Whac-A-Mole Part Deux: Is This Why Meta Doesn't Stop the Fake Ads?

Doing so, a Reuters report suggests, would eliminate what turns out to be a large source of profits.

▶No sooner did I publish my “Possible Fraud Alert” earlier today than I heard from a friend who harangued me, saying…

You left out the most important point, which gives you the answer as to why META allows for this.

Other than the fact that I had wondered in the report why Meta $META allows these fake adds to flourish, I had no idea what he was talking about.

So he forwarded along a “special report” from Reuters from earlier this month, with the headline…

Meta internally projected late last year that it would earn about 10% of its overall annual revenue – or $16 billion – from running advertising for scams and banned goods, internal company documents show.

A cache of previously unreported documents reviewed by Reuters also shows that the social-media giant for at least three years failed to identify and stop an avalanche of ads that exposed Facebook, Instagram and WhatsApp’s billions of users to fraudulent e-commerce and investment schemes, illegal online casinos, and the sale of banned medical products.

On average, one December 2024 document notes, the company shows its platforms’ users an estimated 15 billion “higher risk” scam advertisements – those that show clear signs of being fraudulent – every day. Meta earns about $7 billion in annualized revenue from this category of scam ads each year, another late 2024 document states.

The story went on to say…

Much of the fraud came from marketers acting suspiciously enough to be flagged by Meta’s internal warning systems. But the company only bans advertisers if its automated systems predict the marketers are at least 95% certain to be committing fraud, the documents show. If the company is less certain – but still believes the advertiser is a likely scammer – Meta charges higher ad rates as a penalty, according to the documents. The idea is to dissuade suspect advertisers from placing ads.

The documents further note that users who click on scam ads are likely to see more of them because of Meta’s ad-personalization system, which tries to deliver ads based on a user’s interests.

What does Meta have to say about all of this? Again, quoting from the Reuter’s report…

In a statement, Meta spokesman Andy Stone said the documents seen by Reuters “present a selective view that distorts Meta’s approach to fraud and scams.” The company’s internal estimate that it would earn 10.1% of its 2024 revenue from scams and other prohibited ads was “rough and overly-inclusive,” Stone said. The company had later determined that the true number was lower, because the estimate included “many” legitimate ads as well, he said. He declined to provide an updated figure.

“The assessment was done to validate our planned integrity investments – including in combatting frauds and scams – which we did,” Stone said. He added: “We aggressively fight fraud and scams because people on our platforms don’t want this content, legitimate advertisers don’t want it and we don’t want it either.”

“Over the past 18 months, we have reduced user reports of scam ads globally by 58 percent and, so far in 2025, we’ve removed more than 134 million pieces of scam ad content,” Stone said.

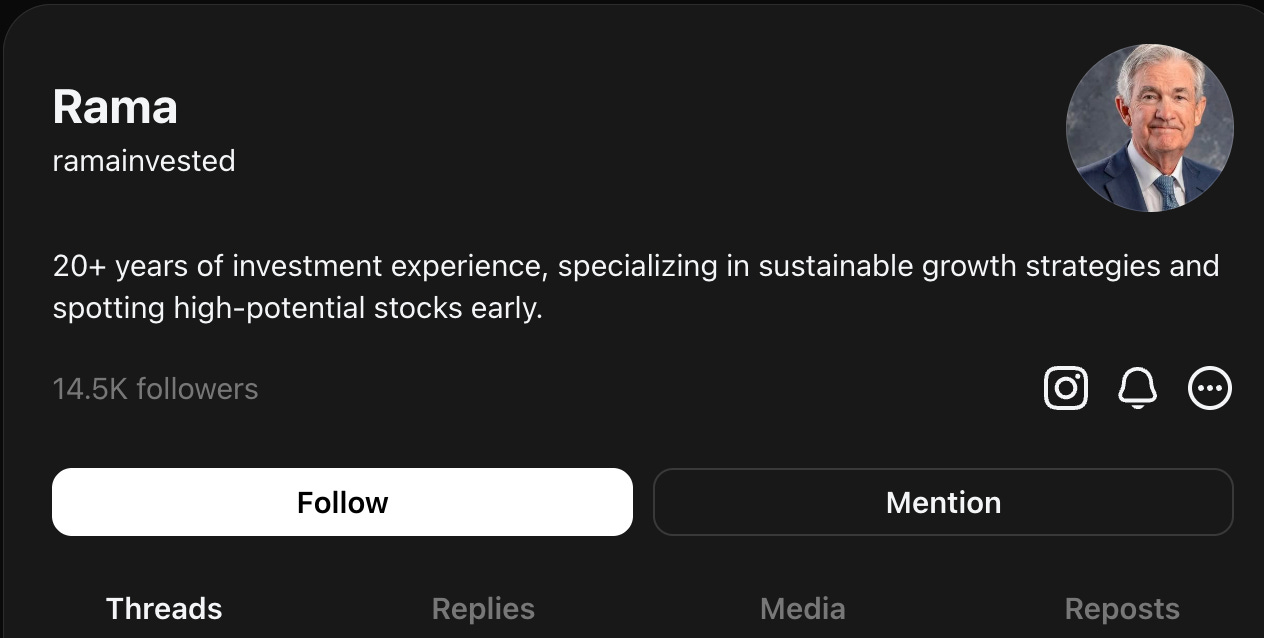

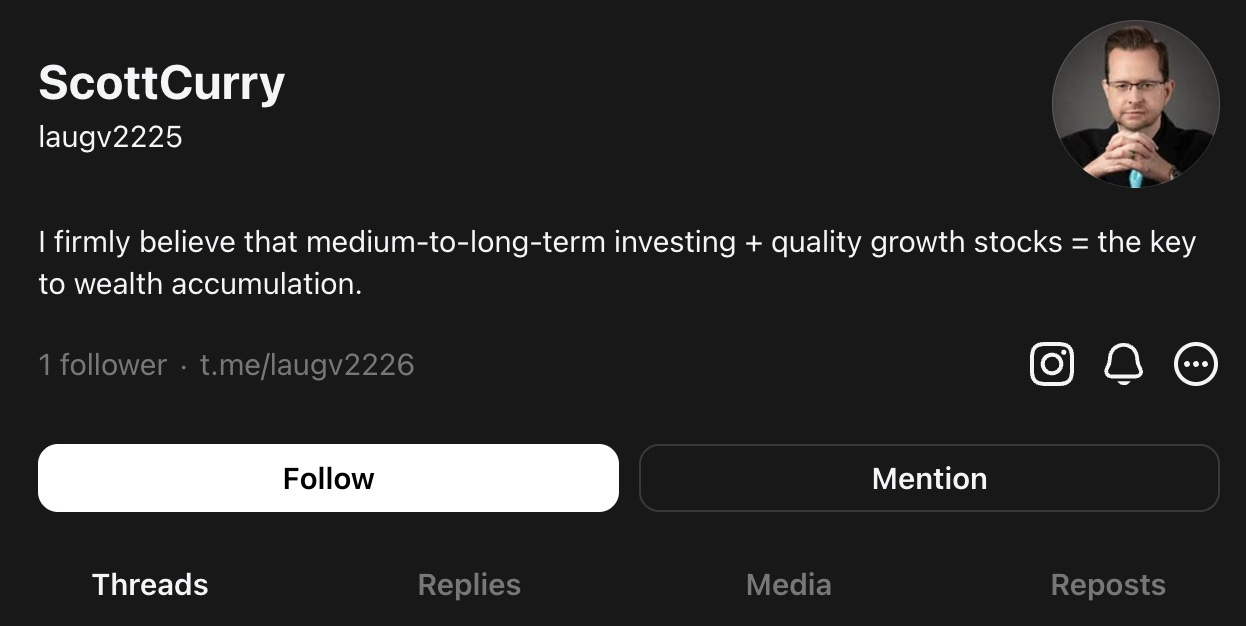

Maybe they’ve removed more than 134 million pieces, but not this guy’s…

Or this guy’s…

The report went on to say…

Fraudulent ad campaigns can reach massive size: Four removed by Meta earlier this year were responsible for $67 million in monthly advertising revenue, a document reviewed by Reuters shows.

As my friend who sent along the Reuters story – and who use to run a large tech-focused hedge fund – explains…

Ten percent of their revenue and it equates to about 20-25% of their operating profits. I already did the math.

It would kill their cash flow, and kill their stock price if they stopped it. The leaked internal documents point to this issue as well where managers discuss the hit they will take if they stop this stuff.

No scam ads = down stock price and no cash flow to waste money on AI!

Interpret at will. As for me, I’m done going any further down this mole hole.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I don’t own any stock mentioned in this report.

I can be reached at herb@herbgreenberg.com.

I haven't posted anything on Threads and only look at it once a month. I continue to get new follower notifications from halfway around the world at a fairly frequent pace.

Generating lots of ad dollars is the only thing that makes sense as you have pointed out.

A year or two ago, Facebook was full of ads for discount US postage stamps. The USPS says stamps never go on sale. I reported the ads and was notified that they did not violate the company's terms of service.