The Real Story Behind NRG’s Sizzling Stock

And why its earnings may not be what they appear.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

▶ Nobody likes wonky accounting except accounting wonks and folks like my pal Jon Weil at The Wall Street Journal.

The story Weil tells about NRG Energy is shaping up as one for the accounting books.The focus, as Weil calls it, is an “an accounting switcheroo” that NRG “used to make its earnings look less volatile.”

Without getting into the nitty gritty, which Weil has done here and here over the course of a few weeks in the WSJ’s Heard on the Street column, the tl;dr is that thanks to an accounting loophole NRG is making its earnings look better – and less volatile – than they really are.

Star of the S&P

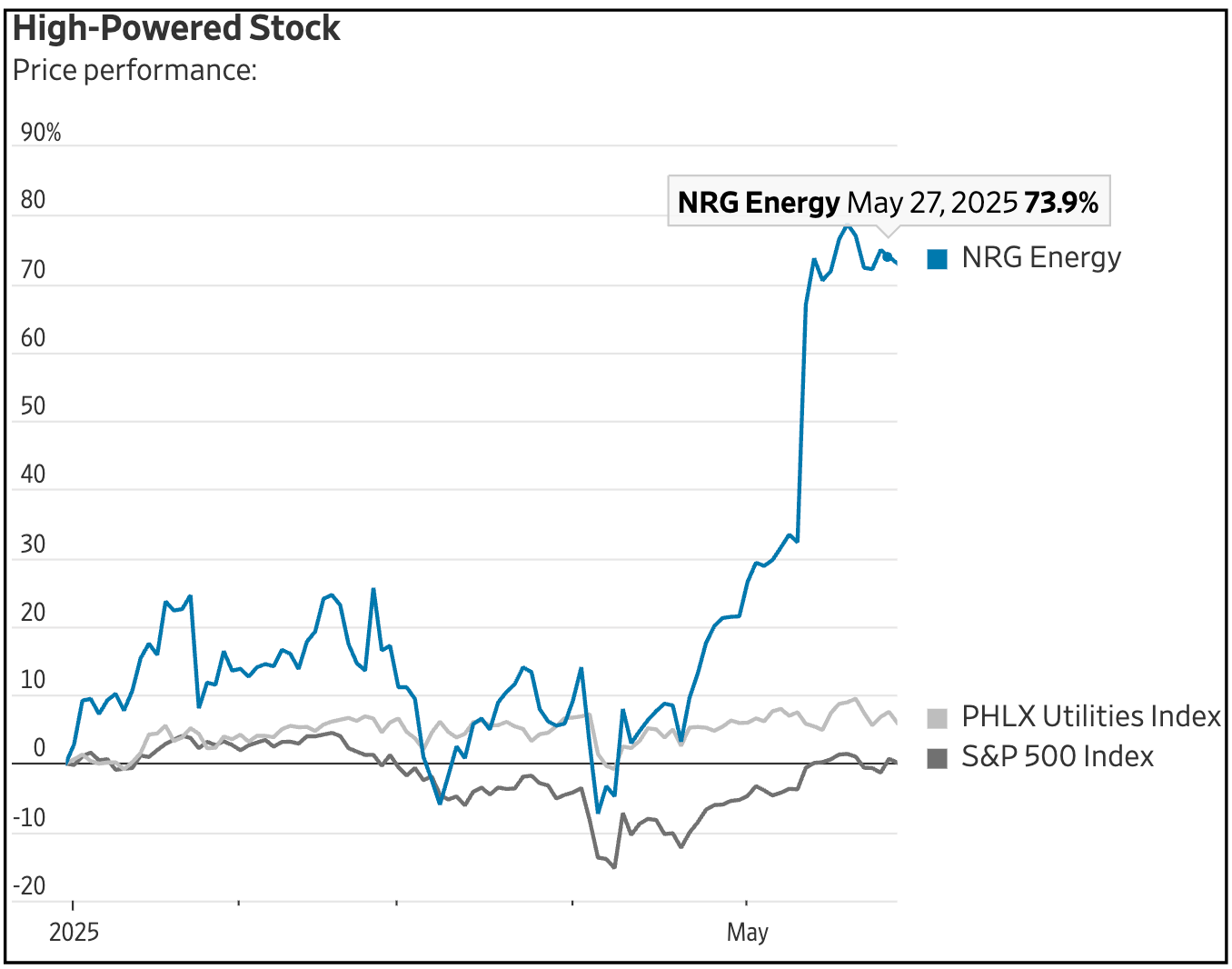

That’s important, because as this chart from the WSJ shows, NRG has been one of the S&P 500’s biggest year-to-date gainers – whose shares have outstripped all utilities in part because of... its earnings.

Central to Weil’s story is NRG’s derivatives trading. And how at the whim of management – through the magic of accounting – it has been able to “freeze balance sheet values for a large portion of its derivative contracts.”

The beauty of it is that this can be done without letting investors know what the impact to earnings has been. Pretty neat, huh?. As Weil writes, energy companies commonly use what’s known as “normal purchase normal sale,” or NPNS for commodity contracts. “What is unusual at NRG” Weil goes on to explain, “is that it switched to NPNS after the contracts began, which isn’t the way this typically works.”

The Kicker to All of This...

NRG CEO Larry Coben did an interview with Julie Hyman at Yahoo Finance, who asked...

I want to ask you about has to do with your derivatives trading business because The Wall Street Journal, I'm sure you've seen, has come out with a couple of stories yesterday sort of asking questions about that business and how the accounting around it works, and I wanted to give you the opportunity to respond to that.

Coben responded – and I’m highlighting the parts that caught my attention...

Look, we talked to the reporter. Derivative accounting is complex, and some people just don't understand it. Our investors and our stock stakeholders and our auditors have all looked at it numerous times. This is right down the middle, it's what every one of our competitors does, none of them are concerned about it in the least. We're not really getting any inbounds at all. They're kind of wondering why somebody is writing these articles because it doesn't seem to have a complete understanding of what derivative accounting – how it works in our industry.

Not letting go, Hyman asked again...

“How big a part of your business is derivatives trading?”

Coben responded...

It's not really, we don't really do – derivatives trading. What we do is we position portfolios for people, you know, if we know that we have to sell you power in three years, we'll buy a derivative to make sure we have the power in three years. We are doing far less of the, you know, speculative derivative trading than anybody in the space. We, you know, we do take some positions, but others take far more than we do. So I'm kind of confused by the articles, but I'm not concerned about them.

My interpretation...

First, Coben starts by saying that “derivatives trading is complex” and “some people don’t understand it.” Me: It’s a fact, it is complex and some people don’t. To point it out is an attempt to cast doubt over the story.

Coben goes on to say that they aren’t “really getting any inbound queries” about what Jon wrote. Me: That’s irrelevant and suggests the story is making a mountain out of a molehill. Truth is, if they truly aren’t getting many inbounds it’s probably because of the nature of the topic – not just wonky accounting, but wonky derivatives accounting.

Corben, who seems affable enough in the interview, then says that while NRG does take “some positions... others take far more than we do.” Me: Point of order! Keep reading...

As Weil reported a few weeks earlier, in his first swipe at the company...

A comparison of NRG and other power companies is instructive. NRG in its proxy identified its peer group as the 21 companies in the Philadelphia Utility Sector Index, which includes NextEra Energy and Duke Energy. NRG’s net derivative assets were 61% of its book value as of March 31. The average for the peer group was less than 1%, according to a Wall Street Journal analysis. Property, plant and equipment represented 9% of NRG’s total assets, compared with 72% for the peer group.

Put another way, NRG, which isn’t in the utilities index, has a much different profile than the companies that are. It looks more like a risky energy trader.

Aura of Irony

Therein lies the best part of this story, with an aura of irony....

That last sentence of Weil’s story – that NRG “looks more like a risky energy trader” – might be easy to dismiss if most any other reporter wrote it. But what often gets lost in the noise is that while working for the Texas edition of the WSJ in 2000, Weil was the first person – period – to publicly blow the whistle on dubious accounting at Enron. Doesn’t hurt that he also has a law degree.

Now, nobody is suggesting this is Enron. That’s not the point of this. The point is that to suggest that this is too complex for Weil to understand or that he doesn’t know how derivatives accounting works, is absurd to the point of laughable.

The Reality...

Things like this don’t matter, of course, until and if they do... and when and if they do, then everybody acts surprised and wonders why they didn’t see it coming. In this case it would be because it was hiding in plain sight, which is the best way to hide in a market where respecting the risk is often an afterthought... as long as, that is, the stock is rising.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com