Why I'm Red-Flagging SharkNinja

The ties that bind in a tangled web of related parties.

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits. Join them here and start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. When the tide goes out…!

For enterprise pricing and invoicing, shoot me an email at herb@herbgreenberg.com.

Sometimes it’s best to just state the facts and let them speak for themselves...

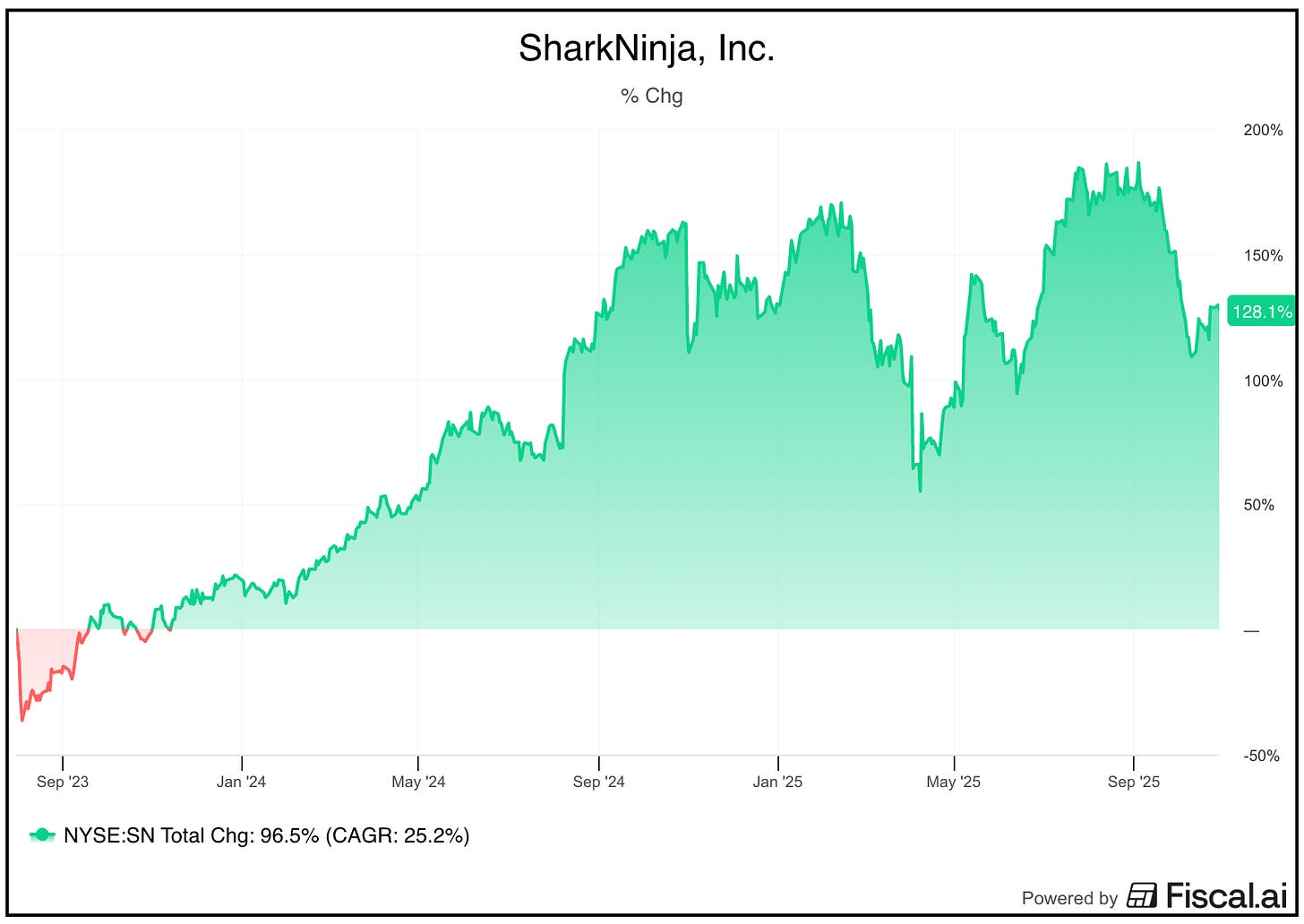

That’s how I felt after trying to untangle SharkNinja SN 0.00%↑, which by all standards has been nothing short of an exceptional investment... rising more than 180% post-IPO to its highs. The stock has since come under pressure, largely the result of concerns over tariffs.

That may very well be a convenient excuse when the company reports earnings next week…

But under the surface, with revenue growth having sharply decelerated, there could be bigger issues that quite possibly play out in coming quarters. And while they’re not yet something investors appear to know or care about, they bear watching, if for no other reason: SharkNinja is eerily similar – almost a direct overlay – to the convoluted case of Michael Kors, which has since morphed into Capri Holdings.

Ties that Bind

I wrote quite a bit about Kors at the time. Like SharkNinja, it had been a hot stock. And like SharkNinja, it had roots in Hong Kong – in its case exceedingly close ties to an entity known as Far East Holdings, which was controlled by billionaire Silas Chou. SharkNinja, meanwhile, was spun out of JS Global Lifestyle Co. Ltd., controlled by Xuning Wang.

And in both cases, with so many business dealings within a complex web of related entities, it’s hard to know what’s really going on, let alone keeping them straight.

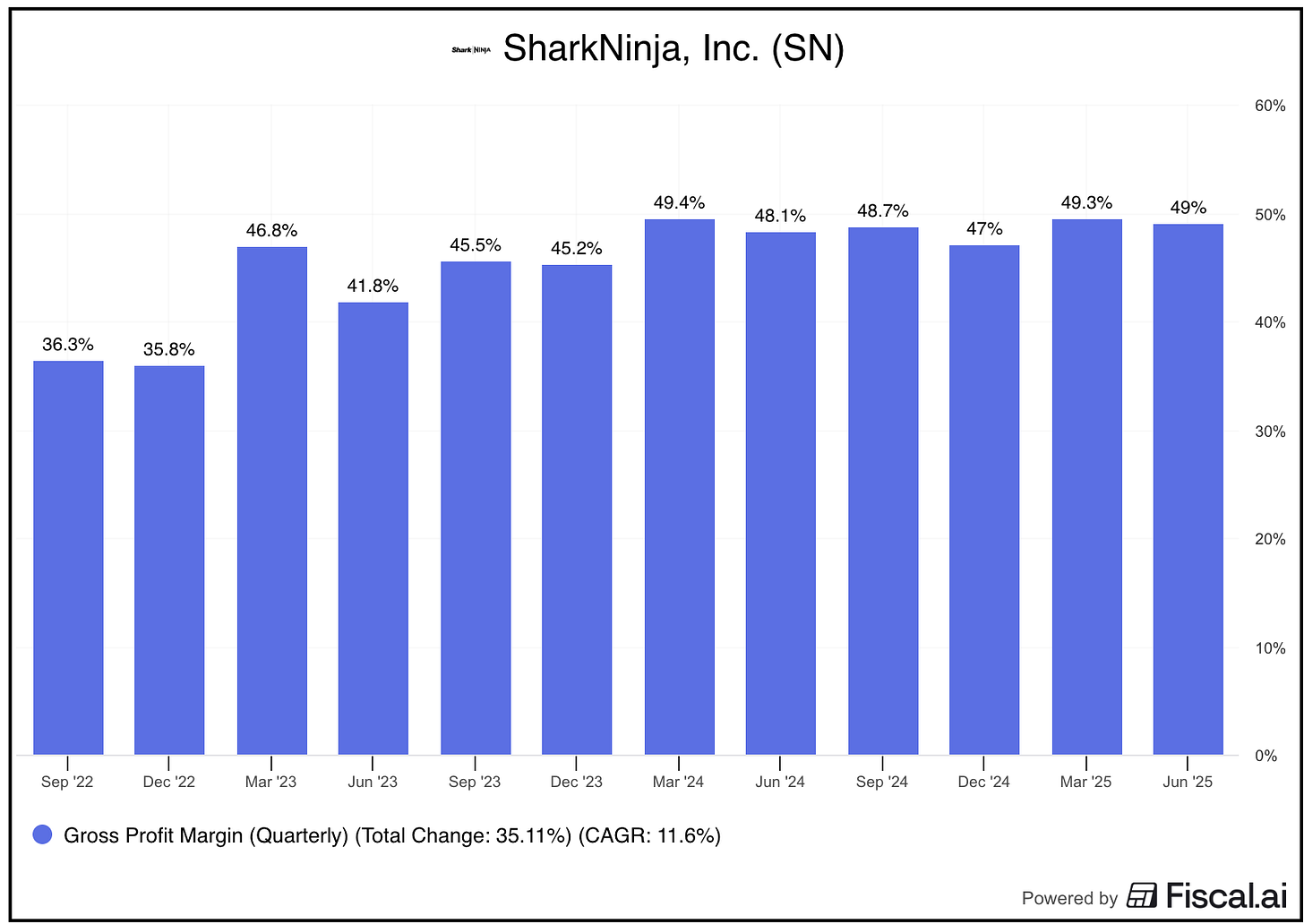

That coziness helped Kors report outsized and stable gross margins relative to its peers... until something had to give. In the case of Kors, the related-party relationships appear to have been serving as a convenient off-balance sheet place to store excess inventory. That, in turn, seems to have helped Kors keep its margins artificially high... that is, until sales slowed and the related parties couldn’t hold any more inventory. That forced Kors to start selling its clothing though discounters... leading to a collapse in margins.

Magic with Margins

Enter SharkNinja, where gross margins are impressively higher than peers, making them a critically important part of the story. Actually, they are the story, and there’s zero room for error…

Don’t take it from me. Here’s the way Interim CFO Adam Quigley put it at an investment conference in September...

I’ve been at SharkNinja almost 11 years now and gross margin focus has been a cornerstone of everything that I’ve done. It’s a cornerstone of everything we do within the company, it is the lifeblood and that enables us to launch in new categories, launch in new geographies, fund the media, fund the R&D. And so, gross margin is the core of everything we do, right?

And...

And so with gross margin so entrenched in what the company does and the lifeblood of what we do, it’s our core KPI.

But it’s not just what Quigley said, it’s what SharkNinja says in its filings...

We view our gross margin as a competitive advantage providing us with significant flexibility over how much we invest in our R&D, selling and marketing and other growth-oriented investments.

In my experience, when one metric is so important and the confidence revolving around it is so high, there’s reason for investors to wonder... Why?

Connecting the Dots

I’ll let you connect the dots and reach your own conclusions. It’s really a matter of laying out the facts – all found in public filings and transcripts. In the end, of course,, it’s subject to interpretation. And as much as I compare this to Kors, no two situations are alike. But SharkNinja is every bit as tedious and complex to pull together – footing JS’s press releases and Hong Kong filings with SharkNinja’s U.S. filings, then cross-checking them with filings and transcripts… stumbling on an apparent inconsistency or two along the way. I augmented all of this with backup from multiple standard AI programs, plus a few that are financially focused. As I did all of this, one thing kept going through my mind: 🤯! All of which is a long-winded way of saying: Unless you’ve already tuned this out, or consider this type of detail meaningless in a headline-driven market like this, grab some paper, something to write with, and diagram it out yourself. Or, if you’re too lazy... ask your favorite AI program to do it for you.

But if you’re willing to take the time, and you understand the possible implications of these kinds of related parties, in all likelihood if nothing else you will find an intriguingly fascinating mosaic.

Let’s Get Started...