Special Situation – Clear Channel's Stealth Turnaround

Why one investor, amid takeover chatter, is hoping the company doesn't get sold.

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits. Join them here and start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. When the tide goes out…!

For institutional pricing, shoot me an email at herb@herbgreenberg.com.

Key Points…

Not so stealth anymore?

What has investors intrigued.

What about that takeover rumor?

Why one investor hopes it’s not true.

Bonus – this investor’s full report explaining why, plus his financial model.

While investors are tripping over themselves to latch onto anything that reeks of AI, they may be missing other opportunities. That includes boring old money-losing businesses and industry that while not direct winners, are overlooked beneficiaries. Even without AI, however, some were undergoing transformations that in their own right would be noteworthy.

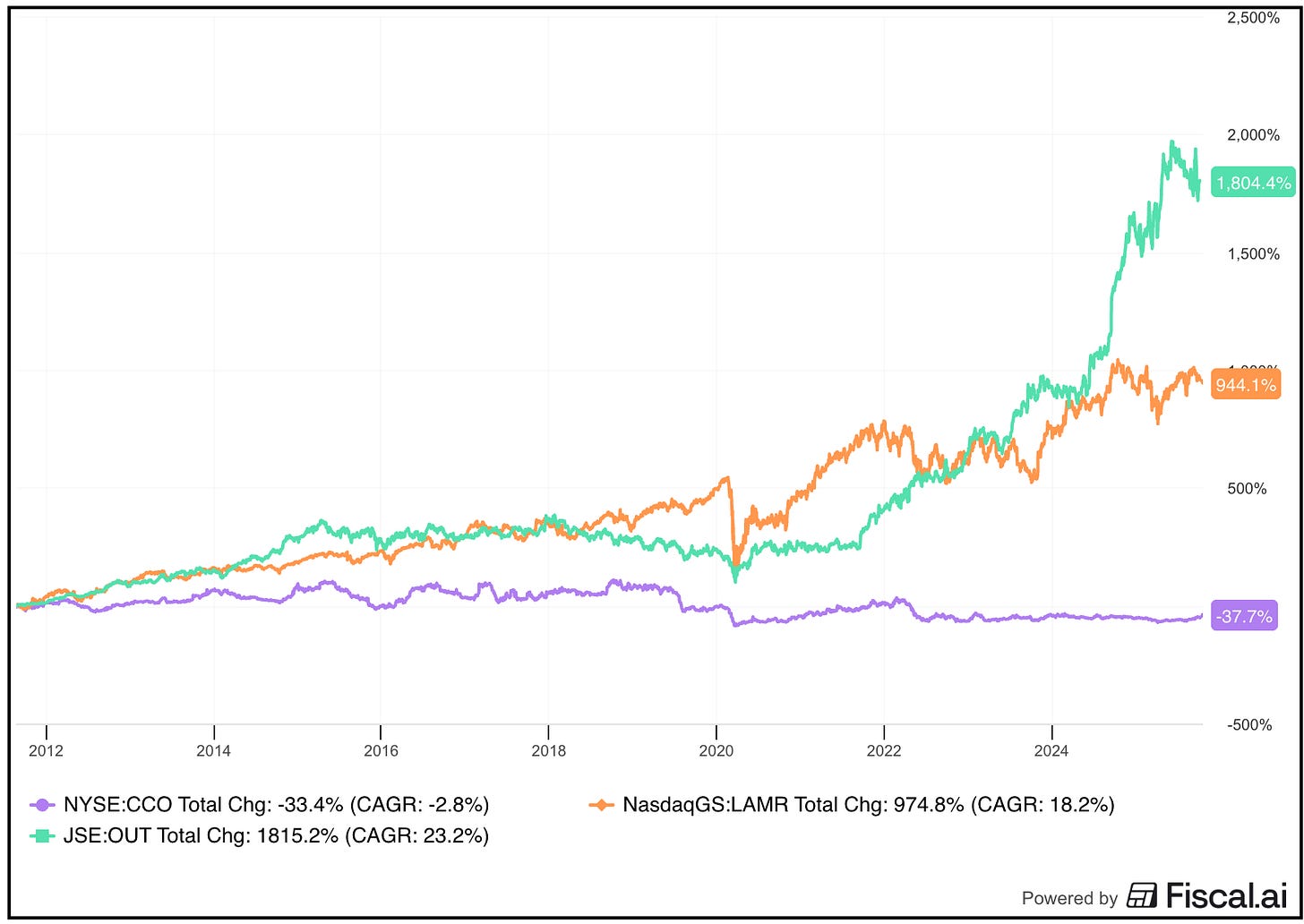

Like the billboard business… notably Clear Channel Outdoors CCO 0.00%↑ , a small cap that for the most part until very recently deserved the lack of respect it never received. Compared with its rivals Lamar Advertising LAMR 0.00%↑ and Outfront Media OUT 0.00%↑ , based on its stock, Clear Channel (in purple) appears to be stuck in a time warp.

And that’s even as Berkshire Hathaway has been buying up shares of Lamar. Perhaps more interesting is that Los Angeles Angels owner Arte Moreno, who made his fortune in the billboard business, has been a steady buyer of Clear Channel’s stock since 2023 at prices in the low-to-mid $1 range, with recent purchases pushing up his stake to around 14%.

That’s not all. Clear Channel shares last month got a lift after activist Anson Holdings pushed for a sale.

Then, starting last week, shares spiked to their highest level in more than a year – just under $2 – on news that Mubadala Capital, Abu Dhabi’s sovereign wealth fund, is in talks with Clear Channel to buy the company.

Should It Sell?

Let’s just say that one of my longtime premium subscribers, who is publicity shy, is hoping there is no deal… certainly not at $3 or so, which is the rumored price.

Rather than me try to explain, I’ve included a report he wrote exclusively for On the Street laying out his thesis – plus a link to his financial model – below.

Before I get to it, though, some quick background…