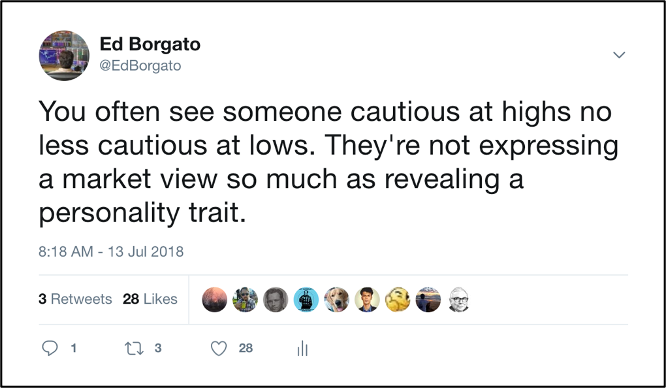

He then started honing them down to a sentence or two and in 2013 started posting them on Financial Twitter, or FinTwit as it was known back then. “It started without aim; just a way to contribute to the community,” he says. “The positive feedback encouraged me to continue.”

I knew Ed, and I’d see these posts pop up. Then I found myself retweeting them because they somehow resonated...

In more recent years, as Ed migrated to Bluesky and Threads, he’d repost them there, citing the “FinTwit Archive.”

They were so good I figured they were worth compiling and sharing and asked if he would mind. So, with his help, I whittled them down from nearly 1,000 to a few dozen.

Something for Everybody

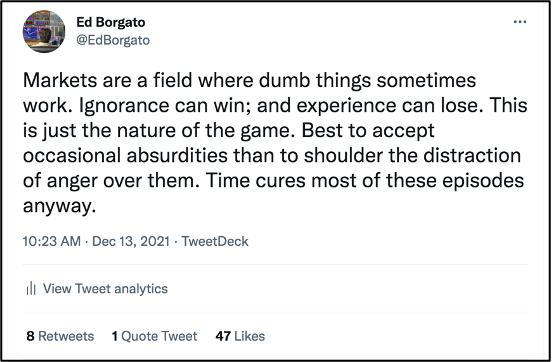

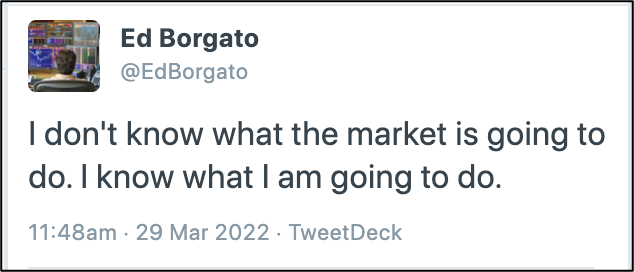

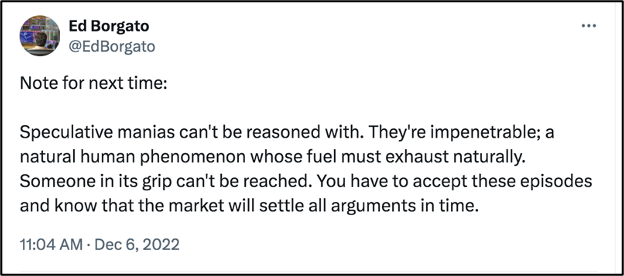

Trust me when I say, if you have ever bought a single stock, short of it being an instant winner: Somewhere in here there is something for everybody, starting with feeling like a fool...

On Investing Vs. Trading…

On Making Predictions...

On Valuations…

On the Virtue of Patience…

On Going Against the Herd…

On the Mind of the Market…

A Bunch of General Common Sense…

And My Personal Favorite…

Because this extends well beyond investing…

Happy New Year, everybody.

Amen to all and Thanks for this!

Outstanding, thank you!