The Wrap: When Gravity Takes Hold

Also, AI's surprising impact on healthcare costs and... what exactly is a bubble? Plus, the widely ignored role AI is playing in pushing healthcare costs higher.

This is not the time to ignore red flags.

If you haven’t already, join the large and growing list – portfolio managers, analysts, auditors, attorneys and even a few regulators – who have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

▶Before we get going… Missed my update yesterday on SharkNinja, UPS and Paycom, you can read it here.

▶And this head’s up… Barring anything that absolutely, positively can’t wait, it’s highly unlikely there will be a Wrap or much else from me over the next two weeks. I’ve got a full house starting later this week through Thanksgiving. And as I say in my FAQs…

In general, I’m committed to publishing, on average, at least once-per-week for 46 weeks out of the year – sliced and diced whichever way you like.

For those keeping score, we’ve just completed week 46 of this year and I’ve published roughly 120 various reports and updates, including 45 tagged exclusively for Red Flag Alerts subscribers. As always, my goal is not to publish for the sake of publishing, but only if I have something to say… and to allow for life getting in the way. I’ve also added The Wrap as a weekly way to keep in touch. Also, a new subscription tier or two with additional perks are in the works. Stay tuned. (Don’t worry, I won’t be taking anything away from current subscribers.)

Now, on with the show…

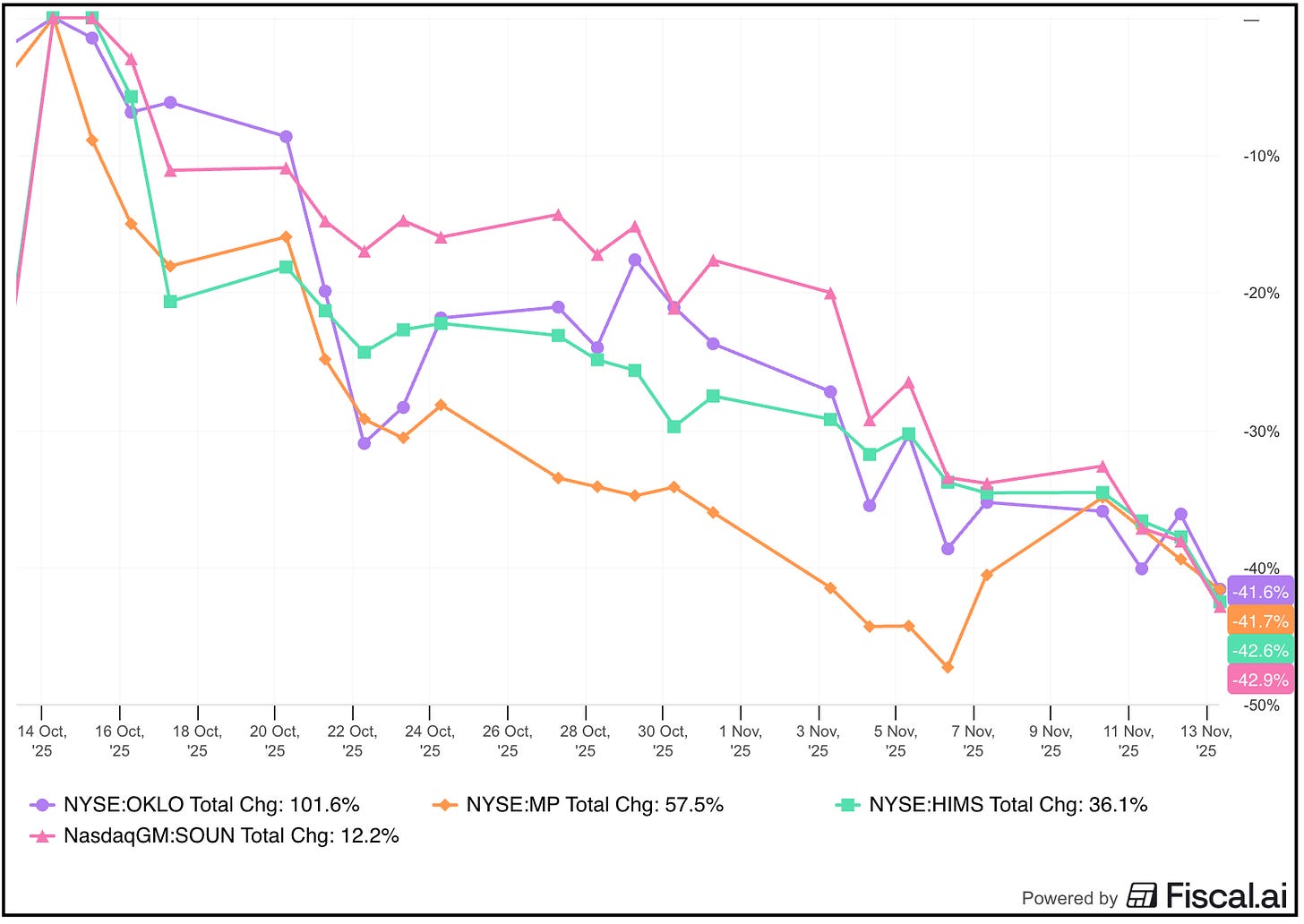

▶Every week is a week to pay attention to red flags… But this week capped a few weeks that should serve as a reminder that in the end – with sanity starting to hit some of the silliest – the laws of gravity ultimately apply. Notably among those on my Red Flag Alerts list that had experienced rocket ship-like blastoffs were MP Materials $MP, Oklo $OKLO, Hims & Hers $HIMS and Soundhound $SOUN. All are still up considerably since I took my first swipes, but taking into account the total drawdowns, each has gone through its own version of a mini-smash crash.

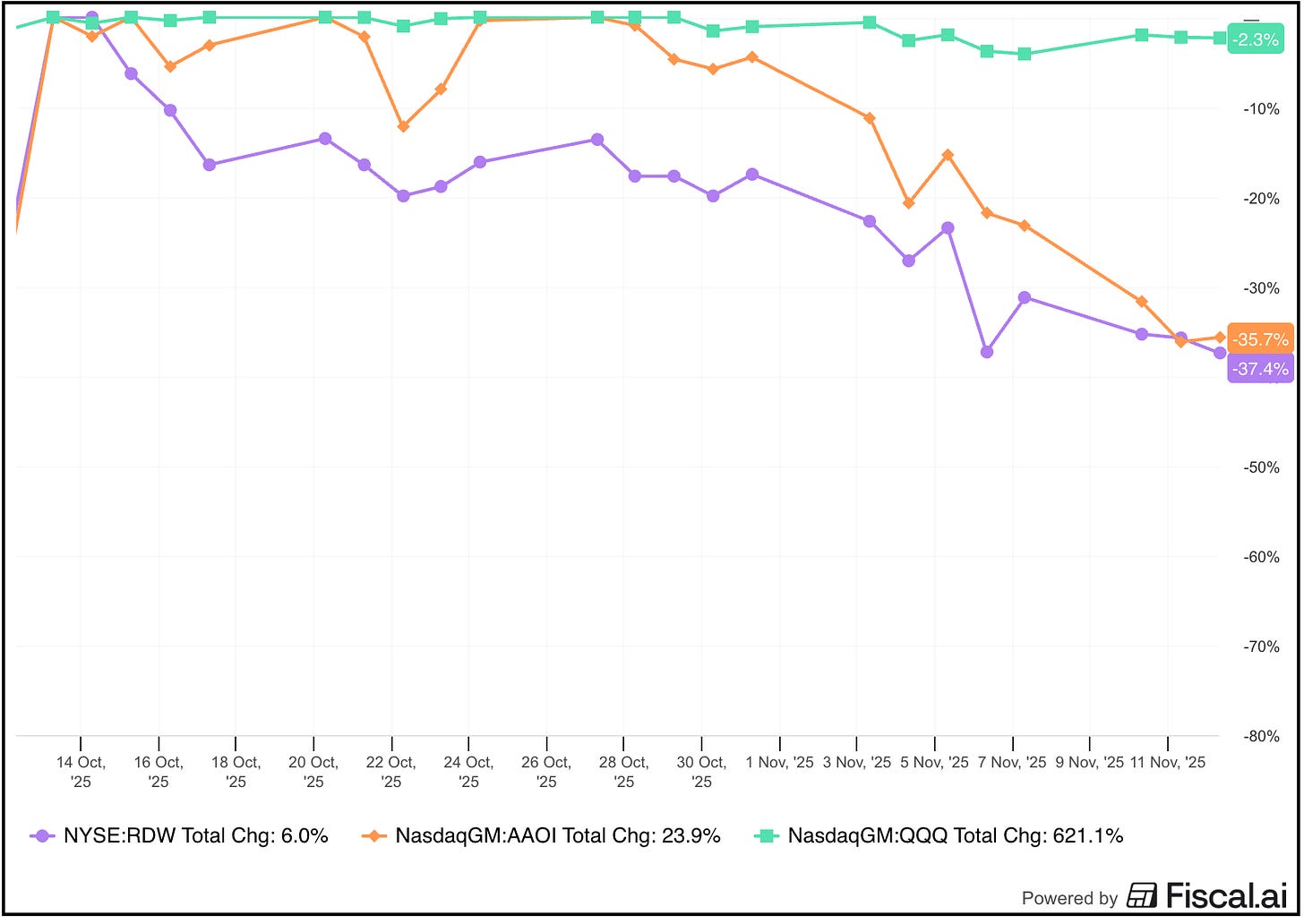

Ditto Redwire $RDW and Applied Optoelectronics $AAOI, which hit my radar roughly six weeks ago.

▶Follow the leader… All of this, of course, follows the downward spiral of this cycle’s from-out-of-nowhere market lynchpin, CoreWeave $CRWV, which has tumbled more than 40% since Halloween. If you missed my “Connecting a Few Dots on CoreWeave” from a few days ago, you can read it here. One dot I didn’t mention was seemingly lost in the noise: In the three months since its post-IPO lockup ended, CoreWeave insiders have wasted no time selling… now having dumped around 39.952 million shares worth more than $4.9 billion; that’s roughly 10.9% of shares outstanding and 13.9% of its public float that was sold – most of it as the stock climbed higher. Imagine how the stock would have reacted if they had filed a secondary offering to unload that amount, rather than dribbling out the shares!

It should go without saying: This is just a moment in time, and these stocks and could reverse themselves in a heartbeat in this market that feels to some of us like no other. Wouldn’t be the first time nor the last… And, oh, yes, I know: Nothing is likely to signal a coiled spring that is ready to reverse itself more than an image on top of this report that says, “This way down!” Regardless, the past few days and weeks demonstrate that stocks priced for infinity and beyond are often no better than Buzz Lightyear thinking his jetpack and lasers are real.

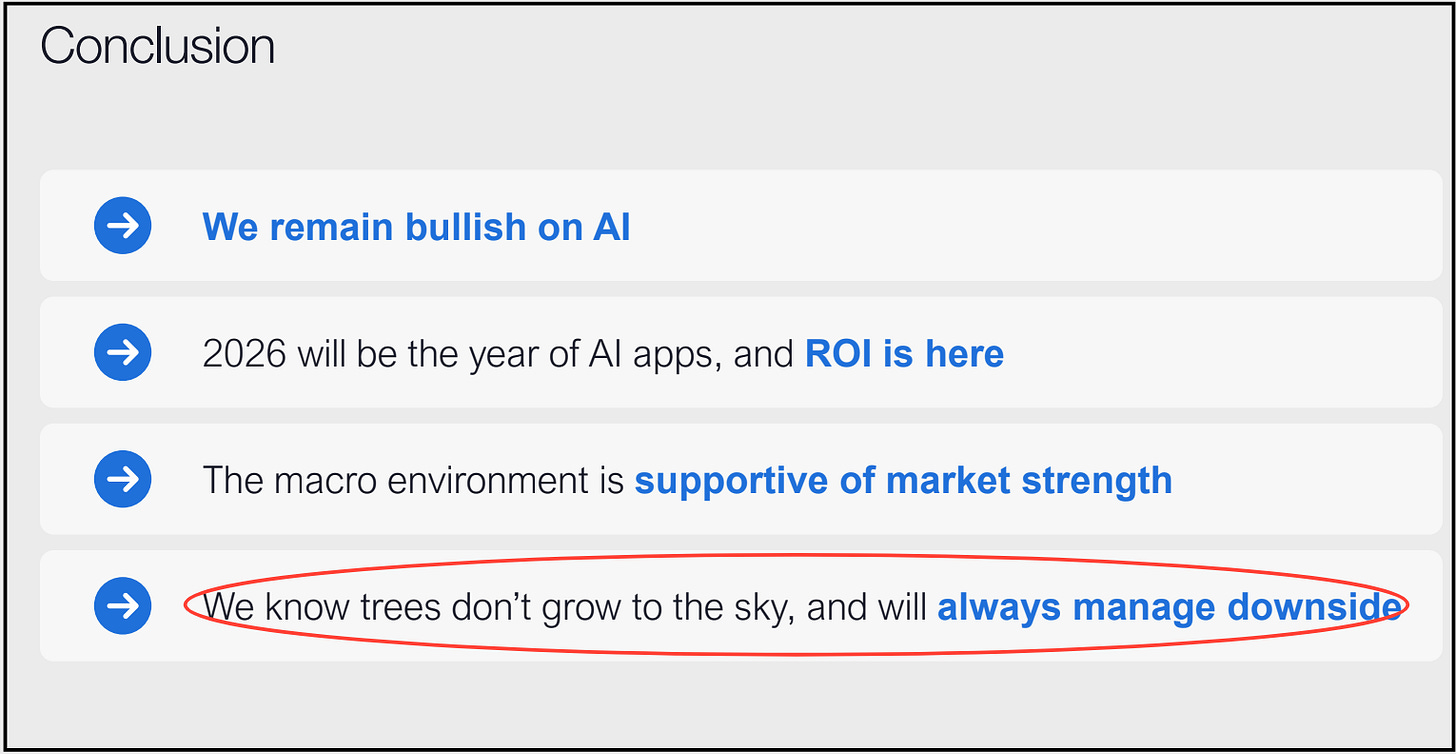

The underlying theme of all of this, of course, is AI. While the AI trade is currently off, the best bull/bear presentation I’ve seen was the month-old 59-page Public Markets Update on this from the hedge fund, Coatue Management. (Hat-tip to my pal Whitney Tilson, whose daily letter included a mention of this.) Coatue is unabashedly bullish on AI, but their view is based on the thesis lasting five to 10 years. It was the final slide – their conclusion – I liked the best… more specifically, their final point.

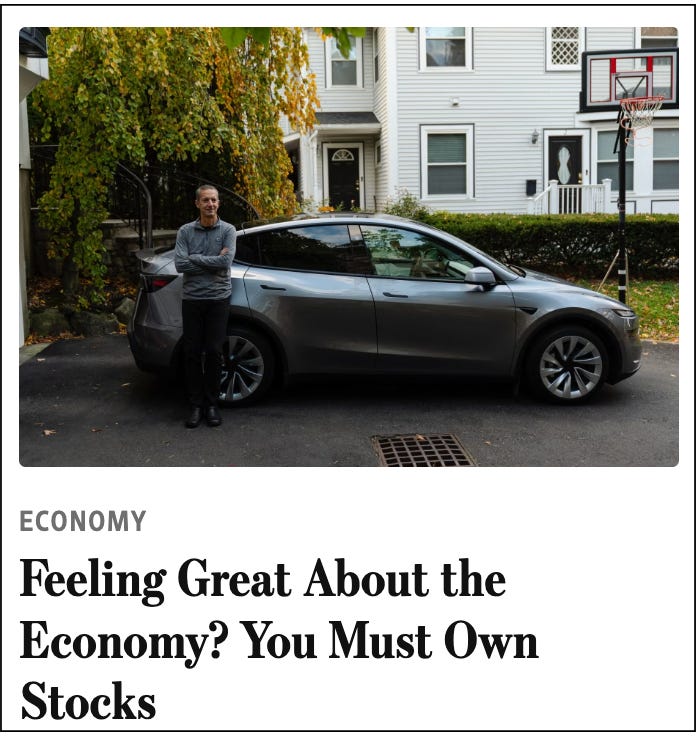

And that’s it: trees don’t grow to the sky, and for all we know Coatue has been shorting the silliest of the silly as part of its effort to get from here to there. Still, the likelihood that stocks could fall – and stay down for an extended period – may simply be too abstract and far-fetched for many of today’s investors to comprehend, especially when it has been so easy to make money and the only way they know is… up! Or not just buying on the dip… and often doing so on the double- and even triple-leverage, at that. Exhibit No. 1: This story in the Wall Street Journal, which makes it sound as though having money in the market is like having it in a bank…

Just another sign-o-the-times…

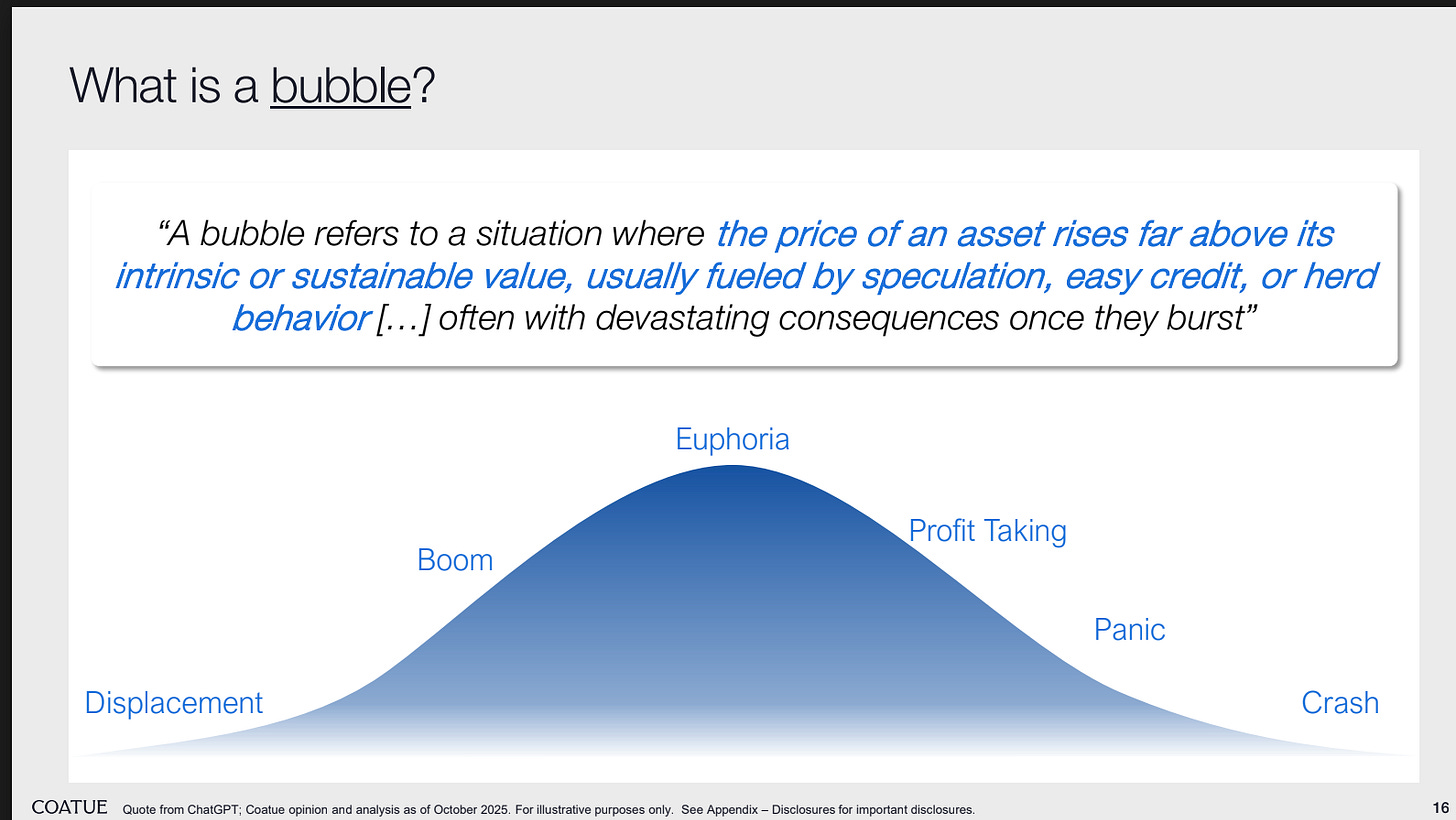

▶Speaking of the times, and oh what a time this is… Since we’ve been talking bubbles, one obvious question: What’s the definition of a bubble? I’ll give you two different views. The first is from Coatue’s presentation…

Sensible. The second is from the CEO of a Taiwanese-based company. During a CNBC Asia appearance, he was asked whether we’re in an AI Bubble. As I put it in a social media post, he said…

Taiwan’s Yogi Berra! And if you’re wondering, kids, my reference in the above post to Chuck Prince, then CEO of Citigroup, was a quote that will go down in infamy…

When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance.

That was in 2007 and proved to be a key sign of arrogance among those on Wall Street as concerns about risks were growing before leading up to the Great Financial Crisis. After the music stopped, Citigroup was among those bailed out by the government after suffering more than $100 billion in losses and impairments.

▶Speaking of bubbles, one that has nothing to do with AI… a friend sent this from a presentation he attended last week in Minneapolis by Christopher Monroe, who co-founded and now serves as Chief Scientific Advisor for IonQ $IONQ, whose stock has been among the most controversial in the quantum computing space. The title was “Hype and Hope”….

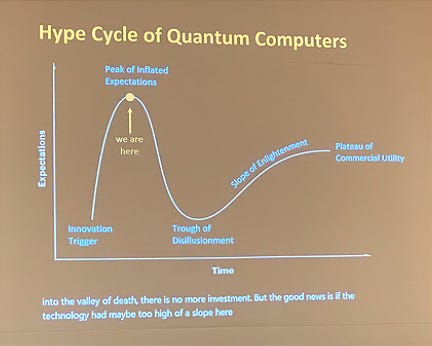

But this slide – especially, “we are here” – was worth the price of admission…

And he’s a bull!

▶Meanwhile, we’re all told that AI will help lower costs. Oh, really?! Not according to Insperity $NSP, among the third-party outsourced HR providers, which are best known for providing considerably cheaper group health coverage to small-and-mid-sized businesses – certainly cheaper than they could get on their own. That’s because by bundling all of their customers together, they become one giant group.

Now hear this: AI may actually be helping to raise the cost of healthcare. Or as Insperity CFO Jim Allison explained on his company’s latest earnings call…

We have recently been made aware that the use of AI tools by health care providers has emerged as an additional contributor to the higher cost trends, impacting everything from condition diagnosis and treatment plans to clinical documentation and coding for insurance billings to preauthorization and appeals processing.

Many insurance carriers have alluded to such issues in their comments on higher cost trends and loss ratios, and our understanding is that they are responding in a variety of ways to reduce issues around up-coding or unnecessary spending. From what we are hearing, it is the accumulation of all of these things happening at the same time that has created the unexpected increase in trend.

Yep, we all know health care costs are rising, but AI as an inflator wasn’t on anybody’s bingo card – let alone the folks who should know. And as best I can tell, this part of the story hasn’t been widely picked up in the mainstream… yet.

▶Finally, assuming I really don’t publish between here and there, to my U.S. subscribers… Happy Thanksgiving!

As always feel free to click the heart link below. And if you have something tips or other tidbits you think I’d find interesting, feel free to send them my way!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I don’t own any stock mentioned in this report.

I can be reached at herb@herbgreenberg.com.

The timing on highlighting RDW's drawdown is spot on. These parabolic moves in space-related stocks always seem to follow the same pattern when reality catches up with valuaton. What really caught my attention though was the point about AI actually incresing healthcare costs through up-coding and unnecessary spending. That's a second-order effect most people aren't even thinking about yet.

On the AI point, the cost of reasoning with frontier models like Gemini and Open AI is not cheap, also known as token costs. So as companies incorporate reasoning tools into their products, we should expect lower gross margins. The offset would be higher revenue growth in my opinion due to more usage.

That’s why I expect many software companies to have higher revenue growth, but lower gross margins, over the next year.

Thanks Herb. Have a great holiday. JB