What the AI Bubble REALLY Rhymes With. (It's Something Nobody Talks About.)

Also, could Expedia be an AI loser? And did you hear the one about the company that called its pre-Thanksgiving restatement a 'revision,' then fired its longtime auditor?

Special thanks to Tenzing Memo, FinTool and Fiscal.ai, whose tools play an integral role in my research, including this report.

This report includes content exclusively for premium subscribers. If you’re not yet a premium subscriber to Red Flag Alerts, becoming one is easy. Simply click here…

1. If You Missed It…

Before we get going, if you missed my latest Red Flag Alert on an online gaming company you likely have never heard of, which I published on Thanksgiving, you can read it here…

As I wrote in a note to premium subscribers…

Yes, I have better things to do on Thanksgiving. And while a broader report is in the works, the downside (or upside, depending on your perspective) of my news background is to share what I know when I know it if I deem it’s worth knowing. For those with an interest in the name and/or space, it will likely be. It’s all part of a broader mosaic... and quite a fascinating one, at that! Stay tuned...

2. What the AI Bubble REALLY Rhymes With…

Sick of AI, yet? Yeah, so am I, but just when I think, “no mas,” I get roped back in…

This time it was a report from a few days ago from Carlyle, the private equity giant. To be honest, of all things I would expect to read from Carlyle, something headlined, “How Much Does AI Rhyme with shale?” wasn’t on the list. While the popular refrain is that AI is the dot-com bubble on steroids, or a combo of the dot-com bubble and the Great Financial Crisis, could it be that it’s really Shale 2.0. Or as Carlyle put it (emphasis by your truly)…

The shale boom was arguably the most notorious “growth at all costs” capex cycle in the modern era, where energy industry-wide capex reached 110-120% of cash flow at its peak . On the eve of the 2014 oil price crash, some energy companies were spending north of 200% of cash flow.

These parallels run deep. In 2014, disdain for the technology sector echoed calls that it was “cheap for a reason,” a likely reflection of scarring from the dotcom bust. This mirrors today’s disdain for energy, where the 2014-15 crash still haunts the industry. Oddly, there are more fears today around an ‘oil supply glut’ after a decade of reigning in spending than there are fears of a ‘compute supply glut.’

Despite the bullish energy narrative in late 2013 and the bearish concerns around technology, what happened after 2014 through the end of the decade was nothing short of epic. Technology went on to create $9 trillion of wealth while energy destroyed 41 cents on every dollar invested, wiping out $2.6 trillion in equity. While much of the equity was lost, bond holders were made whole in the end. Management teams did extremely well, but the biggest winners of the shale revolution were US citizens and their government.

The report does a brilliant job of laying out the parallels, down to the way AI is justifying how it’s financially engineering AI-related costs, via off-balance sheet financing. “Big Tech AI,” the report says, “appears to be using the exact same playbook that the energy industry used as these arrangements clearly rhyme with today’s AI datacenter SPV arrangements. Finally, we cannot forget about the land grab, or the ‘race for positioning’ as the oil patch called it, which mirrors the AI ‘land rush’. These exorbitant costs were held until expiration at which point they could be renegotiated.”

The report’s bottom line…

Some argue that it makes sense for Big Tech AI to spend more than 100% of cash flow if a single generative AI model can achieve monopolistic profits; however, thus far AI looks more like a basic commodity industry. It’s perfectly fine for AI to be a commodity, of course: just don’t be surprised when industry multiples get priced like one.

Don’t say you weren’t warned… from Carlyle, no less!

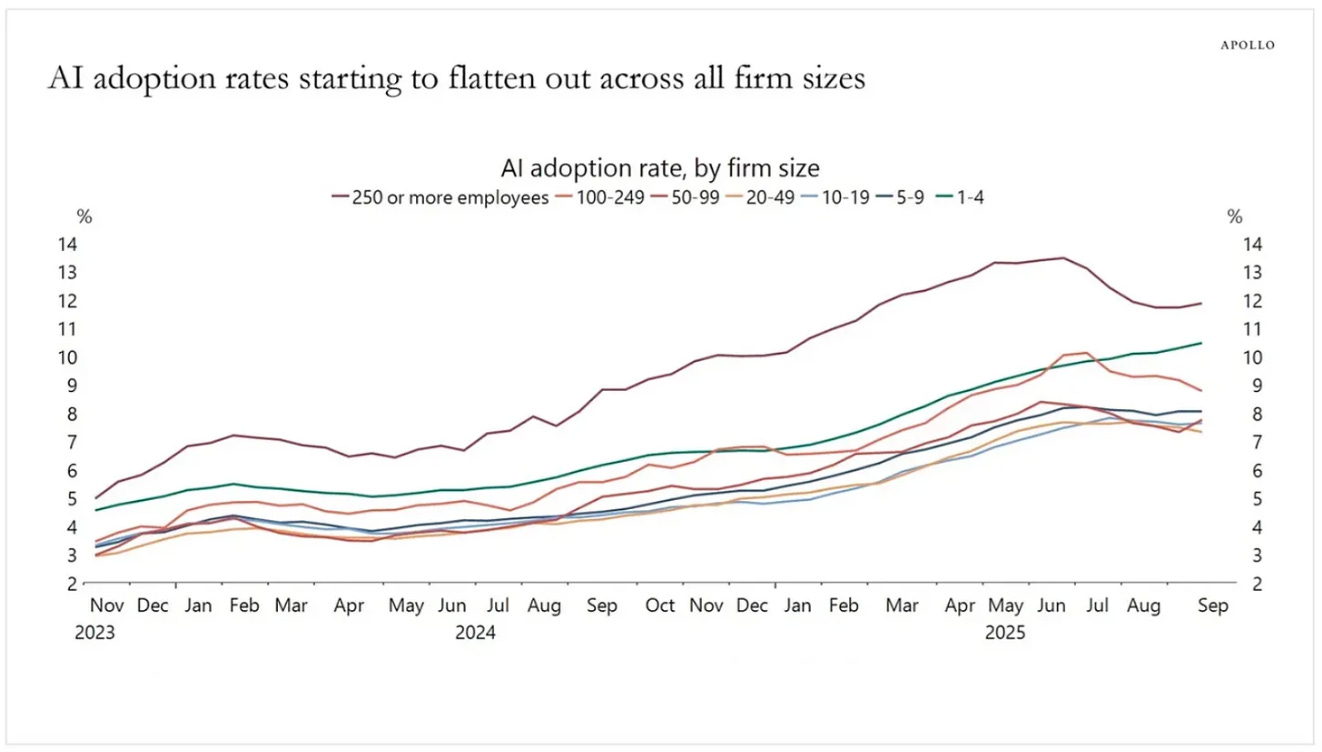

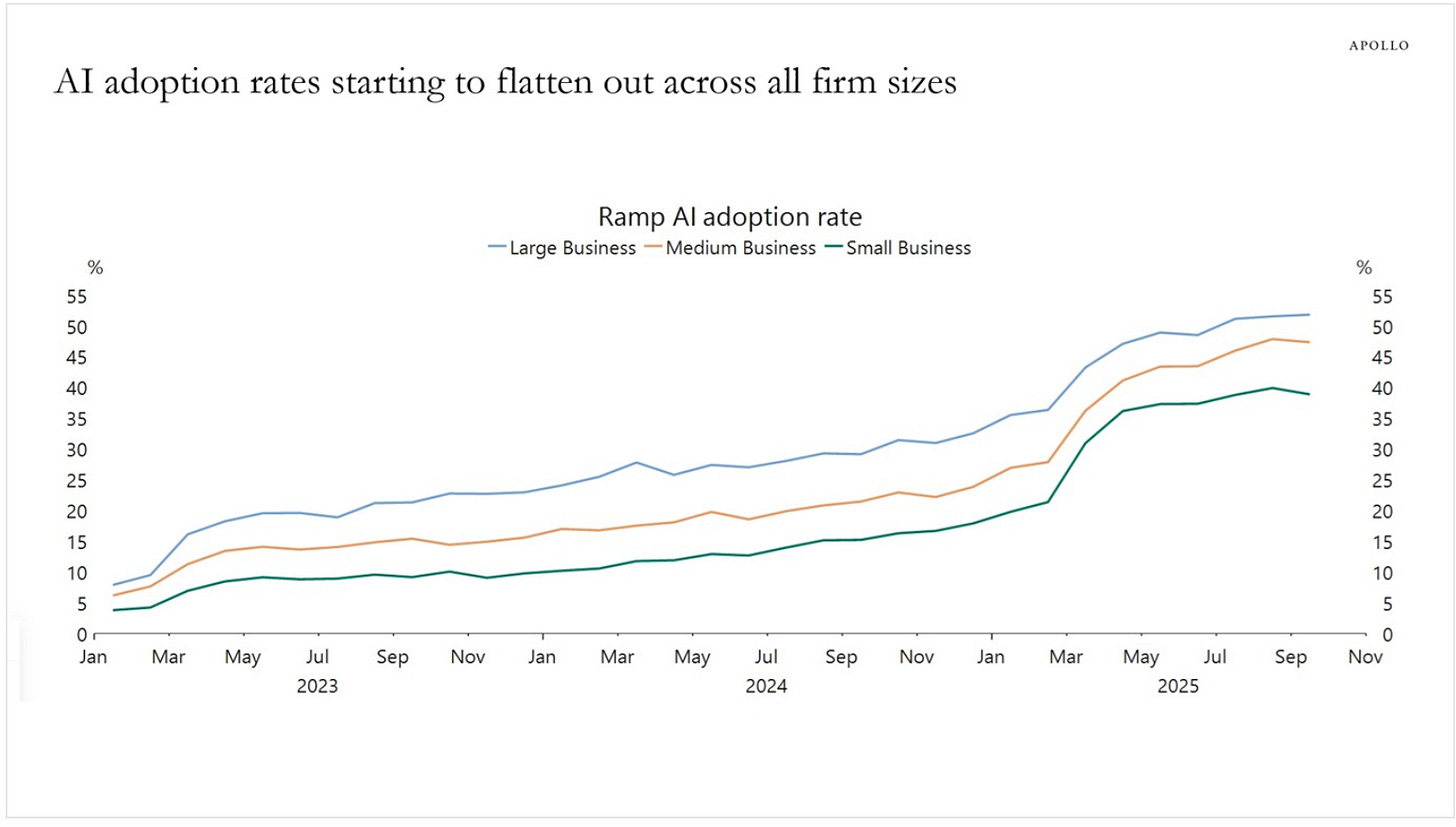

Then again, if you still haven’t had your fill of AI, here’s Torsten Sløk, chief economist of Apollo – the private equity powerhouse that is bigger than Carlyle – saying that the AI adoption rate has flattened across businesses of all sizes. As proof, he cited these two charts, based on data from the Census Department and Ramp…

And…

But as one of my more cynical friends who has been steeped in – and obsessed with – the antics surrounding AI for several years quips…

The title of the chart is misleading. It says AI adoption rates are starting to flatten. For big companies, they are actually going down. Big companies are what matter, because that is where the dollars are. They also moved first, so were the first to figure out it ain’t all that. Smaller companies will follow.

There’s also this must-read from AI skeptic Gary Marcus – who is more informed than most,

Key line: “My verdict, in short, is that ChatGPT is a trillion dollar experiment that has failed.”

The following content is for premium subscribers…

Expedia: An Overlooked AI Loser?

A stealth restatement followed by an auditor resignation… and nobody cares?