Update on Two Oldies but Goodies

In the year since I wrote about Erie and Corvel, both stocks have been hammered. But the fun may have just begun.

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

▶Just over a year ago I wrote a report headlined, “Levitated by Lunacy”...

It focused on two companies – Erie Indemnity $ERIE and CorVel $CRVL. The stocks of both appeared to be rising sharply for no other reason than they had been touched by the silent hand of momentum-fueled, algorithmic-inspired passive investing... rather than what was going on beneath the surface. Both also were well off the radar, which will always be a magnet for me.

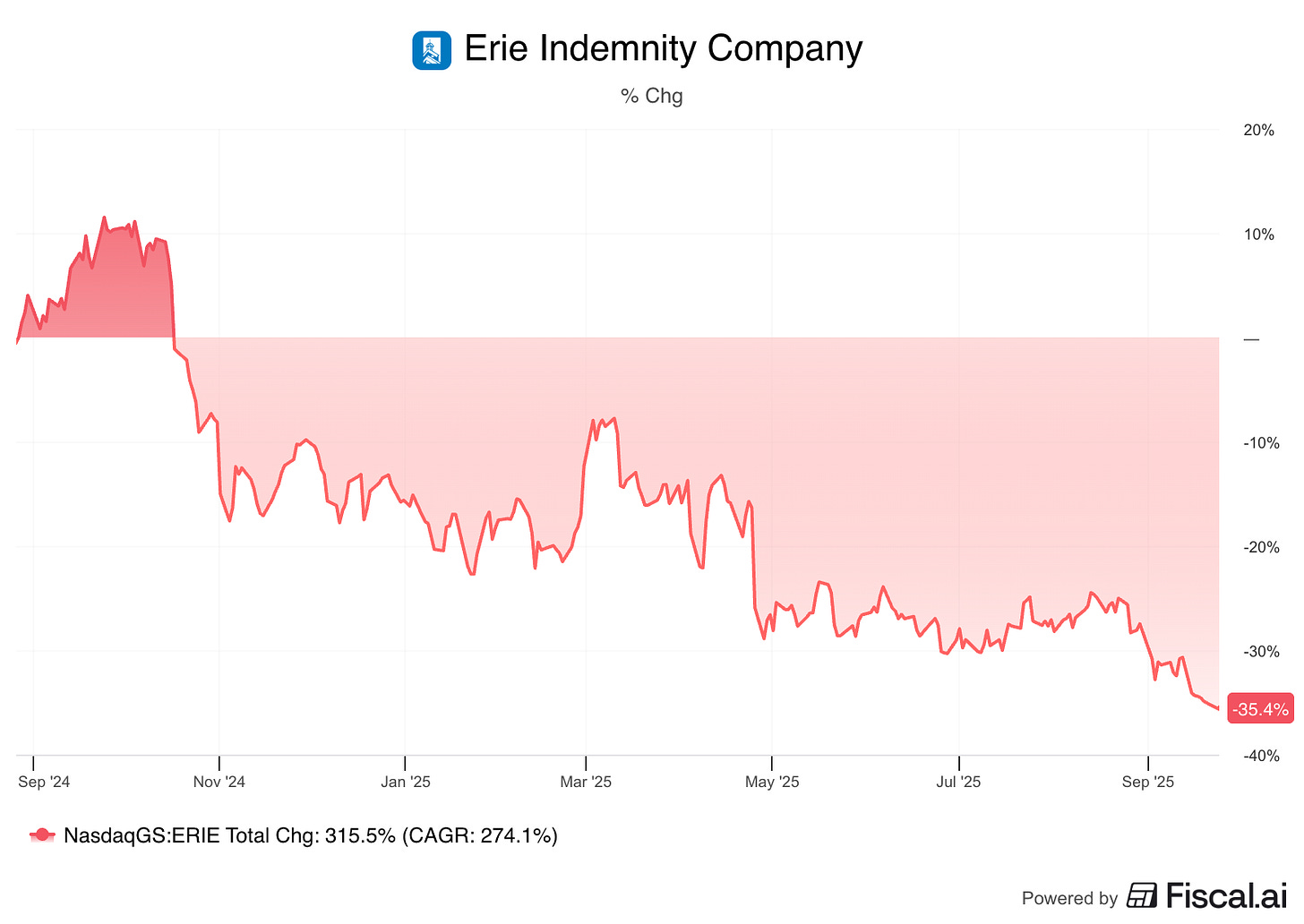

First up, Erie, which is off the radar for good reason: It’s too heavily nuanced for most. But it has been a strong underperformer since I first red-flagged it roughly a year ago...

Not even being added to the S&P 500 could help for more than a few weeks. Since my original report, and several follow-ups. A friend who watches Erie exceedingly closely recently shared his latest internal update with me. In a nutshell, here’s what his work suggests...