Why CoreWeave Is So Important to Watch

And why its Ventures rollout, and its reliance on private credit, is all too familiar.

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

▶This is hardly a canary-like moment, but it’s one you shouldn’t ignore...

While it was likely under the radar for most, last week’s news that CoreWeave $CRWV has launched the CoreWeave Ventures Group is actually a big deal. But before we get going, let me make this clear: this has nothing to do with whether CoreWeave will be a winner or loser as a provider of AI-reliant data centers. That’s one battle I don’t need to fight.

It has everything to do with... WTF – as in, WTF is CoreWeave doing?

Answer: Seizing what in all likelihood is almost surely to be remembered as having been quite a moment.

There’s no question AI is very real. So are data centers and the role they play. So is CoreWeave, largely thanks to its close ties to Nvidia, which is an investor, customer and supplier.

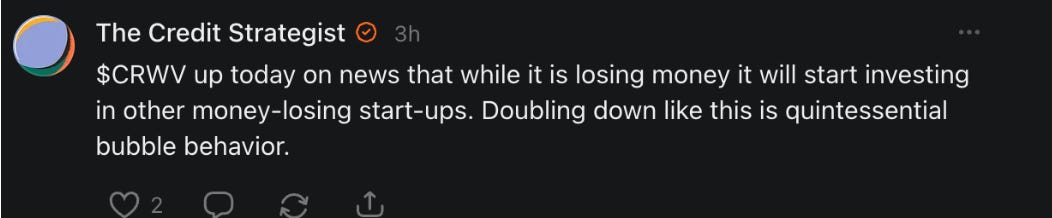

‘Doubling Down’

But still: We’re talking about an eight-year-old company that makes no money, has negative free cash flow and colossal levels of net debt – that are rising! And now, out of the blue, it’s going to start funding other money-losing companies it believes are “the future of AI”? And not just fund those companies, but in the spirit of vendor financing, finance its own customers. Or as this poster put it...

Related-party dealings like these, also known as vendor financing, have been a hallmark of the AI boom. Nvidia taking a stake in CoreWeave may take the cake, since in various ways it’s helping finance its customer CoreWeave’s purchases of its own chips. In other words, via its relationship with Nvidia, CoreWeave is buying its own revenue. The round-tripping even includes an obligation by Nvidia to purchase unused CoreWeave capacity.

The same thing happened during the dot-com era and in cycles since. And has almost always been ignored as a sign of excess... just as it is today. After all, as long as it’s disclosed, it’s all very legal – and it works as long as everything is coming up roses. Boom times help paper over the downside of circular deals. Ditto for these venture investments, which every major tech and equipment leasing company during various booms has engaged in. Unlike CoreWeave, today most companies with venture arms generate cash to make the investments. CoreWeave’s cash comes via debt – and not just any debt, but with a big chunk coming from private credit.

Eerily, Strikingly Similar

This is not just a case of history rhyming, but very possibly repeating itself in an eerily and strikingly similar way. And we’re not just talking about valuations and whatever this chart or that might show. It’s much more than that, and if nothing else, CoreWeave’s rollout of CoreWeave Ventures may very well be a harbinger. Let me explain...