Why Investors Aren't Buying Blue Owl's 'No Red Flags' Comment

A quick trip down a quarter-of-a-century memory lane explains why.

On its earnings call today, Blue Owl Capital’s OWL 0.00%↑ CEO Marc Lipschultz made headlines when he responded to an analyst’s question about whether he was concerned about “any sections” of its AI-related portfolio.

Or to be more precise, he said…

Tech lending has worked, continues to work, and to get very direct, right to your answer, no, we don't have red flags. In point of fact, we don't have yellow flags, we actually have largely green flags. The tech portfolio continues to be the most pristine amongst all of our portfolios amongst all of our subsectors.

Blue Owl is an alternative lender that has become a major player in the private credit markets, which have been the leading drivers of financing the AI infrastructure boom.

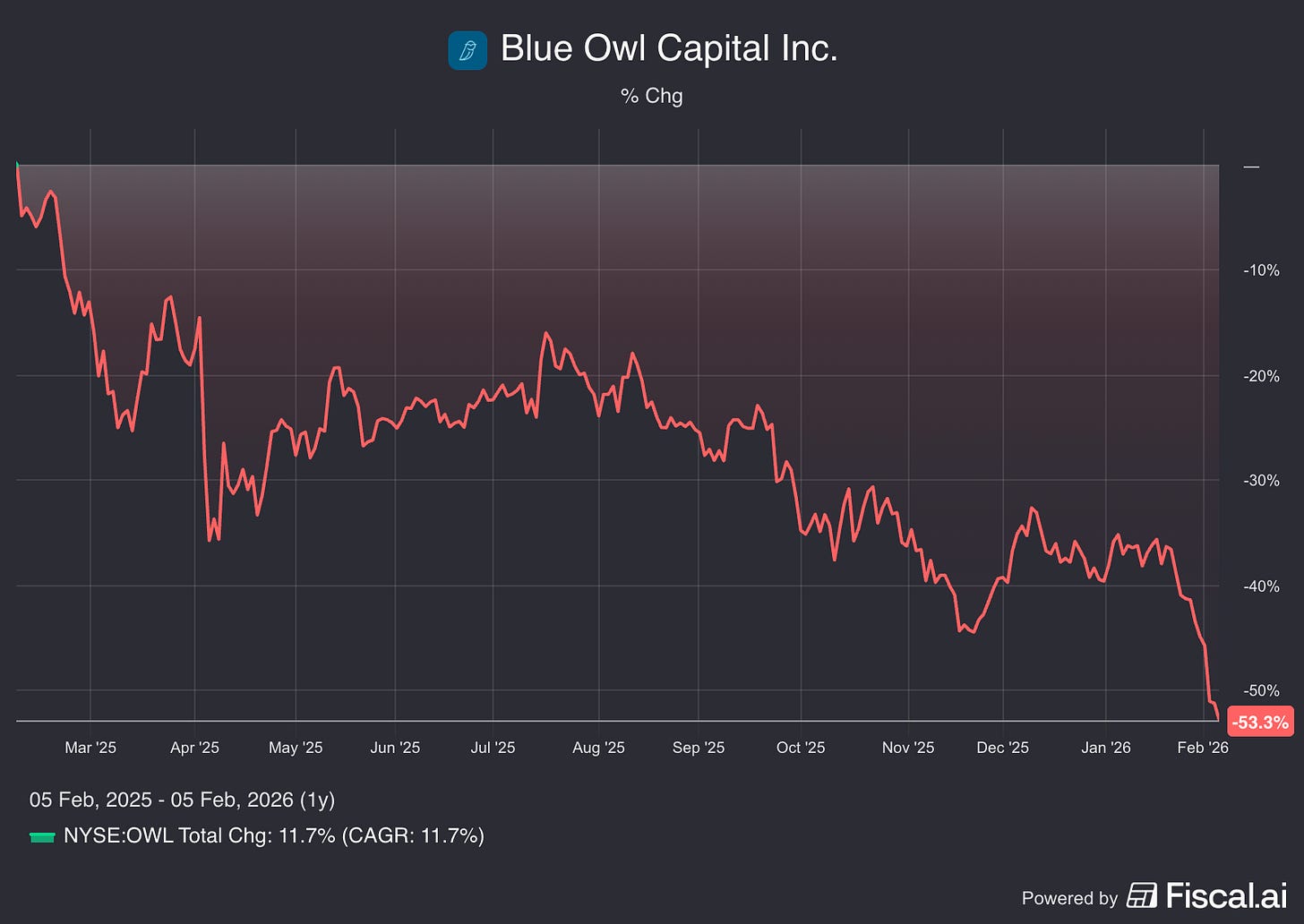

Based on its stock, which slipped another 5% today – pushing it down more than 50% over the past year on snowballing AI/credit concerns – investors weren’t buying it….

This may be one reason why: What he said is exactly what the telecom companies were saying a quarter of a century ago on spiraling credit concerns, just before they imploded.

Not that he’s not speaking the truth. Then again, what else would you expect him to say?

It’s like the telecom guys…

As I wrote in my “Why Coreweave Is So Important to Watch” report from September, even as things were starting to unwind in late 2000, management of the telecom companies was telling investors everything was fine. At Level 3, CEO Jim Crow went so far as to write a letter to shareholders, saying...

We continue to believe that we have the right operation, financial and technical plans to capitalize on one of the great opportunities in business today. We believe that we have built the most advanced communications network in the world and, more importantly, one that continues to advance as technology advances.

And in April 2001, with its stock a fraction of where it had been at the peak a year earlier, Global Crossing’s management had the gall to write in its 2000 annual report how in “less than four years since our inception” it became “one of the youngest companies to have its stock traded on the New York Stock Exchange.” The company didn’t stop there, adding...

Global Crossing occupies a unique position as the first telecom company to independently finance the construction of a seamless, global fiber-optic network. We offer services over this state-of-the-art network to global enterprises that demand global connectivity. Quite simply, we know how big business does business... We believe that we have created one of the first companies that will lead the digital global economy in the 21st century.

Management went on to boast about Global Crossing’s “strong” liquidity.

Less than a year later, the company filed for bankruptcy... and Level 3 struggled until it eventually was sold.

Will history rhyme? Repeat itself? Or none of the above?

As always, interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I don’t own any stock mentioned in this report.

Feel free to contact me at herb@herbgreenberg.com

I remember Global Crossing and WorldCom. You're showing your age, Herb.

If I saw that a CEO’s name was Jim Crow, and he hadn’t had the good sense to start going by James, I would say that company was doomed no matter what