The Wrap: Making it Up As They Go Along

Also, AI fatigue, the rising AI credit crisis and my chipping Apple keyboard.

This is not the time to ignore red flags.

Join the large and growing list – portfolio managers, analysts, auditors, attorneys and even a few regulators – who have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

1. The Week that Was for AI.

Was last week the week investors finally woke up to the possible reality that companies may very well be recklessly throwing more money into AI than they will ever be able to recoup?

Only The Shadow knows for sure, of course, but the rest of us can speculate. What we do know, as I wrote during the week, is that there’s a whole lot of tension and pressure out there. You can read that report here…

If we’ve learned nothing else, it’s that even the supposedly smartest of the smart among the financing class can’t not touch the wet paint… or in this case, resist the same FOMO that sucks in everybody else. These banks and faux banks and the companies they prop up are run by humans, and human nature is human nature… it ain’t perfect.

But Can it Think?

The craziest part is that even in the world of AI there is sharp disagreement over just what is realistically possible – striking to the crux of the only thing that ultimately matters: whether AI will ever truly be able to think.

What’s clear, as of now – while it can be a great sidekick and is good at cutting through the clutter – one thing it can’t do is think. (More about that, with my attempts to get ChatGPT to help me build a spreadsheet, in a second.)

But there appears to be another side to all of this – and it’s evident in the defensive tones coming from the world of AI, most notably OpenAI’s Sam Altman. It hit the point last week that he tried to walk back or “clarify” comments by his CFO, who said there should be a government “backstop” to the company’s infrastructure loans. Never mind the he said/she said dark comedy of it all; it just underscores the seemingly sheer mind-bogglingly amount of money AI is sucking up… and how quickly it’s doing it.

Investor Fatigue

At the same time, investors increasingly appear to be inured to – if not downright fatigued by – the steady stream of AI-related press releases and headlines. All of that seemed to peak a few weeks ago… at least with press releases that pushed stock prices up almost daily and almost entirely on the mere announcement of new data center-related deals.

You can see that clearly with CoreWeave $CRWV, which operates data centers and has become the poster child of all things AI. Used to be, whenever its stock was down, like clockwork the company would issue a press release of a new deal, with insiders selling into the strength. That was until last week, when CoreWeave issued a press release touting “a major global partnership” with CrowdStrike $CRWD. Its shares actually fell.

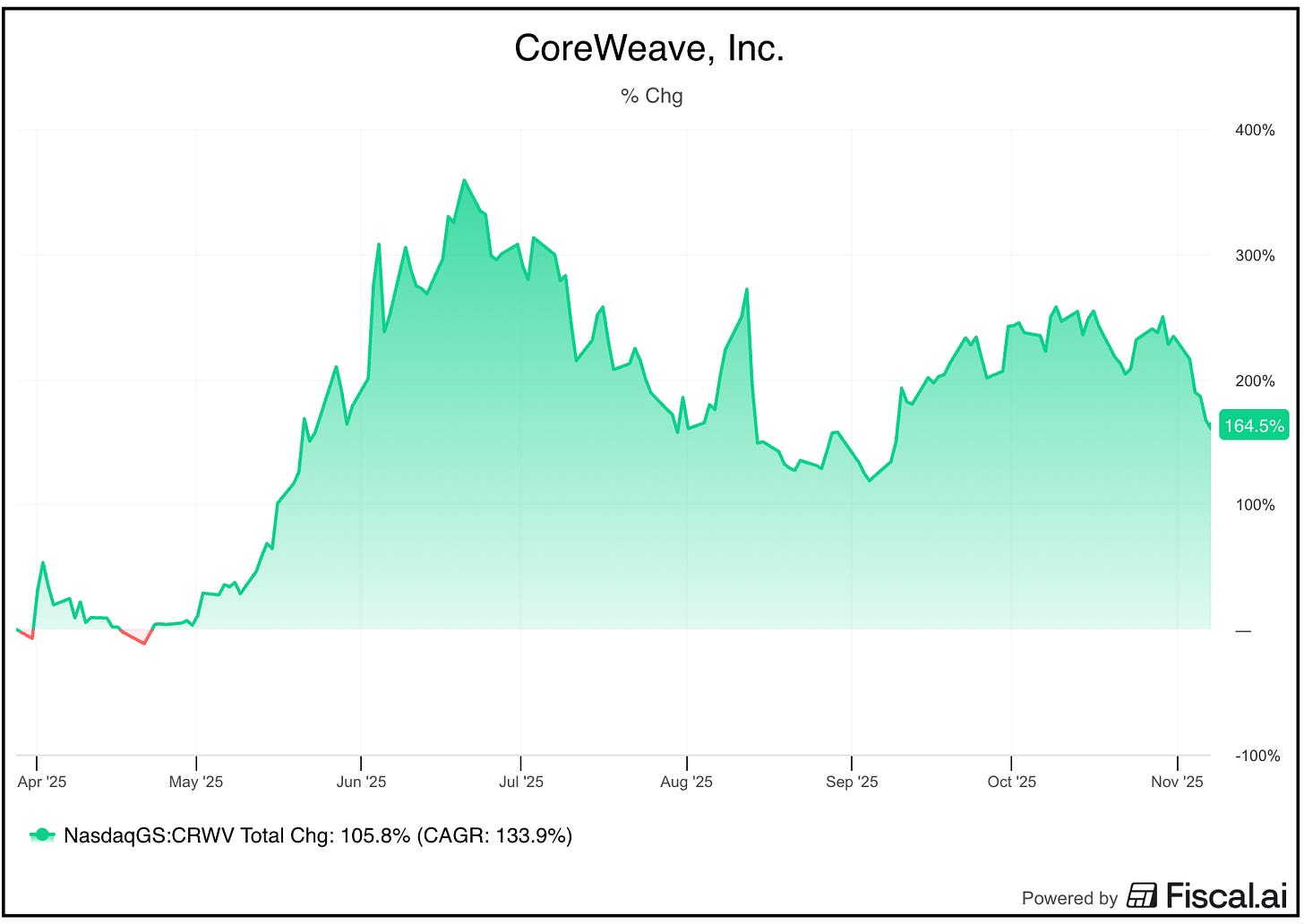

And while its shares remain a big winner since its IPO earlier this year…

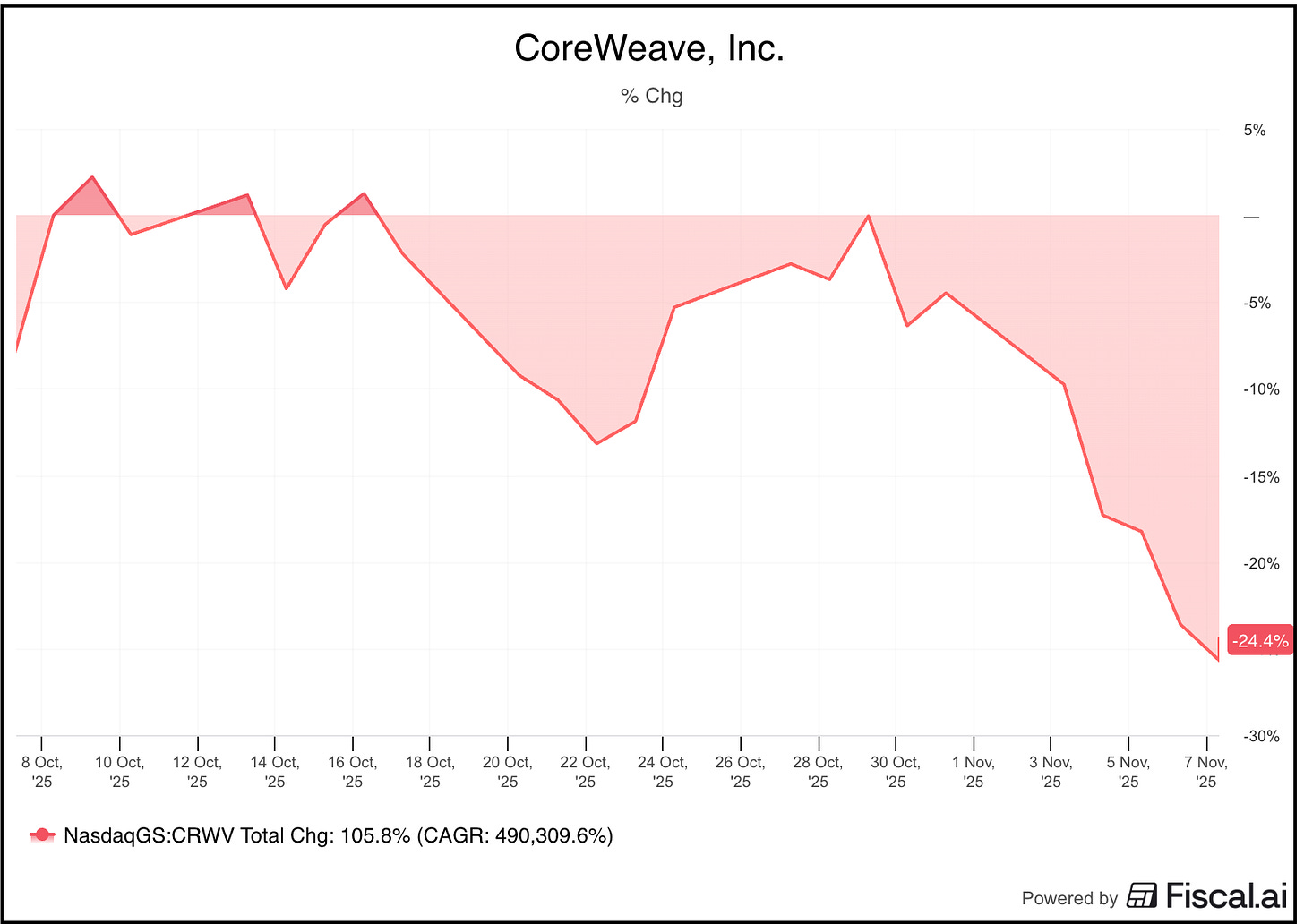

The past month has been brutal…

That’s leading everybody to wonder: Is the AI bubble bursting? At a conference last week CoreWeave CEO Michael Intrator said…

It’s very hard for me to worry about a bubble as one of the narratives when you have buyers of infrastructure that are changing the economics of their company. They are building the future.

For him, that was definitely the right answer. Meanwhile, on the topic of how dicey financing all of the announced data center projects has become, he said…

If you’re building something that accelerates the economy and has fundamental value to the world, the world will find ways to finance an enormous amount of business.

Indeed, it will. (Wink! Wink!)

2. Speaking of Which…

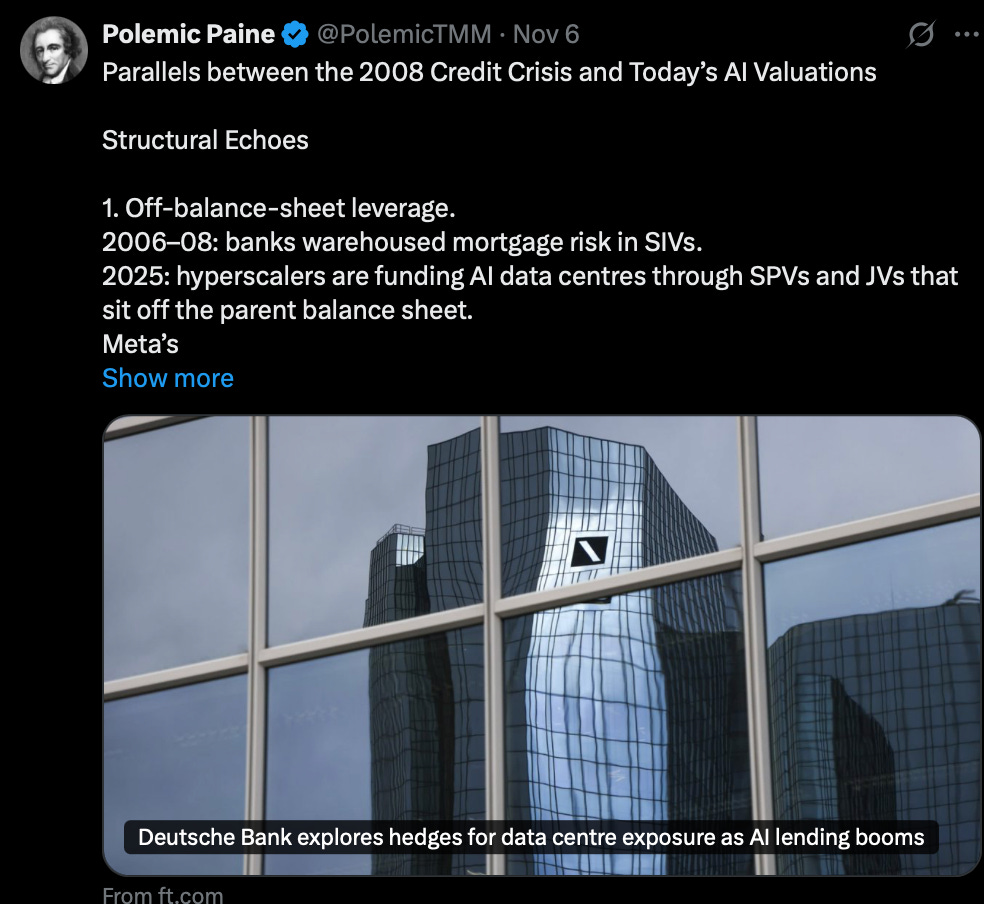

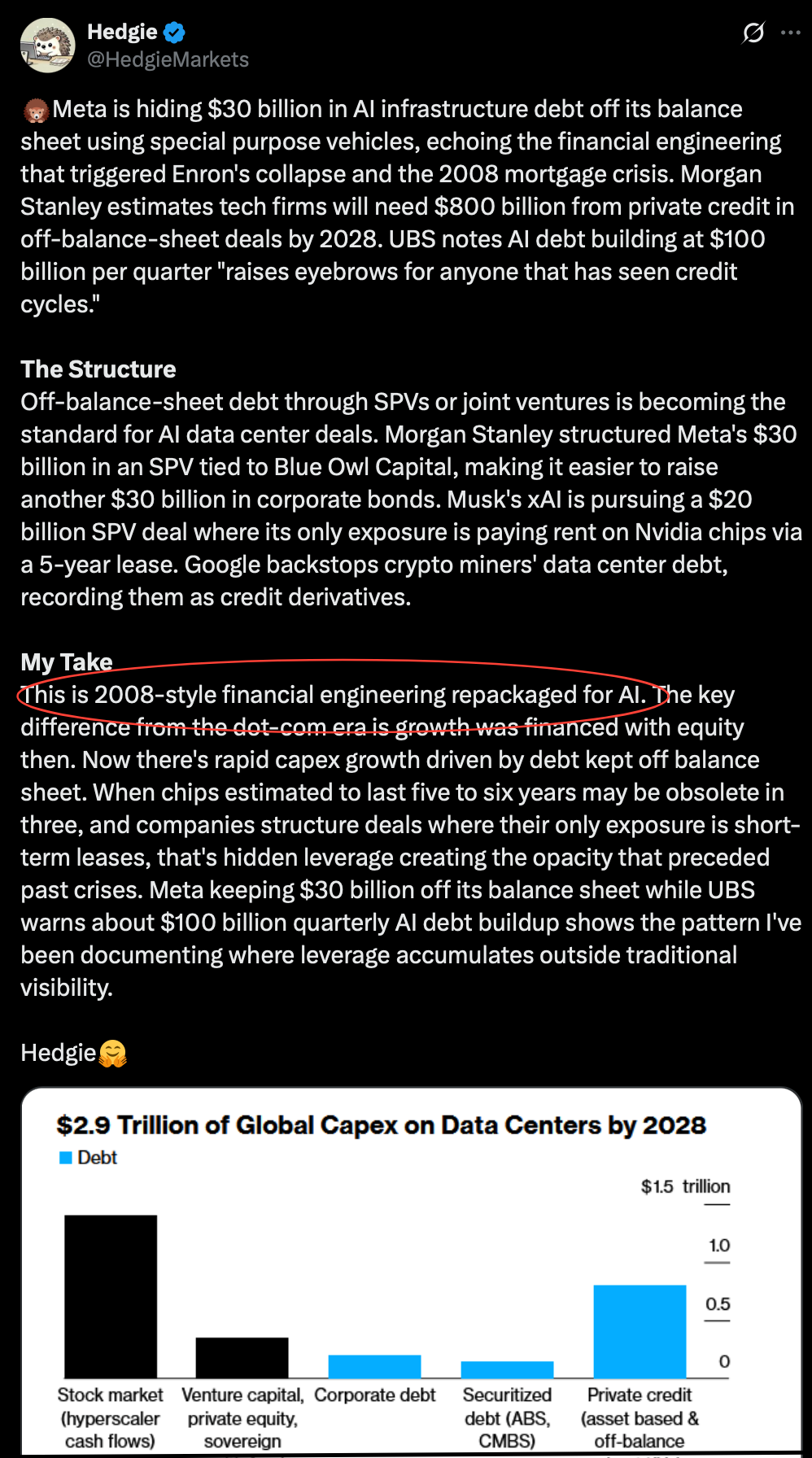

Suddenly everybody, it seems, is comparing the debt-fueled part of the AI bubble to the Great Financial Crisis. Just the other day there was this, which was making the rounds…

And this…

And then yesterday DealBook at the New York Times reported that Blackstone “is on the cusp of closing” a $3.46 billion commercial-mortgage-backed securities offering to refinance debt held by the biggest player in the artificial intelligence infrastructure market.

As the newspaper wrote, $3.46 billion “may seem like small potatoes compared with some other debt-fueled deals, such as Meta’s $30 billion corporate offering to finance its data center in Louisiana. But it’s unprecedented for the C.M.B.S. market, where issuance for data-center-backed deals was just $3 billion for all of 2024.”

Not surprisingly, perhaps, there has been a spike in Credit Default Swaps from the likes of CoreWeave, Oracle and Microsoft; CDS’s are akin to the market’s smoke detector going off.

Follow the Credit

All of this reminds me of what yours truly wrote a few months ago in my “Why CoreWeave is So Important to Watch” report. One of its themes was why it will be important to follow the credit if you’re looking for signs that the AI bubble could burst. If you haven’t already, you can read that report here…

In it, I mentioned how the company is boasting how it is using “new forms of financing, including asset-backed securitizations” to help lower its cost of capital. I noted how the company’s CFO, Nitin Agrawal, made a point of saying, “In terms of the credit agencies, we’ve received incredibly positive feedback from them...”

I then wrote…

I’ve heard that last one somewhere before. Let me think… Oh, yes, pointing to the credit agencies, that was the last line of defense for every subprime lender and – forgotten in the fog – even a few business development companies before they blew up during the Great Financial Crisis.

I continued…

Anybody following the subprime lenders and BDCs, and kept track of the securitizations, saw that one coming.

But today everybody’s smarter, right? They’ve learned from the past, right? Because instead of sleazy subprime lenders on mortgages, or the aggressive overly BDCs of yesteryear, today it’s a more seasoned group of lenders, which is why CoreWeave can boast of how “sophisticated” its approach to financing itself is.

Maybe, but this is also true: Subprime is subprime is subprime... and one thing that hasn’t changed is that the high yield charged by its lenders is because of the high risk of the debt... the very kind of debt that is behind the creation of (drumroll!) CoreWeave Ventures.

That’s one theme, it seems, that’s picking up steam.

3. Moving On… My Love-Hate with ChatGPT

I used ChatGPT and the others a lot, but it’s the one I currently pay for. Last week I asked it to help me build a very specific type of spreadsheet.

I don’t build spreadsheets – period – and the one I needed had some special quirks. Early in the process, maybe within the first hour, I was pleasantly surprised when the chatbot, after some give-and-take, gave me a fully loaded spreadsheet. But everything wasn’t quite right – and least when I needed it to color-code one row. In fact, doing so was its recommendation… and it said it would take no time. It then took eight-plus hours of going back-and-forth as I tried to correct errors or get the calculations to work right. ChatGPT – saying something like, “Okay, I know what I did wrong” – would confidently send me new formulas… only to have those formulas fail. It would then blame the user interface of Google’s Sheets – my go-to for this specific situation – when its own instructions were flawed.

Exhausted, I finally said I’d ask rival Gemini, since Gemini is also from Google…

Blah, blah, blah. So I went Gemini, which was congenial enough. Like magic, almost as if ChatGPT also went to Gemini, ChatGPT gave me the same solution Gemini did. We eventually got the spreadsheet built, but now I need to make further changes since it wasn’t built entirely properly in the first place. I’ll likely hire that out because… I have better things to do. (And that’s after it took a spreadsheet-savvy friend a hour or two to take the spreadsheet to a level that would have been well beyond ChatGPT’s capabilities.)

Moral of my story is that as much as ChatGPT may sound like a person, no matter what anybody says, it can’t think like one.

4. Finally – If Apple’s So Good…

Why is the quality of my Magic Keyboard so bad.

After a year-and-a-half of use, the keys are chipping. In all of my decades pounding on keyboards, I’ve had keys pop off and stick, but never chip. A search shows… I’m hardly the only one. And if the answer is “don’t buy a keyboard with black keys next time,” my response is: Then why do they make them? (Obviously because people like me exist!)

Have a great week, everybody.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

I can be reached at herb@herbgreenberg.com.