The Wrap – A (Blue) Owl In the Credit Mine?

Also, updates on Nordson, Omnicom, Savers Value Village, and an updated full Red Flag Alerts List.

Updates on Nordson, Omnicom, Savers Value Village, and the full Red Flag Alerts list are at the bottom of this report.

If you ever wondered how important “headline risk” can be, Blue Owl OWL 0.00%↑ lays it out in its just-published 10-K with this new disclosure, buried in management’s discussion of the business environment…

An elevated level of headlines about private credit drove higher redemptions in Blue Owl-managed non-traded BDCs, aligning with industry-wide trends, and all investor tender requests for Blue Owl non-traded BDCs were satisfied.

There you have it: The mere mention of “higher redemptions” in the same breath as “an elevated level of headlines” explains why, if you consume financial news, it’s not your imagination that Blue Owl execs have suddenly been everywhere spreading their gospel over the past month or so… including an appearance on CNBC, which I’ll discuss in a moment. And which, in my view, shows how dire the situation is becoming.

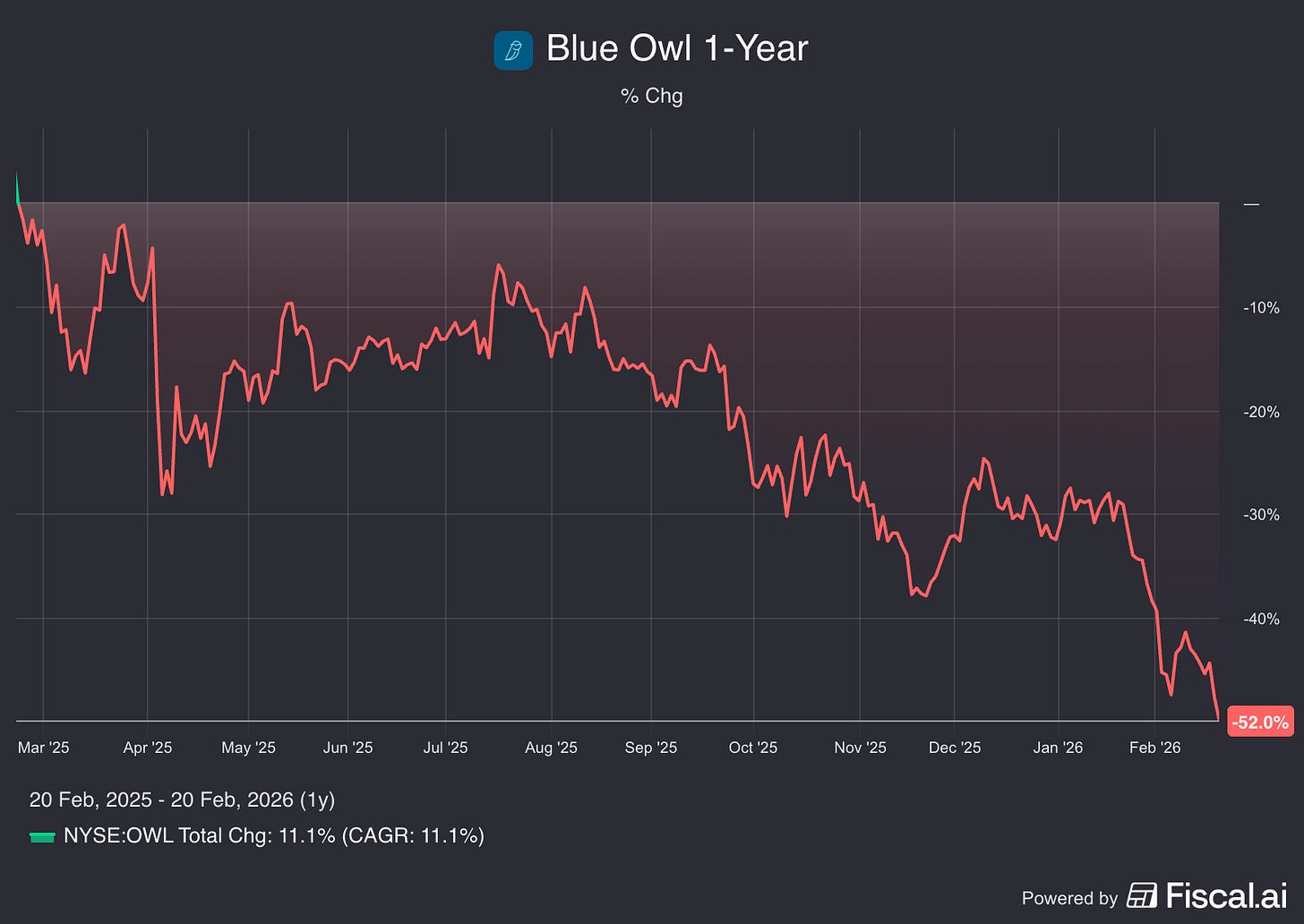

The Story Is In the Stock

You can see just how dire by looking at Blue Owl’s share price over the prior year, as concerns over private credit grew…

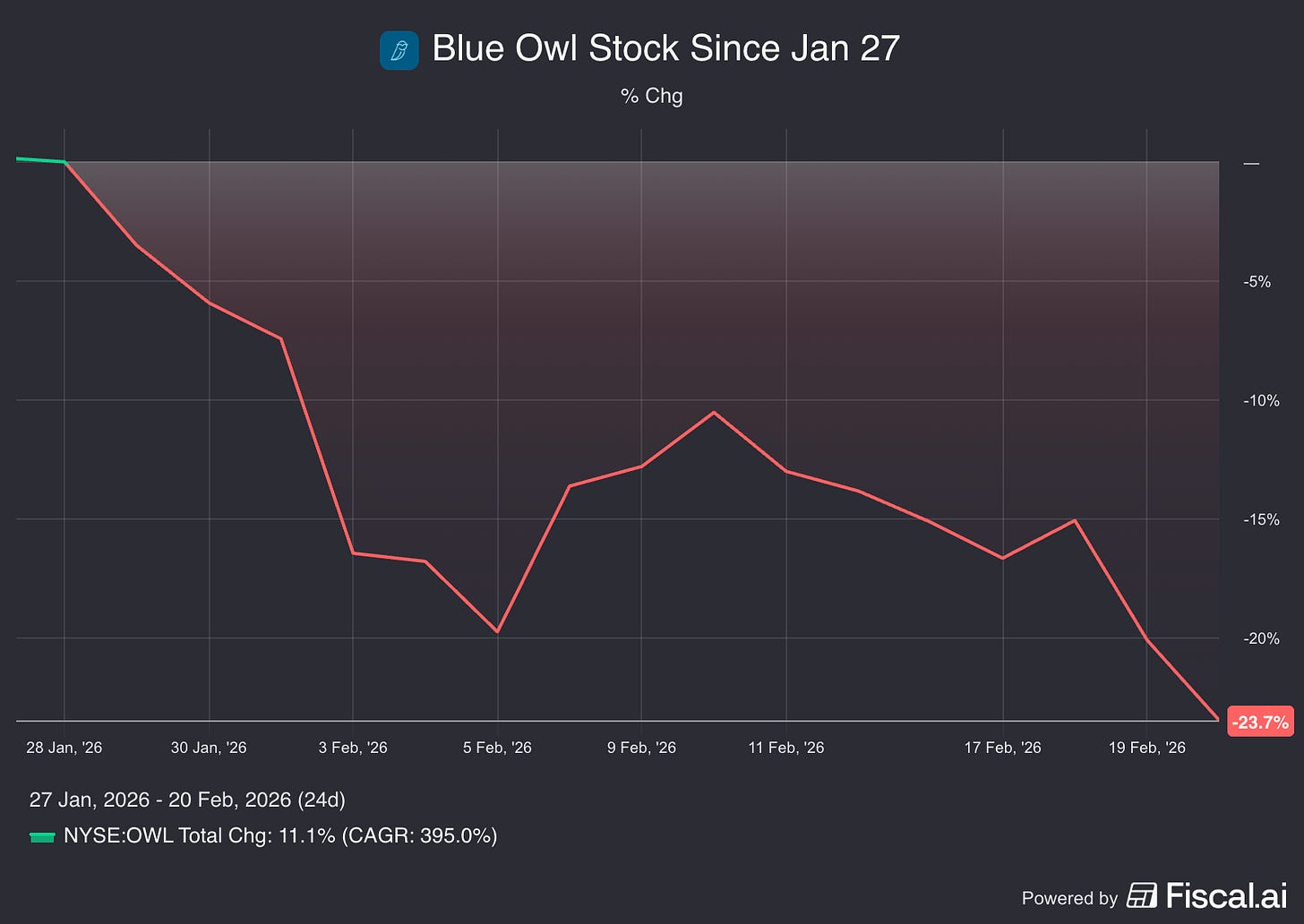

If I had to pinpoint one day when the company’s damage control seemed to shift into high gear, it was on January 27. That’s when Blue Owl announced that one of its execs would appear at an investment conference.

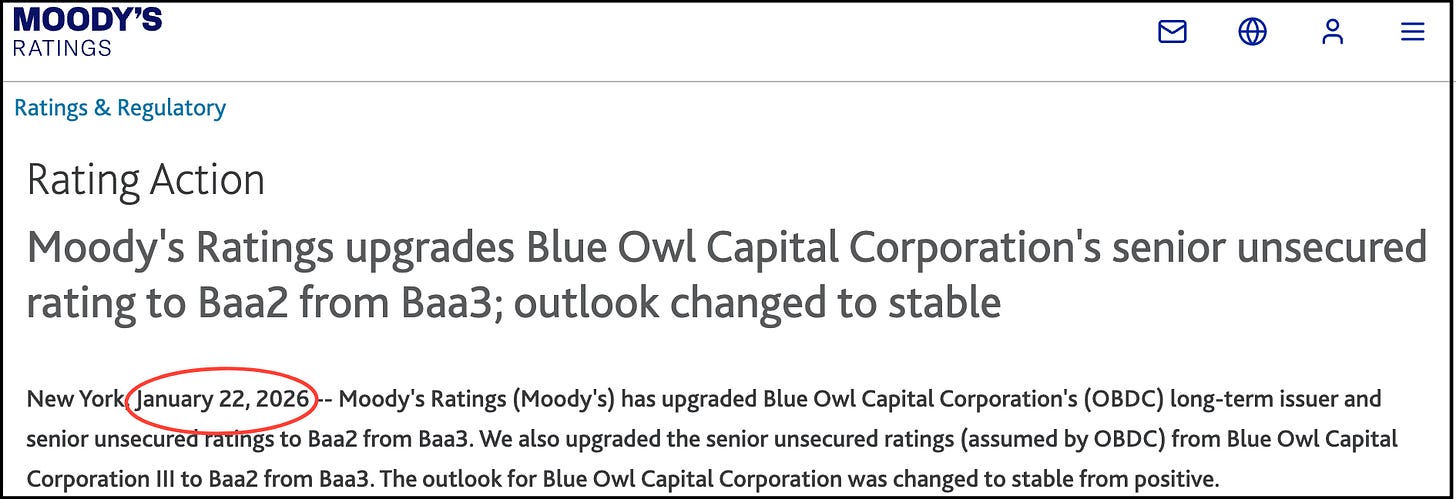

But perhaps more telling, it was also the day Co-President Craig Packer posted on LinkedIn that he was “thrilled to share” that Moody’s had upgraded some of the company’s debt.

Never mind that Moody’s had issued a press release on that very upgrade a week earlier…

The crisis PR blitz seemed to hit a crescendo a week later, on February 5, when Blue Owl Co-CEO Marc Lipschultz, speaking on the company’s earnings call, now infamously and somewhat dismissively said…

Tech lending has worked, continues to work, and to get very direct, right to your answer, no, we don’t have red flags. In point of fact, we don’t have yellow flags, we actually have largely green flags. The tech portfolio continues to be the most pristine amongst all of our portfolios amongst all of our subsectors.

Investors Anxiety

But even as management went into full crisis mode in late January, investors became increasingly dubious – and the stock continued to fall…

By Thursday, it appeared that management had entirely lost control of the story after the FT ran an article that said the company had permanently halted redemptions by retail investors, which had become a growth driver for the company...

Despite the company’s subsequent efforts to spin the concern as a non-event, economist and strategist Mohamed El-Erian – who once ran bond giant Pimco and knows a thing or two about credit – wondered on social media whether what we were at a “‘canary’ – I’d say owl – “in a coal mine’ moment, similar to August 2007.” That’s when the fall of two credit-centric hedge funds inside Bear Stearns arguably were the first big dominoes to fall at the start of the Great Financial Crisis.

As it so happens, Thursday was also the same day Blue Owl filed its 10-K, with the sentence blaming “higher redemptions” on an “elevated level of headlines.” Of course, in the very next sentence – reinforcing the spin that all was well – it implied that even with those redemptions, more people want in than out…

This slowdown in non-traded BDC capital raising coincided with an acceleration in other fundraising within the private wealth channel, driving a record quarter of private wealth flows for Blue Owl.

All of which gets to the question: Will the owl live? Will the owl die?

What I know is this – I know spin when I see it, and companies don’t go to this level of spin unless they’re a company in crisis.

Trying to Bluff CNBC

That spin was in full display Friday morning when Packer, in full damage control mode, went on CNBC trying to spin the story forward. If nothing else, it proved how well-coached he has been at attempting to duck questions.

My favorite moment was when he was asked specifically about whether Blue Owl, as reported by Bloomberg, had sold some of its assets to an insurance company that Bloomberg said Blue Owl had bought.

He started his response by saying, “Look, I really appreciate the chance to be here….” (Take it from me, as someone who has asked those kinds of questions – on air!: That’s a classic diversion tactic! And always a tell.)

He went on to say that the company doesn’t own an insurance company. “It’s not a subsidiary,” he said, quickly adding that he wasn’t at liberty to say who bought the assets.

But it’s not what he said…

It’s what he didn’t say, but could have said: That the company in question is Kuvare Asset Management, which Blue Owl bought for $750 million in 2024. At the same time, the company bought $250 million in preferred stock of Kuvare UK Holdings, which gives it indirect ownership of Kuvare’s other business – insurance.

‘It’s Not Key’

Yet when pushed by CNBC’s David Faber if the information reported by Bloomberg was “incorrect,” Packer started to say, “It’s not…”

My pal Jim Cramer then interjected, under his breath, “It’s key.”

Packer then said, almost matter-of-factly, “It’s not key.” He went on to explain that “the assets were sold to four institutions, they all bought the same, at the same time, at the same price. The fact that one of the four might be part of our insurance business – how would it undermine the other 75% of the sales?”

What it looked like to me was that he knew he had been backed into a corner and tried to talk his way out. But in doing so, Packer said three things that were red flags:

First, he wouldn’t say that Bloomberg’s reporting was incorrect. He didn’t because the gist of it wasn’t… and he went on to imply as much. In its report, Bloomberg’s error, which it later corrected, was to say Blue Owl had bought an insurance company, when it invested in an insurance company, while buying the insurance company’s asset manager. It’s impossible to know which part of Kurvare bought the Blue Owl assets. Packer could have cleared up any confusion, but didn’t, it would seem, because (in my view) rather than talking around it, he would have to come right out and concede that this transaction was related. After all, even if the assets in question represent only 25% of those sold, it was a related-party transaction.

Second, the amount bought by Kurvare wasn’t a mere 25% of the assets that were sold. It’s twenty-five percent! One quarter. That’s a significant amount to sell to a related party.

Third, he responded to Jim by saying that what Jim thought was “key” wasn’t “key.”

That last point, as nuanced as it may seem, is important because the question of whether Blue Owl sold assets to itself isn’t just key; it is central to the concerns.

Telling Jim that “it’s not key” is akin to telling a journalist or investor that they’re asking the wrong question. In my experience, that usually means it was very much the right question.

Interpret at will.

▶Finally, a few quick updates – and the full red flag alerts list since inception…

Earlier in the week, I red-flagged industrial super-stock Nordson NDSN 0.00%↑, pointing out why its high-flying stock is at risk – even a day before its Q1 earnings. You can read it here…

As for those earnings…