The Perfect Set-Up For This Tech Bubble to Burst

Also, the moral of the MP Materials story, More on Stock Scams and counting Teslas.

I want to give a personal welcome to all the new subscribers to Herb on the Street. I hope you’re enjoying the content and will consider becoming a premium member of my Red Flag Alerts. Find out more right here. — Herb

Weekly Wrap...

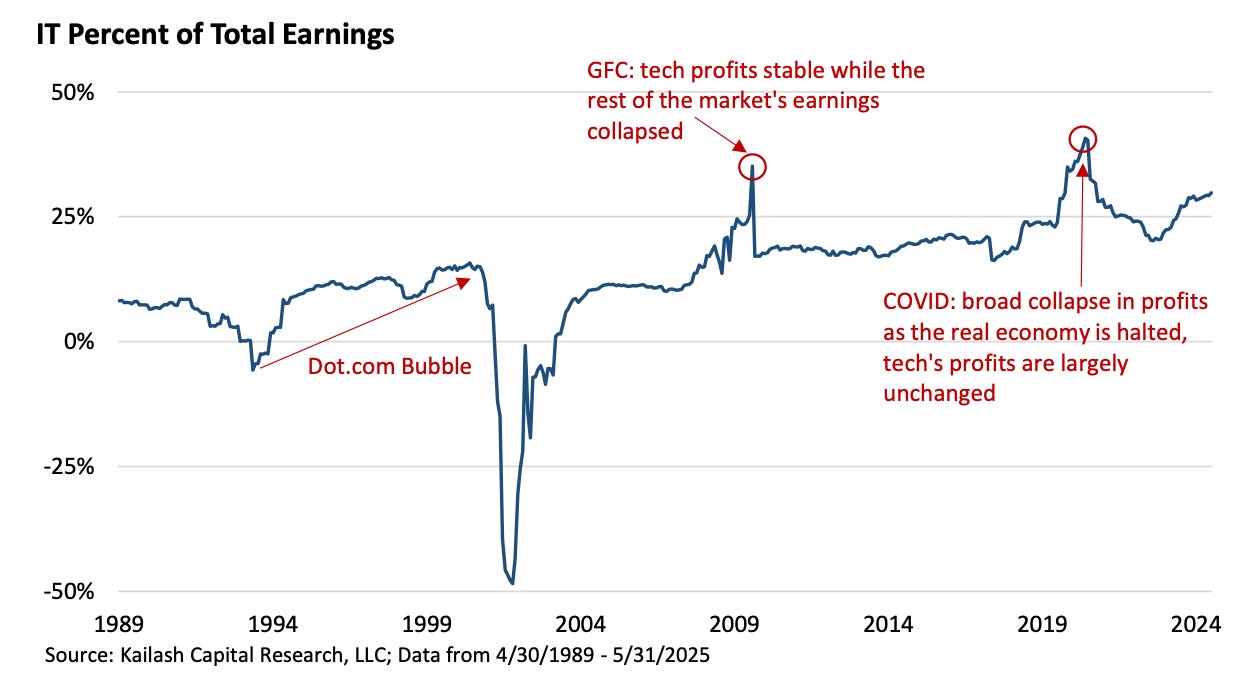

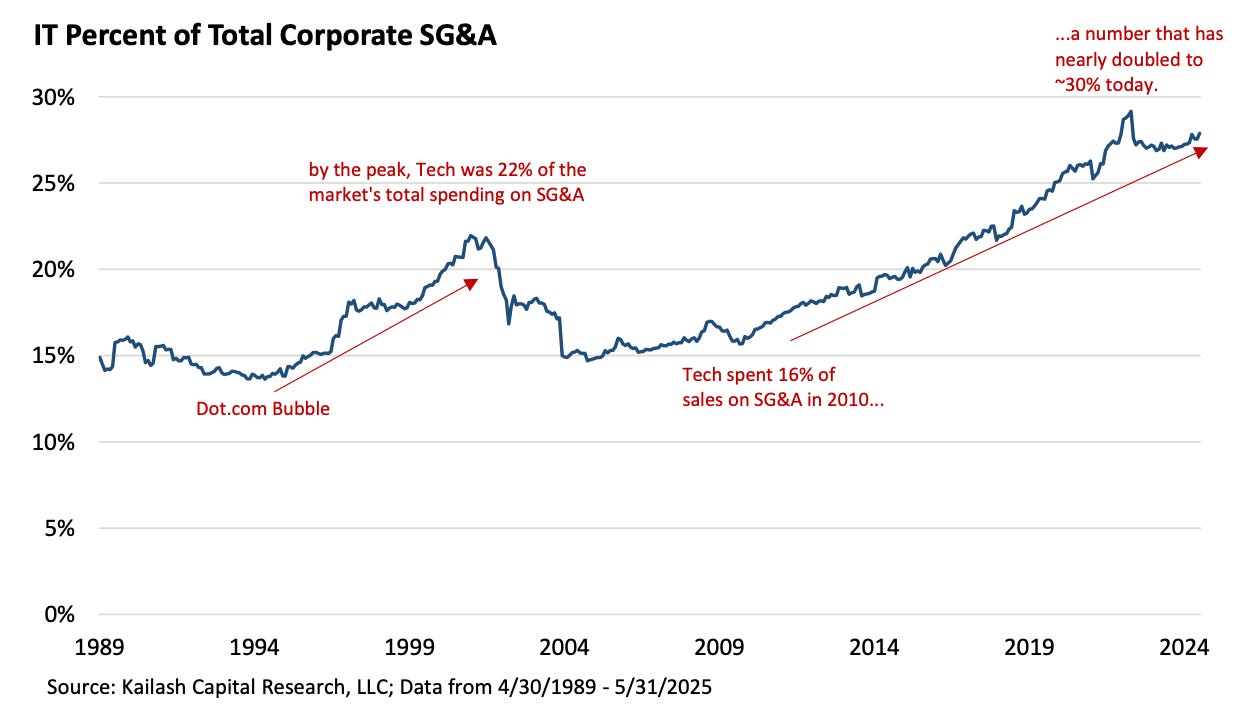

▶Rod Stewart’s voice rumbles around in my head when I see good charts. ”Every picture tells a story, don’t it?” Like the most recent from my pals at Kailash Concepts, whose quantamental work I often cite here because it has a knack for saying the quiet part out loud... in pictures and words. They put out a report every few weeks, and it’s always original based on their data. It was three charts in the latest – headlined, “Tackling Technology’s ‘Earnings Elephant’ – the Great Grift Continues” – that caught my attention.

The first...

The second...

And the one that hammers it all home in a yowza kind of way...

Central to all of this is the durability of this tech bubble – and just like the dot-com days, make no mistake: it is a bubble.

So much of this, Matt writes, is driven by the same thing that we saw in the dot-com bubble, except on steroids. Or as he explains...

The demand for technology equipment from loss-making startups created an illusion of robust and rising profits at the larger tech firms. In response, technology companies ramped spending on engineers, salespeople and

advertising known as “SG&A.”

You can see all of this in the first two charts, but it’s that third chart that matters most. Why? As Matt writes, “It is a mechanical truth that the vast spending on property, plant, and equipment, which is capitalized, ends up flattering earnings. “

He goes on to use Microsoft $MSFT as an example, noting that its capital intensity – 13% in 2013 – has soared to 57% today. Here’s the rub, as Matt sees it (emphasis by him)...

These assets need to be expensed through corporate income statements eventually. The problem is so dire that big tech leviathans have been manipulating profits higher. How? As article after article explains, tech companies extend the claimed useful life of their computer servers and systems, which gooses profits.

These are the same companies touting the miracle of Artificial Intelligence and saying it is the reason they must spend so much to stay competitive. Their views on what AI will do depend on it becoming wildly more effective, reliable, and widely used.

This, in turn, has led to the ebullience around companies like Nvidia who supply ever faster chips which are gobbled up by catastrophic loss-making firms like Coreweave.

If AI is truly disruptive and each new generation of chips kicks off an arms race to purchase new compute, it takes only rudimentary math and accounting skills to understand that depreciation schedules should be shorter.

In other words...

Definitionally, disruptive technologies render the “latest and greatest” obsolete faster, not slower.

With tech industry margins and valuation near all-time highs, the risk is obvious. Or should be. Of course, the concept of respecting the risk hasn’t been this irrelevant since at least 2021. So, there’s that.

▶Speaking of risk.. For years and years I’ve told anybody who will listen that if you’re counting on the coming actions of courts, Congress or a regulatory body as the backbone of your investment thesis – good luck. It’s the ultimate investment wild card for longs and shorts... sort of like trying to guess the outcome of Phase 3 clinical trials. These are all wild cards, outcomes of which are completely unknowable. You can think you know, but you never really do until it’s official. Which brings us to MP Materials, which I red-flagged when it was much lower for fundamental reasons. Turns out I missed one critical element – the likelihood the government wouldn’t just bail out the company, but would become its largest shareholder.

There’s risk to every thesis, and the underlying theme to what I write is to respect the risk. That went for my thesis on MP, where I wrote in one report that there was “headline risk in the sense that MP is a pawn in a geopolitical war, the outcome of which nobody can predict.” In another, I wrote that one obvious potential boost to the MP long thesis “would be a headline that the government is granting the company subsidies in the name of national security.” I added...

In 2022 the Department of Defense granted $35 million to help build a heavy rare earths refining facility in Nevada. And the Inflation Reduction Act included tax credits that help MP.

But subsidies, unless they’re bottomless, can only take the company so far. Even rare earth price increases, which would be helpful, tend to be unpredictable if not unsustainable. (See lithium.)

But there are subsidies... and there’s the government taking a stake. And not even just a stake, but becoming the company’s largest holder – like they do in China... to the point that the company becomes the U.S. equivalent of state-owned. With MP, the government taking a stake was not on my bingo card. I don't think it was on anybody’s.

But it really strikes to something else that is more obvious than ever in this cycle – the importance of not tilting against the narrative... at least not unless you have the stomach, wallet and/or mental fortitude – or are simply a masochist – to see it through to the other side. And that’s assuming there is another side. Narrative has always been what drives meme (aka: concept) stocks. That’s why plenty of investors – long and short – waded through the controversial 900-plus-page Project 2025 MAGA political manifesto... to determine what the next actionable investment narratives were likely to be once Donald Trump was elected president. Those narratives are now driving stocks up and down in such things as health care, nuclear, crypto, stablecoins and, well, rare earths. And will until they don’t.

All of which gets back to my mantra of the courts, Congress and regulatory bodies. Now I suppose I’ll need to add the chances of the “government taking a stake” to the list.

▶In other news: The latest in the stock scam saga... I have no idea whether Ruanyun Edai Technology $RYET is part of the WhatsApp stock scams I’ve been writing about, but it has all the hallmarks... such as its 90% plunge last week on no news. If Ruanyun sounds familiar, maybe this photo will ring a bell...

That was the official Nasdaq photo I ran back in April with my “New China Hustle” report, when I mused not just about the timing of the company’s IPO, but that its CEO (above) was ringing the opening bell of the Nasdaq. After all, this was just days (okay, maybe a bit more than a week) after President Trump launched his trade war with China. Since then, I hadn’t heard Ruanyun’s name until about two weeks ago. That’s when I saw it listed by Canary Data, an institutional database that focuses on risk, as having the same high fraud score and sharing the same red-flag auditors as Ostin Technology $OST. That’s the company I red flagged a few weeks ago – the day before its stock plunged nearly 100%, as it sealed its place in history as a poster child of the WhatsApp stock scams. Speaking of which... Edwin Dorsey at The Bear Cave did a good job digging even deeper into these Whack-a-Mole scams, with some additional – and somewhat humorous – insights into how they operate.

▶ Moving on, counting Teslas... Better than counting the cars on the New Jersey Turnpike is counting Teslas on Interstate 5 between LA and San Francisco. Or... Tesla car carriers. I’ve been doing this for more than five years... since I’m usually driving up and back at least four times a year to see my grandkids. In the early days, as I’ve mentioned here in the past, it was hard to keep up because there were so many carriers. It didn’t matter which day – or what time of the month. They were driving to LA from the Gilroy cutoff, which is a key east-west route between the 5 and the 101... the fastest way to get from Tesla’s Fremont factory to SoCal. A few months ago I reported that I saw only a few. This time – last week – I counted maybe 8 on the drive up; maybe two, on the way back. Both weekdays. Interpret at will.

▶ Oh, and before we go, if you missed it... In strong collaboration with my friend Katherine Spurlock, who tends to find things others don’t, I red-flagged G-III Apparel $GIII the other day. It’s hard not to red flag a company that went as far out of its way as G-III did to avoid disclosing some pretty significant info. It was until the SEC literally pried it out of them that they acquiesced. Makes you wonder... Why? Even though the stock has already been pummeled – making it possibly too cheap in the eyes of some – the desire to not to disclose this one piece of information suggests there’s still plenty of risk. Premium subscribers can read the full report here.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com