The Wrap – Degenerates, AI and... How Oracle's Larry Ellison Finances His Lavish Lifestyle

A peek via the proxy of one way one of the world's richest men finances his lavish lifestyle.

1. Announcing Office Hours…

If you’re a premium member, join me Monday at 1:00 P.M. ET / 10 A.M. PT for an experimental office hours using Substack’s new desktop video program, which I haven’t yet used… but you should able to ask questions… live! So, if you’re a premium member, feel free to show up by clicking here. I’ll also send a reminder in the Substack chat. If you’re not yet a premium member and would like to participate, you can upgrade in the link below. Hope to see you there. Remember… this is a test.

2. If You Missed it…

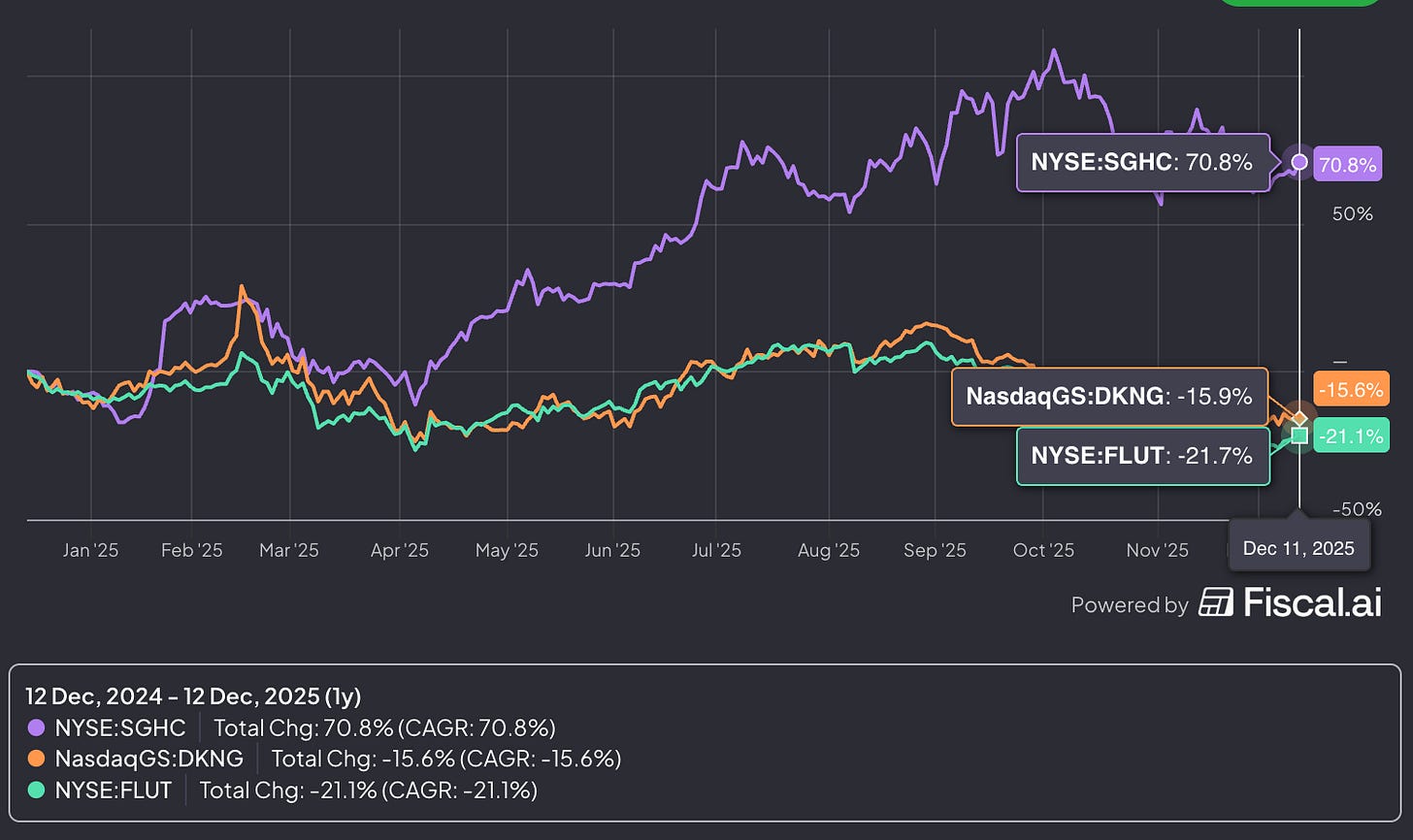

If you missed my report this week on Super Group SGHC 0.00%↑ and you’re a premium subscriber, I think you’ll enjoy it if for no other reason than it’s a fascinating albeit highly convoluted story. As I ask toward the end, “Why does it have to be so complicated?” To that point, I would say, it’s way too complicated for comfort. But here’s the thing… We’re talking about an online gaming company – a graduate of that glorious SPAC class of 2022, no less –that most investors have never heard of, yet its stock this past year has left DraftKings DKNG 0.00%↑and Flutter FLTR 0.00%↑ in the dust. But is it really that much better, or that less risky, than the others? You be the judge…

And by the way, while I say many people most likely have never heard of Super Group, despite its $6 billion market cap and very actively traded shares, you may know its best-known brand – Betway – which is fairly well-known in the UK and Canada and South Africa. For a brief time it tried to compete in the U.S., and was even sponsor of a number of teams, including the Golden State Warriors, Cleveland Cavs and Chicago Bulls.

Here’s the link…

3. Sticking with a Theme… Calling All Degenerates.

Hats off to my old pal Howard Lindzon of the VC firm Social Leverage, perhaps best-known for creating Stocktwits and the cashtag ($) that has become ubiquitous as a way to tag stock tickers on social media. He’s also the proprietor of Howie Town and as I suspect his wife Ellen reminds him – on a daily basis, no doubt – he’s a legend in his own mind.

But credit where credit’s due. Well over a year ago, as this stock market shifted into high gear, with the blurring of investing and gambling like never before, Howard coined the best description ever: Degenerate Economy.

Or as he put it…

I use the term ‘degenerate’ a little differently than the ‘degens’ themselves do. ‘Speculation as Entertainment’ and ‘Investing as a Sport ‘ is how I think about the ‘degenerate economy’.

He went on to explain…

If I were to pinpoint the beginning of the ‘Degenerate Economy’, I would go way back to 2008 during the GFC (Great Financial Crisis), and FAZ 0.00%↑. The ticker $FAZ represents a 3x leveraged bearish financial ETF…

He then took it one step further and created the Degenerate Economy Index of 20 stocks…

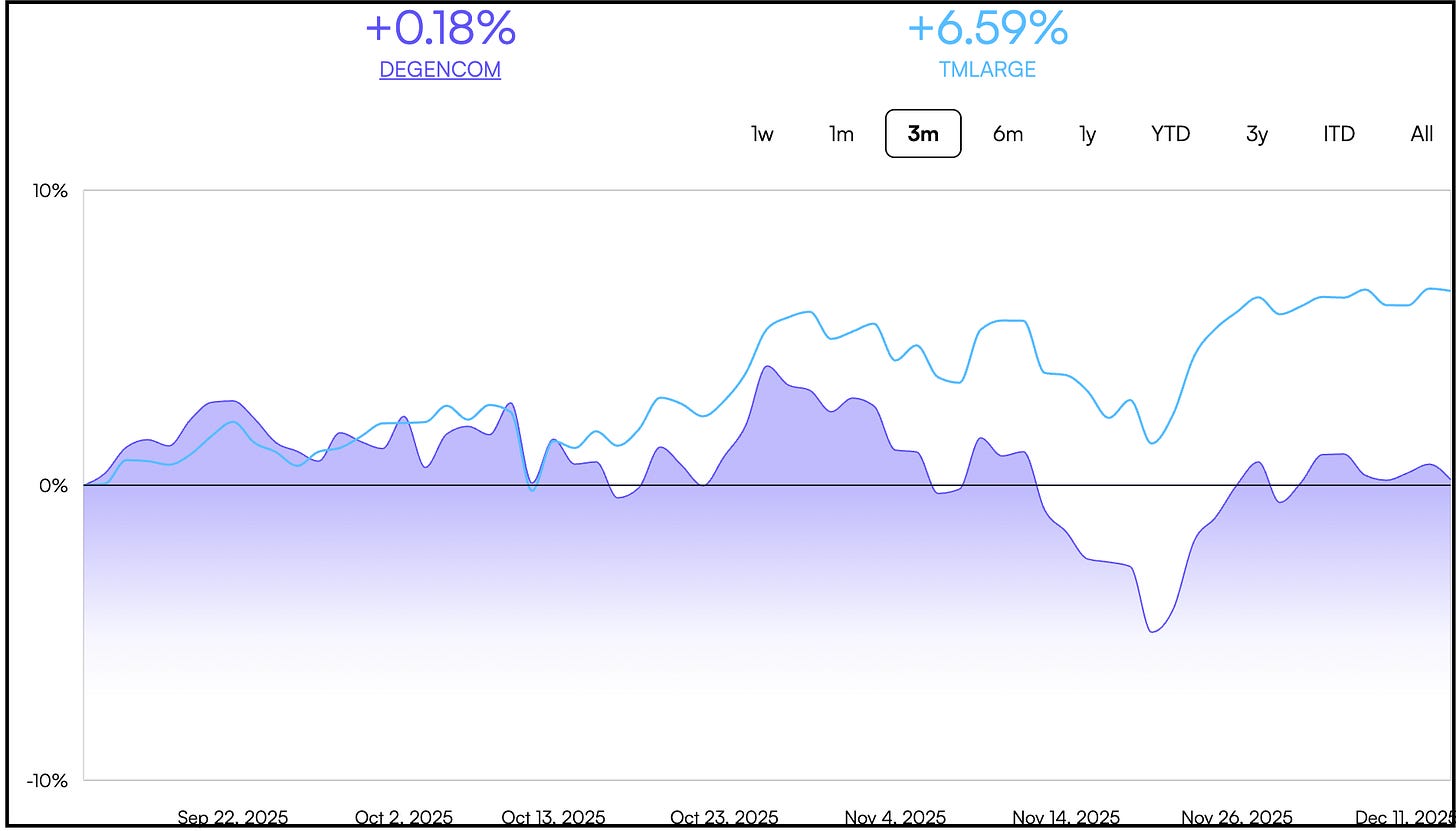

The best part is the performance. If you go back to its start in May 2023, when the rocket was blasting off, the degenerates (purple) have done well, up 164%…

But as time has gone on, they’ve done less well, shrinking to a gain of 22% over the past year and then, as reality hit over the past three months…

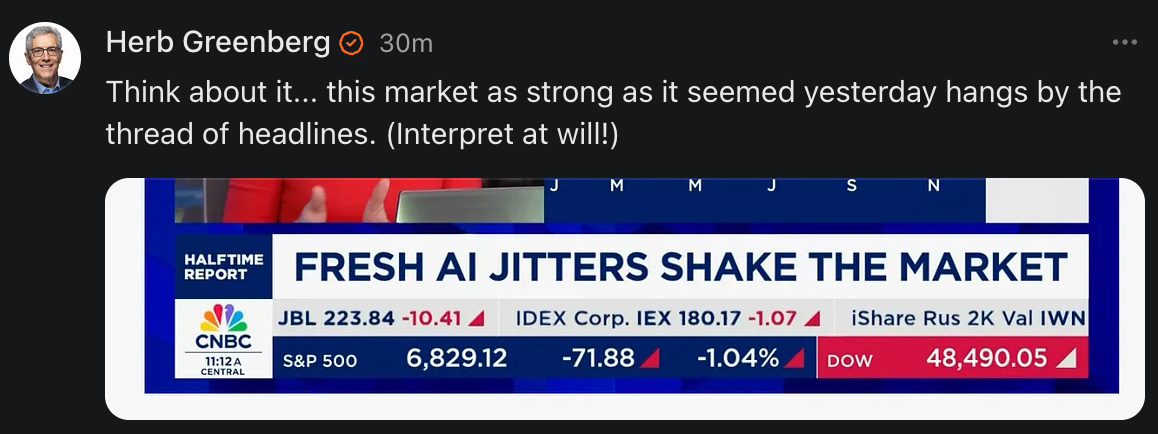

Then came yesterday, and the reminder that – hey kids, it may not be Howdy Doody time – but while I’m sure this dip is being bought like all of the others, sometimes investing is about more than just the ticker. (Oh, sorry, that’s an old-timey word for stock symbol.)

4. Which Reminds me…

From my social media mutterings…

The reality… this market has become a big game of chicken. I know, I know… the charts say it’s a bull market. I’m sure it is, but even strategist Tom Lee, whose has been stubbornly optimistic and right in every downturn, is warning that you may want to tighten those seatbelts for some heavy turbulence next year… “before a strong finish.”

And speaking of AI… I just signed up for a free 12-month subscription to Perplexity, which includes ChatGPT and Claude. I got it through a promo the company has with Venmo, one of many similar deals it has struck. That means I’ll cancel my ChatGPT subscription, since I’m finding the free Gemini from Google GOOG 0.00%↑ to be faster and better (I’ll give ChatGPT 5.2 a whirl for fun); and for image creation, I’ve figured out a way to use Adobe’s ADBE 0.00%↑ Firefly rather than ChatGPT as a surprisingly creative alternative. (Race to the bottom, anyone?)

Meanwhile..

5. Speaking of Oracle…

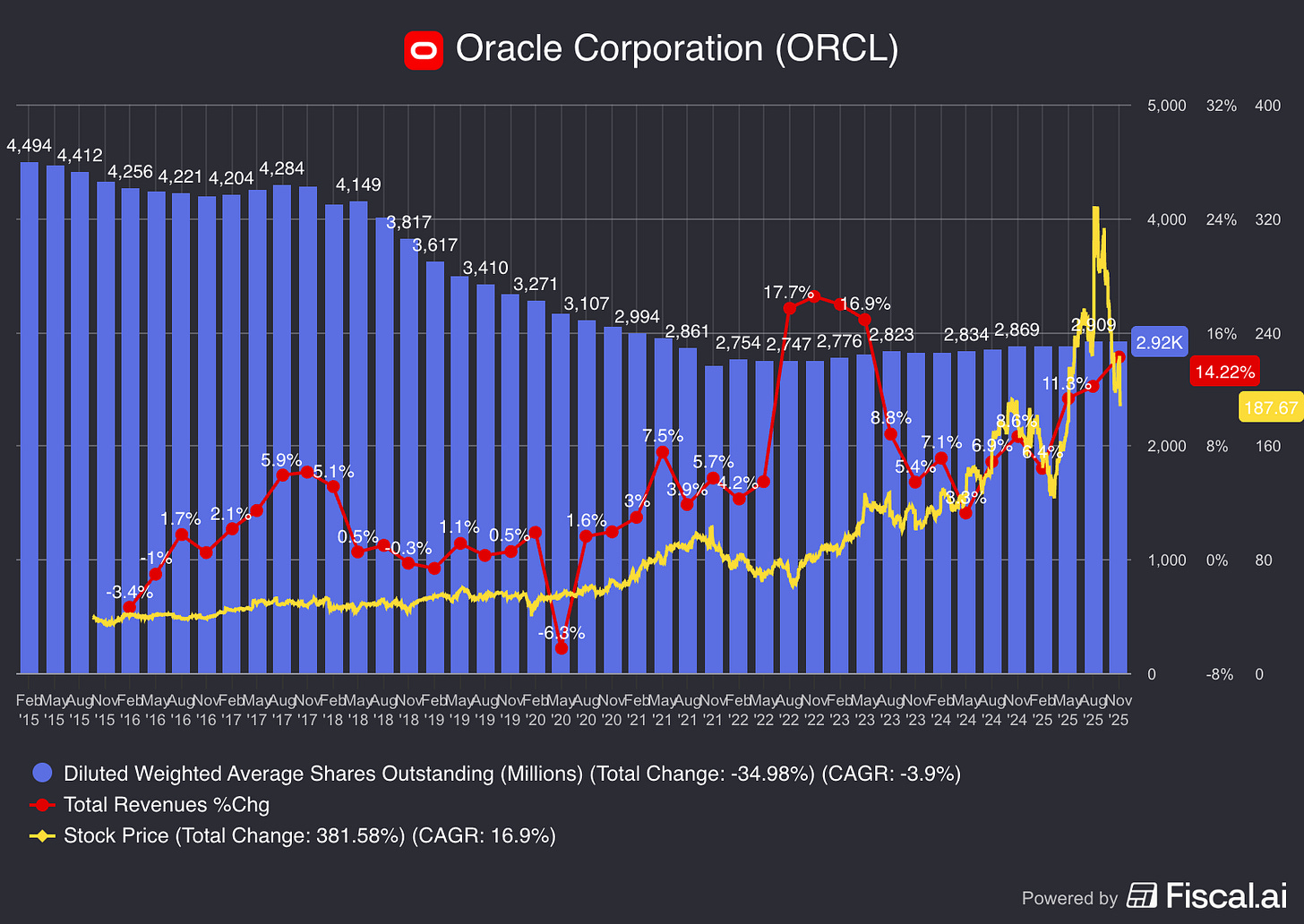

If I’ve learned nothing over the years it’s that betting against Oracle’s ORCL 0.00%↑ Larry Ellison can be foolhardy. If he doesn’t get his company out of a jam by making an acquisition, it has been by share repurchases. You can see that clearly here, with diluted share count (blue) vs revenue growth (red) and share price (yellow)...

What stands out is how all of the financial maneuvering and engineering has led to unsustainable results, with the benefits of 2015 NetSuite and 2022 Cerner acquisitions rapidly dissipating… only to more recently be bailed out by the the gush of money into AI. But even with that, for Oracle’ stock, its moment in the sun may very well have been a mere flash of fun…

And even then, the company’s 10-Q shows that Oracle is more leveraged than ever… with lease commitments – almost all to data centers – shooting up to $249 billion from $99.8 billion a quarter ago. But get this: terms of the new leases are for 15 to 19 years. That compares with 10 to 16 years over the past two years.

But, hey, not to worry: Ellison is the richest guy in the room, and one of the richest people in the world, which mean he surely knows what he’s doing, right? (Well, there was that time in 2008 he called cloud computing “gibberish” and later said he believed “it’s ludicrous that cloud computing is taking over the world.” But I digress…)

Which gets us to how Ellison finances his lavish lifestyle – not just the big racing yachts, jets and who knows what – but even backstopping his son’s winning bid for Paramount and current run for Warner Bros WBD 0.00%↑ ?

Turns out, to enhance his wealth he uses a form of financing that isn’t unheard of, but is often a red flag, and as a regular and significant source of funding is rare – especially among celebrity billionaire founders in Silicon Valley, with two notable exceptions…