The Humanoid Factor

One simple way to play the coming boom

If two years from now you look back wondering what the OpenAI moment was for robotic humanoids – their ChatGPT moment, when things really got real – it very well may be the below video posted last week by privately-held Figure...

Figure 01, as it’s called, debuted in this post from Figure on social media, showing a human robot that while slow acting, sounded and most importantly reasoned like, well, a real person...

My first reaction was that it was a fake video created entirely by AI – kind of an advanced version of Nikola’s purportedly self-propelled hydrogen-powered truck driving down the road. It apparently wasn’t, in which case Figure 01 is not just the latest, but certainly most advanced of any humanoid debut so far.

And that includes Tesla’s ($TSLA) Optimus, which has probably generated the most buzz, certainly among investors. But just yesterday Gizmodo ran a story comparing Optimus to Figure 01 under the headline...

Whether that’s really the case isn’t the point...

The point is that the next big thing investors are likely to chase as the natural evolution of AI – even if it’s two years from now – is likely to be human robots.

‘An Inflection Point’

This is something my futurist friend Paul Kedrosky of SK Ventures

has been telling me for months... but I just couldn’t find the right hook. “Robots are at an inflection point,” he was saying, citing the emergence of large language models, imitation learning and declining costs.

A few days later Figure announced funding from Jeff Bezos, OpenAI and Nvidia, giving it a valuation of $2.6 billion.

That sparked a few stories, including this one on Bloomberg, headlined...

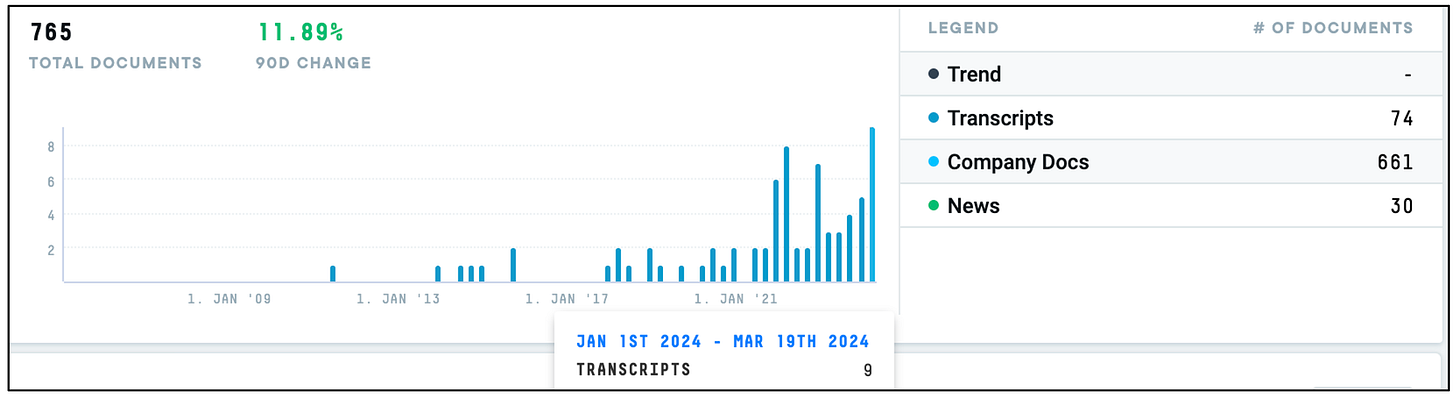

But so far, the coming boom in humanoids hasn’t yet really caught Wall Street’s fancy, which you can clearly see in the below chart, which shows the number of times the word “humanoid” has shown up in searches on AlphaSense…

While mentions in transcripts are clearly up over the past few years, since 2009 it has made its presence in only 765 documents, including just 74 transcripts. Last quarter alone, the word showed up in a mere nine transcripts... and that was the most ever in a single quarter.

By comparison – and to show how fast these ideas can ramp – “large language model” has been mentioned in 3,912 documents over the same span, including 1,353 transcripts. Last quarter alone it showed up in 242 transcripts, which is quite a bit less than its peak a few quarters earlier.

The obvious reason is that there are simply so few public pure plays.

Another reason, Paul believes, is because “it’s caught in what Gartner calls the trough of disillusionment. Robotics has been hyped and failed many times, so people roll their eyes...”

The Nvidia Effect

That could be changing, though, especially after Nvidia’s CEO Jensen Huang mentioned “humanoids” four times during his address yesterday at the company’s annual user conference, while surrounded by a group of human robots. “We’re starting to do some really great work and the next generation of robotics,” he said, adding: “The next generation robotics will likely be humanoid robotics.”

Given Huang’s and Nvidia’s current popularity, that should send investors scampering in search of plays on humanoids...

That’s already been happening out of the limelight by venture investors, with CB Insights citing record funding for humanoids. Many of those, CB says, “are targeting more realistic human-robot interactions using large language models and natural language processing.”

The thing is, there’s more to robots than language, and plenty of money will be made in the less-sexy side of the story: companies that make nuts and bolts, or in this case case, the likes of actuators and sensors.

The challenge, however, is that if they’re not private, most of these manufacturers are buried inside larger companies, like Swiss-based ABB Ltd., Japan’s Keyence and Japan’s SMC, where the “humanoid” aspect is currently too small to have impact.

Enter the ETFs

Which gets to the bigger question: What’s currently the best publicly traded humanoid idea?

Right now, there isn’t one, per se. Some investors are placing their bets via Tesla, which is viewed by many as the proxy for robots – in large part because Elon Musk says it is.

But there are other ways, as well… something Paul mentioned almost in passing on a call with our group the other day, notably: The Global X Robotics & Artificial Intelligence ETF, better known by its symbol, $BOTZ.

While Nvidia is 8.78% of its holdings, it has almost equally larges stakes in the likes of ABB, Keyence and SMC. Its third-largest holding is Intuitive Surgical ($ISRG), which on its own has been a longtime medical robotics pure-play... but could also benefit from the ongoing advancements in robotic technology.

Another is the Robo Global Robotics and Automation index ETF, or $ROBO. It has less exposure to Nvidia, but is also less top-heavy with any one company, which as Paul says, “is good and bad, since it has limited leverage to any winner.”

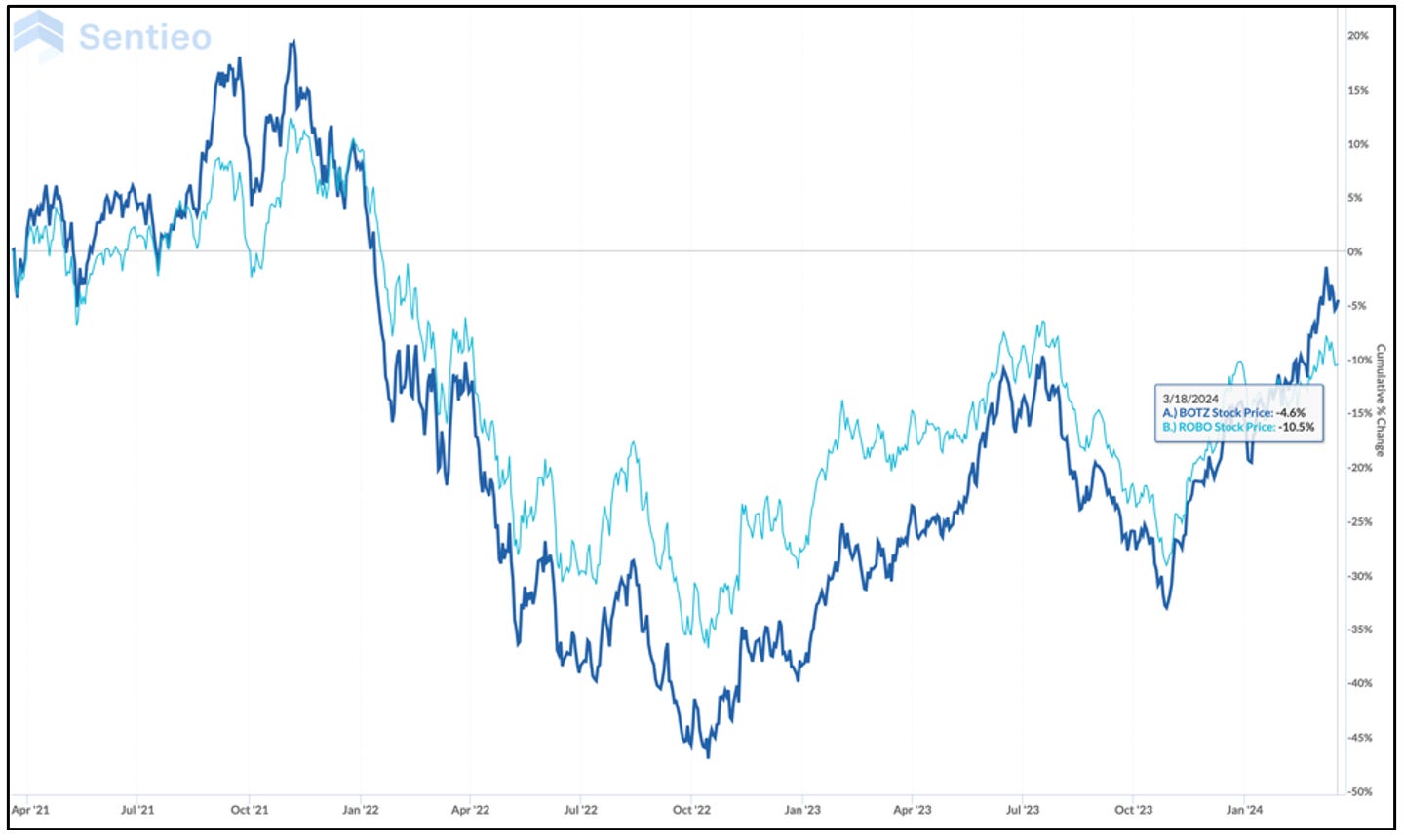

Both have seen runs over the past year year, but BOTZ is up 35% versus a bit more than 10% for ROBO.

Longer term, over three years, however, both have been duds...

The irony is that – in theory, at least – humanoids and human robotics should be a story retail investors are tripping over themselves to somehow own.

And if they were, one place it would be showing itself is in the comments under write-ups of both ETFs on Seeking Alpha, where I often head to determine a stock’s popularity.

With BOTZ and ROBO, there are less than a handful of comments under analyses of each.

Of course, anything tied to AI didn’t fare much better a few years ago.

So much for the wisdom of crowds.

If you liked this, please click the heart below and feel free to share with friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Talk about skating to where the puck is going. Fantastic article as usual. Definitely caught me napping in the "trough of disillusionment" but this is a wonderful wakeup call. What's interesting is that nobody talks about Hyundai which owns Boston Dynamics. Those robots are doing parkour. Could the mechanical sophistication they have mastered be a nice fit with something like this Figure 01? Or is there some crazy interdependence in developing the neural stuff with the physical movement? Totally over my pay-grade! Thank you as always for the wonderful work! For those that haven't seen the videos from Boston Dynamics, they are amazing IMHO: https://www.youtube.com/watch?v=yqF8g3xcD5c

https://www.youtube.com/watch?v=-e1_QhJ1EhQ

Thanks for this research and sharing your discoveries on Seeking Alpha. I am old enough to remember bulky carphones and huge personal video cameras. The changes to current smart phones was methodical.

This genie is just coming out of the bottle. Changes from this technology will likely be rapid. Part of me is excited and part wants to "gulp."