The Wrap – But Aren't Stocks Supposed To Go Straight Up?

Plus, Corning as a canary? And just when nobody wants to hear about short-selling, along comes a book on how to WIN doing it... something the author knows a thing or two about.

This is a free report for all subscribers. If you’re not subscribing, just remember, the risks are real. For more on subscribing to Red Flag Alerts, along with a full FAQ, click here.)

▶Before we get going, just a reminder: If you’re a premium subscriber and would like to participate in an ideas Zoom call, let me know. Spots are limited. Just be willing to bring the name that you would avoid or short and the reason, keeping the market cap above $1 billion and average daily volume above $15 million… and just know I might share it with everybody!

▶If you missed it… Last Tuesday, in collaboration with my friend Katherine Spurlock, I red-flagged for-profit college operator Adtalem ATGE 0.00%↑, which has a healthcare bent (MDs, nursing, psychology, social work). You can read it here…

Subsequently… The next day, post-market, the company reported earnings. The following day, the stock, after spiking post- and pre-market, got clobbered despite beating estimates, raising guidance and boasting that it had its “tenth straight quarter” of total enrollment growth.

The tell that there was more to this tale was the headline of the press release, which said that Adtalem “raises” this year’s guidance. (Pro tip: Headlines with positive spin on earnings are often meant to distract from negative news.) Long story short: The trends are not Adtalem’s friend.

▶Meanwhile, from the “best laid plans” department…

As the market rocketed higher on Wednesday, I thought I would get ahead of myself and start writing this week’s Wrap, with a focus on the seemingly unstoppable market. The headline I wrote said, “Next Stop.. the Ionosphere?” with the below image…

I figured it would surely hold for a few days. As it turns out, I should’ve known better because in this market, which hangs by the thread of every next headline, nothing holds – sometimes not even for a minute, let alone a few days.

Then came Friday…

With more stocks in the red than the green, and gold and silver getting smacked, I switched themes. And I did it knowing full well that what happened yesterday doesn’t necessarily portend what will happen tomorrow.

With that in mind, and assuming the next stop short of an all-out correction is only a galaxy away, I figured what I originally wrote but hadn’t yet published is as relevant as ever.

And That Was…

This feels so familiar, with the FOMO seemingly so palpable…

Just the other day, someone I know who doesn’t follow the market mentioned, “I was in the car and heard on the radio that gold has hit $5,000. Should I buy it?”

My head wanted to explode! Since I never ever offer advice, I responded, “I honestly don’t know because I can’t see the future.”

Then I relayed that story to the most pragmatic guy in the markets I know, my pal Bob Howard, who writes the Positive Patterns newsletter from “down in the Ozarks.”

“Bob,” I said, “this sounds like a ‘taxi driver’ moment.” (If you’re new to the markets, that refers to taxi drivers doling out stock tips.)

He to me…

I do think gold goes to 10,000 - but, timing? Who knows, maybe in two years, and maybe in 20. Gold hibernates for years. It’s like the guy down the street that has a great party/rarely, but when he has one - IT ROCKS....like right now. And let’s face it: most people don’t understand correlation to the Yankee dollar.

He went on to tell me that for the first time ever, he is recommending that his subscribers sell a third of their gold ETF and a few other gold-related stocks he has been recommending. His reasoning…

I think that makes sense. I do. It’s the prudent thing to do.

Regardless…

The market is rocketing higher… giving even more punch to my headline from over the weekend that questioned whether short-selling is dead. If you missed that, you can read it here…

My old friend, short-seller Jim Chanos, who read it, texted me saying…

Even wondering if short-selling is dead was EXACTLY what people were saying in 1999-2000, about short-selling. “It doesn’t work anymore….Why bother? The market only goes up….”, etc. Doesn’t mean it can’t go on for a while, but still.

Then there’s another old friend, Doug Kass of Seabreeze Capital Partners, who often has a bearish bent. As he put it the other day in one of his missives…

Bears are going the way of the flightless and extinct dodo bird - rapidly becoming an endangered species.

If you fly red flags, that’s how it feels. But as those of us who were smack dab in the middle of doing just that during the dot-com era know all too well, it felt exactly this way years before the peak. Maybe the best example of all was when Zip drive maker Iomega’s stock peaked before imploding in 1996 after rising something like 2,000% in a year… and things felt nuts even then.

Here’s the Thing…

Just because this market feels frothy, doesn’t mean it is… or isn’t - depending on how you define froth. You won’t hear that it is right now based on the breadth and depth kind of stuff my technical analyst friends watch… who, from what I can tell, remain solidly (though more cautiously) aboard the rocket.

And why wouldn’t they, based on what they see in the charts, with the S&P 500 hitting and blasting through the all-important 7,000? Therein lies a bull/bear battle of the charts. Or as another old friend and long-ago nemesis, the currently bullish technical analyst Jim “Rev Shark” DePorre put it on Wednesday…

Then again, one person’s logic is another person’s hallucination…

No matter which way you're wired – technical analyst or not – everybody is looking for signs that we’re just about there.

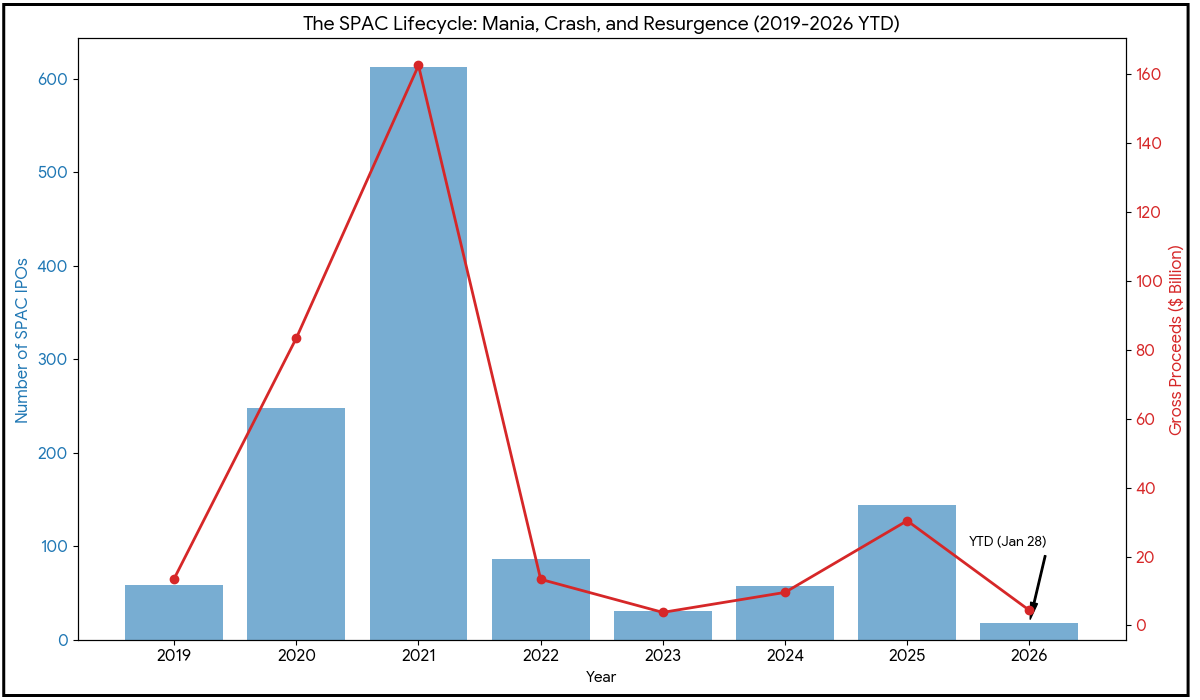

One that dropped the other day is from Ken Brown, who had just written about the resurgence of SPACs in The Information…

I even reposted it on social media, as if Ken’s SPAC story landed “on cue” for this phase of the market.

Of course, I wrote something similar in May, headlined, “Beware of This SPAC Attack,” with the tagline, “Proof that suckers continue to be born every minute.”

Yet… here we are! And what was happening in May, as it turns out, was merely the warm-up act. For perspective…

Interpret at will…

▶Speaking of the markets, if you’re looking for “signs,” here’s one…

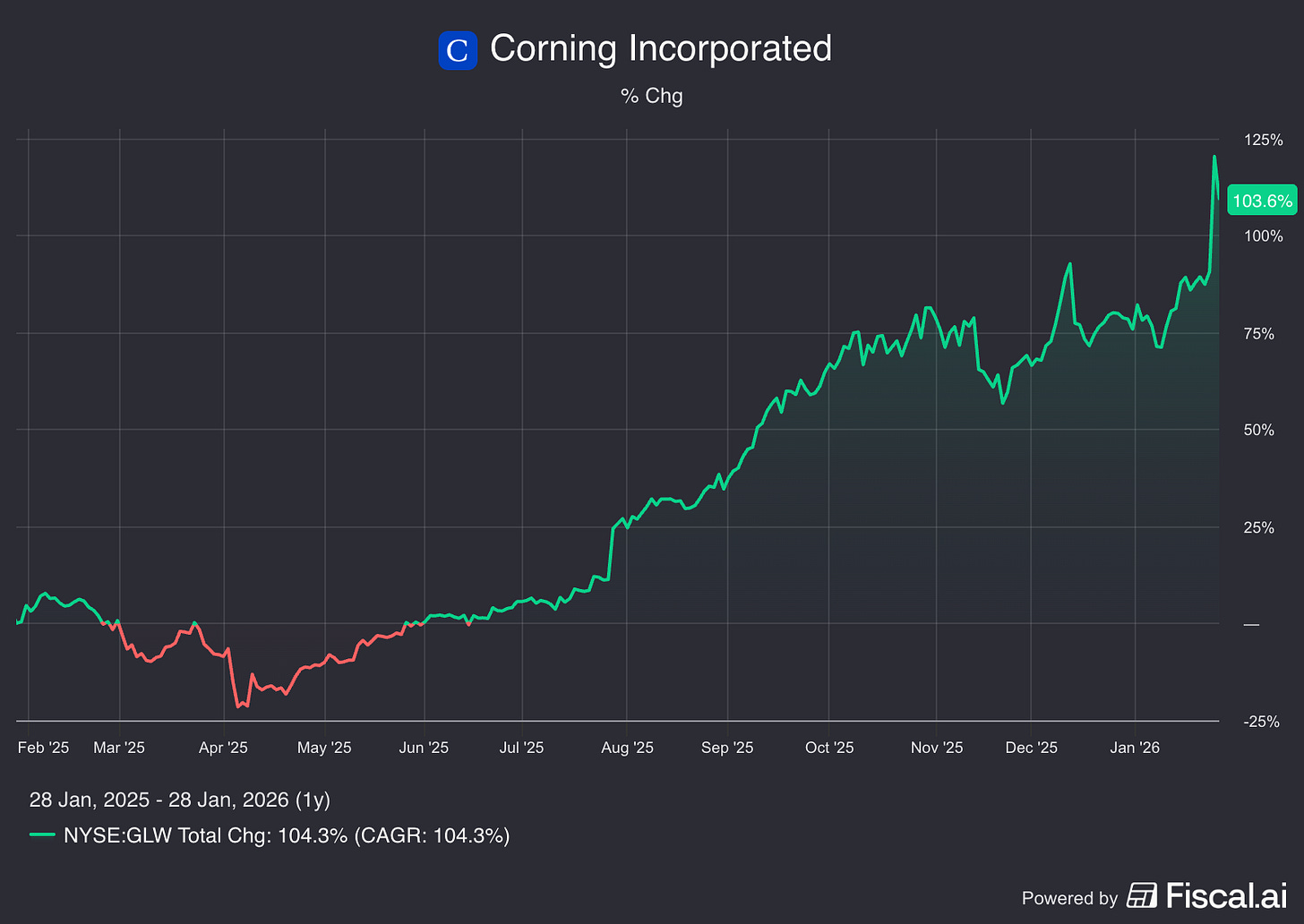

Corning’s stock spiked roughly 16% earlier this week – briefly surpassing its all-time dot-com high – on news that it has struck a multiyear $6 billion deal to sell fiber-optic cable to Meta.

Sound or even look familiar?

In the late 1990s, as the dot-com bubble was bursting, investors flocked to the seemingly “safe” infrastructure plays like Corning, in the belief that, given the internet’s potential, its backbone would need an infinite amount of fiber optics. Enthusiasm pushed its stock to all-time highs, with a market value of roughly $100 billion at its peak.

But then…

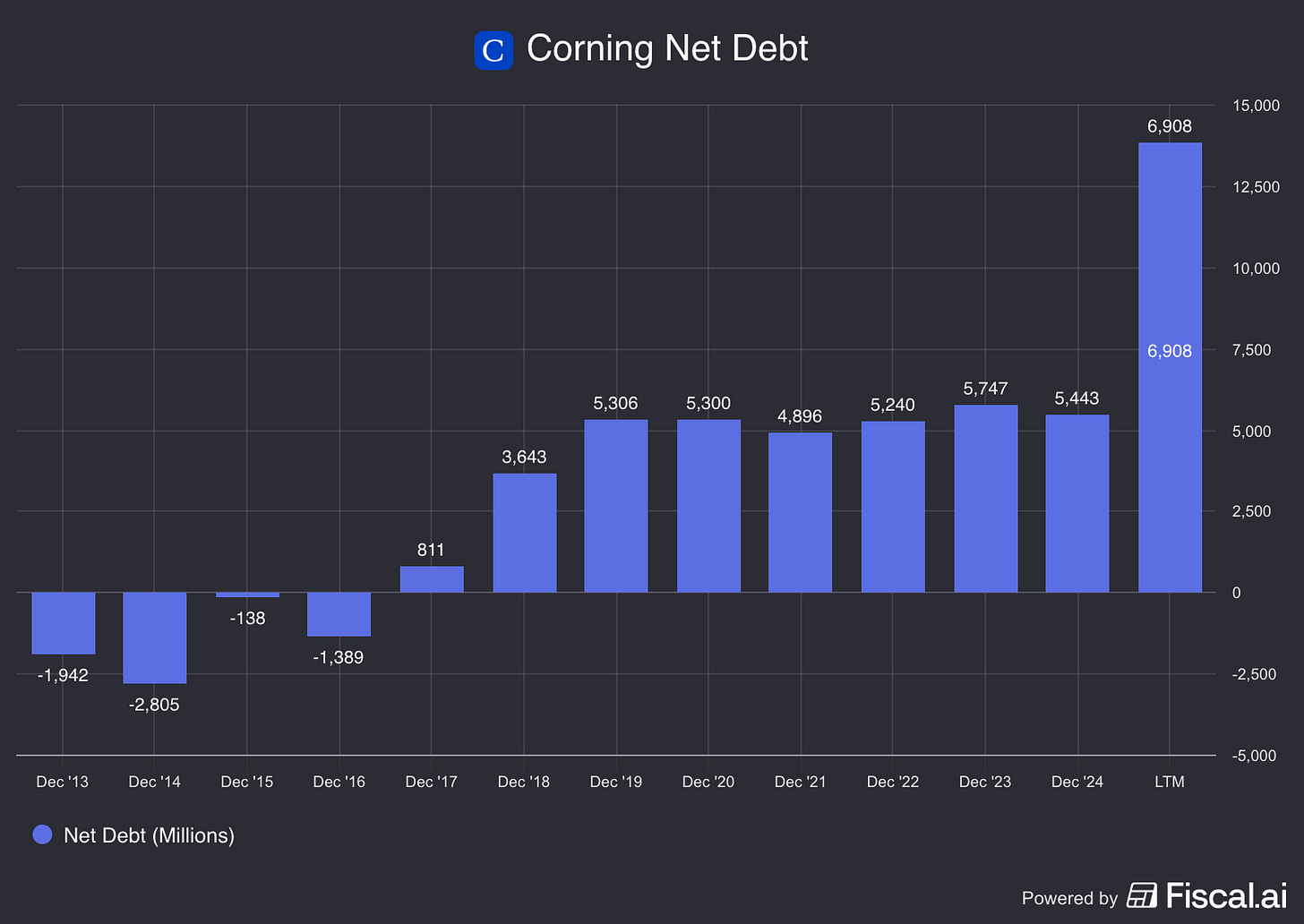

As it turned out, there was a glut of capacity as customers either froze their Capex budgets or went bankrupt. Corning itself has loaded up on debt to expand fiber optics capacity.

As the telecom bubble burst, Corning’s shares plunged by 99%, falling to roughly $1 from a peak of higher than $100.

Fast-forward to today: Over the past six months, Corning’s stock has risen by over 100%, with a market value of $88 billion.

And if you’re wondering, here’s how its net debt looks today…

To be fair, much of the current spike has little to do with fiber optics but a lot to do with solar.

Still, taking its debt out of the equation… given Corning’s place in bubble history, the only question here is whether history will rhyme or repeat itself or… prove this time really is different?

▶Finally, back to our earlier discussion on short-sellers, and how absolutely out-of-favor they are: It’s fitting that with so many having fallen away or gone underground or otherwise tossed in the towel, and few if any still exclusively doing short-selling, that a new book on “how to win” at short-selling is about to be published. “Off Wall Street: How to Win at Short Selling by Betting Against the Crowd” by the legendary Mark Roberts is in queue to hit the shelves on Amazon next month. I’ve known Mark for years. He’s the dean of deans of anybody who has done short-biased research, having founded the iconic research firm Off Wall Street, which went on to spawn more than a few analysts who themselves became short-sellers.

Surely, he must have an opinion on whether this time is different, especially given the current market structure. His response…

Yes, market structure has changed quite a bit. I think Mike Green's work on this subject has been the best. [Mike writes the cerebrally elegant and always thought-provoking, “Yes I Give a Fig”]

Despite this, short-selling fundamentals have not really changed for the vast number of names. It is a matter of knowing what kinds of stocks to avoid as short sales, as well as what kinds of stocks to do work on. Shorting the crowded small stocks is a bad idea as much as shorting the big institutional stocks that attract the kind of flows that Mike Green talks about.

There is something in the middle, and it is fertile and less popular ground for retail short sellers. These are the names that are interesting. Legitimate companies with substantial market caps, where there is near unanimity in enthusiastic expectations that are reflected in the price – and where the actual prospects are less rosy and the shares are vulnerable to substantial disappointment due to the company not meeting expectations. The old rules still apply.

Which, of course, is what my Red Flag Alerts are all about. And which is why – given where “the crowd” has been and likely remains – the timing of Mark’s book arguably couldn’t be better.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no position in any stock mentioned here.

I can be reached at herb@herbgreenberg.com.

Thought provoking piece. Looking forward to reading Mark Robert’s book.