Weekly Wrap – Speculation on Steroids – Are We There Yet?

Also, I just finished recording an interview I think you will want to hear/see. And catch me on a short-selling panel in San Diego this week.

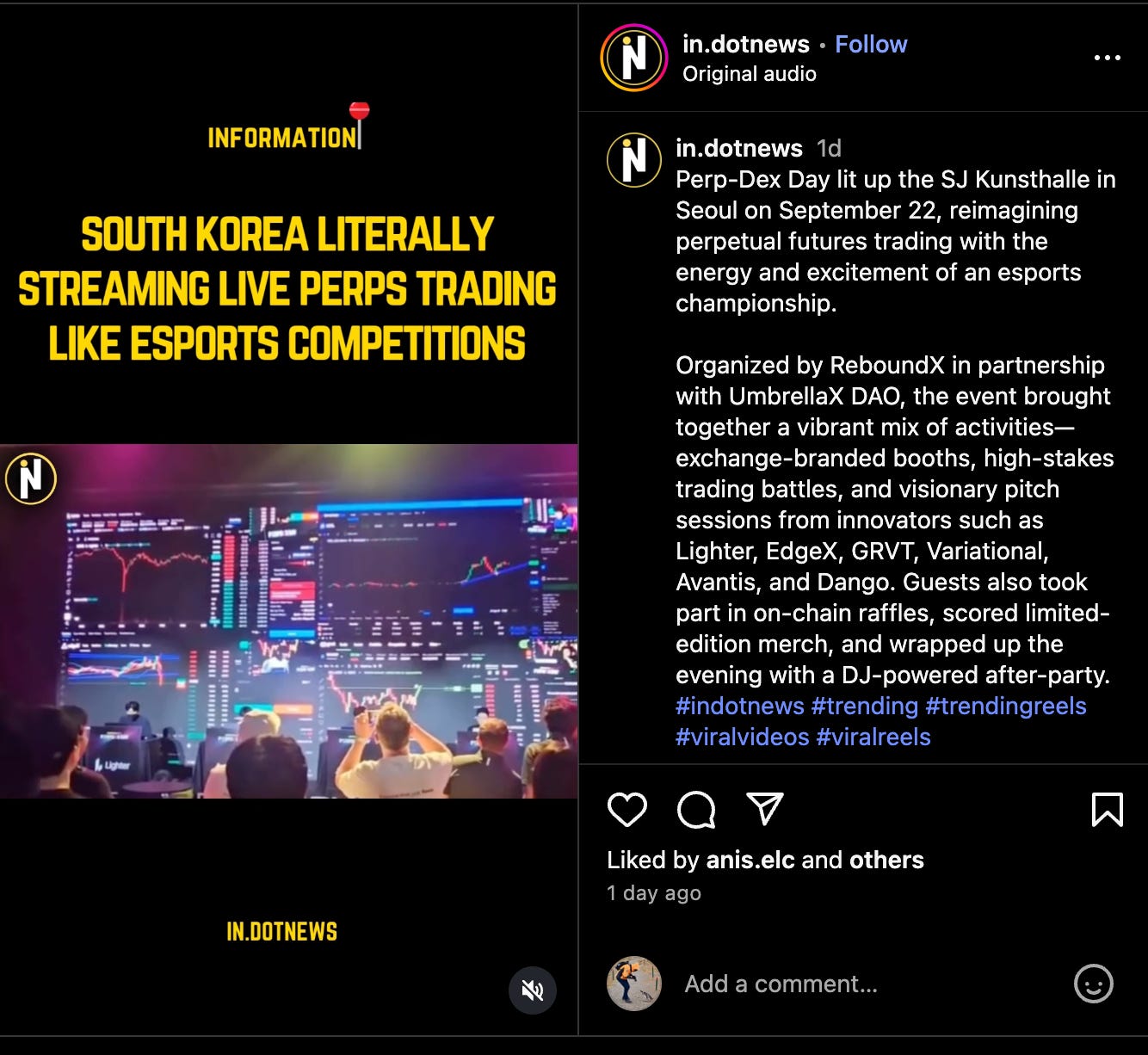

▶Just when you think things couldn’t get any more nuts... On the day before this market started to slip – after hitting yet another high – a tweet with this video started making the rounds. If nothing else, it showed just how far the sports gamification of securities trading has become. Here’s a screen shot...

Did that mark the tippy top? Is this the beginning of the end of this edition of the ease of the squeeze?

To repeat what I always say: I have no idea. But as I wrote last week in “The Trillion Dollar Question,” the velocity of what we’re seeing in some of these names is simply not normal. Neither are scenes like the ones above, which happens to be at something called Perp-DEX DAY in South Korea, which its promoters tout is “reimagining perpetual futures trading with the energy and excitement of an esports championship.” YEEEEhaw!! At least that’s the way it was explained in various Instagram posts, like this one....

So far, this mostly involves crypto. But as the Wall Street Journal explained a few days later in an article on the topic...

Known as perps, the contracts give traders access to extreme leverage and have exploded in popularity during a rally that has sent bitcoin prices up more than 70% over the past year. Though popular in other parts of the world, perps were largely unavailable until recently to U.S. traders on regulated venues.

Their emergence is a sign that financial markets, which have steadily grown riskier since 2020, will likely keep growing more speculative.

That this is in South Korea should be no surprise. “Korean Capers,” as I’ve called it, has been evolving as a tail-wagging-dog element of this market for quite some time. This is the latest list of the most active U.S. stocks traded in South Korea...

Among the top 25, note the number of super-duper leveraged ETFs, plus the others – all of them on one speculative list or another. No wonder some of these names are trading more on hype – and maybe not even hope – than fundamentals. As I’ve pointed out previously, but is worth a mention again, perhaps nobody has put this in perspective better than Owen Lamont, a portfolio manager of Acadian Asset Management, who in January 2024 wrote...

Unfortunately, in recent years the U.S. has been following Korea on the road to crazytown. What Americans call ‘meme stocks,’ Koreans call ‘theme stocks.’ These absurd objects have been a wacky feature of the Korean stock market since at least 2007.

In March of this year he went on to say...

Every market has an iconic group of retail investors who, like George Costanza, exemplify bad decisions leading to wealth destruction. In 1929, it was ‘the little fellow’ buying high leverage investment trusts traded on the NYSE. In 1989, it was Japanese salarymen speculating on land and stocks. In 1999, it was mutual fund investors buying growth funds. In 2021, it was Robinhood investors buying meme stocks. Today, perhaps that group is Korean retail investors.

Not perhaps, I’d argue – it is!

▶ Speaking of speculation, there’s no question we’re in a bubble... Good luck figuring out if and when it pops. Until then, here’s something to keep in mind from John Hussmann of Hussmann Econometrics, who a month ago wrote...

The bubble hasn’t burst yet because investors haven’t quite yet recognized that the highest valuations in history imply the lowest expected future returns in history. A market crash is nothing but risk-aversion meeting a market that’s not priced to tolerate risk. Every fresh record high in valuations amplifies the likely downside when that occurs, but examining the collapse of past bubbles, the “catalyst” typically becomes evident only after the market is in free fall.

This month he added...

Division by zero is known as a ‘singularity.’ It’s the point where equations break down, values become ‘indeterminate,’ things stop working normally, and variables shoot toward infinity and suddenly collapse on the other side.

The current speculative bubble was driven by a singularity. Avoiding the crash on the other side relies on the willingness of investors to accept the lowest long-term return prospects in U.S. history, forever.

Extremely high prices may seem like a beautiful thing, but they’re a corrupt bargain. Unless you actually sell, the cost of “enjoying” record high valuations is that you are locking-in record low future rates of return.

Interpret at will...

▶ Moving on, this head’s up... In July, I published a Green Flag report on Turning Point Brands $TPB, featuring long/short Dallas hedge fund manager George Baxter’s rationale for calling it the single-best long he has ever owned. In that report, I said that at some point I should do a podcast or video with George... whose background isn’t quite (or even close to) your typical hedge fund manager. I don’t have my own podcast – as if the world needs yet another? But I finally got around to doing a video with George, who tends to keep a low profile and is as much a short-seller as he is a long investor. In the interview, among other topics, he lays out his Turning Point thesis... and not just why he personally bought shares at roughly 80% above what his firm paid, but why he recently bought even more at even higher prices. This video should drop within a few days via email. If you’re a premium Red Flag Alerts subscriber, you’ll also receive his fully detailed 60-plus page 65-page deck, as well as a Cliff’s Notes version. Disclosure: I bought shares in Turning Point several weeks after my original report ran.

▶ Finally, If you’re in San Diego this week, join me along with my fellow San Diegan, short-seller Matt Kliber of Gracian Capital, to talk about (what else?): why we still tilt at exposing risk in a world where nobody seems to care. Matt’s the real deal – he shorts stocks and tends to veer from the limelight. Unlike Matt, I’m not a short-seller and merely fly red flags.

With the market hovering at new highs, the obvious question is: Why would anybody short stocks anymore? Is Matt, who likes nothing more than to dig through the numbers and minutia, the last man standing? He’s certainly the only short-seller living in San Diego. Given the market, I’d be surprised if more than a handful of people show up. You can find out more here.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I currently own Turning Point, but am under no obligation to disclose updates on personal positions disclosed here.

Feel free to contact me at herb@herbgreenberg.com