The Wrap – Is Short-Selling Dead?

Also, the main event: Why Shake Shack hit the Red Flag Radar.

(An audio version of this report, narrated by yours truly, is linked lower in this report for premium subscribers.)

Now that I’ve got your attention, some housekeeping and other tidbits…

▶First, one idea that evolved from last week’s Office Hours was building on something I’ve already been pondering: To host an ideas call that would be limited to, say, a maximum of 10 bona-fide premium subscribers. You bring the ideas. The rules: They need to be stocks to avoid or possible shorts – however you want to define that, with at least $1 billion in market cap and $15 million in average daily volume. You discuss them quickly with a group of nine others on Zoom – opening yourself up to questions. I’ll then do a recap here for premium subscribers, along with an audio version of the meeting. Interested? Let me know. And if you’re wondering, for you introverts or professional investors, who need or prefer to keep a lower profile: while you need to let me know who you are, you can participate without being on camera and without using your name.

▶Second, I have a new Red Flag Alert dropping, hopefully by Monday… since the company reports a few days later. Also, in today’s report I’m adding Shake Shack SHAK 0.00%↑ to the Red Flag Radar. It was a name offered up by a participant during Office Hours. I’m also working on a bunch more. I’ll clue you in next week, assuming I get to them. You never know which will become full-scale alerts!

▶Third, if you missed my report last week on why it appears that Vital Farms VITL 0.00%↑ has cracked, thanks to a new health-related revelation, you can read it here…

Of course, given the volatility of this market, within days the stock was back up to where it started…

Is that proof they really CAN put Humpty Dumpty together again? Nah, it was just a short squeeze, which by Friday showed the cracks were very much still there.

▶Finally, with AI continuing to be front and center, this Steve Eisman interview of AI gadfly Gary Marcus is worth the listen.

My favorite part…

Everybody’s leaving to start their own startup. Now, think about it: If you were at OpenAI, and they really were going to release AGI next week, would you want to leave just before this cataclysmic event that was going to revolutionize the world and go start a little company that’s going to take, you know, four years with the developer or whatever? Of course, you wouldn’t. You’d want to be there for the magical coronation. So the fact that everybody is leaving tells you that they don’t really have what they think. And then: what else is going on?

What else… indeed!

Moving on… Is Short Selling Dead?

▶Ok, I admit – that was a cheap clickbait headline….

But as a guy who flies red flags, and has been plugged into a good network of short-sellers for decades – some of which is still in-tact – I have a front-row seat to what’s happening. The reality is: Stocks still blow up and there are still plenty of people shorting stocks, with a twist: Just as market structure has changed, so has the nature of short-selling. Michelle Celerier, who is now on Substack writing about billionaires, went through some of this a few months ago in a piece for Institutional Investor.

Enter Adam Taggart’s interview this past week with activist shortseller Carson Block of Muddy Waters Research.

I’ve known Carson for years, and very briefly tied up with him a few years ago to do my poorly-timed, failed foray into activist short-selling – the one where I pulled the plug before even really getting started. A good thing, too!

Carson’s view is that the world of short-selling as we knew it has pretty much disappeared… as have many short-sellers. But as the hundreds (and growing) number of premium subscribers to my Red Flag Alerts can attest, many of whom I’m sure are looking for shorts, it’s hardly dead. Or as he explains…

You know, like it’s not a pre GFC [Great Financial Crash] market anymore. You just don’t have the frequency of corrections and the duration of corrections that you used to have.

And it sounds like that because there’s several things that are going on. I don’t know if we can call them a natural or not, but they are trends that weren’t there, let’s say 20 years ago, that have a strong bias to keeping the market supported here.

Like, I would say, the merger of gaming and investing, with the broad, seemingly sustained push from retail – not to mention that wild South Korean influence, but I digress…

Carson goes on to explain…

Short selling traditionally has been this discipline where you go out there and you say, ‘I want to find the most screwed up companies.’ Now, when you get those massive disconnections, it’s almost always because the company is actively doing something to cause that. They’re hiding the ball, they’re misleading investors, they’re doing things to manipulate the perception of the company.

And, arguably, I would say, in this Golden Age of Grift, they’re getting a free pass… and getting more emboldened, leading to what likely will be more fraud, more manipulation and much of it, hiding in the open for all to see. And pretend not to, while the party rages on…

Which is why “in this environment,” Carson continues, “trying to identify those shorts… is a bad idea.”

What’s more, other than the kinds of names activists chase, Carson believes for those who want to short it’s best to stick with “the mediocre companies that are kind of just sleepwalking through things,” where “you’re not finding anything revelatory, you’re not really finding things that the world doesn’t know, you’re just looking for those who are lagging the average…”

Hard for me to disagree, since finding the laggards is the main concept behind Red Flag Alerts. The more boring, the better! (Not that I can’t help myself from touching the wet paint every now and then – it’s in the DNA.) Oh, and by the way, some of those boring companies can blow up, too. Exhibit No. 1 is Erie Indemnity ERIE 0.00%↑, which is down 45% since it was first mentioned here.

There’s obviously much more to the interview, including nuance I only touched on. Best line, in my opinion…

You know, one of the best and truest things I’ve heard said about investing and maybe just life in general – but especially the investing industry – is that when you speak with them, pessimists sound smarter than optimists. Optimists live in bigger houses.

Ain’t that the truth.

Special thanks to FinTool ,Tenzing MEMO, Fiscal.ai and ManagementTrack, whose tools played a role in researching this report.

Why Shake Shack Hits the Red Flag Radar

▶I hadn’t given much thought to Shake Shack for quite a few years…

Then, during Office Hours last week, one subscriber, a professional investor I happen to know, mentioned why he was short the Shack. (And short, I should add, as a long-term trade that he believes will take time to play out.) This is a guy who also happens to be mostly a growth investor; he also has good instincts on shorting broken growth stories, especially after the stocks have tumbled.

He thinks Shake Shack, one of the former stars of restaurant stocks, is on its way…

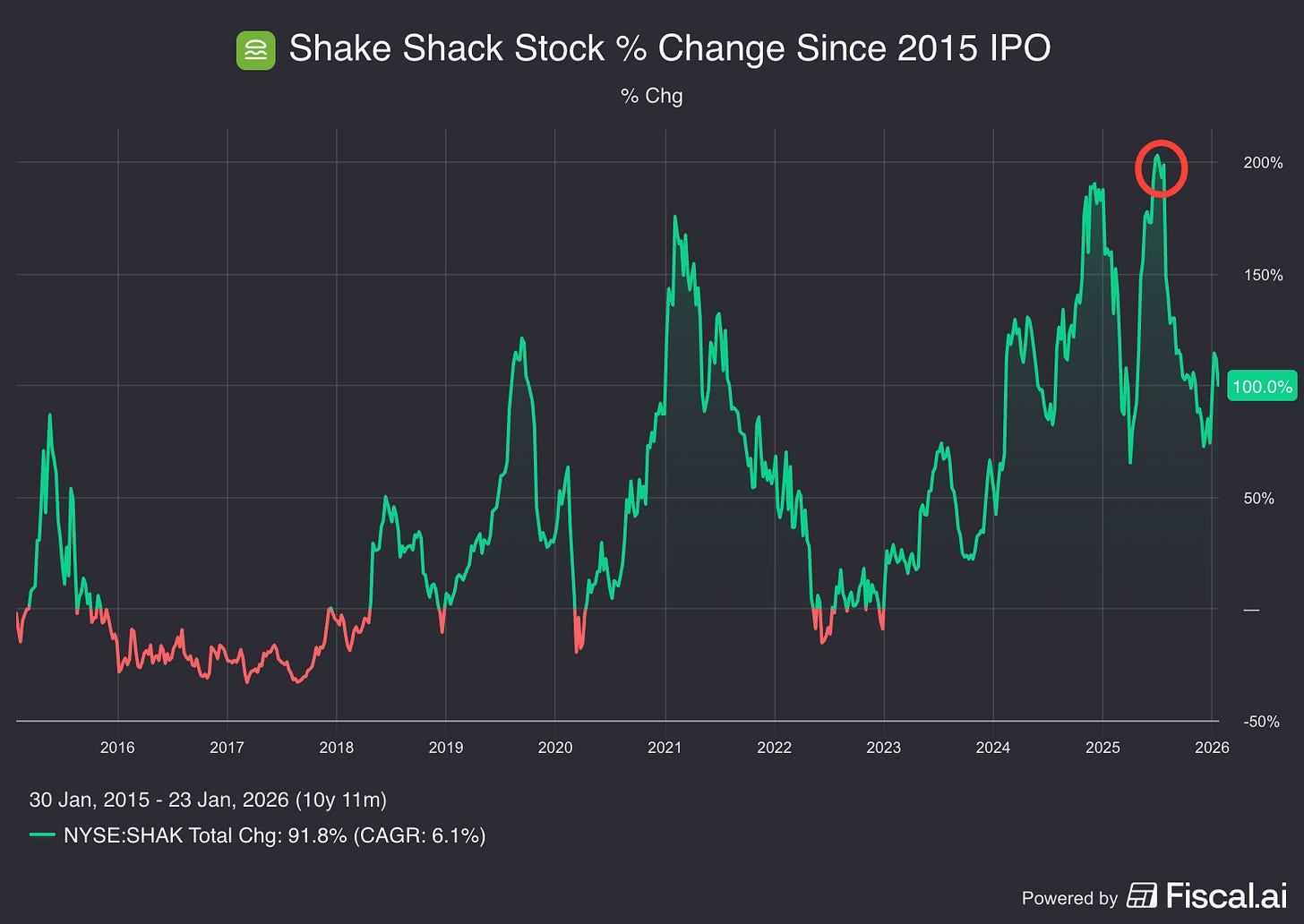

And while its shares have been whipsawed since its 2015 IPO, early investors have done well – that is assuming they got out at last July’s all-time highs. And even then, the company has had a good run…

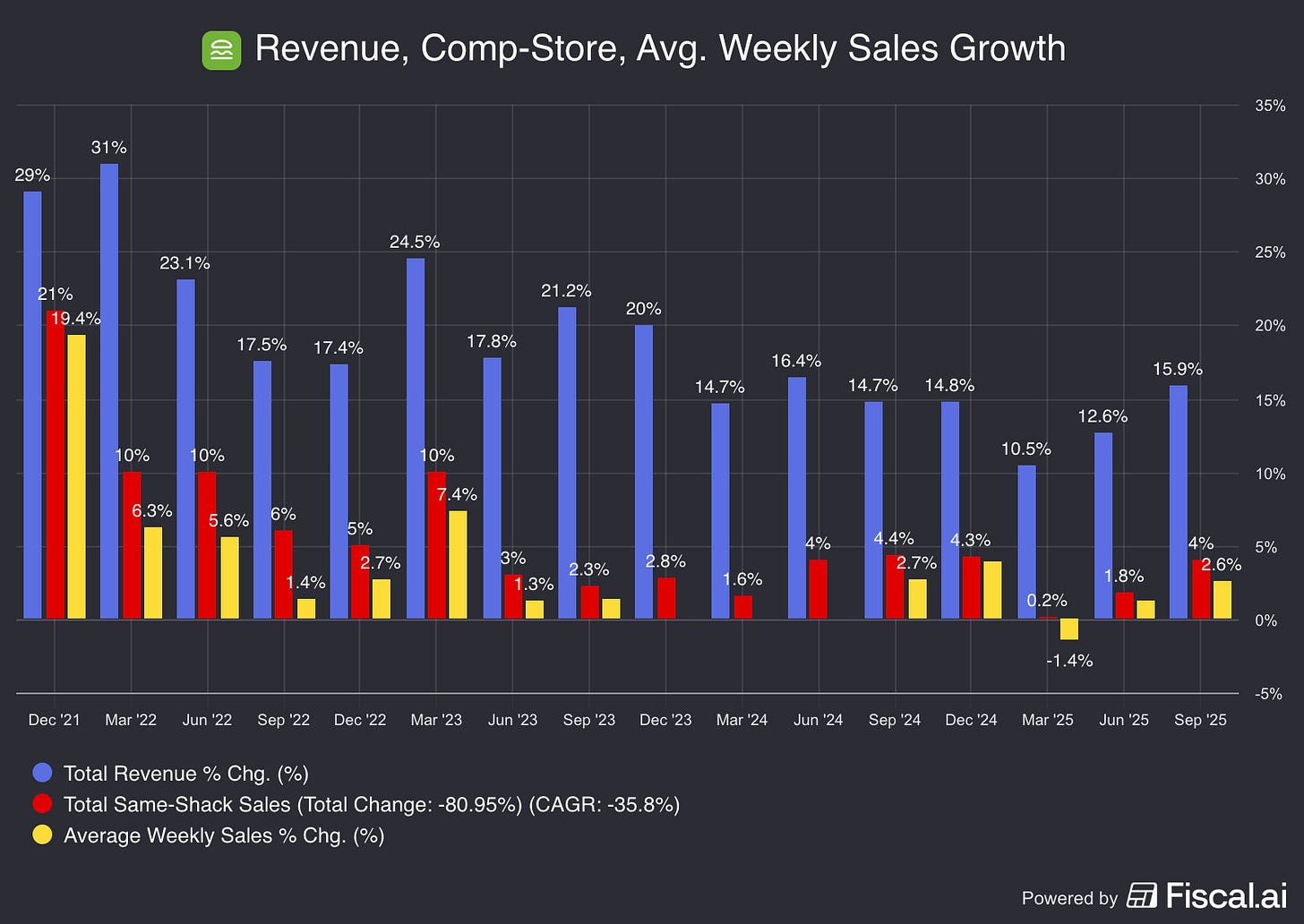

In recent years, the company has had a rough go of it. You can see it in revenue growth, average weekly sales and comp-store sales…

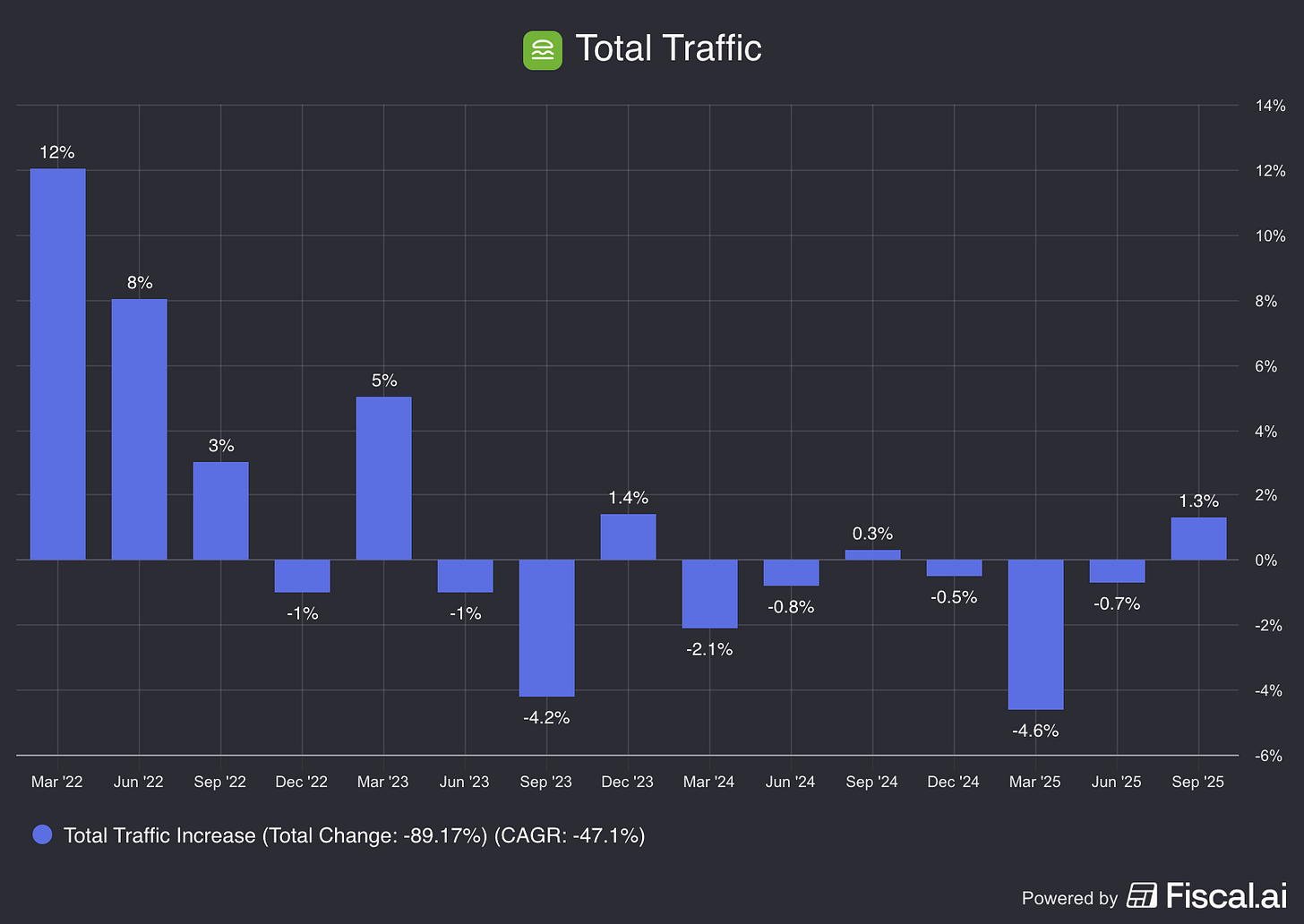

Worse, take a look at total store traffic…

Wall Street, of course, cheered the blips higher as proof that a turnaround under CEO Rob Lynch, who arrived two years ago from Papa John’s PZZA 0.00%↑, is taking hold. Never mind that any blip higher is against dismal prior results. In other words, they’re little more than easy comps! Ditto for his recent comments at the recent ICR investor conference suggesting that margins will improve and that comp-store sales momentum will continue.

He also said new-store builds will accelerate, which is part of his for there to e 1,500 company-owned stores “over time.” That’s roughly double the number today.

Not Buying It

So, why isn’t my growth stock subscriber buying it?