Happy Days...! YOLO, FOMO, MOMO

No, this time is NOT different.

Hi Everybody, if you missed this – it’s a fun one. It’s a resend of something you should have received in your inbox at 7 a.m. ET yesterday morning. If you didn’t, please let me know. If you did, fantastic! f you have comments, go for it. Comments are open to everybody. As you know, I’m in the process of shifting platforms. Should be completed soon, but will keep a presence here.

We're in the money.

We're in the money.

We've got a lot of what it takes to get along.

We're in the money. – The Gold Digger’s Song, 1933

Here we are again. Yet another silly season on steroids. Then again it’s seemingly like that all day, everyday... the market’s equivalent of climate change.

Reality is: These are not logical markets and likely never will be, assuming they ever really were.

The algos, pod shops, resurgence and resilience of retail investors – and anything else you want to toss in – only exaggerate what already was.

And that’s before throwing in the full-throttle YOLOing, FOMOing, MOMOing of what once upon a time used to be called “concept stocks,” until they were rebranded, recycled and rechristened as memes... with the goal of hitting the jackpot!

It’s as if 2021 never happened! The difference is that interest rates aren’t zero.

See It, Feel It, Hear It...

As I do every time we hit this phase, which seems like it’s every other week lately, I ask myself and my friends – especially those who short fundamentally flawed stocks: Is this the time it’s different?

The answer, of course, is that it’s not. And the very fact that we’re even having that discussion is a sign that an inflection point is near. Always has been. Always will be. Maybe not tomorrow... or next week, but it doesn’t take a market technician to know when things are moving too far, too fast.

It also doesn’t take a genius, if you’re a reader of mine, to know how I’m wired...

It’s very different from a happy-go-lucky technician like J.C. Parets, one of the genuinely happiest people I know, who runs Stock Market Media.

In a note Sunday, J.C. lampooned a headline on the cover of the current Barron’s, which said, "The S&P 500 just hit 6,000. Start worrying?"

He added...

Start worrying?

Seriously?

He went on to say...

I'm more of "see what the headlines are so we can do the opposite" kind of guy.

And this Barron's cover certainly plays.

Because we've been buying stocks – obviously we're buying stocks; it's a bull market – seeing these kinds of headlines brings a smile to my face.

His comments, which are currently on the right side of this trade, tell me we’re closer to the end of this run than the beginning... unless of course – we’re not.

For a Reality Check...

I turned to my pal Bob Howard of the always-entertaining Positive Patterns newsletter.

Bob’s an old-school hybrid technician/fundamental investor, who looks for good long-term bets that he watches from his home in the Ozarks, where he says he has nothing better to do. He’s so old school that one of his favorite stats to determine fear/greed are the new-high and low lists for the NYSE and NASDAQ.

How’s that looking? Bob to me:

This last week - 528 to 274 - improving, 2-1, not all that impressive and now, not nearly as good as then. But, we are approaching highs which is amazing. Who predicted that? Certainly not me and all those BARGAINS disappeared in less than two months as” the usual bearish crowed “is wrong again.”

He adds, likely getting no disagreement from the likes of J.C...

The thing to watch is the QQQ, just 2% away from the highs. If they

take charge again that would be uber bullish but the strength right now

is strange – strong groups are Utilities, Gold, Cybersecurity, Insurance,

some banks...

And...

If the market makes new highs, then expect a FLOOD

of IPOs from everywhere the Big 7 [Meta, Google, etc] are not that overpriced.

Or the way I look at it, if this is the setup for the surge of surges, the silver lining is that it’ll result in a crop of new ideas for my Red Flag Alerts List. The more things change...

▶This quick head’s up... If you missed the newest Red Flag – on SiteOne $SITE – you can read it here. In short, it has all the attributes of a rollup in reset. I have received some pushback, which I address in my latest report for premium subscribers, which you can read here.

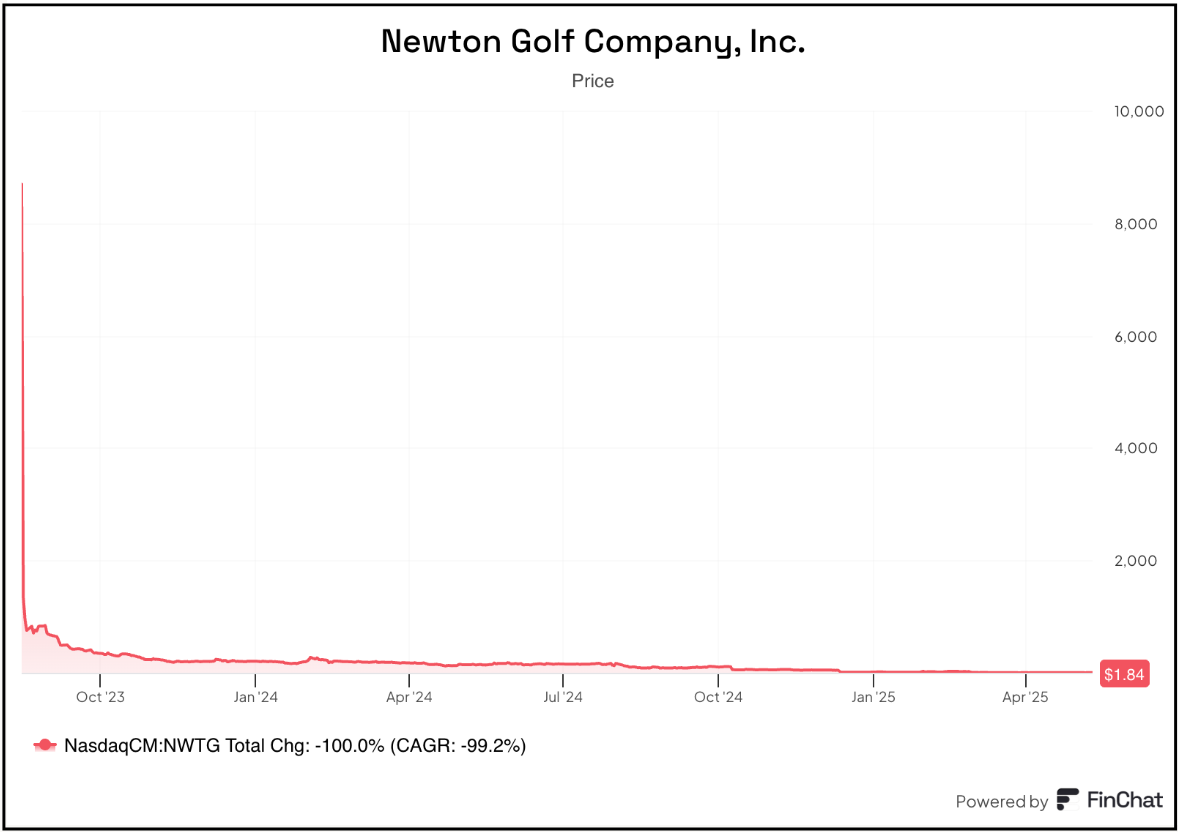

▶Finally – sudden thought... I was going through some old reports and noticed that back in 2023 I wrote about the zany market action in the stock of a company called Sacks Parente, which had just gone public via an IPO. Its claim-to-fame is a $400 putter my golfing friends have never heard of. Still it made the headlines because its stock shot up 600% on its first day of trading. I looked it up to see... where is it now? Couldn’t find it. Turns out it changed its name to Newton Golf $NWTG and earlier this year did a 1-for-30 reverse stock split. Not just a reverse split, but...ONE FOR THIRTY! Now (drumroll) let’s look at its stock...

Yep, it’s $1.84. Without the split it would be 6 cents. If this market REALLY takes off, expect to see more of those. Fore!

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com

What if it’s 1998?

I did not receive Happy days... yesterday. I would also comment that from the prospective of someone who has been running money in various formats since the 1970's that the fun and games will continue until it doesn't. Timing is the difficult issue.