The Wrap – 'Playing' the Market

Things don't matter till they do. Plus, HIMS, SN, IR, CCO, WING.

Special thanks to FinTool, Tenzing MEMO, Fiscal.ai, and ManagementTrack, whose tools were used as part of this research.

▶Things don’t matter till they do…

That’s especially true with the most dopamine-driven gamification of the stock market ever, which has put a new twist on the old saw of what it means to “play the market.”

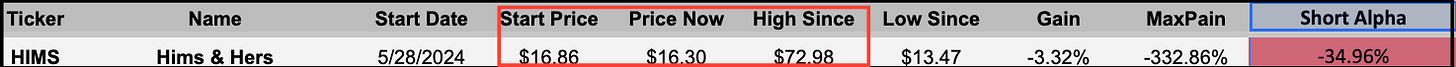

Even so, we still get glimmers of the law of gravity whenever a hot air balloon pops. And they do pop, like Hims & Hers HIMS 0.00%↑, which tumbled roughly 30% this past week and around 75% from its 52-week high – and a full round trip from when I red-flagged it, as reality caught up with the fantasy that the company devised a drug to make you skinny…

Watching the stock rise 333% was no fun, especially when the real story was there for all to see: that without its allegedly illegal compounded versions of GLP-1s, Hims’ core business was getting clobbered. The government’s rollout of its own online RX portal, which sells GLP-1s, in turn led to a regulatory assault on HIMS and sped up the inevitable. (Side note: That last part gets lumped into the bucket of the new wild card to any investment thesis, long or short, of the government taking a stake in companies and industries. In this case, it’s the reverse of what happened to MP Materials MP 0.00%↑after it was red-flagged here.)

What happens next with Hims? If you missed it, I took a stab at going through some of the options in my take…

If nothing else, it’s living proof that things don’t matter till they do!

But wait, there’s more. Seems Hims’ big compounding partner has a few headaches of its own. You can read about that here.

▶Speaking speculating… If you didn’t catch my report on Strategy’s MSTR 0.00%↑latest efforts at trying to control the narrative – this time with a so-called “digital credit” yielding 11.25% – which is being pitched as being the next best thing to safe – you can read it here…

The reality is very simple, as I wrote, regarding what company founder Michael Saylor was saying…

Saylor’s approach is either brilliant or brilliantly devious or deviously deceptive, depending on which side of the bitcoin and more specifically – Strategy – divide you’re on.

Let’s just say: Based on my interpretation of management’s comments, which I provide in the report, I’m on the side that says: Run for the hills.

In the meantime, the security in question – dubbed, Stretch STRC 0.00%↑ – trades enormous volumes, proving once again: Things don’t matter till they do.

▶It doesn’t always happen this way… But I’ll take it when it does. In last week’s Wrap, I mentioned two companies I was taking a look at: Wingstop WING 0.00%↑ and Progress Software PRGS 0.00%↑. They’re both down around 15% and 17%, respectively, over the past week. Progress was likely down because it has “software” in its name. But Wingstop, which reports earnings on Wednesday, wound up getting a few analyst downgrades.

My reason for mentioning the company was the possible impact of having a large Hispanic demographic and employee base, leading to a possible freeze in some sales over ICE concerns. In an effort to soften the blow, on its last earnings call, management said…

As we look forward, it’s really about broadening the top of the funnel, bringing in more new guests, new guests that maybe look a little bit different than our core, and diversifying the business a bit.

Did they say: Look a little bit different than our core?

Interpret at will.

P.S.: Over the past two quarters, the company has mentioned costs associated with installing a new ERP computer system. I’ve yet to hear any company say its new ERP installation was done on time and at the cost they expected. And, if nothing else, it has been the perfect cover for other things gone bad. But as we know, and repeat after me: Things don’t matter till they do.

▶Moving on, bitten by a Shark, cut down by a Ninja… When I red-flagged SharkNinja SN 0.00%↑ last October, it admittedly was largely (but not entirely) based on the most challenging of all red flags: The ties that bind, in this case, related parties with the company’s former Chinese parent. Yowza, shares are up 54% since then. (Better than the 338% gain in Hims, before it round-tripped!)

But still, there’s no getting around that related parties are hard to hang any stock-related hat on – let alone one of a hugely successful company that is known for aggressive product innovation, which has helped SharkNinja continue to grab market share. That’s why, in the report, I merely presented a mosaic and said that if this plays out, it might take quarters. Plural.

But the reality is…