The Wrap – Stocks Hang by a Thread

Also, if you missed it: SharkNinja. Plus, LRN, FI, IR, OMC, UPS and more...

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

1. First, What You May Have Missed

Before we get going, if you missed my new Red Flag report on SharkNinja SN 0.00%↑ you can read it right here..

As I said in the report: In my experience, when one metric is so important and the confidence revolving around it is so high, there’s reason for investors to wonder... Why? Add in related parties from another country – and as I said after doing the work and trying to make sense of it all – only one thing went through my mind: 🤯!

One other thing: In response to those of you who wondered why I would issue a report in the absolute heat of the earnings season, when it is bound to get buried in an avalanche of emails and more pressing news, it’s simple: I don’t time publication to anything other than when I’m finished… Period. (That goes for the time of day I publish, too.)

Prefer to listen to a preview, here you go…

2. Hanging By a Thread

One thing about this market... it’s brutal for any company that doesn’t perform up to expectations. As much as a stock might produce outsized gains on a whiff of good news – ditto for the opposite. On that score, this week will go down as one for the books. Think about it, Stride LRN 0.00%↑ and Fiserv FI 0.00%↑ tumbled more than 50%. Even Chipotle CMG 0.00%↑ off 18%, or Meta META 0.00%↑ down more than 12% over three days, are worth paying attention to because their declines underscore something I’ve written about a number of times: The lack of conviction in this market, and how so many stocks that overshoot their own realities are hanging by a thread… often held together by hope and hype.

3. Earnings Call Evasion

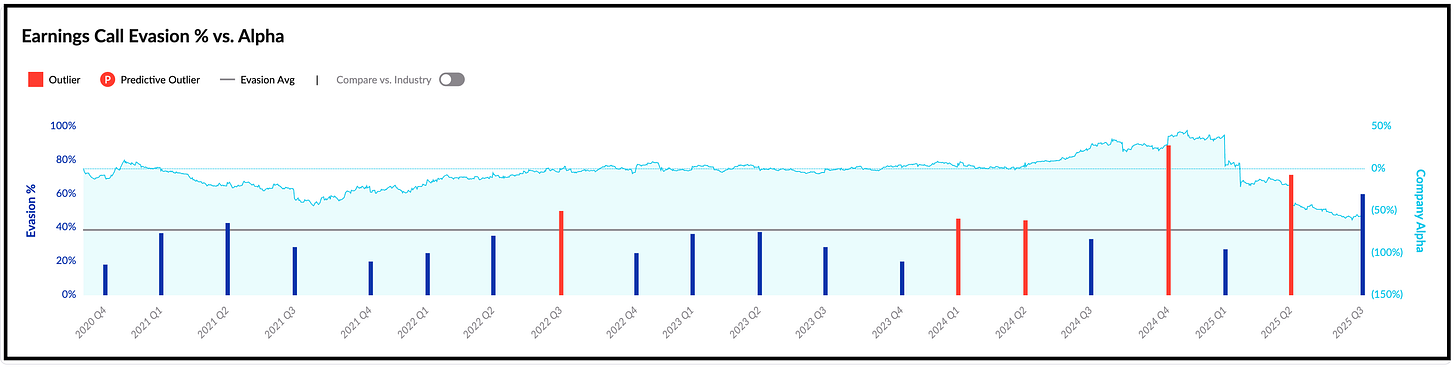

Speaking of Fiserv... Great call by my pals at ManagementTrack, whose earnings call evasion program spotted trouble at Fiserv multiple quarters before this week’s disappointing earnings news hit. The higher the evasion to the point that it becomes an outlier(red line) the more likely the stock will underperform as it did here…

While on the topic of Fiserv, ManagementTrack’s interviews with former colleagues of fairly new CEO Michael Lyons, on the job since June 30, conclude that he “is an ideal fit to clean up the mess left by his predecessor and inherited management team.” Among the reasons: “He led Bank of America’s ‘Project New BAC’ crisis restructuring in the past and is known for making tough decisions.”

4. Sticking with Evasion…

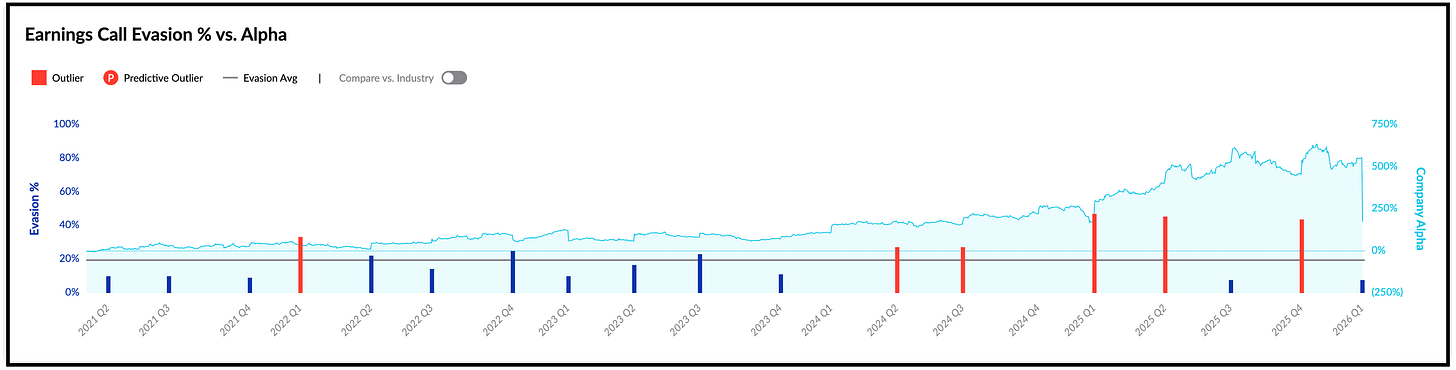

And speaking of ManagementTrack, take a look at Stride, which I first mentioned here in August as a possible red flag: Its most recent quarter had little evasion, but for the much of the past two years it has been a chronic evader…

If you’re a premium subscriber, I have more on why Stride may be vulnerable even here behind the paywall below.

5. Sticking with the Theme…

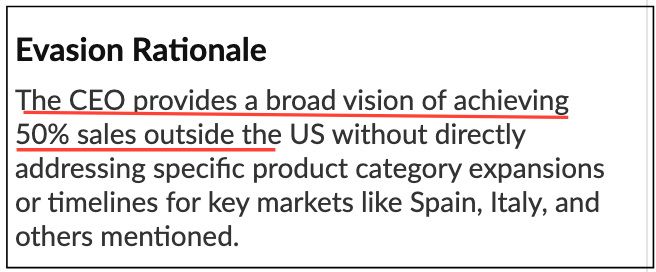

As I do with all of my reports, while I was researching SharkNinja, I checked out ManagementTrack’s evasion chart. While it didn’t flash anything unusual, it did spotlight this, regarding the company’s narrative shift to having more sales internationally…

That helped remind me of something I had read in the most recent earnings call, but given the amount of moving parts to the story I hadn’t focused on… and turned out to be a significant catch.

6. Finally, for Premium Subscribers...

As I explain clearly in my FAQs, I don’t hinge my life to earnings season. That doesn’t mean I don’t pay attention, and it doesn’t mean I won’t follow-up at some point. I’m more interested in those that generate the least amount of noise, or are new twists to the existing tale. With that in mind, a few quick updates from the recent swirl of earnings on companies that have either been formally red flagged or had been tagged as possible red flags (A.K.A. the Red Flag Radar) :

Stride. Even with a 50% decline, could its shares be headed much lower?

Ingersoll Rand. The fun may have just begun.

Omnicom. Is the tumble in rival WPP Group’s shares after its earnings a preview of what Omnicom faces?

UPS. One quarter does not make a trend.