What is Tesla?

I figured I’d start out the New Year hoping to make a few new friends (sarcasm)...

You might think you know what Tesla is, but what is it... really?

The below post from X, the former Twitter, is the reason I ask...

That post quoted Roth Capital analyst Craig Irwin as saying that by using Toyota “as a benchmark,” Tesla is “egregiously overvalued.”

Musk responded, saying that “he has the wrong frame of reference” because Tesla is really “an AI/robotics company.”

AI/robotics… really?

To find out, let’s roll the tape – or in the very least head to the “Business” section of Tesla’s 10-K. That’s my first stop whenever I try to figure out what a company really does, because that’s its official description, even if it often still requires an untangling.

Here’s what Tesla says about itself...

It couldn’t be any clearer: Tesla makes cars – electric cars, but they’re still cars.

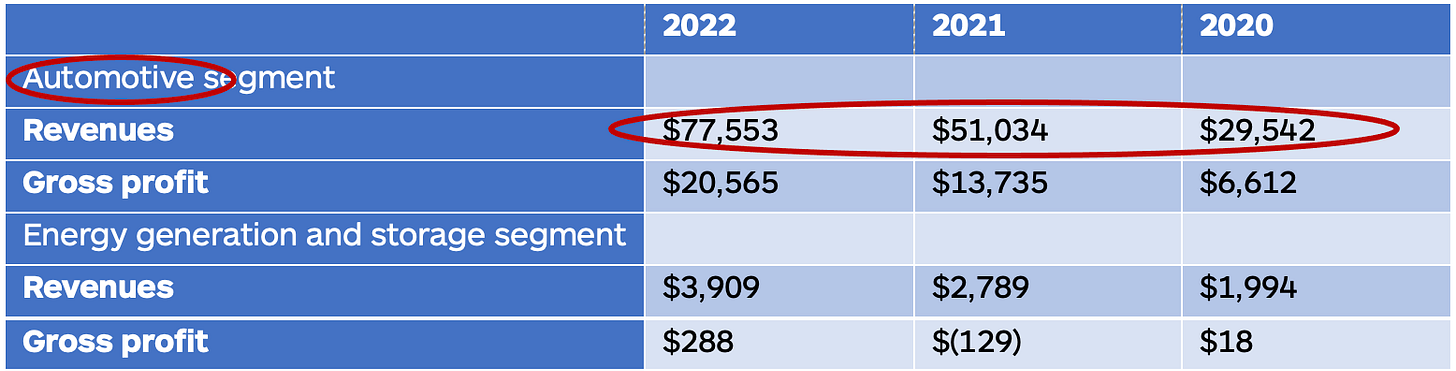

In fact, as the chart from Tesla’s 10-K shows, roughly 95% of its revenue comes from “automotive,” which is another word for car. (There’s some other stuff thrown in, but it’s mostly cars.)

In fact, the word “automotive” is mentioned 138 times in the filing; “automobile,” 49 times. That include 37 mentions where “automobile” is part of the name of a Chinese subsidiary, usually as “Tesla Automobile Sales and Service” for specific provinces.

That’s not all...

If It Smells Like, Looks Like...

The auto industry is so important to Tesla that it warns warns “sales of vehicles in the automobile industry tend to be cyclical in many markets, which may expose us to volatility from time to time.”

It goes on to caution that “the worldwide automotive market is highly competitive today and we expect it will become even more so in the future.”

There are no such warnings about AI or robotics. In fact, artificial intelligence or AI are mentioned just six times; robotics, a mere three. And as Motorheadon Substack pointed out the other day...

It should be noted that Tesla has never published any data on its AI or robotics-related earnings. Its Full Self-Driving technology might be considered an “AI” type of technology, but if that’s the case, then carmakers like Mercedes Benz should possibly replace Tesla in the Magnificent 7: Tesla’s Full Self-Driving product is a cruise control system rated by itself as Level 2 technology whereas Benz has received approval to test its Level 3 system in multiple cities.

So, where does Musk get the AI/robotics description from? It’s either from Crisis PR 101 – control the message by telling the people what you want them to think – or, more likely, simply his vision of what it is.

True AI Companies

There’s no question that Tesla is an innovative power user of AI and robotics. But using and even developing something to help generate revenue is not the same as deriving most revenue from selling that technology. The product that is being sold is the business a company is in… and with Tesla that’s cars and, ultimately, trucks.

Using Musk’s logic, Alphabet should be calling itself an AI company, even though 80% of its revenue comes from advertising revenue, mostly from search. (Which, of course, largely uses internally developed AI and machine learning.)

Ditto for Microsoft, though most of its revenue comes from cloud, software and subscriptions.

The irony is that Alphabet and Microsoft may very well be the closest among public companies to pure AI plays… and it’s why both well outperformed the S&P 500 and Nasdaq 100 in 2023. (And, surprisingly, Google outperformed Microsoft.)

They’re not alone...

AI has become a theme at Amazon, Meta and so many more, which have developed and use AI but... are they really AI companies? (After all, it wasn’t that long ago that Amazon was considered a cloud company, but that was when “the cloud” was hot.)

Privately held OpenAI, the creator of ChatGPT, is an AI company. So is its private competitor, Anthropic... and a bunch of their competitors, including Musk’s fledgling x.AI.

What Musk is claiming for Tesla would likely fall in the category of what SEC chief Gary Gensler calls “AI Washing.” That’s his spin on what became known as “greenwashing” during the ESG craze, when companies that had nothing to do with ESG tried to cash in on it by suddenly claiming to be ESG compliant.

The good news for Musk is that even though he may think Tesla is an AI/robotics company, Tesla itself isn’t saying it is.

Projecting the Future?

Maybe something else is going on...

I’ve said it before and I’ll say it again: I still think Musk is waiting for the “X” stock symbol to free up if U.S. Steel is sold, especially now that it has a deal to sell itself to Nippon Steel. Who knows? Maybe Musk was projecting… Maybe Tesla will buy X, the former Twitter – helping it get out of a financial jam just as Tesla did with Solar City. And, maybe Tesla buys his x.AI and whatever else he wants to toss in there and voilà – he’ll have his AI and robotics company.

I’m making that up, of course, but it’s as plausible an explanation as any.

All of which gets us back to the issue that started all of this… Whether the Roth analyst was right in using Toyota as a benchmark for Tesla.

Of course, he was!

While Tesla may have been the first to mass produce electric cars, Toyota was a few decades ahead in the electrification department. In 1997 its Prius was the first mass-produced electric hybrid. At the time, a 26-year-old Musk was midway through his first startup, Zip2, which licensed online city guides to newspapers.

Sizzle vs Substance

While Toyota makes a range of types of vehicles, before Tesla it was the leader in auto battery/electrification technology. And while Tesla no doubt disrupted the auto industry with its approach to manufacturing and self-driving cars, it also woke up the likes of Toyota, which has been pouring hundreds of millions of dollars into R&D and startup investments related to AI and robotics.

Toyota may not have the sizzle of Tesla, but it has every bit the substance... making it not just a benchmark, but perhaps the single best benchmark.

Today, thanks to Tesla, all of the major car companies are developing AI and robotics. They’re not AI and robotics companies. Neither is Tesla.

I rest my case.

If you enjoyed what you read here, please don’t hesitate to hit the heart below, and sharethis with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Threads @herbgreenberg.

Totally agree with your comments on Tesla.

Another great blog Mr. Greenberg, Fear & Greed is a condition, NOT a signal to buy or sell.