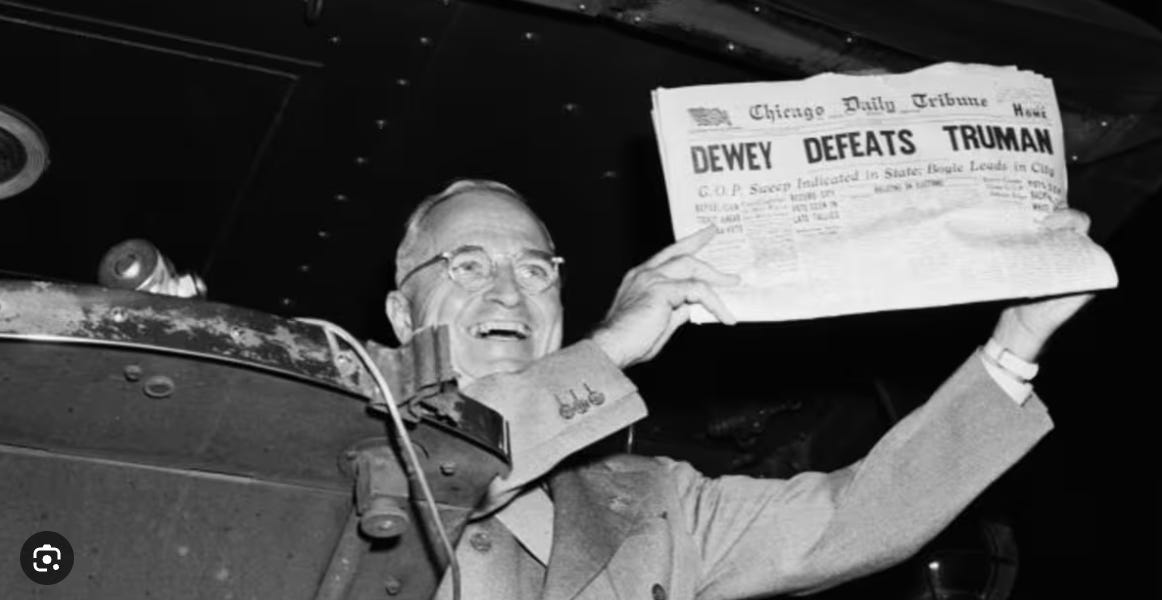

With CoreWeave, It’s All About the Headlines

Who needs proof of annual recurring revenue when you have recurring purchasing orders?

A large and growing list of serious investors — portfolio managers, analysts, private investors — already have signed on as premium subscribers to my Red Flag Alerts for one reason:

To understand what could go wrong before... not after the news hits.

👉 Join them here and start flying your own red flags. (With a few green ones, like WW, thrown in!)

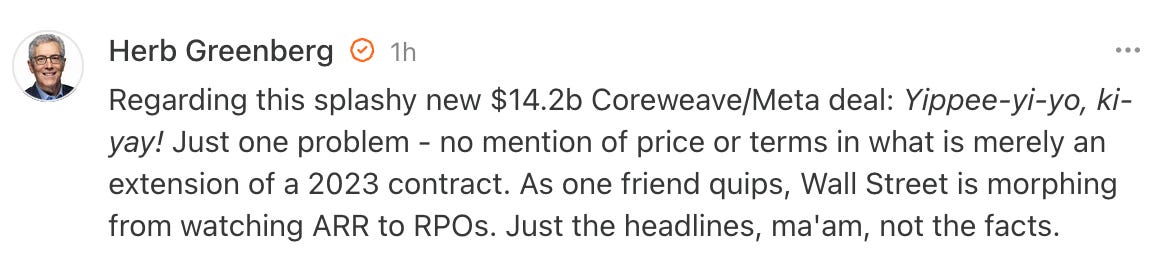

▶Another day, disclosure from CoreWeave $CRWV of another deal with another giant...

This time it’s a $14.2 billion agreement extension with Meta $META or as I put it on social media....

It’s an important deal if for no other reason: for spin purposes, because it comes after CoreWeave’s two biggest customers – OpenAI and Microsoft – struck deals with Oracle and Nebius, respectively... showing just how competitive the space is becoming. More competition generally doesn’t mean higher prices.

But it also shows that the only thing investors really care about, at least right now, is the deal, not the details. Or recurring purchasing orders, or RPOs, rather than annual recurring revenues, or ARR – which historically is the lifeblood of companies like CoreWeave. One is real, the other is... just an order. Whatever “outs” Meta has other than for cause aren’t spelled out in the original agreement, which is attached to the 8-K announcing the deal. (Or, if they are, they’re redacted.)

Not that any of this really matters, since we’re in that sweet spot of the gold rush for all things AI.

What’s more, coincidentally or not, the Meta transaction follows growing concern about the levels of debt and creative financing used to support these deals.

If you missed take from September 19: Rather than focusing on CoreWeave specifically – I’ll let others fight that battle – I zeroed in on the importance of the company’s announcement that it was launching its own venture capital arm, CoreWeave Ventures... and the role that debt/credit and even securitizations are playing...

Citing the sheer level of hubris we’re seeing, I wrote...

Today’s builders of AI infrastructure aren’t quite there, but they’re emboldened by the ease of raising cash. The ultimate red flag to me, as trite as it may seem, is the level of hubris... especially by CoreWeave. We might as well be back in 1999, except here we are in 2025, and in multiple regulatory filings, CoreWeave has said each Blackstone/Magnetar deal “represents one of the largest private debt financings in history and signals the confidence that debt investors have in funding our company to build and scale the next generation AI cloud.” And in a press release announcing last year’s Blackstone/Magnetar deal, CEO Michael Intrator said...

“The caliber of investors in this large debt financing round is a powerful testament to both the insatiable market appetite for AI infrastructure and their belief in CoreWeave’s ability to deliver cutting edge innovation for the largest AI labs and innovators at scale. And we are really just getting started - our ambitions are to help reshape the cloud landscape, accelerate the AI race, and power the next generation of AI innovation that is changing the course of history.”

What about the already ballooning size of the company’s debt? Not to worry. At recent investor conferences, CFO Nitin Agrawal used the word “sophisticated” multiple times to describe the company’s approach to financing... as if CoreWeave knows something nobody else does.

Maybe he’s referring to what the company discloses in its filings – about how the company is using “new forms of financing, including asset-backed securitizations” to help lower its cost of capital. Whatever, Agrawal recently made a point of saying, “In terms of the credit agencies, we’ve received incredibly positive feedback from them...”

Wait... what?

I’ve heard that last one somewhere before. Let me think… Oh, yes, pointing to the credit agencies, that was the last line of defense for every subprime lender and – forgotten in the fog –even a few business development companies before they blew up during the Great Financial Crisis..

Anybody following the subprime lenders and BDCs, and kept track of the securitizations, saw that one coming.

But today everybody’s smarter, right? They’ve learned from the past, right? Because instead of sleazy subprime lenders on mortgages, or the aggressive overly BDCs of yesteryear, today it’s a more seasoned group of lenders, which is why CoreWeave can boast of how “sophisticated” its approach to financing itself is.

Maybe, but this is also true: Subprime is subprime is subprime... and one thing that hasn’t changed is that the high yield charged by its lenders is because of the high risk of the debt... the very kind of debt that is behind the creation of (drumroll!) CoreWeave Ventures.

Which gets us to where we are today – and an important part of the story, which as is often the case is hiding in plain sight:

That with these kinds of deals, Meta and the others are signaling to the market that rather than put the risk of overbuilding future capacity on their own balance sheets, they’re offloading it to CoreWeave and others.

That shouldn’t be surprising since even Meta’s Mark Zuckerberg – as aggressive as he says the company needs to be building out its AI infrastructure – conceded this could be a bubble. He said as much on this recent podcast...

There are compelling arguments for why AI could be an outlier and if the models keep on growing in capability year-over-year and demand keeps growing, then maybe there is no collapse. But I do think that there’s definitely a possibility, at least empirically, based on past large infrastructure buildouts and how they led to bubbles, that something like that could happen here.

Insiders seem to agree... or at least are taking no chances. Ever since CoreWeave’s post-IPO lockup ended, before today’s leap in its stock, insiders have sold roughly 7% of their holdings. Yes, they still hold a ton... but a steady drip, drip, drip makes less noise than a secondary filing.

For everybody else, it’s party on! As with all irrational extrapolation, the claims of today are impossible to disprove until proven otherwise.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I don’t own any stock mentioned in this report.

Feel free to contact me at herb@herbgreenberg.com