‘Too Cheap to be True’

The case for one overlooked fracking supplier. Plus, an update on last week's Red Flag Alert

The concept of “too cheap to be true” is too obvious to be ignored as a way to find potentially good ideas...

At least it is for former hedge fund manager Bob Marcin of TB Partners, who is no stranger to my readers.

Like so many seasoned investors with a few decades under his belt, he’s highly independent and spends time rummaging through the junk yard of often overlooked stocks… in search of a winner.

My favorite, in recent years, is Bel Fuse (BELFB), which makes electronic connectors. Bob first told me about it in January 2022, when it traded at $12. As is often the case with ideas like this, I listened politely and forgot about it… until April of that year.

Bob will never be accused of being an introvert. And with the stock at $15, up 25% from his initial mention, he wrote chiding me for not writing about it when he first mentioned it.

But even after that nice gain, he felt it was still cheap.

Long story short, it’s now around $62.

Bob still owns it and forwarded along the below chart with a note: “You asked why I still own it. Self-evident here.”

Best New Idea

The obvious question: What’s his favorite and best idea today?

While it’s not the microcap Bel Fuse was at the time he first started talking about it, this one has some of the same attributes, with the three main things he looks for in a stock:

A compelling valuation.

Exceptional fundamentals including strong cash flow and a clean balance sheet... but with disappointing expectations.

And it’s in its own bear market.

This all equals what he refers to as “too cheap to be true,” but also, “too unsustainably cheap to pass up.”

Water in the Permian

That gets us to Select Water (WTTR), which supplies and recycles water used for fracking. Nearly half its revenue is in the Permian Basin of Texas and New Mexico, and its stock is trading at roughly half its 2017 IPO price, when it was known as Select Energy.

Bob first pinged me on it last July and then again in September after a New York Times investigation into the controversy over the amount of water fracking uses – and then again in December. It was all too reminiscent of his passion over Bel Fuse.

In his latest missive, he wrote (emphasis added)..

Every once in a while, a stock has bunch of things going for it so that one can buy in size and expect positive outcome, even as markets make new highs.

This company has decent sales growth, better cash flow /earnings growth, no debt, a nice dividend, an opportunistic buyback, big free cash flow yield, and solid operational skill and management. Without debt, one can average down should the oil price cycle hit the shares in a recession.

He went on to say...

The company has a business model that no one else can match in the oil patch. They deliver water for fracking, treat water with chemicals pre/post frac, and gathering, move and store produced water from oil wells.

No other supplier offers this full system service capability. With ESG forces driving more water recycling, WTTR’s full cycle platform is a competitive advantage in the Permian and should drive market share gains in all 3 divisions. It also makes the water delivery, heretofore a commodity biz, more technologically driven and distinguished.

Therefore, EBITDA/free cash flow growth should significantly exceed sales mid- to hi single-digit sales growth for the next few years. If the company hits intermediate term profit margin targets, EBITDA could rise from $250mm in 2023 to $400mm in 2026, half of which would be free cash flow!

This makes the company's $900mm enterprise value stupid cheap. Since the biz now has more stability and tech IP than ever before, and growth, and free cash flow, a fair multiple should be 6-7x's EBITDA for a 3-4x price move over 3-4 years.

As Always, There’s Risk

The obvious risk, he goes on to say, “is a bear market in oil/natural gas prices and a larger decline in rig count/well completions. This would happen in a recession for sure. One cannot dismiss the cyclicality of the company's water delivery biz, its largest source of sales and cash. But over time, as water recycling grows in bigger share, the stability of that division will help mitigate the overall company biz risk. This is another reason for higher valuations.”

With the stock at these levels, Bob continues to be a buyer and just this week told me, “I added more today.”

Yeah, Bob is talking his book. Just like he was with Bel Fuse.

It just so happens I have a soft spot for independent investors, with track records, who are willing to share ideas with their name and money on the line. After all, ideas have to come from somewhere, and Bob acknowledges the risk...

First rule. Nothing is a sure thing. So each trade becomes a set of dynamic odds. I don't marry the buy or the sell.

I know how I will lose before the trade starts.

Barring something significant or more troubling he has missed, which is always a possibility, it’s hard to argue with that.

Red Flag Alert Update

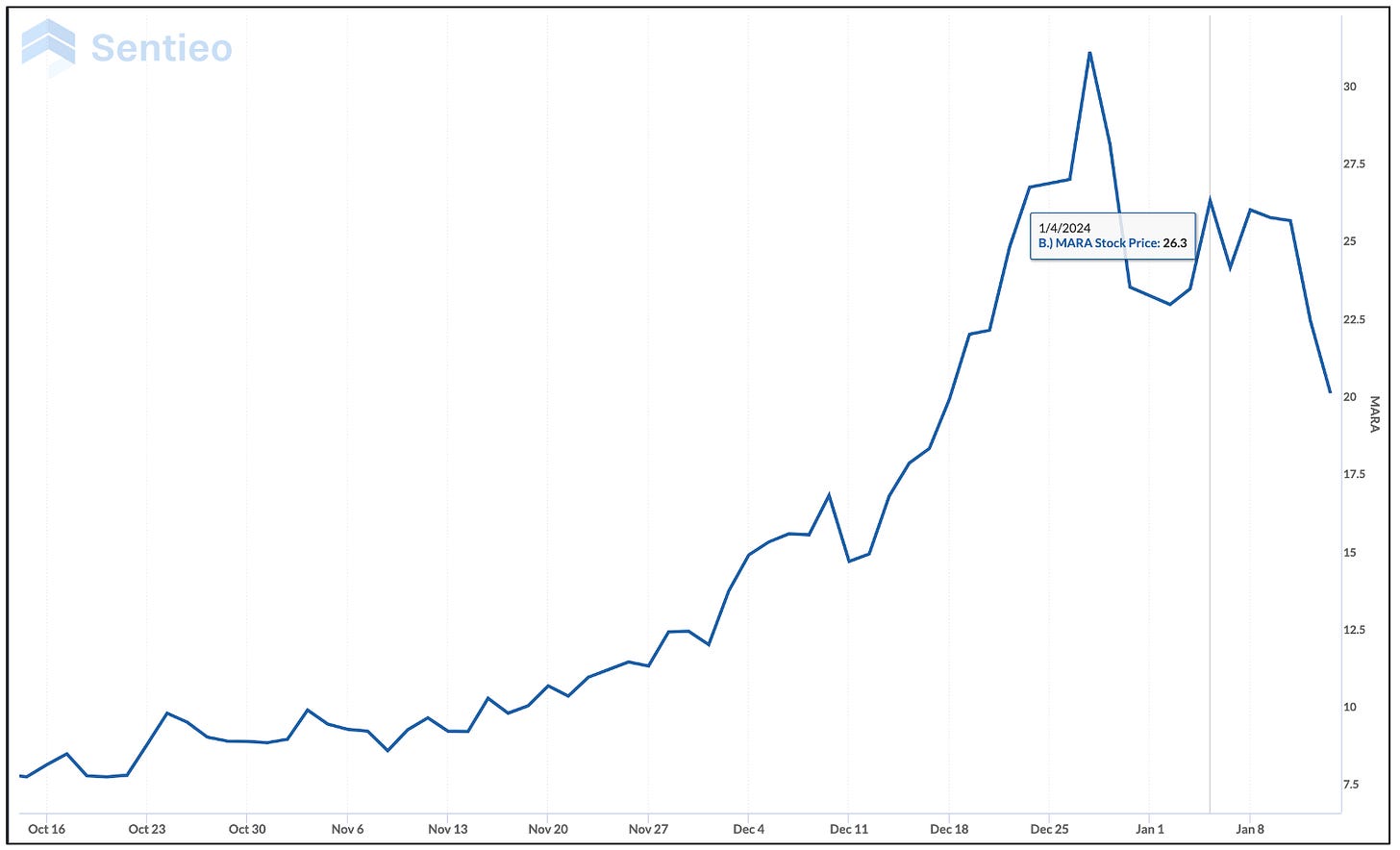

Last week I red-flagged bitcoin miner Marathon Digital (MARA), citing a variety of reasons. The bottom line was… if the bitcoin ETF is approved, why buy a proxy like the miners?

The ETF was approved and Marathon has tumbled 25% since I first mentioned it, with more than half that decline today alone.

Names on my Red Flag Alert list all obviously don’t prove themselves like this… or this fast. But whether ultimately warranted or not, the names I mention are red- (or yellow-) flagged for a reason.

I view the Red Flag Alert/Stocks to Avoid portfolio as a proxy of sorts for what appear to be lower-quality or riskier ideas at these prices in this market. I should probably find a good acronym for it. If you have one, let me know.

As of now that portfolio, which started in May - and its peak as down more than 30% – is off 19%. In this kind of market it’s a moving target.

P.S. - not every name on the list is low-quality. Some are special situations. DexCom, as an example, has proven itself to be a fantastic company, with an exceptional product. But it’s there for another twist in the story. And who wouldn’t have wanted to be long Enphase all the way up? Its inverters are on my house. At some point, as this evolves, I may cull the list.

Coming Up…

And before we go, this head’s up: I’m working on an exciting project with a bunch of “friends” that, if all goes according to plan, should start rearing its head in coming months. As they say, stay tuned.

If you like this, please don’t hesitate clicking the heart below and sharing with your friends. And as always, if you have comments or ideas to share, feel free to contact me directly or share them with everybody below.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not own any stocks mentioned here.

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Threads @herbgreenberg.

I owned BELFB in that 12 range and wound up selling out of impatience in the 15 range IIRC. Still kicking myself.

Thanks Herb. I gave only been a subscriber for a few months but it seems like you have a lot of smart friends on your holiday shopping list. Thank you for sharing these insights.