Why I’m Red-Flagging SiteOne

The company appears to be in denial that it is a rollup in the process of resetting.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

Many if not most rollups eventually reset. They either run out of good companies to buy or wind up stretching on the wrong one. Or they run out of firepower to do more deals... at least the kind that make financial sense.

There are exceptions, to be sure, such as insurance broker Brown & Brown, which I recommended in 2022 while writing a long-biased newsletter. At the time its stock was a bit less than half where it is now.

I was dubious when I started my research – in large part because... it’s a rollup!

Or as I wrote at the time...

I’m not a fan of rollups – companies that generate much of their growth from acquisitions.

But the insurance brokerage industry is different, with acquisitions playing a perpetual and central role to the model...

Some deals are quite large, such as the purchase earlier this year of Irish broker Global Risk Partners, which has revenue of $340 million.

But most are considerably smaller, with a never-ending supply of targets. All in, there are 25,000 agencies in the U.S. That number hasn’t varied much, because for every agency sold, another is started with the ultimate goal of selling.

But they’re not all like that. I always think about Brown & Brown when I dive into a rollup, since they can fool and trap both shorts (betting against them too soon) and longs (overstaying their visit.)

Tale of Two Rollups

That gets us to SiteOne Landscape Supply $SITE, which since going public nine years ago has evolved into the nation's largest wholesale landscape distributor – largely through acquisitions.

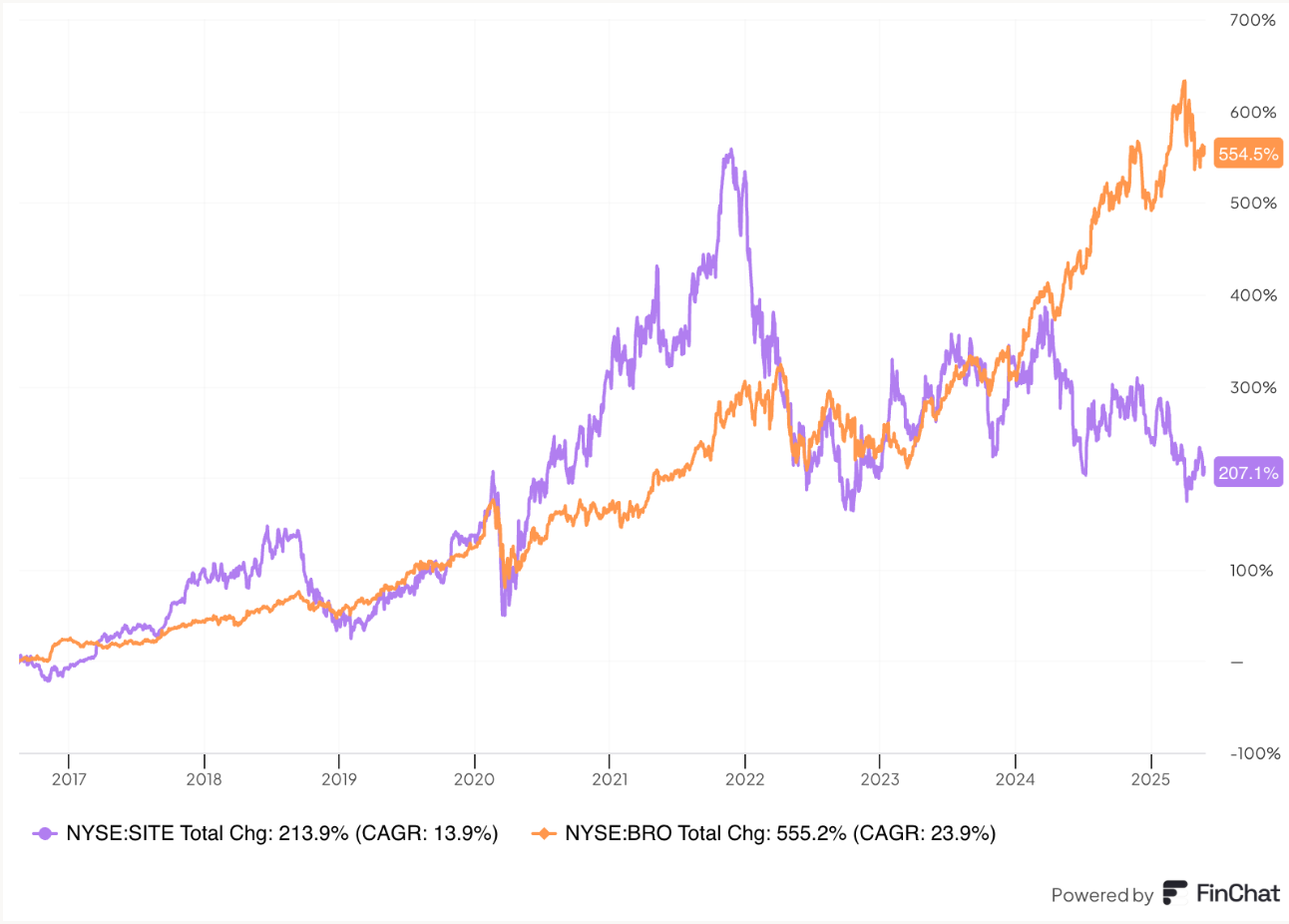

A look at the total return and gains on the stocks of SiteOne and Brown & Brown since SiteOne’s IPO tells the tale of two very different roll-ups. SiteOne is the purple line...

Source: FinChat. (See SITE overview here.)

Or since 2020...

Or a true compounder like Brown & Brown by itself since its IPO...

The obvious question: Why red flag SiteOne? And why now? After all, its shares are already well off its 2021 highs and have done nothing for the past three years...