Special Situation – Clear Channel's Stealth Turnaround

Why one investor, amid takeover chatter, is hoping the company doesn't get sold.

Key Points…

Not so stealth anymore?

What has investors intrigued.

What about that takeover rumor?

Why one investor hopes it’s not true.

Bonus – this investor’s full report explaining why, plus his financial model.

While investors are tripping over themselves to latch onto anything that reeks of AI, they may be missing other opportunities. That includes boring old money-losing businesses and industry that while not direct winners, are overlooked beneficiaries. Even without AI, however, some were undergoing transformations that in their own right would be noteworthy.

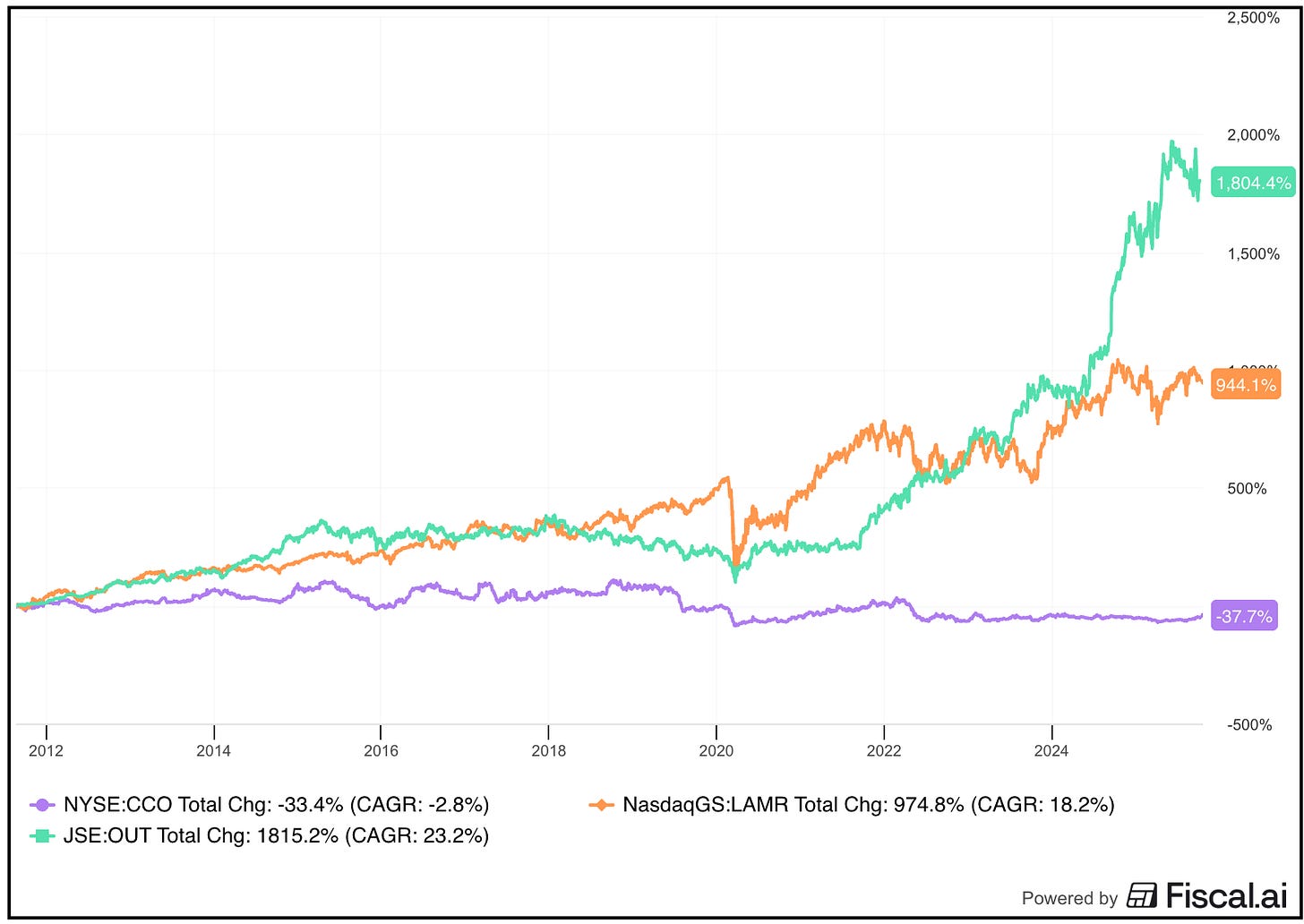

Like the billboard business… notably Clear Channel Outdoors CCO 0.00%↑, a small cap that for the most part until very recently deserved the lack of respect it never received. Compared with its rivals Lamar Advertising LAMR 0.00%↑ and Outfront Media OUT 0.00%↑, based on its stock, Clear Channel (in purple) appears to be stuck in a time warp.

And that’s even as Berkshire Hathaway has been buying up shares of Lamar. Perhaps more interesting is that Los Angeles Angles owner Arte Moreno, who made his fortune in the billboard business, has been a steady buyer of Clear Channel’s stock since 2023 at prices in the low-to-mid $1 range, with recent purchases pushing his shares up to around 14%.

That’s not all. Clear Channel shares last month got a lift after activist Anson Holdings pushed for a sale.

Then, starting last week, shares spiked to their highest level in more than a year – just under $2 – on news that Mubadala Capital, Abu Dhabi’s sovereign wealth fund, is in talks with Clear Channel to buy the company.

Should It Sell?

Let’s just say that one of my longtime premium subscribers, who is publicity shy, is hoping there is no deal… certainly not at $3 or so, which is the rumored price.

Rather than me try to explain, I’ve included a report he wrote exclusively for On the Street laying out his thesis – plus a link to his financial model – below.

Before I get to it, though, some quick background…

He got involved in the company a little more than a year ago with the stock in the low $1 range after he was at a cancer benefit in Minneapolis and sat a table sponsored by Clear Channel. After sitting down next to one of the company’s local executives, he took out his phone and started researching the company, and as he explains, “They looked terrible.” He looked over at the Clear Channel executive and was surprised by how relaxed he was for a company that, on paper, looked that bad. The executive explained to him that the company was in the middle of a turnaround.

So my subscriber, who runs his own money and is exceedingly independent – and not connected to the usual Wall Street networks – did more work. The more work he did, the more interested he got…

He saw that Moreno had been quietly buying the shares, and took a small stake himself.

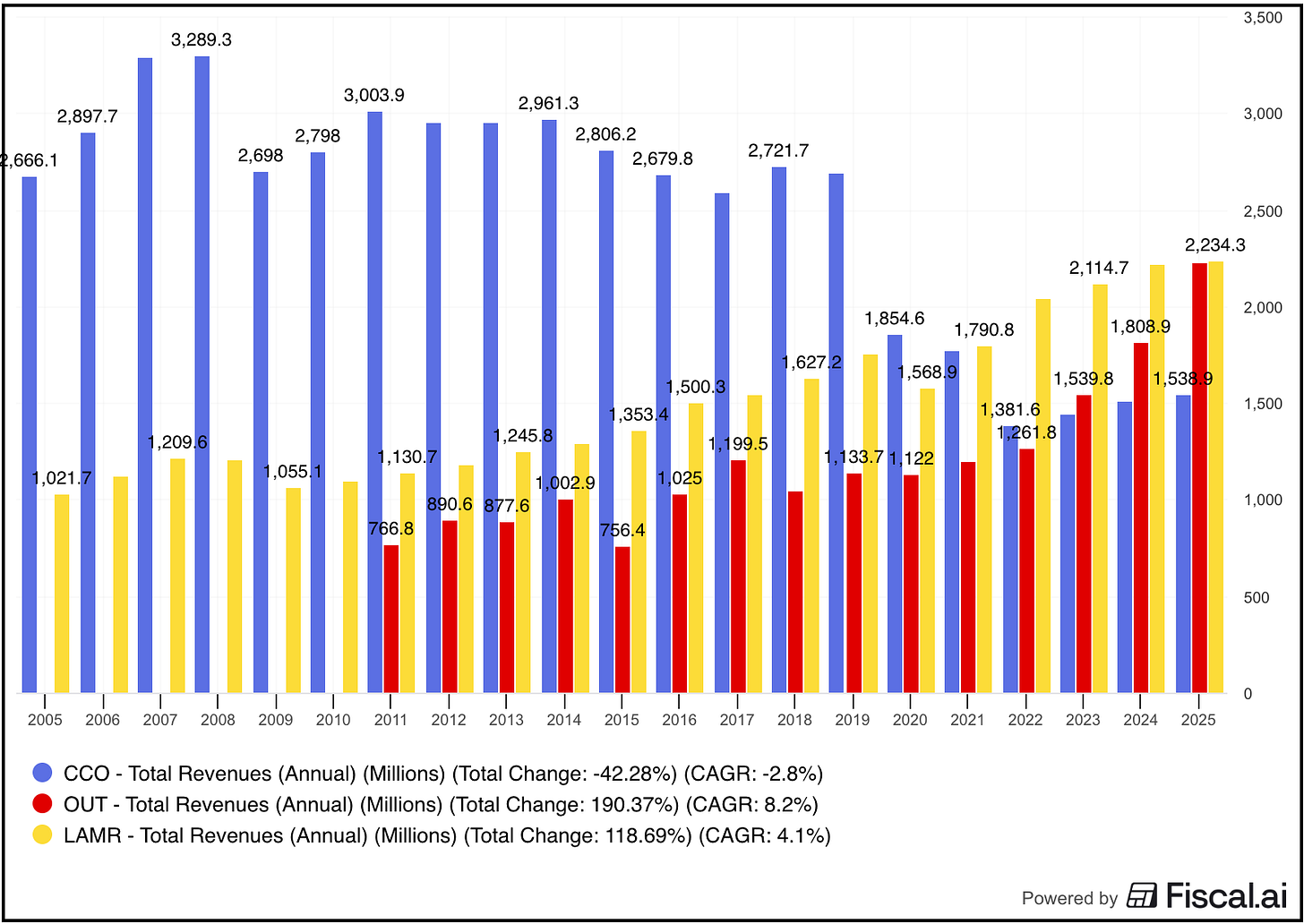

And while investors had been more focused on Lamar and Outfront, which have done a substantially better job with substantially cleaner balance sheets, without much fanfare Clear Channel has been cleaning up its act. You can easily see the change in its revenue, which used to dominate the other two, but has tumbled in recent years – not because its business is getting worse, but because it has been selling off its money losers…

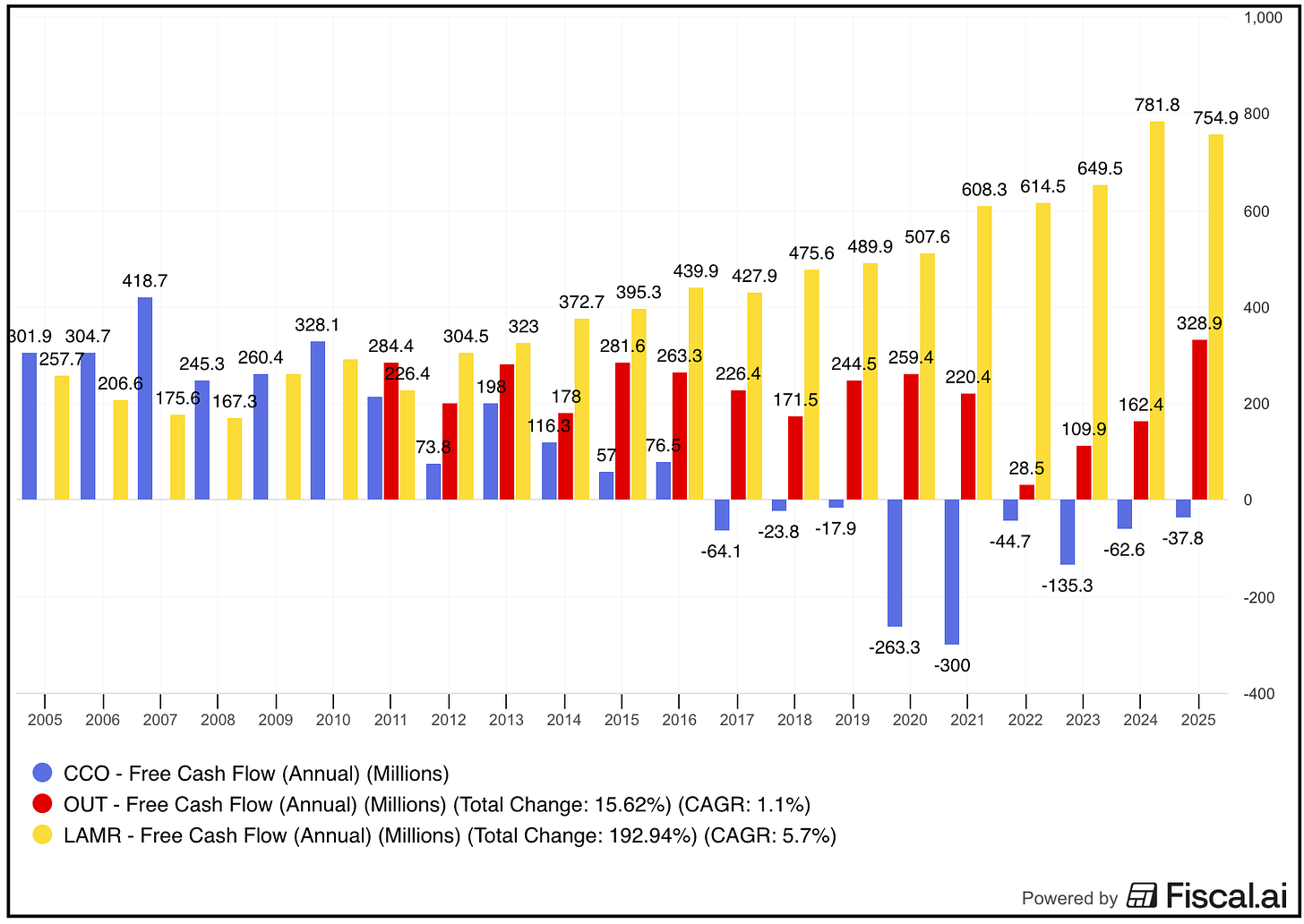

The shift can be seen in free cash flow, which is slowly digging itself out of a hole…

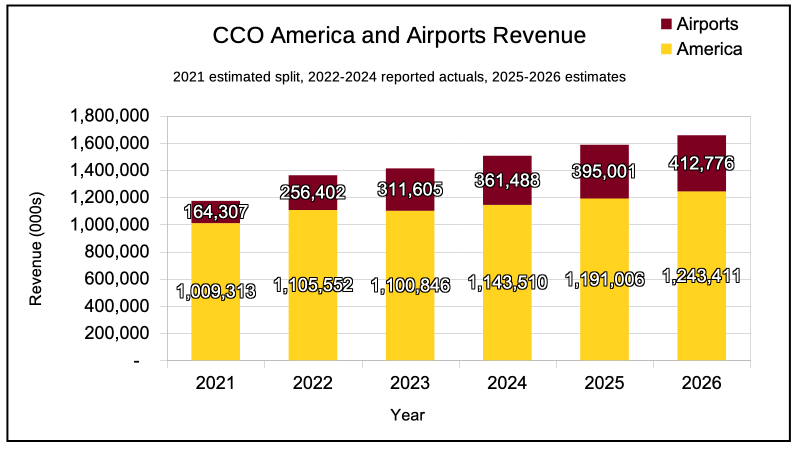

The improvement can be seen even more clearly in the results of its two remaining segments – Airports and America…

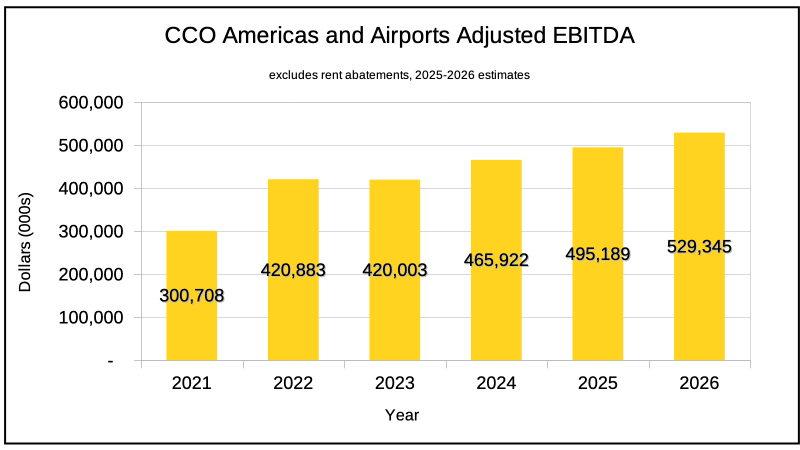

Ditto adjusted EBITDA…

Which gets to the bigger question: Would a sale right now be premature?

Below is a copy of the report along with his financial model. It should go without saying, this is NOT investment advice. Interpret at will…

Clear Channel Outdoor Holdings, Inc. (CCO) – Bull Thesis

Disclaimer

This document is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The information presented herein represents the author’s opinions and analysis and should not be construed as a recommendation to buy, sell, or hold any security.

The author has conducted research and analysis to the best of their ability; however, this document may contain errors, omissions, or inaccuracies. The information provided is based on publicly available sources believed to be reliable, but the author makes no representation or warranty as to the accuracy, completeness, or timeliness of the information.

Past performance is not indicative of future results. Investing in securities involves risk, including the potential loss of principal. Readers should conduct their own research and due diligence and consult with a qualified financial advisor before making any investment decisions.

The author may or may not hold positions in the securities discussed in this document. This document should not be relied upon as the sole basis for any investment decision.

By reading this document, you acknowledge that you are using the information at your own risk and agree that the author shall not be liable for any losses or damages arising from the use of this information.

Introduction

Clear Channel Outdoor Holdings, Inc. (NYSE: CCO) is a billboard (out-of-home, or OOH) advertising company that has recently attracted acquisition interest from Mubadala Capital of the United Arab Emirates. TD Cowen released a note stating that in their investigation of this bid, they found that the reports are “substantially accurate” and they believe CCO has received a non-binding offer subject to due diligence, and CCO’s board now in the process of conducting due diligence.

We believe that CCO shares are substantially undervalued and represent a unique opportunity over the coming years. The purpose of this note is to clarify the opportunity that CCO presents over the coming years and, in doing so, explain why a premature sale may significantly undervalue the company’s shares.