The Wrap – Yes, the Market is Rigged

Plus, leverage, greed and a reminder that contrary to growing popular opinion, fundamentals still matter.

This is not the time to ignore red flags. Join the large and growing list – portfolio managers, analysts, private investors – who already have signed on as premium subscribers to my Red Flag Alerts for one reason: To understand what could go wrong before – not after – the news hits.

Start flying your own red flags, with the goal of avoiding the laggards and losers... because lurking under the cover of this market’s euphoria are the frauds and failures. After all, when the tide goes out…! Subscribe now!

For institutional pricing, contact me at herb@herbgreenberg.com.

1. What You May Have Missed

Before we get into it, a quick note: I’m continuing to work on a new Red Flag Alert that I hope to have out within a few days. It’s a tangled one, and worth the wait, so be patient.

In the meantime, I’ve added a new section to On the Street – Special Situations. While my focus is red flags, there are always exceptions, like the two I mentioned this week. Both are generally off the radar... which gets them on mine!

▶The first is a differentiated angle on post-bankruptcy WW International $WW, a.k.a Weight Watchers. The upshot, from the report...

There’s yet another side to the bullish thesis, which most stock investors have likely missed. That’s because this angle is steeped in one of those nuanced details only a credit investor with a focus on bankruptcies would pick up. That’s to be expected, because with distressed situations, there is often an information gap between what credit and stock investors know. And as we all know, credit investors often know best.

You can read it here...

▶The second focuses on Clear Channel Outdoor $CCO, the laggard in the billboard industry. Its stock has been up lately on takeover speculation. My report explains why one investor (and premium Red Flag Alerts subscriber) I’ve known for a very long time is hoping there isn’t a deal despite the stock’s sluggishness. After doing my own work, my view is that if you knew nothing else, it would be this...

Perhaps more interesting is that Los Angeles Angels owner Arte Moreno, who made his fortune in the billboard business, has been a steady buyer of Clear Channel’s stock since 2023 at prices in the low-to-mid $1 range, with recent purchases pushing up his stake to around 14%.

You can read it here...

2. The Rigged Market

With the almost-out-of-nowhere gamification of everything, the betting scandal at the NBA is likely the opening salvo of a much bigger story.

Given how people are outright betting on stocks, I’m just waiting for news that some company faked its numbers to juice its stock to supercharge bonuses (say it ain’t so!), but this time with the mob somehow involved. Or something like it. I mean, in this golden age of grift – where anything goes and the market is the ultimate political scorecard – why not? Whatever makes stocks go higher – right?

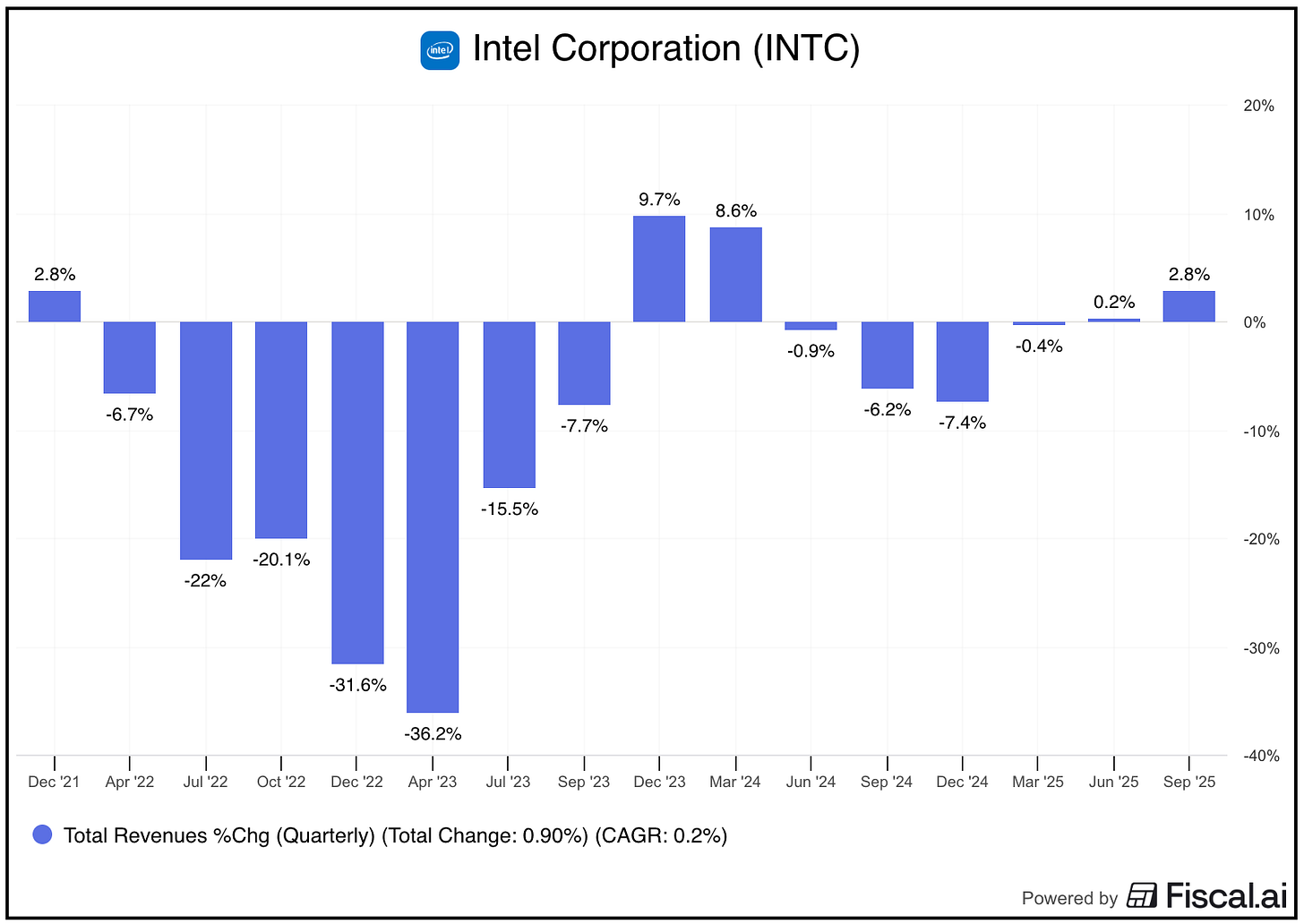

You think Nvidia likely would’ve taken a $5 billion stake in Intel INTC 0.00%↑ if the government hadn’t invested first… or it hadn’t received some kind of, uh… nudge? You think Intel, up more than 50% since the Nvidia NVDA 0.00%↑ news, would be shooting past almost all analyst targets if its rival chipmaker hadn’t taken a stake? That kind of action usually only happens with the wildest of growth stocks, not a company whose revenues are barely growing...

With the government now taking positions in not just Intel, but red-flagged MP Materials MP 0.00%↑ and a few others (as of now), all bets are off. If you can’t fight city hall, you definitely can’t fight the U.S. government. The government, after all, is the house. And its purchases of shares of public companies – “in the nation’s interest” – appear to be the ultimate rig, with more to come – fundamentals, be damned.

3. Funda... what?

We’ve hit that point! Just a week ago, someone I know wrote something in a newsletter about how the worst advice he ever received was to buy companies with good fundamentals. “Well, they lied to me,” he wrote. “And they’re lying to you too! We don’t want to buy stocks that have ‘good fundamentals.’ We want to buy stocks that are going up in price.” He’s right – in theory. And I’m thrilled that trading stock symbols – not the stocks of companies – works for him. Through it all, the reality is that fundamentals eventually do matter.

Just ask anybody who rode the Hoka wave up at Decker’s DECK 0.00%↑ without watching what was happening beneath the surface. I laid out some of what was happening here in February, as part of a bigger mosaic, which I first mentioned in June 2024. So far this year the stock has tumbled by more than 55% from its highs, down 15% alone on Friday after reporting earnings.

Sure, the chartists will say the stocks see it first. And many times… they do! But in this market, saying fundamentals don’t matter is all too reminiscent of SPAC King Chamath Palihapitiya’s comments at the peak of SPAC mania… when he took a swipe at Warren Buffett. After the market subsequently imploded, Palihapitiya conceded that it was “a surprise to most of us.” Of course it was. Hubris can be so humbling. What Ben Graham wrote in 1934 in the Intelligent Investor holds true today…

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Vote now, vote often. This time will not be different.

4. Know What Game You’re Playing

Truth is, there’s no right or wrong way to invest – as long as you make more money than you lose. It’s how you’re wired and whatever your risk tolerance is. It’s like my wise friend Vitaliy Katsenselson, chief investment officer of Individual Portfolio Management – who also happens to be a prolific author on investing and life – recently wrote an essay headlined, “Why Smart Investors Should Sit Out the AI Arms Race”...

Let me tell you a secret about investing. You get to choose the game you play. You can observe and be entertained by the AI game transpiring before your eyes, but you don’t have to play it. You can simply be honest with yourself and say, ‘This is too difficult. I just don’t know.’

Most people, of course, don’t. Certainly not right now.

5. Stunner!

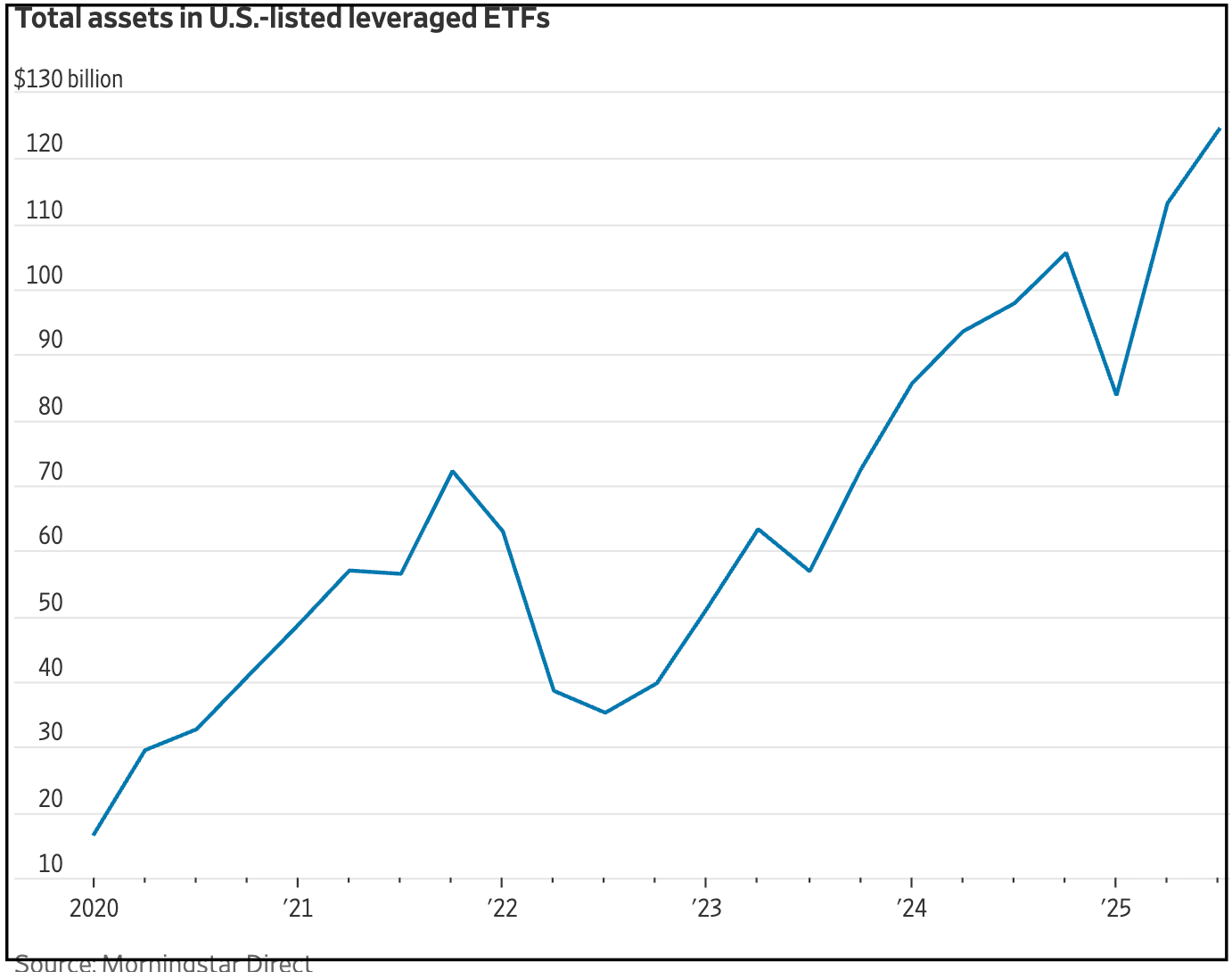

Can you believe it? That’s exactly what I thought when I saw the below headline from the Wall Street Journal this week...

I’m kidding, of course. The only question I had was... why did it take so long? These double- and triple-leveraged ETFs, the ultimate poster children of the gamification of Wall Street, have become “disasters waiting to happen” in each cycle in recent years. Yet they’re also the favorites of the “too smart by half” crowd, who pile debt upon debt to bet in the quest for supercharged returns. This chart from the WSJ says it all...

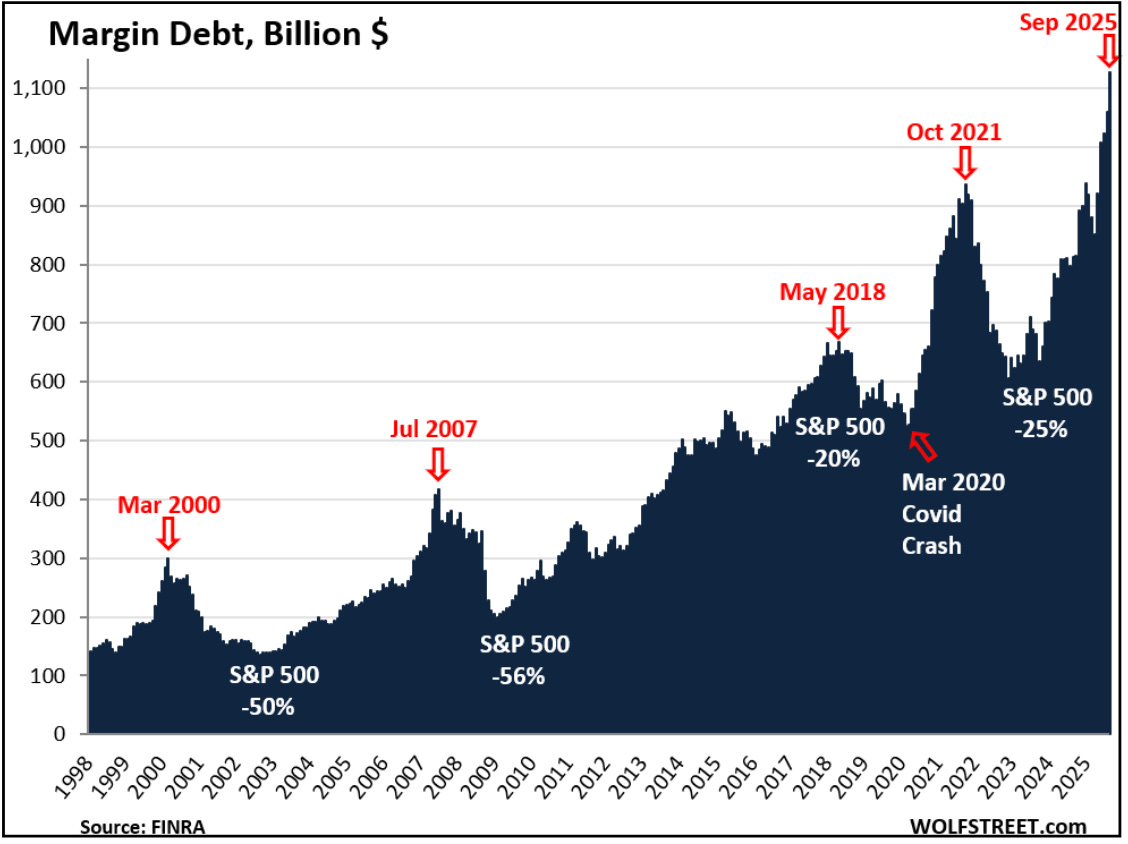

Then again, in this chart from Wolfstreet, you can only wonder how much margin is loaded on top of these already-levered funds to create the setup for one heckuva lollapalooza of losses...

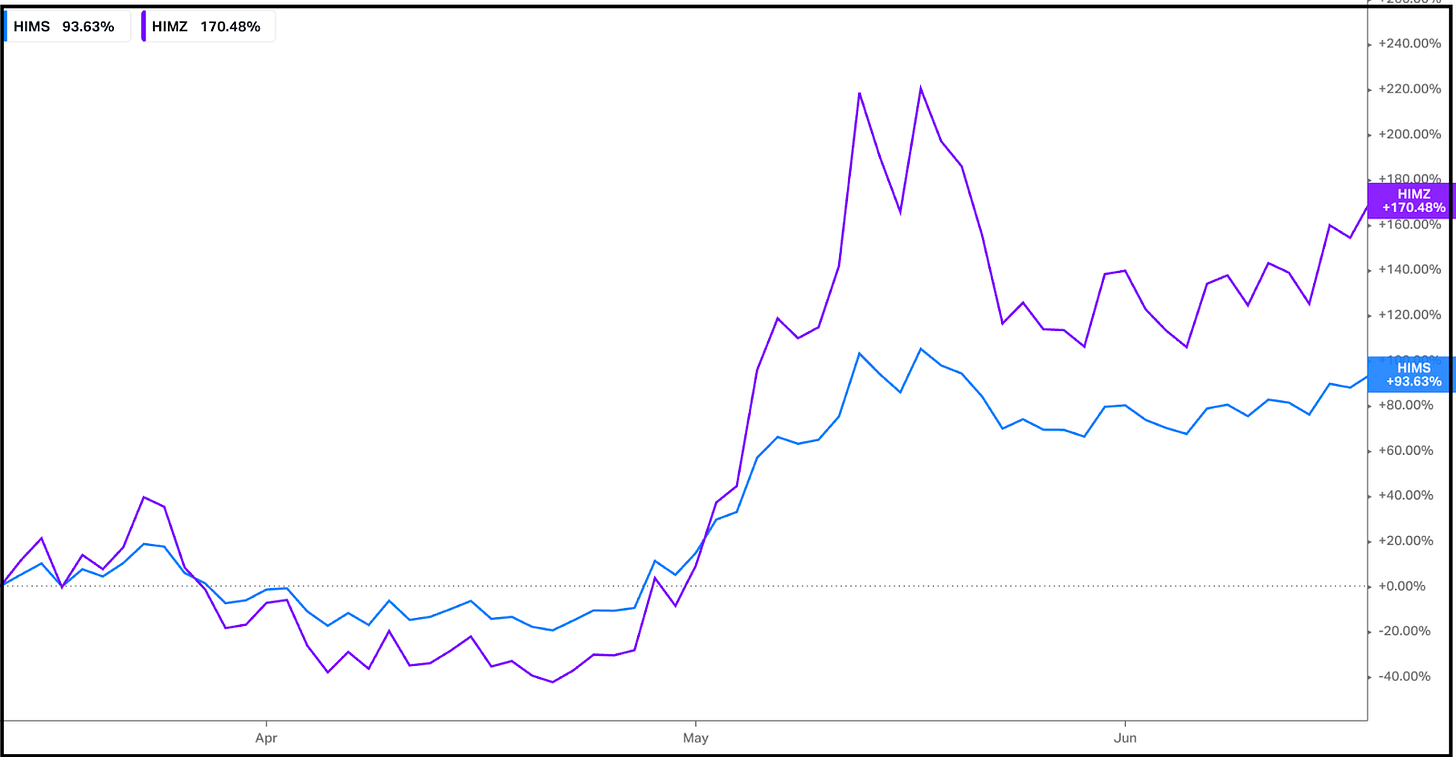

For a quick snapshot on how vulnerable this kind of leverage is, let’s look at the leveraged play on Hims & Hers HIMS 0.00%↑, one of the biggest “we’ll show him” stocks among those I’ve red-flagged. Its leveraged doppelgänger is the Defiance Daily Target 2X Long HIMS ETF HIMZ 0.00%↑ . On the way up, shortly after it was created, HIMZ left Hims in the dust...

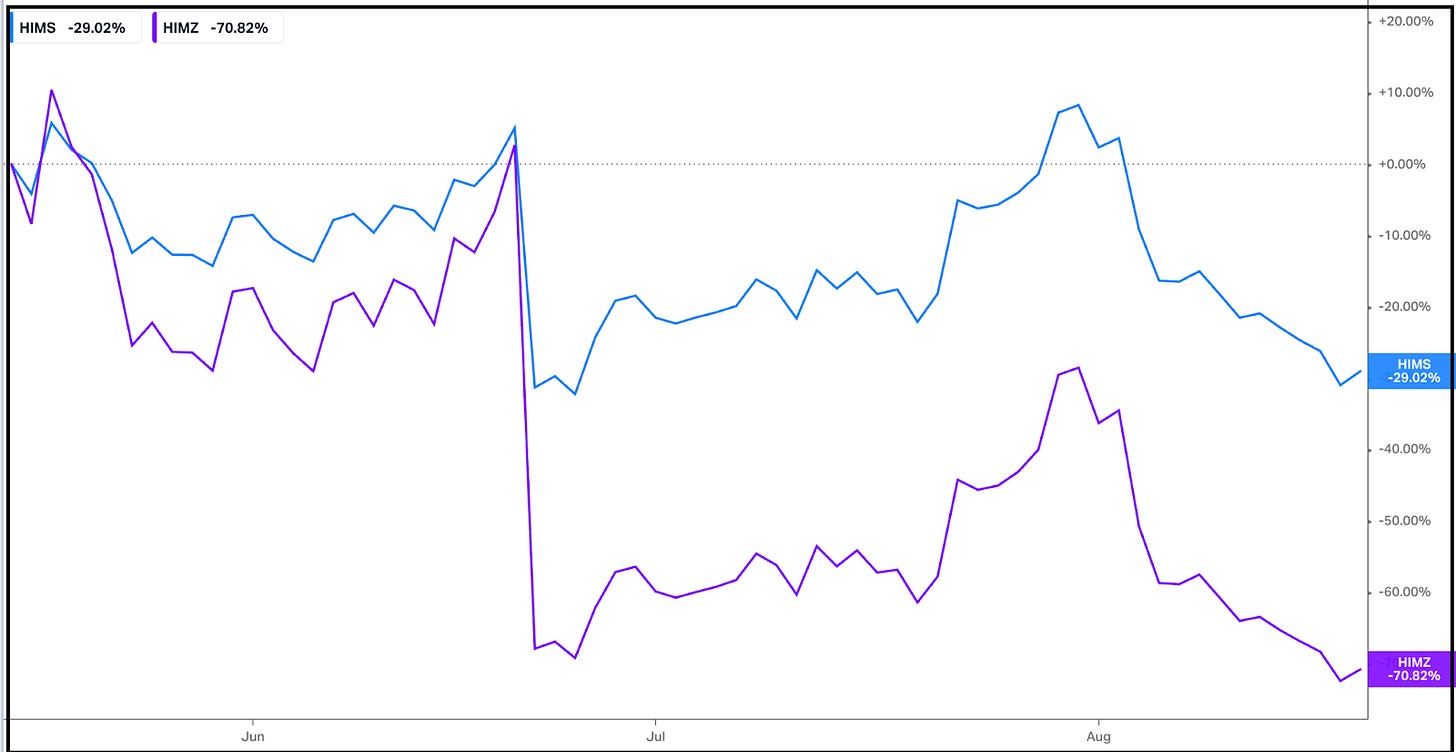

But what goes up comes down even harder. This was as of midweek...

Of course, this can all reverse itself as fast as it plunged, but as my friend the ever-quotable Bob Howard, who writes the Positive Patterns newsletter from “down in the Ozarks” joked...

It’s like the lines from one of my favorite movies of all time - Chinatown.

Cop to Nicholson: “I bet you think I’m pretty stoopid.”

Nicholson: “I don’t think about it that much”

Leverage is a two-way street... The greedy seldom think about that either.

Gambling is fun, but in the end humans are humans, addictions are addictions and the house always wins.

Have a great weekend, everybody!

Feel free to click the heart below if you liked this. And don’t forget, if you aren’t already…

Please consider becoming a paid subscriber. My On the Street and Red Flag Alerts are reader-supported.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) As of publication, I own shares in Clear Channel, purchased after my original report. I’m under no obligation to provide updates on any future trades.

I can be reached at herb@herbgreenberg.com.

Sorry, back on substack Herb?

Back on subs