Scraping the Bottom of the Barrel

Plus the silly squeeze in solar.

I want to give a personal welcome to all the new subscribers to Herb on the Street. I hope you’re enjoying the content and will consider becoming a premium member of my Red Flag Alerts. Find out more right here. — Herb

▶This is one of those “you know it when you see it” moments in the markets...

As I put it in my repost of a post this morning by CNBC’s Carl Quintanilla regarding the pre-market rise of the meme stocks...

Just looking at those names, and a few more... you know the market has hit the loony phase when the day’s biggest winners come from scraping the bottom of the barrel.

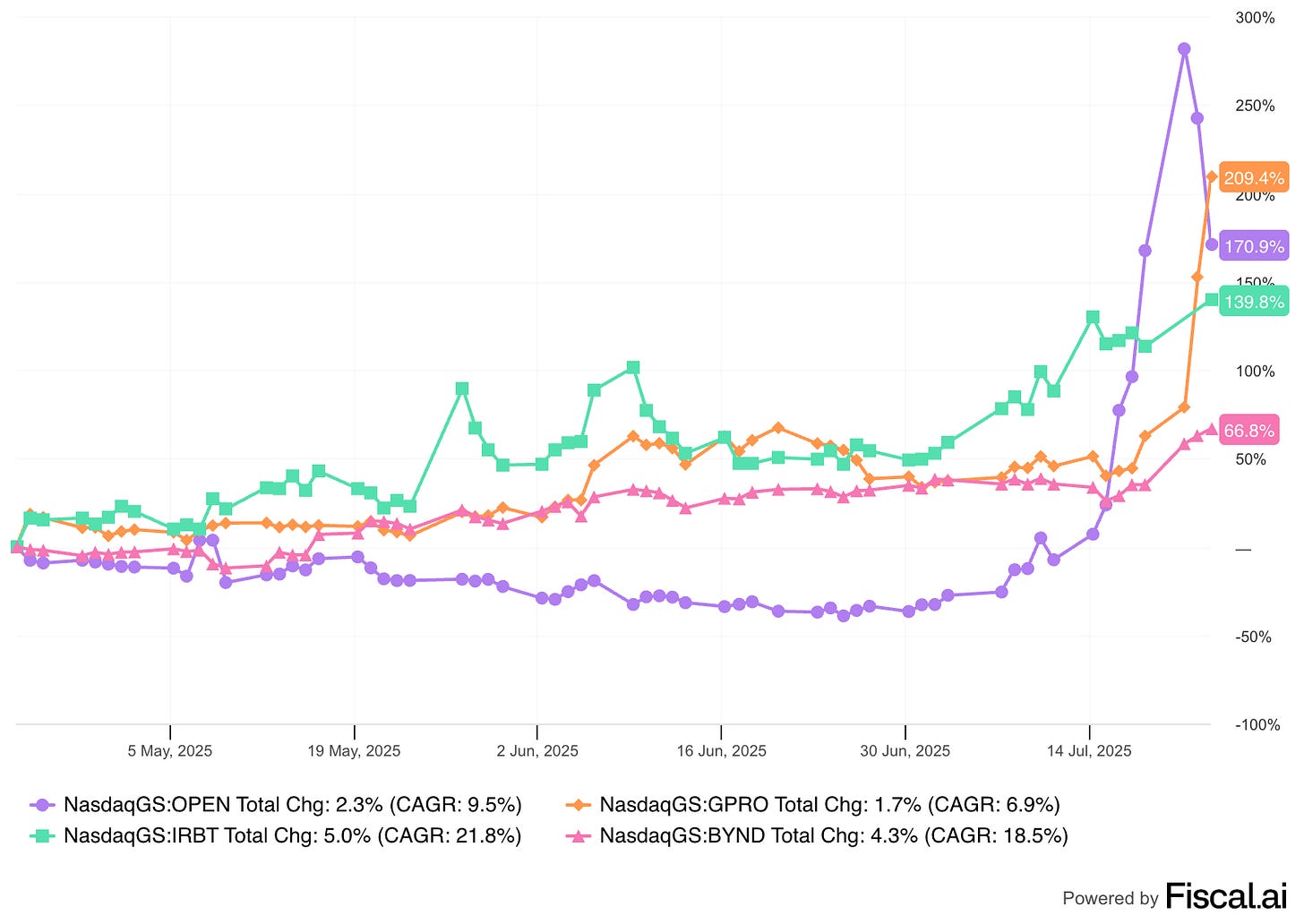

In this case, the market sees dead people – or dead stocks. Or stocks that if they’re not now completely dead, are likely to be. Picking four of the most absurd randomly: Open Technologies $OPEN, GoPro $GPRO, iRobot $IRBT and Beyond Meat $BYND. This is a three-month chart....

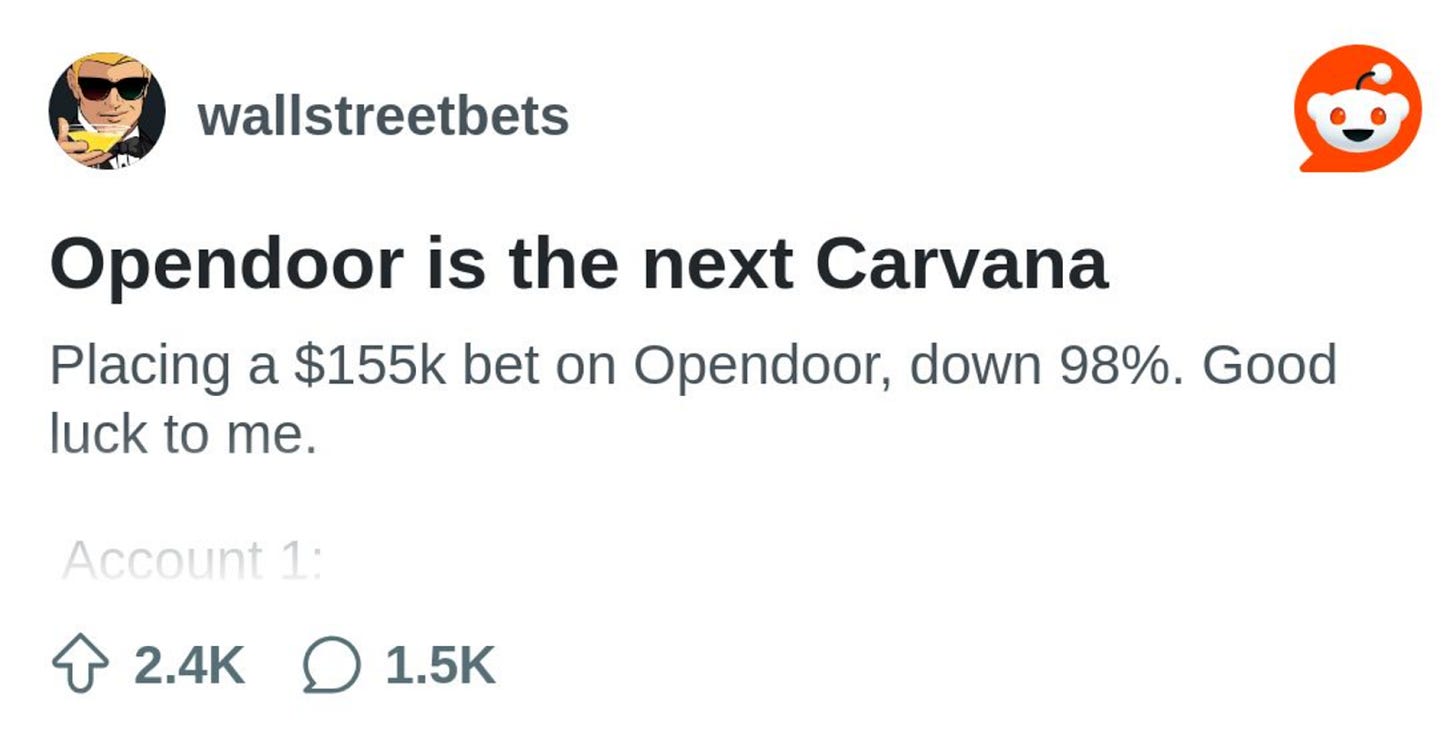

Over on the various forums, the pumpers are pumping. Like this one from Wall Street Bets on Reddit...

Oh, dear, where do I start...

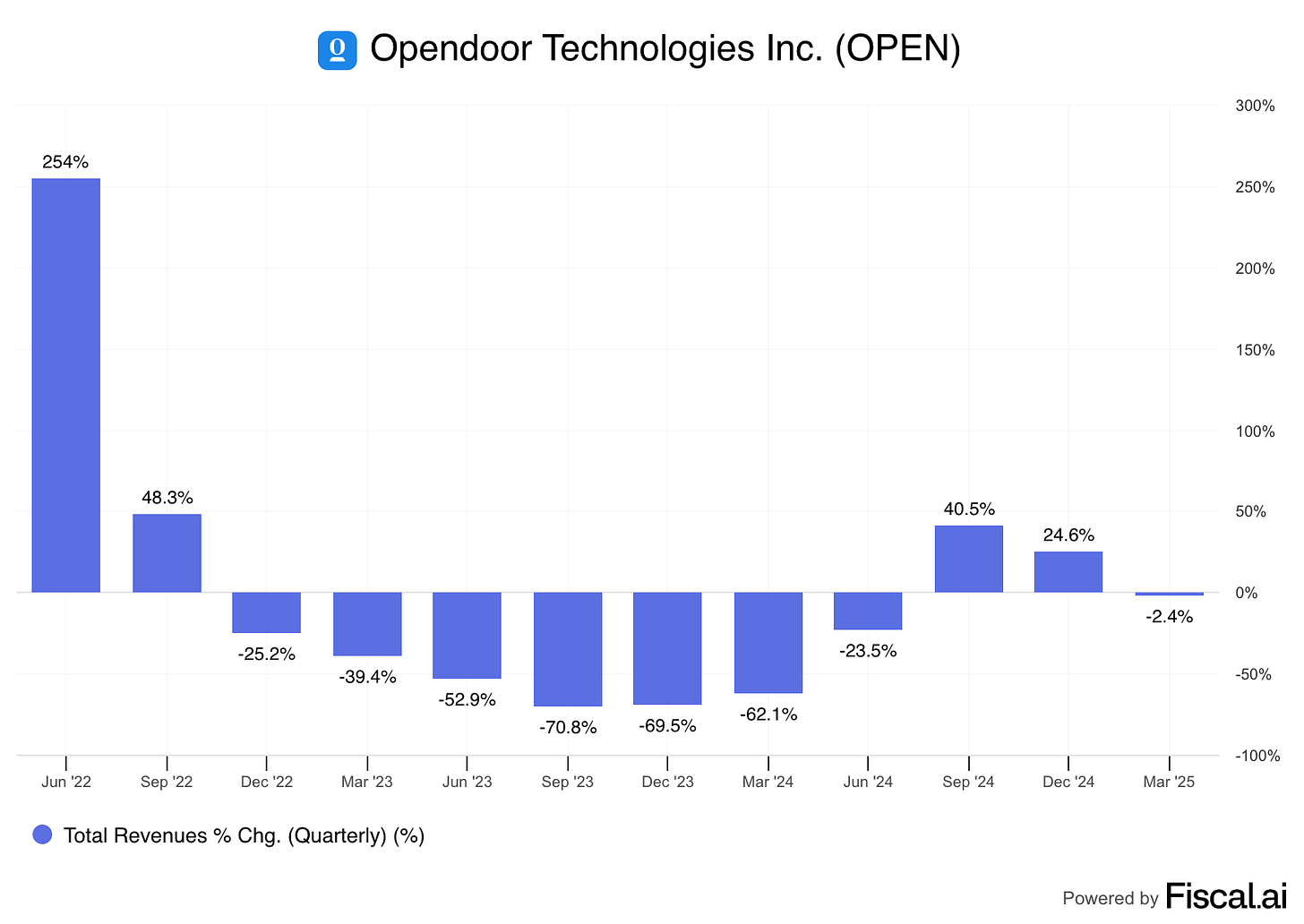

For fun this morning, I went through a bunch of metrics for each. One is worse than the next, but to simplify things, let’s just look at revenue growth, starting with OPEN...

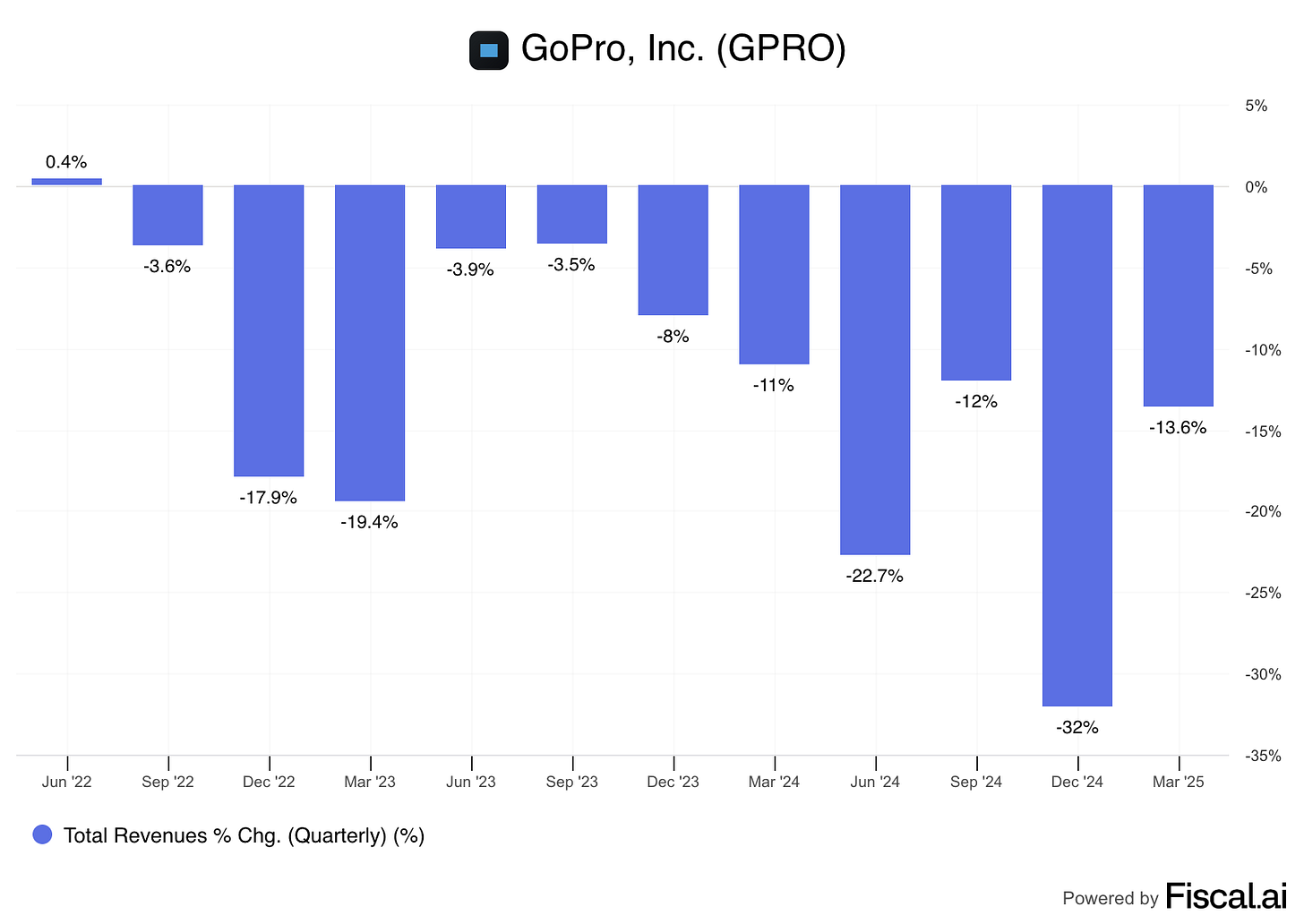

And GoPro...

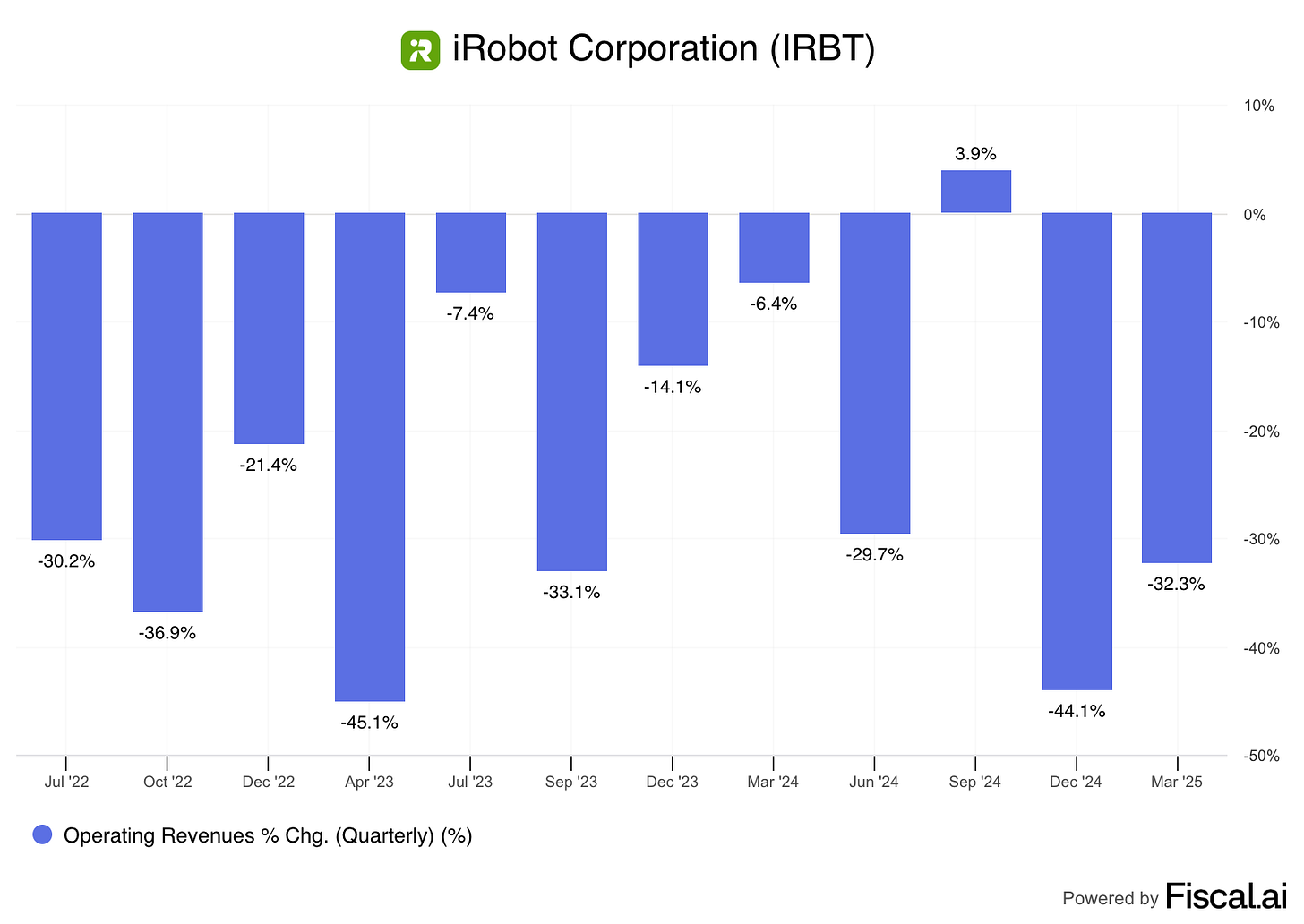

And iRobot...

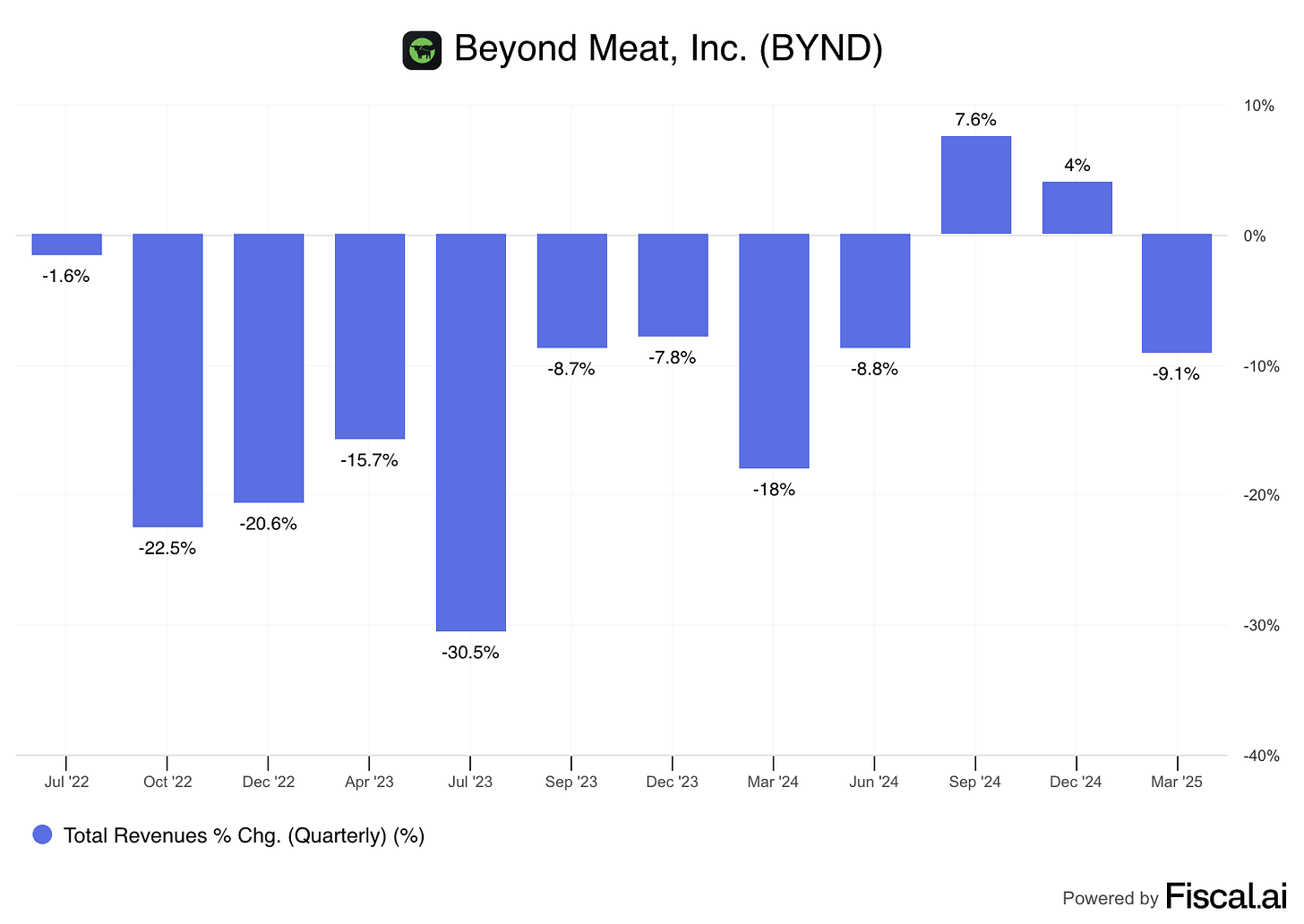

And Beyond Meat...

Some, like Open, are reversing themselves as we speak. But that’s the point: These things can reverse themselves in a heartbeat.

Enter Solar…

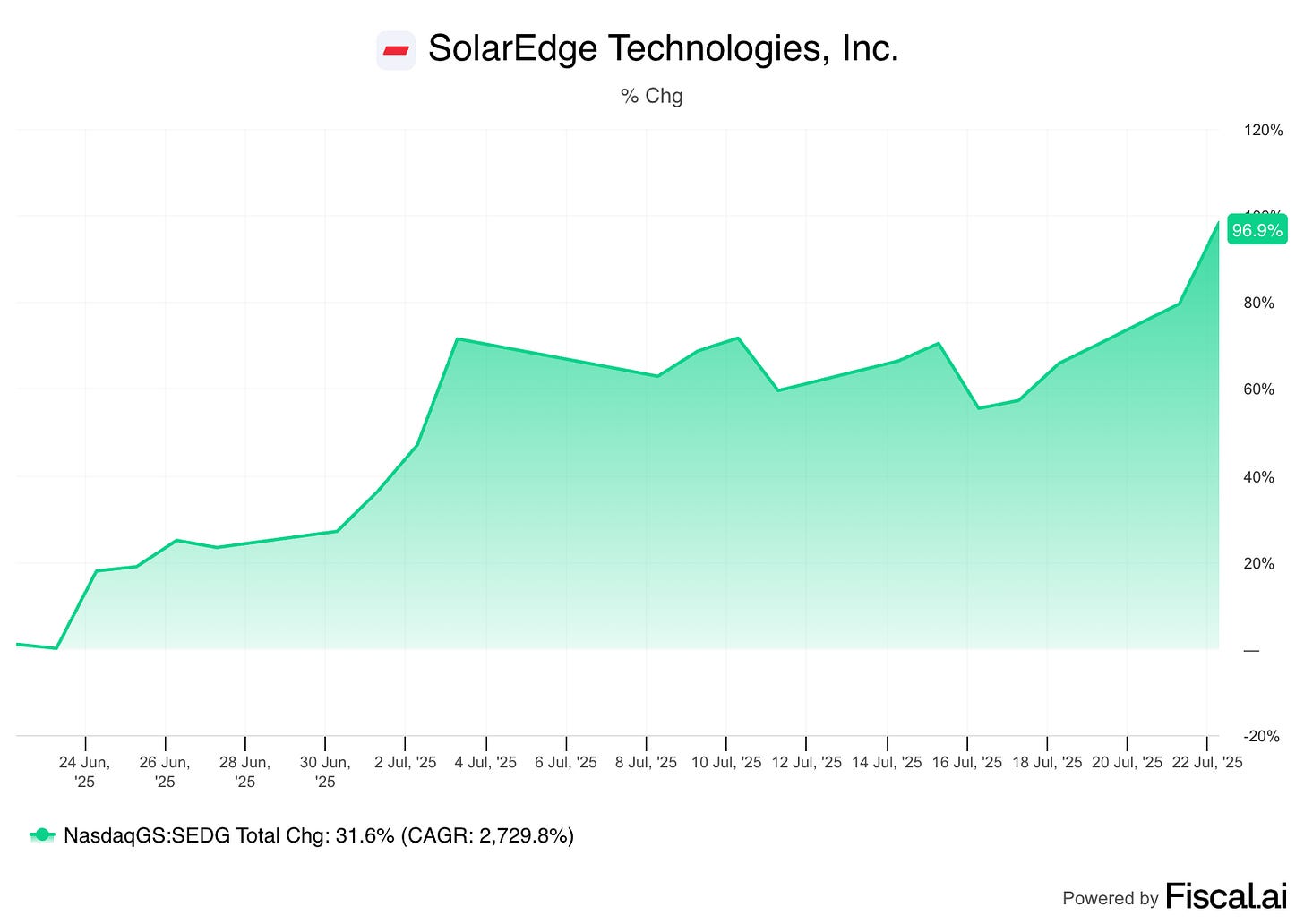

The craziest squeeze of all in recent weeks has been SolarEdge $SEDG, which was at its depths down around 90% since I first red-flagged it. Then came the latest squeeze, and as of yesterday it was up 100% over the past month.

The stock gave some of that up today – down around 9% as I write this – after rival Enphase $ENPH reported Q3 results with guidance that wasn’t quite as robust as investors had expected. The thinking was that with tax credits on solar ending at year-end, there would be a mad dash of purchases.

Trouble is, there’s a glut of inventory in the channel. Plus solar-powered batteries are now a critical component in the world of solar installations. On that score, Tesla $TSLA – almost under-the-radar, since energy is only 10% of the company – is leading that charge and stealing share with batteries and entire systems that are considerably less expensive than either Enphase or SolarEdge.

Here’s the thing...

The only reason SolarEdge isn’t down more today is because it had sharply higher short interest than Enphase. Or put another way: The only reason Enphase hadn’t squeezed higher was because it had less short interest than SolarEdge.

And the reason SolarEdge had higher short interest than Enphase is because its fundamentals are worse... if that’s possible.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com