Year-Ender: That's a Wrap

Also, announcing higher pricing and a new Pro tier.

State of the increasingly volatile state…

Over the years I’ve asked my friends who lean into short-selling why they torment themselves the way they do. Especially now, in a stock market many can’t recognize. The answer is usually the same: That’s how they’re wired. It’s in them. They can’t not do it. Such as one friend, who used to be a professional short-seller but now manages his own money with a mix of longs and shorts… and who is as willing to be long popular shorts as he is short popular longs. When I ask him why he continues to find himself in those dysfunctional battles, he concedes the agony of defeat and turmoil is worth the thrill of victory. My friend’s goal, of course, is to make more than he loses, with some fun tossed in. That’s the whole point of investing….

My approach in Red Flag Alerts has been to identify companies that have a risk of underperforming. On that score, it has been a good year, with 9 out of 14 formally red-flagged companies – not including yesterday’s on Ingersoll Rand IR 0.00%↑ – lagging the market. That’s using the S&P 500 as the benchmark the day each company was added to the list… and with no cutoff if they rise, as if this had been a managed portfolio. Which it isn’t!

That’s also during a year in which the increasingly gamified market seemed to lose touch with all sense of reality, reason and rationale…

In Going Back Over The Year…

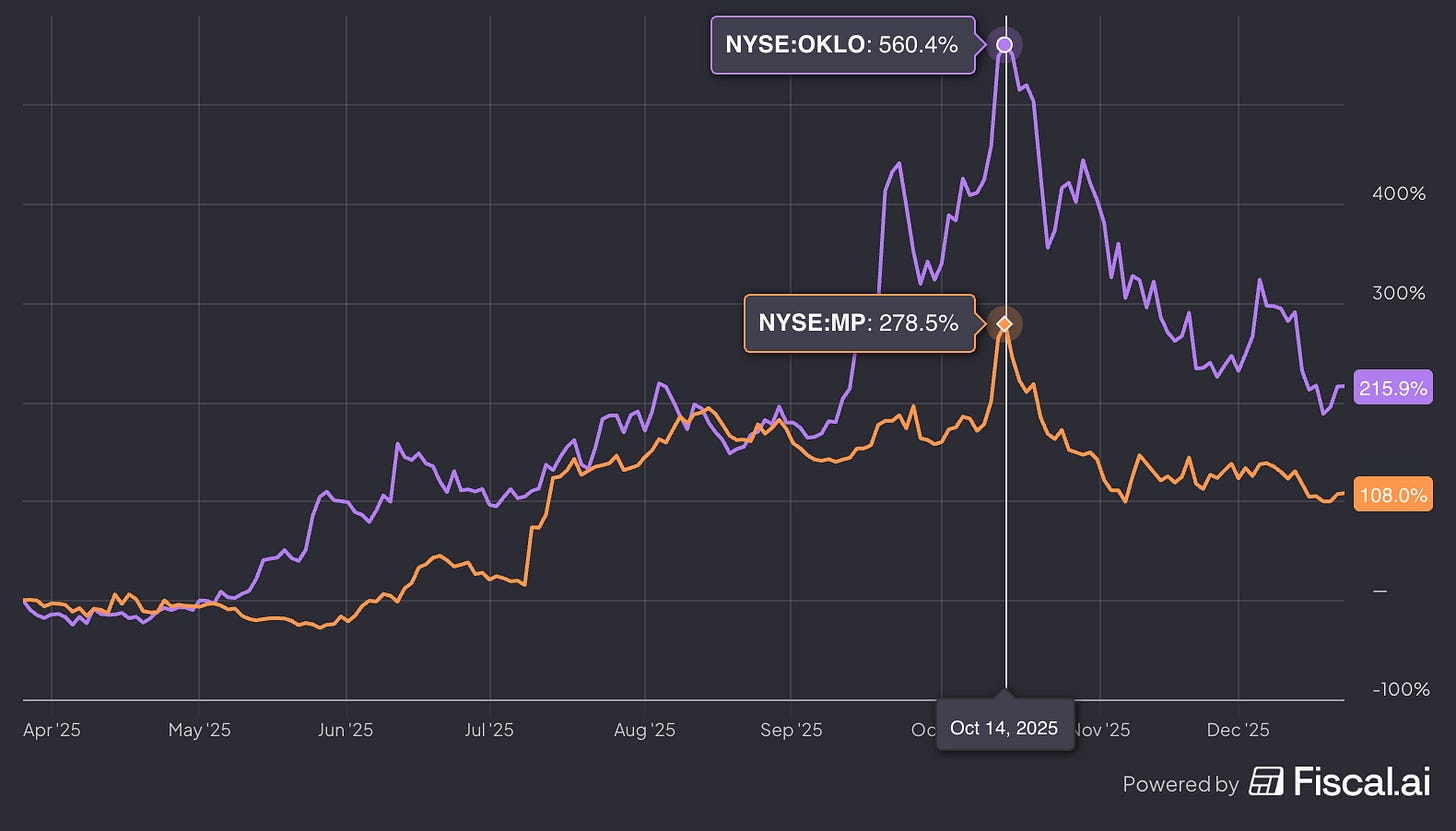

Without question, the two biggest misfires, on my end, were Oklo OKLO 0.00%↑and MP Materials MP 0.00%↑. The below chart shows both, with the start date as of my my Oklo report in March, which was followed by MP a month later…

As you can see, they both are well below their highs, but well above where they were when I wrote about them. And if you’re wondering: There’s not a word I would change in either. I always thought the biggest risk with both was memefication.

But here at Hindsight Capital, as part of our ongoing post-mortem of the good, bad and ugly, the overlooked flaw in red-flagging Oklo wasn’t that it might be blasted into the nuclear nanosphere. That was obvious! The flaw was that a month before I wrote my report, one of its directors had just been named U.S. Energy Secretary, making the company one press release away from announcing a meaningless but stock-juicing government deal. As it stands, at these levels Oklo is on plenty a short-seller’s “top short” lists. It also has one of the lowest quant rankings by my pals at Kailash Concepts, with the lowest possible quality scores for valuation, balance sheet quality, and earnings quality.

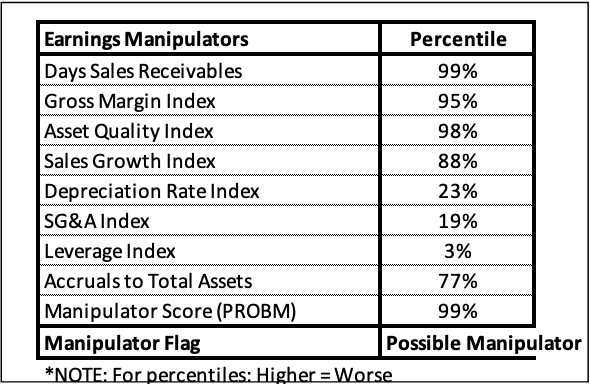

As for MP, as I’ve written previously, the issues I raised remain valid… especially the simple fact that the company’s business model doesn’t appear to make any economic sense. That argument went out the window, though, after the government became the company’s largest investor, providing a backstop of sorts. With that, all bets are off. And that’s even as it scores low on Kailash’s latest rankings, with the company joining its list of possible earnings manipulators…

That manipulation score, by the way, can be fleeting on a monthly basis, and in this case, is irrelevant because whatever the company does is with the blessing of the government.

Related Party Roulette

Beyond that, there’s something else worth mentioning…

I prefer flagging companies that are flashing issues with their business models or strategy. But the former journalist in me (my ultimate DNA) will almost always also be attracted to the likes of a SharkNinja SN 0.00%↑ or SuperGroup SGHC 0.00%↑ – or even G-III Apparel GIII 0.00%↑ – where there’s a fascinating and generally overlooked mosaic that most investors haven’t focused on.

Notably, related parties, which can play a role in enhancing results. Many investors ignore them, responding with a simple, “…but they’re disclosed.” In other words, they’re often hiding in plain sight – and then, only after having being told to do so in “comment letters” from the SEC.

The trouble with hanging any thesis on related parties, however, is that most are meaningless. And even if they’re worth watching, they often don’t become relevant until fundamentals start sputtering. (It’s the ol’, we’ll know for sure when the tide goes out…)

With each of these companies, in two of the three – SharkNinja and SuperGroup – the webs of related parties are off-the-baseline tangled, complex and opaque. In all three, sales growth has been slowing. But all three also have exceptional narratives, which have helped drive their shares higher. And two of the three are run by well regarded founders who have done exceptional jobs of long-term execution. Especially, SharkNinja, which has a history of disruption and innovation and whose enthusiastically compelling CEO is the epitome of “always be closing.”

I Write, You Decide

Then again, my job is to point out the issues which can take quarters to play out; yours is to do with it as you please. What I don’t generally do is time the publication of my reports to an immediate catalyst.

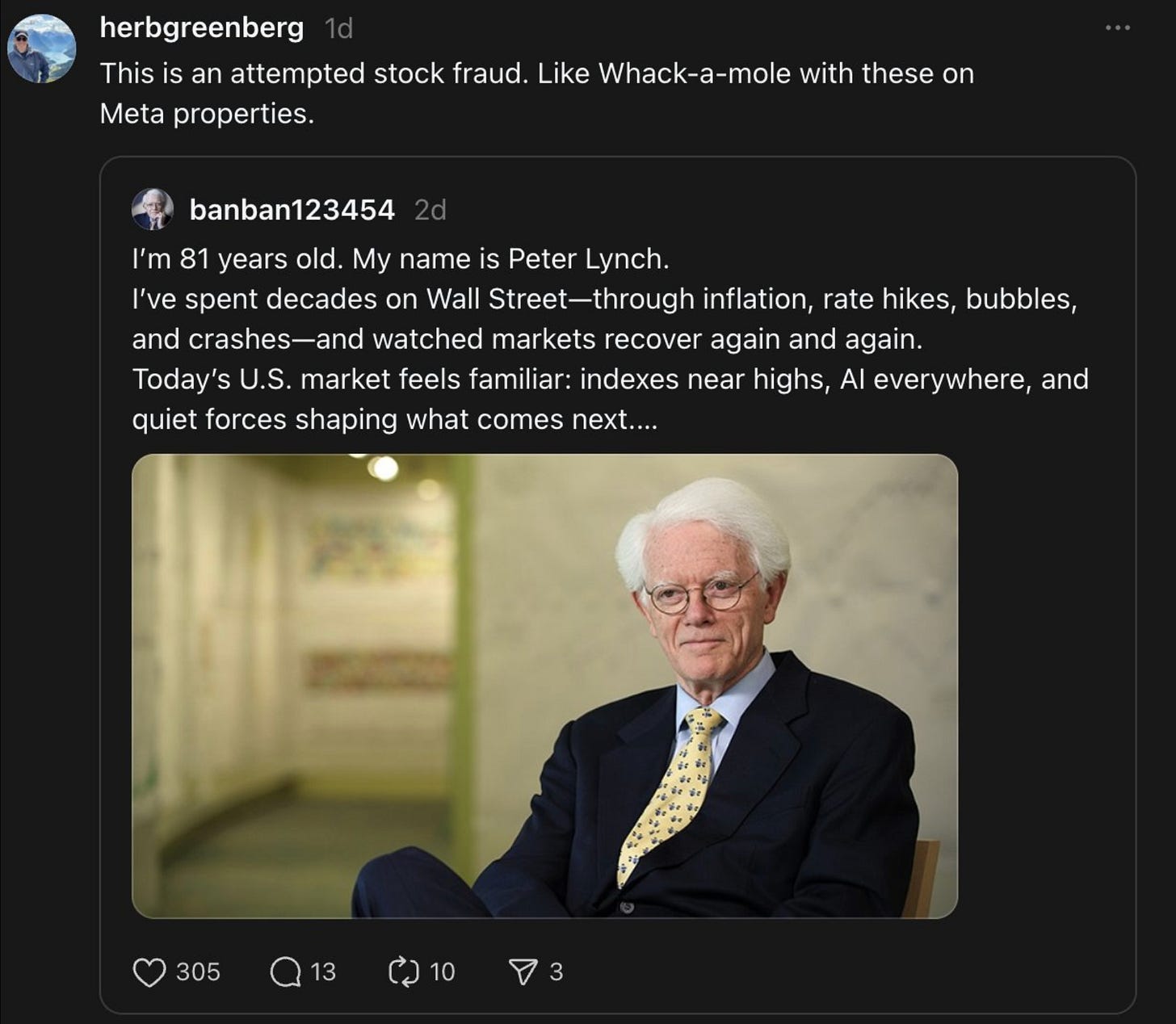

Ironically the biggest wins this year among Red Flag Alerts were a few Chinese stock frauds whose shares plunged to pennies within days or weeks of my reports. Believe it or not, new versions of these frauds continue to pop up on Meta’s META 0.00%↑ Facebook, Instagram and Threads… or at least they did as recently as this past week. This is my reaction to one on Threads…

Why can’t Meta stop it? The headline to this Reuters Investigation says it best… “Meta tolerates rampant ad fraud from China to safeguard billions in revenue.”

Maybe that will be next year’s big scandal. Unless of, course, that will be the year the entire market gets a dose of reality… which is why it’s never a good idea to ignore the red flags.

Speaking of Which…

In terms of not ignoring the red flags, if I had a single favorite non-stock-specific report this year it was the one headlined, “Why CoreWeave Is So Important to Watch.”

The focus wasn’t as much on CoreWeave CRWV 0.00%↑, but what it represented, zeroing in on what I believe was the single-most overlooked “tell” that suggested just how overly confident the company had become: its rollout of CoreWeave Ventures. The report itself went deeper into overlaying this cycle to the telecom bubble, while also drawing parallels with the Great Financial Crisis. This was on the early side of the wave of both of those themes gaining mainstream traction.

In the same vein, there was my report on the reality of the sudden firehose of data center-related press releases…

And lest you forget, I also do longs, with a focus on overlooked or under-the radar companies. You can find them under the “Special Situations” section of my website. While I lean into the red flags, I also know a good story when I see it… and simply can’t resist.

Without question the best so far this year (knowing full well this is a year when anything not nailed down can soar) was my report on Turning Point Brands TPB 0.00%↑ , which is 33% higher since George Baxter of Sabrepoint Capital shared his research with me.

Also worth watching, Weight Watchers WW 0.00%↑, which has an asymmetric credit angle…

And Clear Channel CCO 0.00%↑, which has been given up for dead. Wait’ll you see who has been buying the stock…

I would love to do more longs, including updates on some of the others in my archives. Trouble is, I’m one guy, with only so much time. And my fingers can only type so fast.

And Finally…

I’m taking the holiday weeks off – famous last words! – returning January 5. Have a fantastic holiday and Happy New Year! – Herb

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I own shares of Turning Point and Clear Channel.

I can be reached at herb@herbgreenberg.com.