Weekly Wrap – ‘Not Normal’ is the New Normal

I’m talking about the market, of course, but the ‘signs’ of stretch would appear to be everywhere, as they have been... all the way up!

▶Before we get going, quick note.You might have noticed a subtle change in this email: There’s no “Red Flag Alerts” logo on top. That’s because I’ve shifted my publishing platform back to Substack after a multi-month experiment on an email marketing platform. The entire ordeal back-and-forth has been pretty seamless for most subscribers, though for some there have been a few hiccups – especially trying to sign into herbgreenberg.com. Apologies for any inconvenience. Things are now back to the way they used to be. Thanks for your patience. – The Management.

▶If there has been any theme lately, with some of these stocks doubling or even more in what seems like – and sometimes is – a matter of days, it has been that this is not normal. This week, just before the market took a hit, I said to myself: “Not normal is now the new normal.” Which is why you should consider subscribing to my Red Flag Alerts. Understanding and respecting the risk before reality hits is half the battle. With that as a backdrop....

▶Tariff trauma. The conviction in this market is as strong as the brick wall on the side of my house, which is leaning so badly to one side that I’m surprised it hasn’t caught the eye of the prediction markets.

The market’s vulnerability and overall lack of conviction is evident from the way stock prices were jolted – first, by the temporary hit caused by The Information poking holes in Oracle’s ORCL 0.00%↑ announcement of a $381 million-in-future-revenue deal, which at first caused its stock to leap an astonishing 35% in a single bound. And second, by the way it was jolted Friday after the President threatened 100% tariffs on Chinese goods.

Here’s the rub: While stocks tumbled on the news (for the day, at least) it ironically may not be good news for short-sellers who are short real companies whose real fundamentals are under real pressure from real underlying issues unrelated to tariffs. The reason, as one short-seller mentioned to me: Everybody who misses gets a massive hall pass. It’s better, for sure, than the old “blame the weather” excuse.

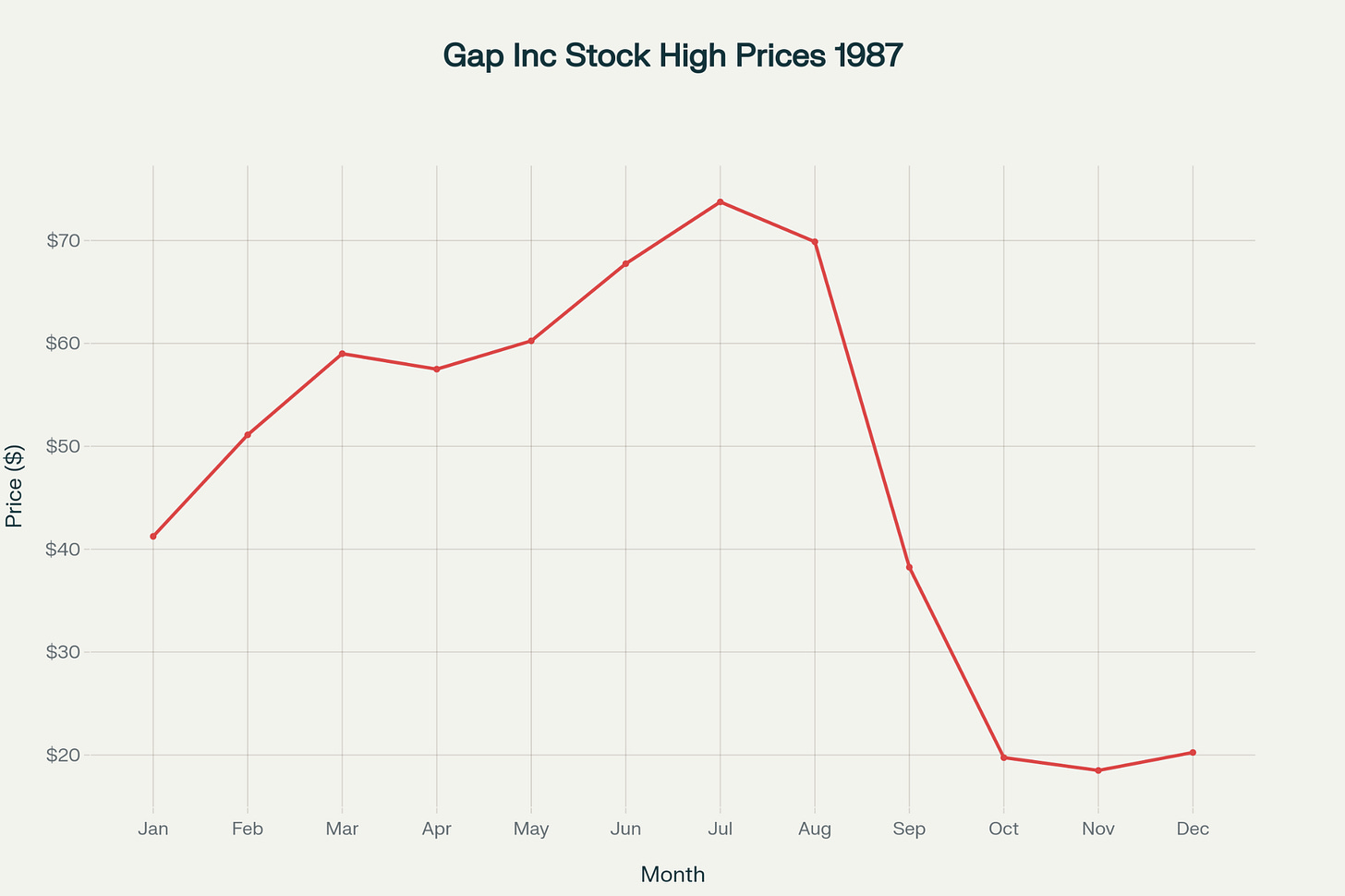

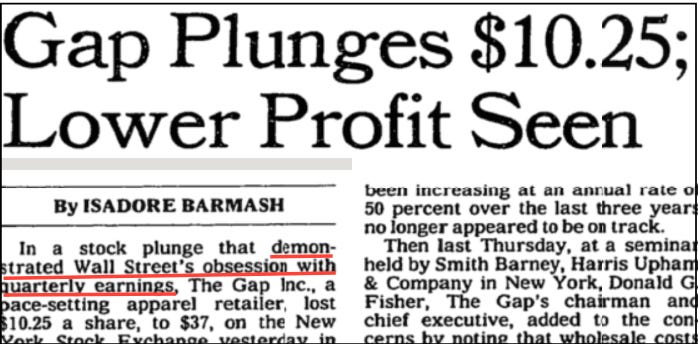

▶Blast from the past. All of this reminds me of the little tremors leading up to the 1987 October stock market crash, which celebrates its 38th anniversary this Friday. Back then, before tech became the market, it was retail. And in retail, the most dazzling of all stock market stars was Gap $GPS. Until, that is... inventory started piling up and sales growth started sputtering. Between August and September the stock lost half its value.

That final whoosh down in its shares in a single day by another $10 or 20% – or “plunge,” as the New York Times put it – was poor guidance. (Back then, kids, that was a plunge, and as the Times wrote, it was proof of Wall Street’s “obsession with quarterly earnings.” Yes, short-termism was also a thing back then in this world where what old is new, again. But I digress...)

Will history rhyme or simply repeat itself? All of the signs that we’re at least in rhyming territory seem to be there – as it has been... all the way up. Like the announced restart last week of the MEME ETF MEME 0.00%↑, which crashed and burned during the original meme-driven bubble so badly that it ceased to exist. (During its latest new and improved debut week, it fell 5%.) Or the latest Barron’s, where Oracle’s Larry Ellison is on the cover, but which also has a story headlined: “Utility Stocks Aren’t Just for Safety Anymore. This One Has Strong Growth Prospects.” Maybe it does... but is it sustainable? And if so, for how long?

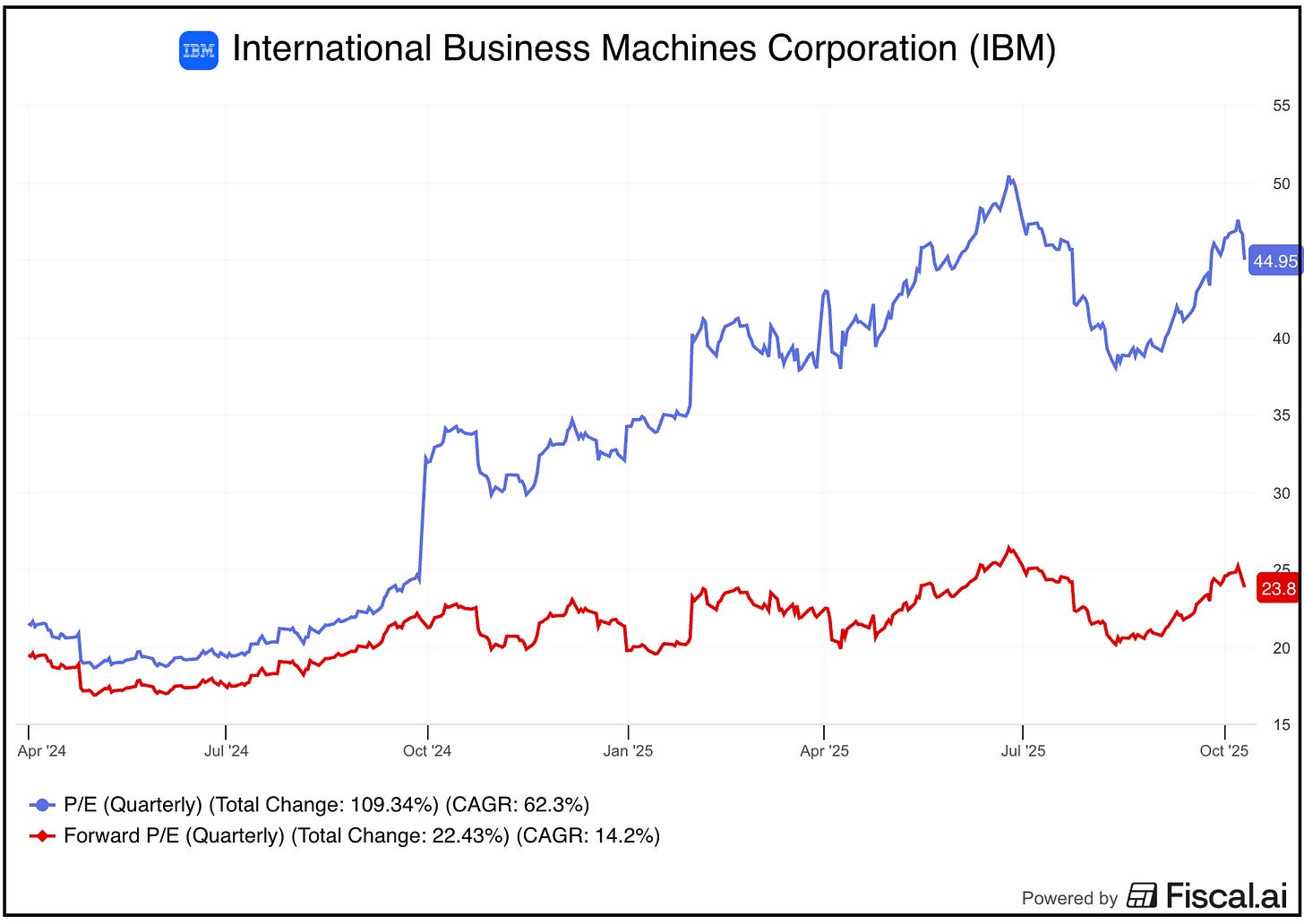

In the meantime, it’s AI all day everyday. So much right now is based on the expectation of future data center buildout, like IBM IBM 0.00%↑. Its valuation has spiraled higher on the hope/hype of so much, including billions from its generative AI “book of business” that may or may not be sustainable over a time frame consistent with investor expectations.

We’re at that point when stocks are rising more on press releases of deals rather than results... such as Applied Digital’s APLD 0.00%↑ latest deal to lease data center space to CoreWeave CRWV 0.00%↑ , which was announced as part of the company’s earnings release. While results were good, the mention of the deal, which was announced with earnings, was noteworthy since it adds $4 billion in revenue onto an existing contract with CoreWeave over – wait for it! – 15 years. The first part of the deal, which Applied “anticipates” will generate $7 billion in revenue, was originally announced in May. Truth is, even a sliver of that actually coming to fruition would be a big deal for a company that last year did a mere $145 million. Of course, in keeping with the round-tripping nature of the way these AI infrastructure deals are being done, CoreWeave got a slug of APLD warrants. Those warrants, in turn, which are now deep in the money, were immediately exercisable. As of the end of last quarter, according to the 10-Q, a tiny amount was already cashed in. Such a deal!

Speaking of CoreWeave, since the IPO lock-up expired two months ago, insiders – including top executives and big holder Magnetar Financial – have sold just under 10% of their shares... dripping them out rather than filing a secondary. You would sell too if it happened to you!

Speaking of the AI bubble: This week I recorded my thoughts on this AI bubble during an inquisition by Matt Stoller and David Dayen on their Organized Money podcast. Matt writes the BIG newsletter – focused on monopolies. David is executive editor of American Prospect. Their questions, and the context they put them in, are considerably more informative than my answers... All in all you will likely enjoy it. I’ll post a copy here when it drops in a few days.

▶Meanwhile, in the works. Needless to say, with the switchover back to Substack, the past week has been nuts – and that’s excluding the market. During it all, I’ve been working on a new Red Flag Alert. This is a case where I don’t want to give the name... it’s simply and potentially too good. This is a company with a $10 billion-plus market cap, good volume, is well known and is moderately shorted. It’s as tangled an internationally spiked-related parties web as there is. And it’s almost a direct overlay to one I wrote about more than 10 years ago. The angle I’m working on is not out there. The bigger question is: Will I get to the finish line? I think so. Stay tuned!

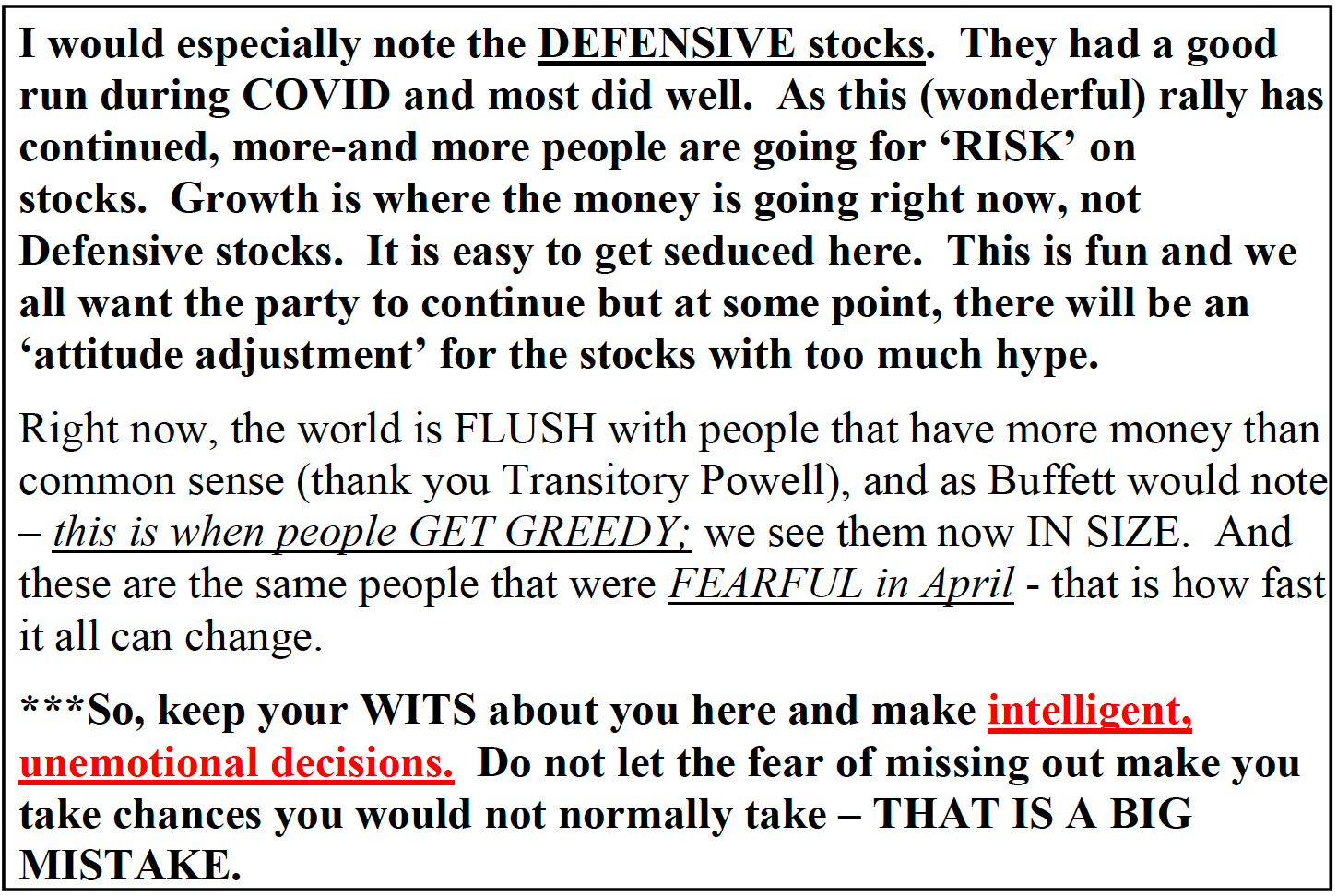

▶And before we go, this reality check on the increasingly FOMO nature of this market with the latest dose of common sense from my friend Bob Howard, who writes the always entertaining, informative and common sense-filled Positive Patterns newsletter from somewhere “in the Ozarks”...

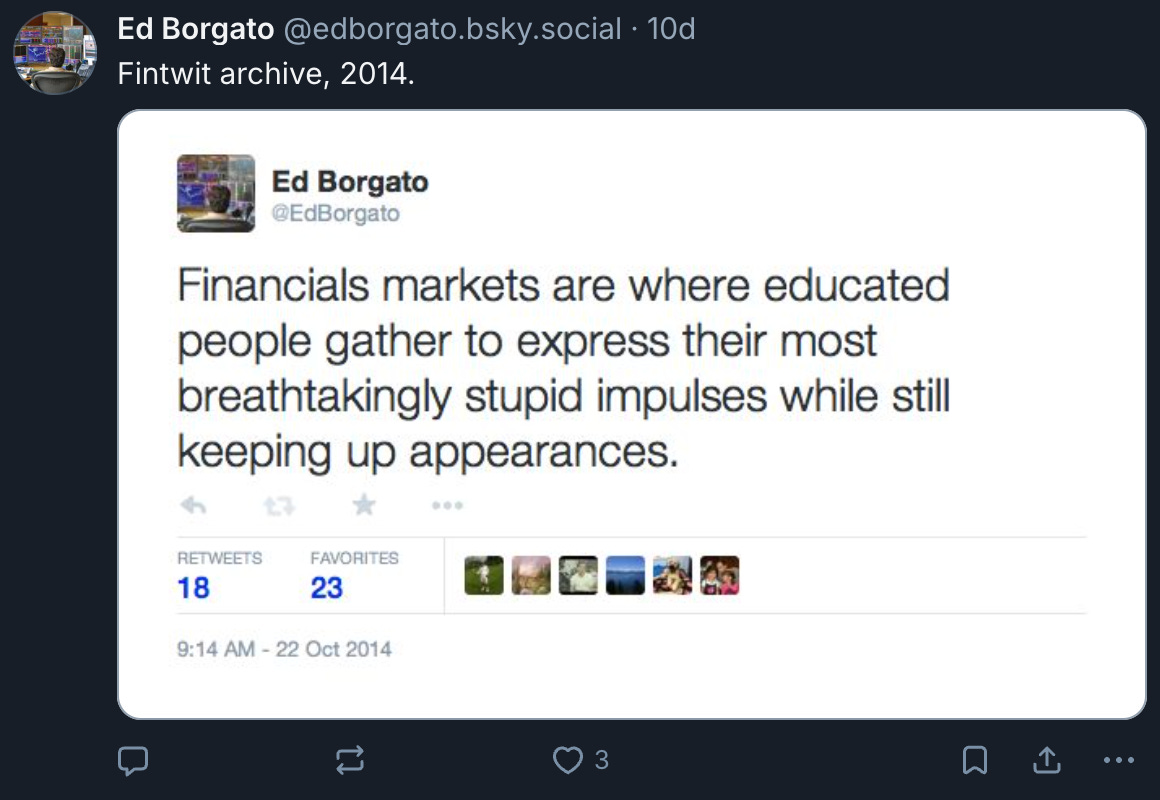

▶Finally, speaking of common sense... While Bob is best at giving it in 240 characters or more, another friend, Ed Borgato – who runs his own fund in LA – does best in 240 characters or less. If Ed sounds familiar, I featured him and his social media posts well over a year ago in an essay headlined, “You’re Not as Dumb as You Feel.” This one that shows how the more things change...

I had so much more to write, but ran out of time. And if you got this far, so have you! Have a great rest of the weekend, everybody.

▶As always, if you liked this, feel free to hit the heart below or if you’re so inclined, post your comments. And feel free to share this with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I don’t own any stock mentioned in this report.

I can be reached at herb@herbgreenberg.com.

What I see is revaluation happening one stock at a time. Earnings (or cashflow?) reality will eventually be the blood in the water that allows the market sharks to attack every weak swimmer. That said, I don't try to bet on when Ms. Gap or any other swimmer is going to lose a limb.